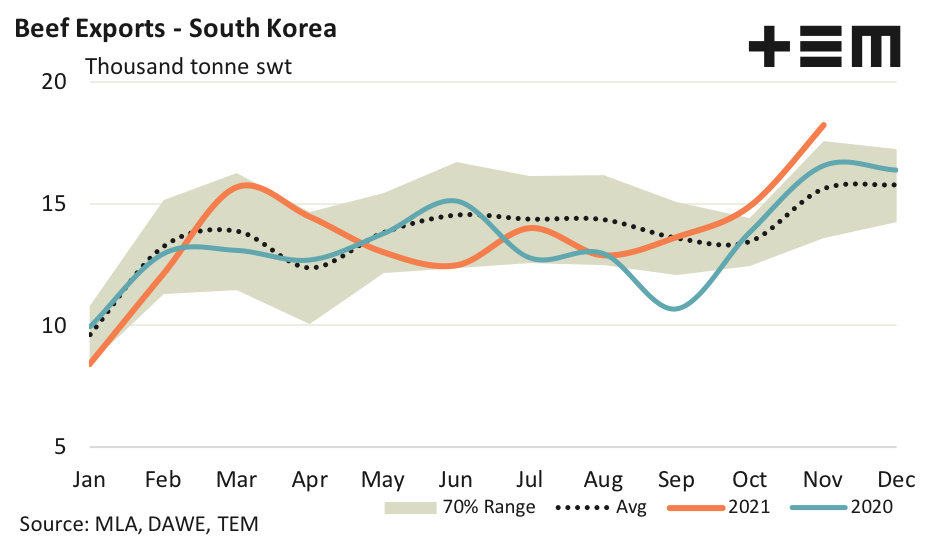

Safeguard doesn’t slow South Korea, yet.

The Snapshot

- Korean demand for Aussie beef lifted 22% over the month to place current volumes 17% above the five-year average pattern for this time in the year.

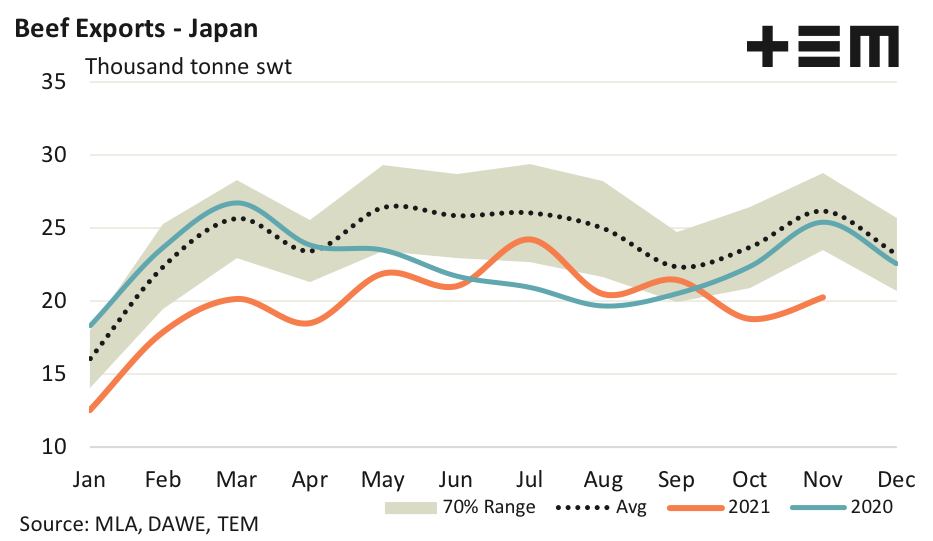

- Japanese demand for Australian beef rose 8% during November. This is nearly 23% under the levels maintained during November according to the five-year pattern.

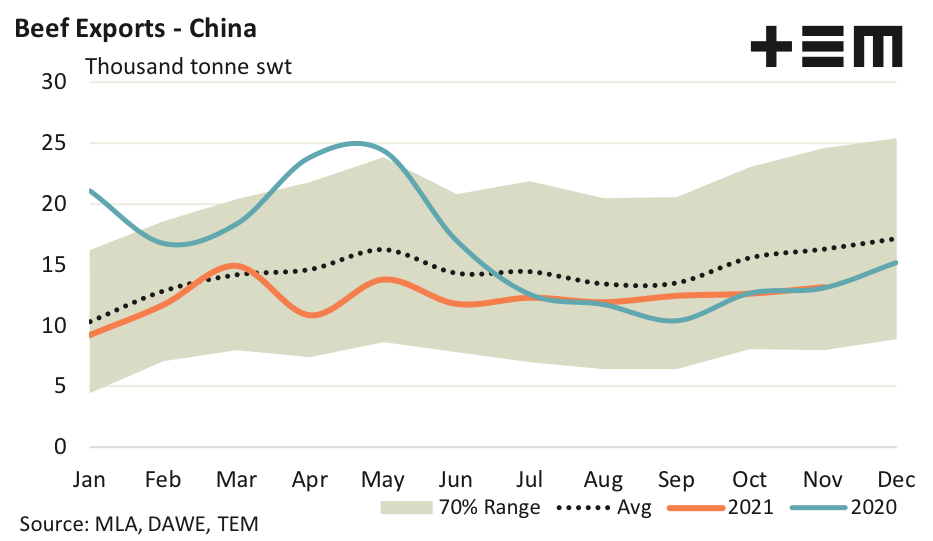

- China saw a 4% increase in Australian beef export flows over the month, but are still operating 19% under the volumes usually seen in November, based on the five-year average flows.

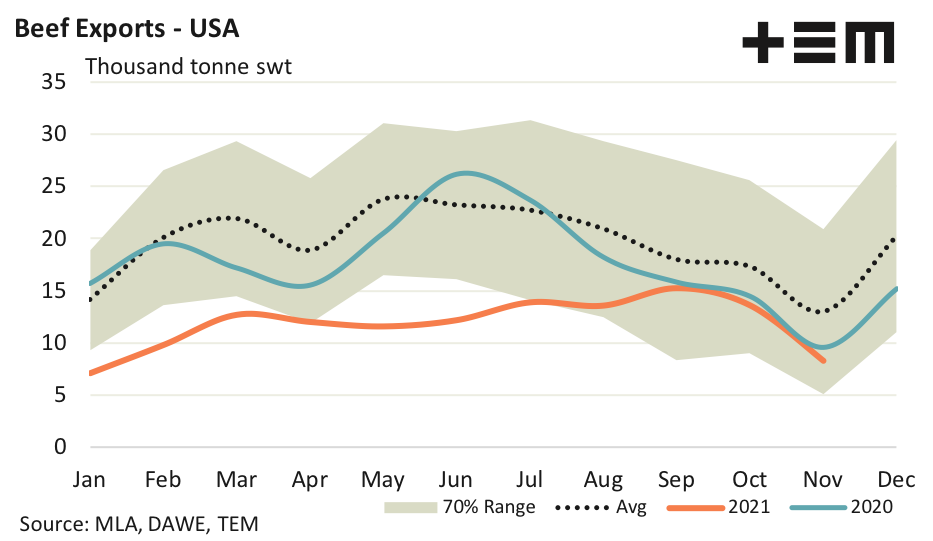

- The USA was the only top four beef export destination to record a fall in trade flows over November with volumes easing 39% over the month. This is the lowest monthly volume to the US since January 2021 and the weakest November figure on record.

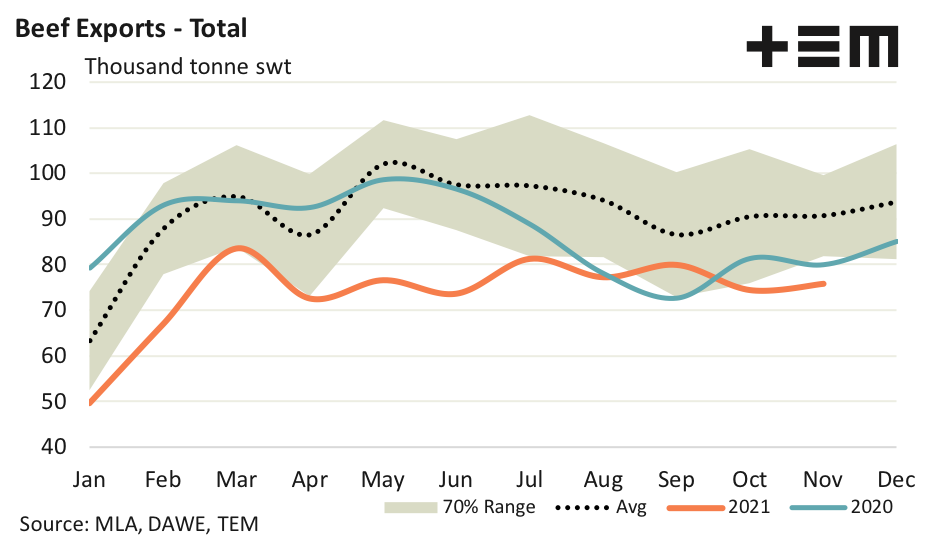

- The subdued performances in Japan, China and the USA keeping total Australian beef exports relatively static, with just a 2% lift in total flows for November. Total beef exports volumes from Australia in November are nearly 17% under the seasonal trend.

The Detail

Concerns over a looming tariff hike for Australian beef into South Korea as the safeguard export volume threshold is exhausted for 2021 did little to dampen beef export demand during November. Monthly beef exports from Australia to South Korea hit 18,238 tonnes swt, the highest monthly flows in five years. Indeed, the previous monthly high in the trade was in November of 2016 when Aussie beef exports topped out at 19,797 tonnes.

Korean demand for Aussie beef lifted 22% over the month to place current volumes 17% above the five-year average pattern for this time in the year. Unfortunately, South Korea is the only top beef export destination to register trade volumes above the average seasonal pattern, with Japan, China and the USA all trekking under their respective November five-year average levels. The subdued performances in other markets keeping total Australian beef exports relatively static, with just a 2% lift in total flows for November to see 75,712 tonnes consigned. Total beef exports volumes from Australia in November are nearly 17% under the seasonal trend.

Japanese demand for Australian beef rose 8% during November to hit 20,239 tonnes swt, but this is nearly 23% under the levels maintained during November according to the five-year pattern. China also managed a 4% increase in Australian beef export flows over the month to see 13,157 tonnes registered. Despite the small gain in demand Chinese beef consumers are still operating 19% under the volumes usually seen in November, based on the five-year average flows for November.

The USA was the only top four beef export destination to record a fall in trade flows over November with volumes easing 39% over the month to just 8,254 tonnes. This is the lowest monthly volume to the US since January 2021 and the weakest November figure on record (back to the early 1990s). Current Australian beef exports to the USA are 36% below the five-year average for November.