Sheep meat summary

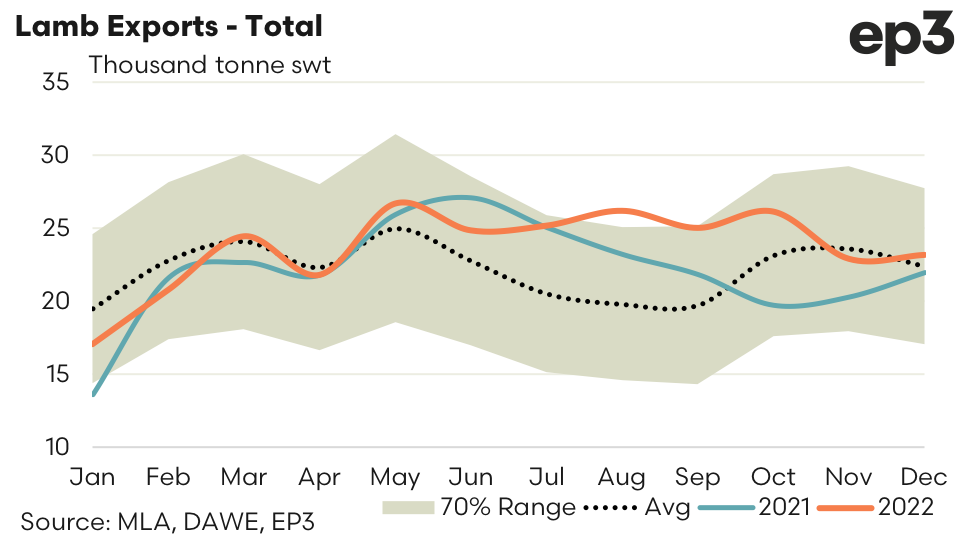

Australian lamb export volumes for December 2022 finished the year ahead of the five-year trend, albeit marginally. There was 23,174 tonnes of lamb exported for the final month in 2022, which brought the total lamb exported for the year to 284,256 tonnes swt. This represents lamb export volumes that are 7% ahead of the 2021 season and also 7% above the average annual volumes according to the five-year trend. Indeed, annual lamb export volumes were the strongest on record and 1% higher than the previous record set in 2019.

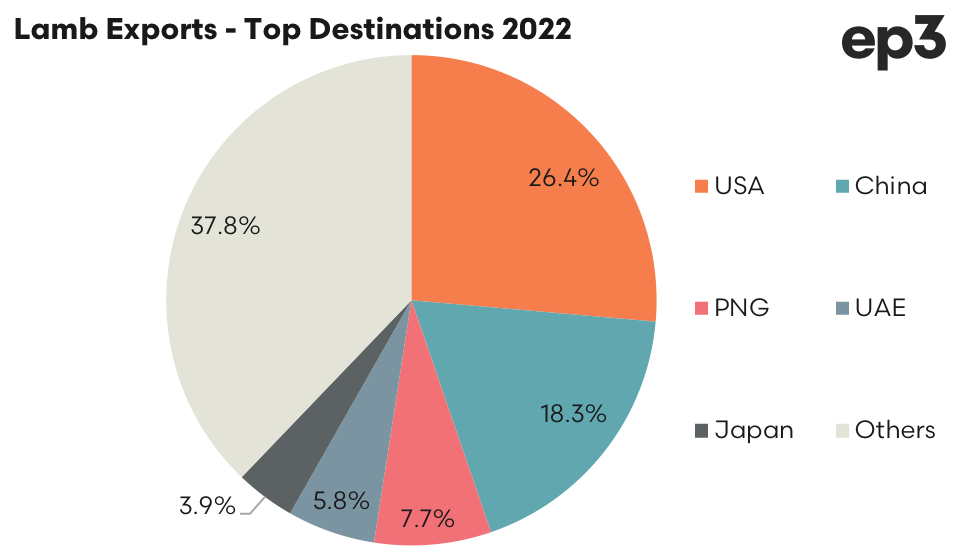

Underpinning the growth in lamb exports was exceptionally strong demand for Aussie lamb from the USA. 2022 saw 75,011 tonnes swt exported to America from Australia, 6% higher than the volumes set in 2021 (which was the previous record highest season) and 24% above the five-year annual average volumes. The USA cemented their position as top export destination for Aussie lamb accounting for 26.4% of the trade in 2022.

China took out second place in terms of top destination for lamb market share with 18.3% of the lamb export volumes, representing 52,151 tonnes swt in 2022. Lamb export volumes to China were 17% lower than the flows seen in 2021 and nearly 13% under the five-year average pattern.

Papua New Guinea moved into third place during 2022 with their market share of Australian lamb lifting from 4.9% in 2021 to 7.7% in 2022. There was 21,900 tonnes swt of Aussie lamb exported to PNG over the 2022 season, representing a 68% increase on volumes seen in 2021 and an impressive 97% lift on the annual average volumes exported over the last five years.

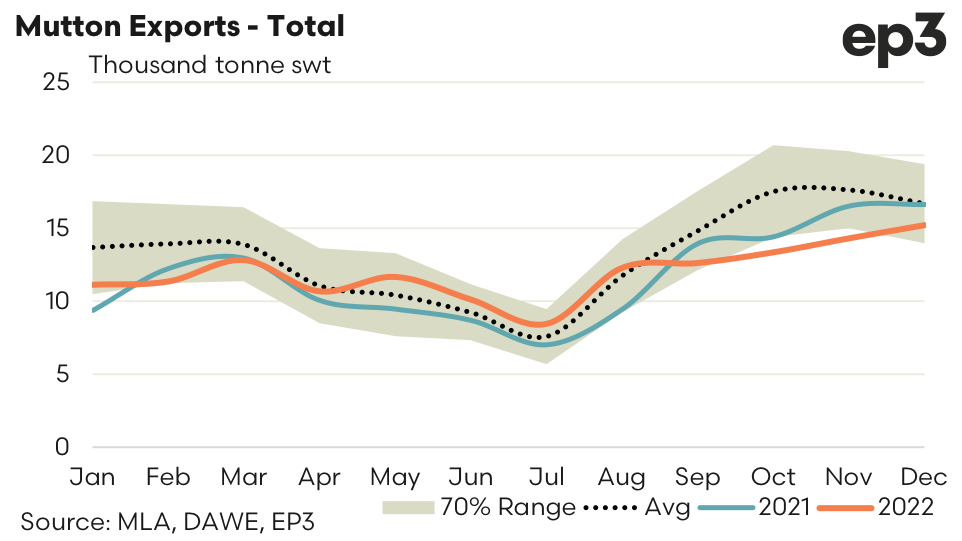

Australian mutton exports finished the 2022 season in a little more lacklustre fashion, coming in at nearly 9% under the five-year average for December at 15,217 tonnes swt. Total mutton exports for the 2022 year was 2% higher than 2021 with 144,005 tonnes swt of Aussie mutton product exported for the entire year. Compared to the annual average volumes over the last five-years the current mutton export volumes are 9% under trend.

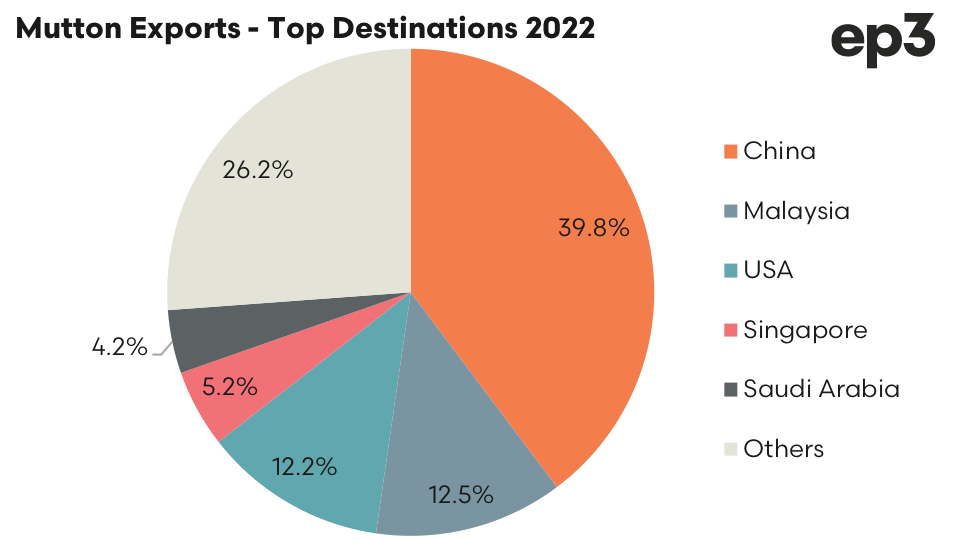

As has been the case for the last 3 years China took around 40% of Australian mutton exports at around 57,000 tonnes swt. While this was a pretty solid result it is a far cry from the 81,000 tonnes China took in 2019 when they were in the depth of their pig herd decimation due to African Swine Fever and were chasing meat protein from all available sources around the globe to fill their protein void.

Demand for mutton in the USA couldn’t match their appetite for lamb in 2022 and the USA slipped from second to third place in terms of market share of Aussie mutton exports. The USA lost second place to Malaysia who picked up 12.5% of the Australian mutton export trade in 2022, or around 18,046 tonnes swt. Mutton exports to Malaysia in 2022 were nearly 11% above the annual average volumes shipped over the last five years.

The USA rounded out third place with 17,555 tonnes of Aussie mutton consumed, or 12.2% of the total Australian mutton exported in 2022. This was a 23% decline on the record volumes seen in 2021 when nearly 23,000 tonnes of Aussie mutton made its way to America.