Sheep selling away

The Snapshot

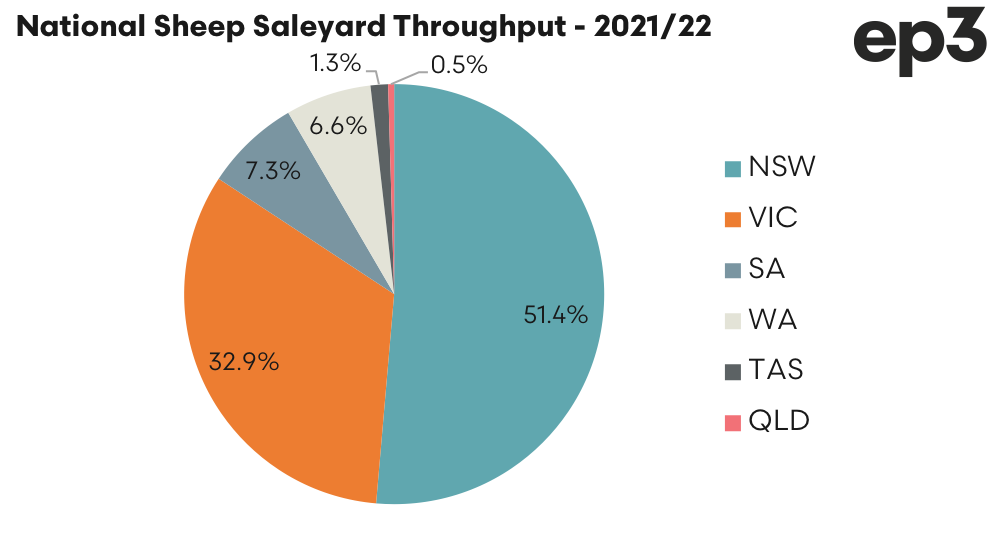

- New South Wales have captured the lions share of sheep & lamb saleyard throughput for the 2021/22 financial year at 51.4% of the national saleyard transactions.

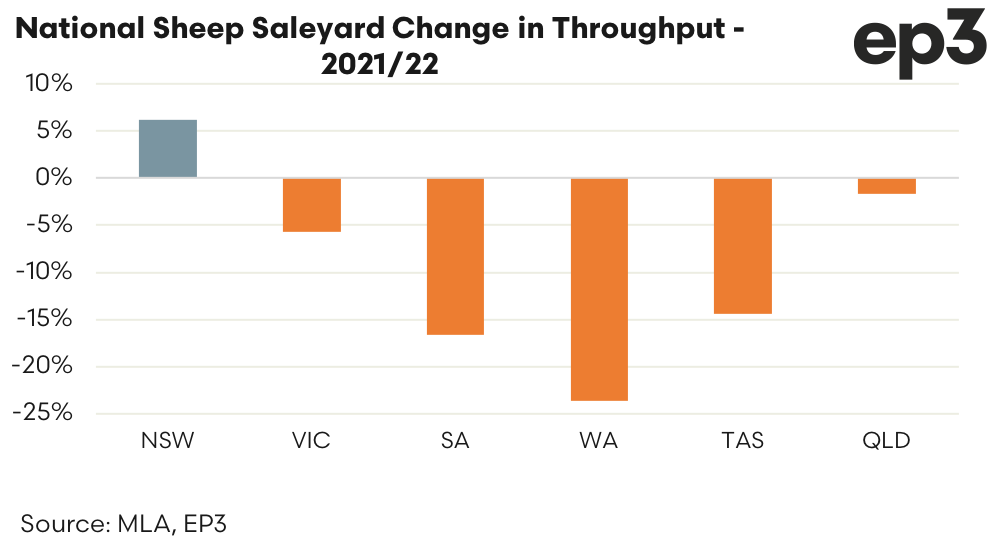

- The change to saleyard volumes from the previous financial year shows NSW was the only state to record an increase to sheep transactions with throughput volumes gaining 6.2%.

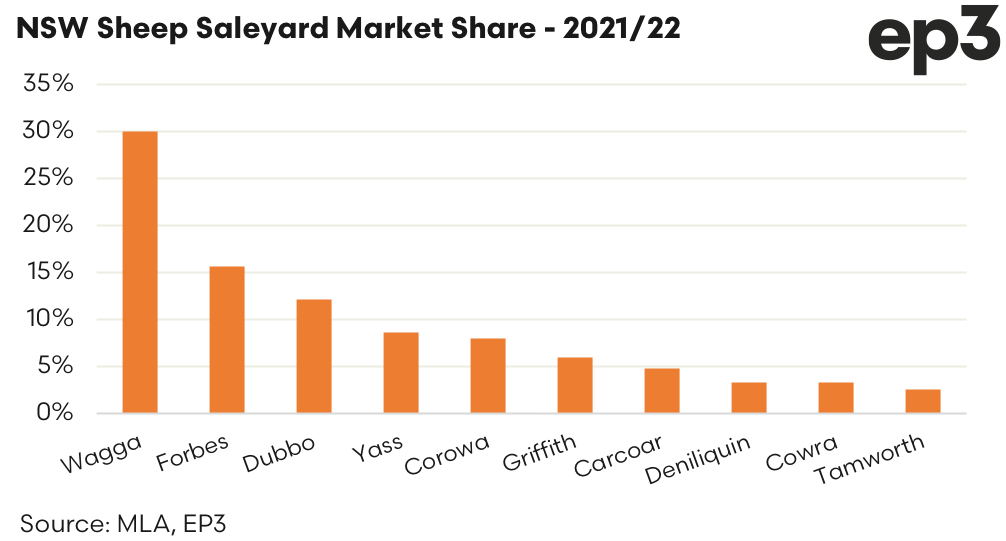

- In NSW the Wagga Wagga saleyard continues to dominate the sales volumes with 30% of the states annual throughput of sheep & lamb.

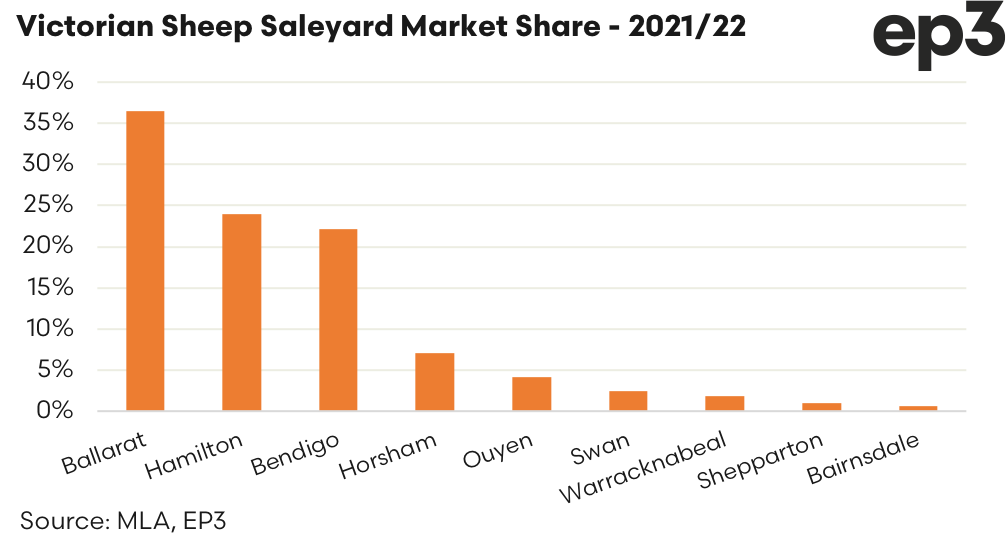

- The Victorian saleyard of Ballarat managed to maintain the highest market share in the state at nearly 37% of transactions.

The Detail

Meat & Livestock Australia have released saleyard throughput figures for sheep & lamb sales for the 2021/22 financial year which shows saleyards in New South Wales have captured the lions share of the turnover at 51.4% of the national saleyard transactions. NSW holds the most sheep in the country, at around 36% of the national flock, so its probably unsurprising that saleyards in this state dominate the transaction numbers.

Victoria, with around 23% of the national flock, come in at second place for saleyard throughput market share making up nearly 33% of sheep and lamb transactions for the 2021/22 season.

A look at the change to saleyard volumes from the previous financial year shows NSW was the only state to record an increase to transactions with throughput volumes gaining 6.2% from 6.3 million head to nearly 6.7 million head this year. Meanwhile, Victorian saleyards saw a 5.7% drop in sales from 4.5 million head to nearly 4.3 million head. Out west sheep producers shunned the saleyards even more aggressively with WA posting a 23.6% drop in sheep and lamb throughput volumes.

In NSW the Wagga Wagga saleyard continues to dominate the sales volumes with 30% of the states annual throughput of sheep & lamb. Wagga Wagga saw a 10.3% lift in sheep & lamb yardings for the 2021/22 financial year up from 1.8 million head last year to 2.0 million head this year. Forbes and Dubbo saleyards recorded nearly 20% gains in sheep and lamb throughput volumes apiece to sit in second and third position for saleyard market share at 16% and 12% of the states throughput, respectively.

Meanwhile Corowa and Carcoar saleyards posted the biggest annual declines in sheep & lamb throughput out of the top ten NSW saleyards with falls of 17% and 12%, respectively.

The Victorian saleyard of Ballarat saw a 5% decline in sheep & lamb throughput over the year, with numbers dropping from 1.64 million head to 1.56 million head, but managed to maintain the highest market share in the state at nearly 37% of transactions. Hamilton and Bendigo are in a tight tussle for the second top spot at 24% and 22% of the states market share of throughput. Bendigo saw numbers lift 2% over the year to 0.94 million head but it wasn’t enough growth to topple Hamilton at a little over 1 million head.

Of the top ten Victorian saleyards Horsham saw the largest fall in sheep & lamb throughput volumes, down 31% from 441,000 to 303,000 head.