Sheep meets export values

The Snapshot

- The USA maintained the top destination for average annual value of lamb exports with 1204c/kg swt for the 2021 season.

- China has demonstrated an increasing trend in lamb export values from 2017 to 2019 with average annual values lifting by 48% from 548c/kg to 813c/kg swt.

- Mutton export values into China have risen 44% from 582c/kg in 2017 to 837c/kg in 2020, dipping by a fraction to 834c/kg in 2021.

- Since 2017 the USA has seen mutton export values range between 707c/kg in 2018 to 859c/kg in 2020, before easing 14% to sit at 742c/kg swt during the 2021 season.

The Detail

The Department of Agriculture, Water and Environment (DAWE) publish monthly volume and value red meat trade statistics on our top destinations, with which we can derive average export values across exported product to some key export destinations.

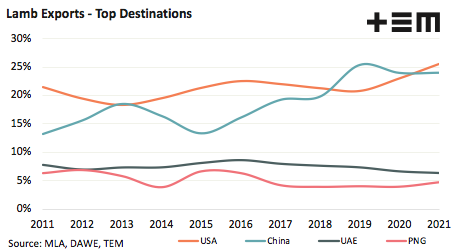

The USA regained the lead from China in terms of market share of volume during 2021 to see Aussie lambs flows to the USA at 25.5% of total flows, compared to 23.9% for China. The United Arab Emirates (UAE) comes in at third place for market share volume at 6.4% and Papua New Guinea (PNG) has moved into fourth spot this year, after displacing Qatar, with 4.7% of the market share of total lamb export trade volumes.

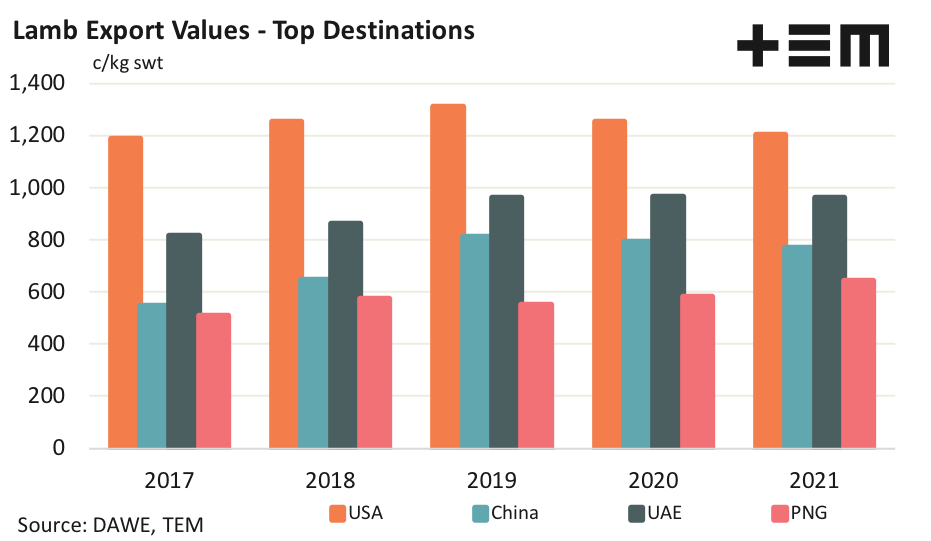

Annual export value trends for the top four lamb destinations of China, USA, UAE and PNG show relative levels of consistency across the last five seasons for average annual export prices achieved in each region.

The USA maintained the top destination for average annual value of lamb exports with 1204c/kg swt for the 2021 season. Over the last five years lamb export values to the USA have averaged 1241c/kg, and while the current export values have softened from the peak of 1310c/kg in 2019 it is only showing an 8% decline.

China has demonstrated an increasing trend in lamb export values from 2017 to 2019 with average annual values lifting by 48% from 548c/kg to 813c/kg swt. Since 2019 values have eased marginally, dropping by 5% to see them at 769c/kg swt in 2021.

Lamb export values to the UAE have grown steadily from 2017 to 2020, rising from 815c/kg to 966c/kg (a gain of 18%) and has slipped to only 959c/kg swt during 2021. Meanwhile lamb export values to PNG have increased by 26% over the last five years from 509c/kg in 2017 to 642c/kg swt in 2021.

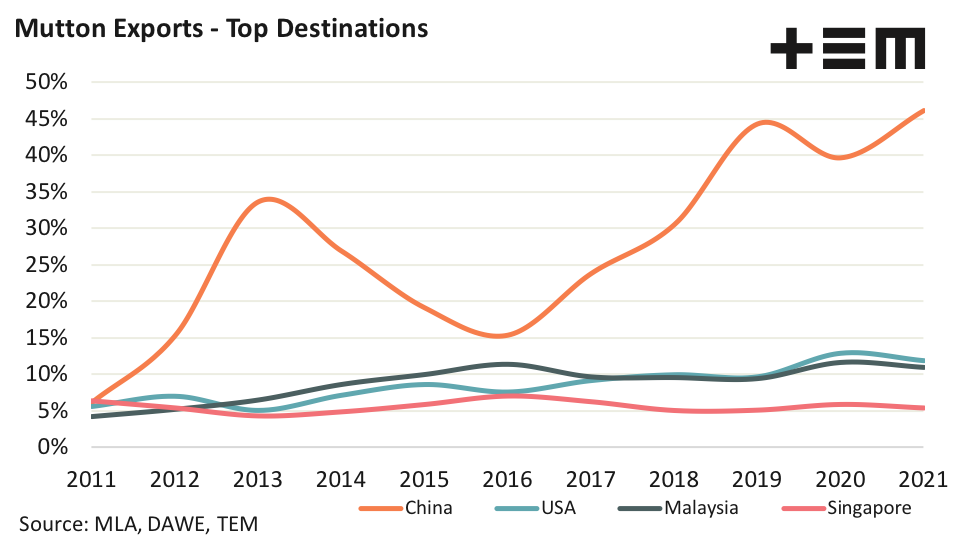

In terms of mutton export volumes, Chinese demand dominates the export market share, capturing 46.1% of the flows in 2021. The USA and Malaysia are in a close tussle for second and third placing on 11.8% and 10.9%, respectively. Meanwhile, Singapore holds the fourth spot with 5.4% of the market share of mutton export volumes.

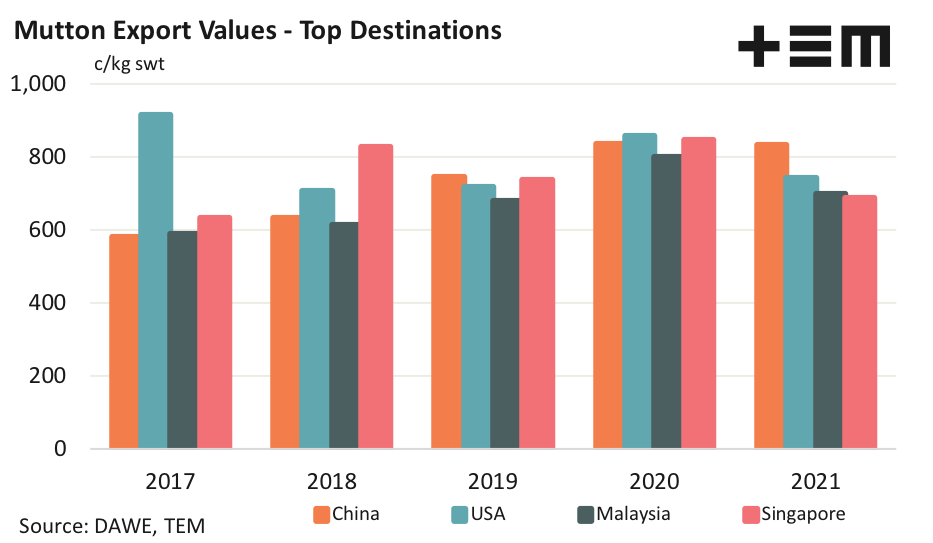

After some variable results across the top four mutton destinations in 2017 and 2018, the 2019 and 2020 seasons saw annual average export values move into sync with each other. During 2021 China managed to maintain mutton export values while the other top nations slipped away.

In 2017 the USA market was a clear leader in mutton export values registering an average annual level of 915c/kg compared to the other nations sitting within a 582c/kg to 633c/kg range. Since 2017 the USA has ranged between 707c/kg in 2018 to 859c/kg in 2020, before easing 14% to sit at 742c/kg swt during the 2021 season.

Mutton export values into China have risen 44% from 582c/kg in 2017 to 837c/kg in 2020, dipping by a fraction to 834c/kg in 2021. Malaysian mutton export values have demonstrated 36% growth from 2017 to 2020, moving from 589c/kg to 802c/kg. However, in 2021 values in Malaysia eased by 13% to average 700c/kg swt during the season. Mutton values to Singapore have fluctuated between 633c/kg and 846c/kg over the past five years, but have eased 18% from 2020 to 2021 to register an average of 690c/kg swt this year.