Share Chopper

Lamb Producer Share of the Retail Spend - June 2023

In conjunction with Sheep Central, and with the approval of Meat & Livestock Australia (MLA), the team at Episode 3 will begin reporting each quarter on lamb producer’s share of the retail spend on sheep meat products. Quarterly national sale yard lamb prices in carcass weight terms have been converted into an estimated retail weight equivalent and compared to average retail sheep meat prices, as reported by the Australian Bureau of Statistics (ABS).

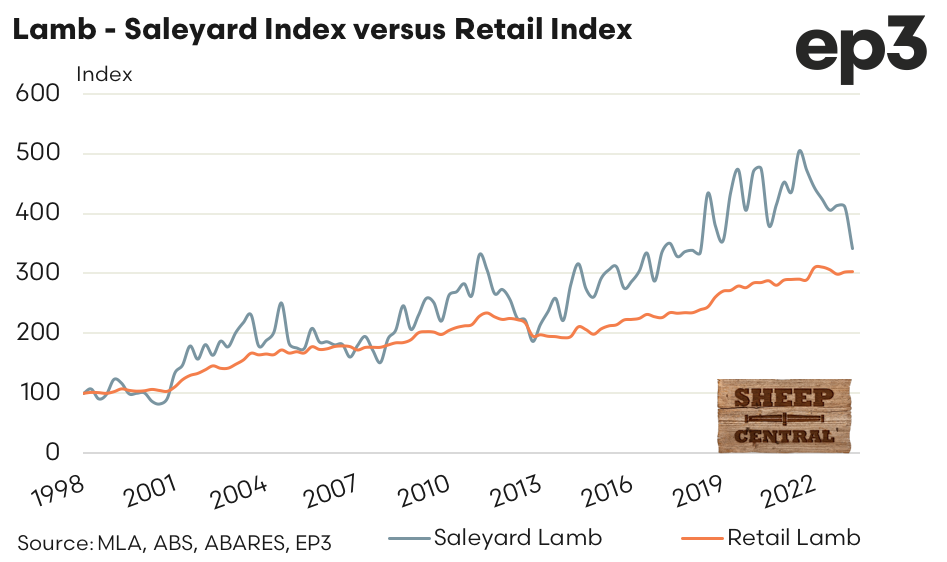

At the saleyard level lamb prices have been in decline since the middle of 2021. The lamb sale yard index peaked at 505 during Q3 2021 and has fallen to 342 as at the June quarter of 2023, reflecting a drop of 32%. In comparison the retail lamb index has actually climbed over the same period, rising 4% from 291 in Q3 2021 to 303 in Q2 2023. Although the current retail lamb index is still nearly 3% lower than the record retail index peak of 311, seen during Q2 of 2022.

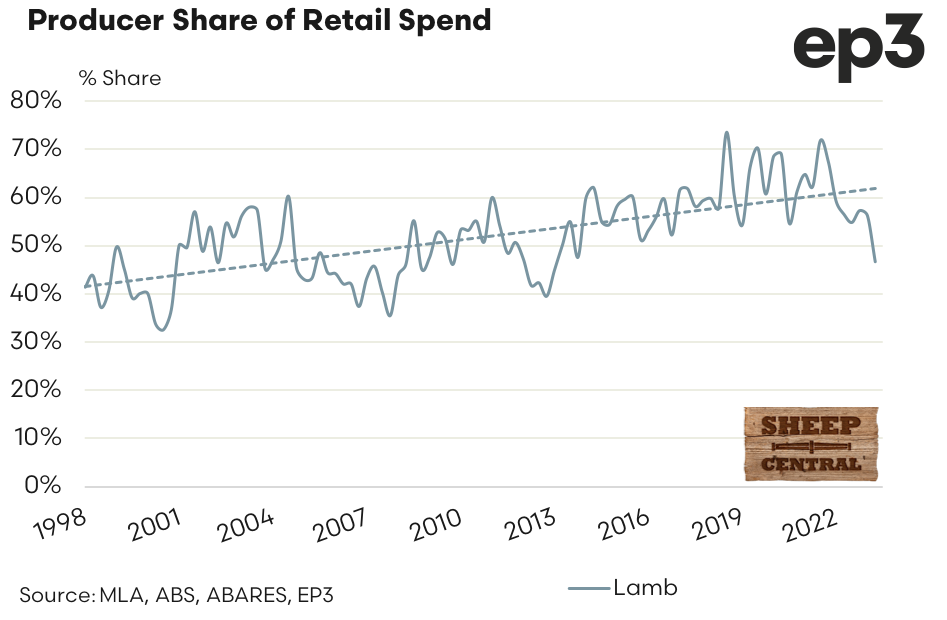

In terms of lamb producer’s share of the retail spend there has been a steady upward trajectory since 1998, rising from around 40% to a little over 60% in recent years, as indicated by the dotted trend line. Through much of the 1998 to 2017 period the share for lamb producers ranged between 35% to 60%. However, from 2018 onwards the lamb producer’s share of the retail spend mostly ranged between 55% to 70%, peaking at 73.4% in Q3 of 2018.

The most recent peak in producer share was in Q3 2021 when it hit 71.8%, but it has been in decline subsequently. It currently sits at 46.6%, which is is the lowest the share has been since the first quarter of 2013. The average lamb producer share from 1998 to 2017 was 49%, so it could be suggested that the current decline is just a move back to the more normal long term situation. Although, I’m not sure lamb producers would feel the same way as it is a fair discount to the 60%-70% share they had being enjoying in recent years.