Sheep sliding away

The Snapshot

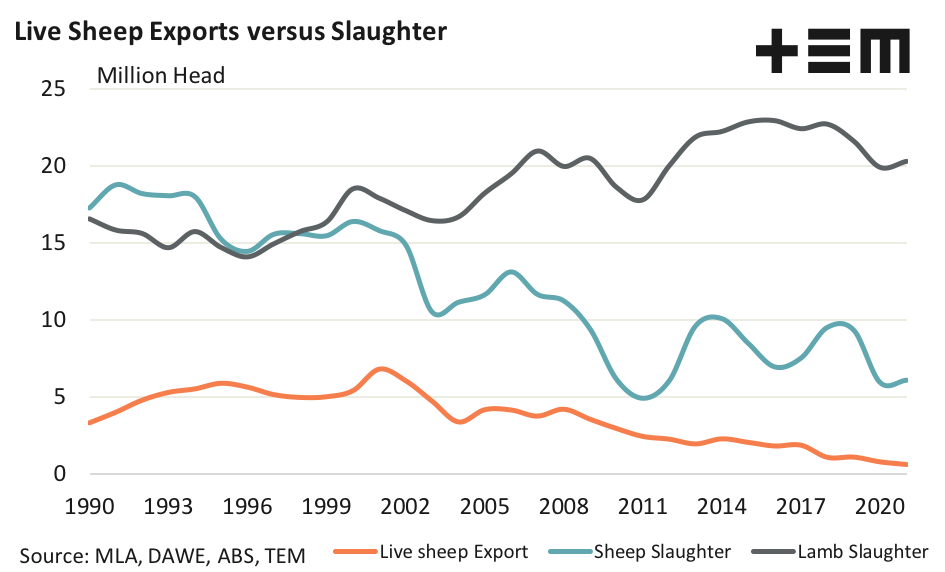

- Forecast volumes for live sheep export flows in 2021 are expected to be 640,000 head, which is about 88% lower than the peak in transports seen in 2001.

- Lamb slaughter volumes have increased by 11% despite the flock reducing from 110 million head in 2001 to an expected 68 million head for the 2021 season.

- WA dominates the port of exit for live sheep, with 98% leaving from WA in 2020 and 42% of these sheep destined for Kuwait.

The Detail

A subscriber query on the annual proportion of sheep and lamb turnoff each season prompted this piece as they had been advised recently that “most sheep in Australia go to live export” and wanted to test the veracity of this claim against the historic annual sheep and lamb slaughter volumes.

We often see comments made that are unsubstantiated by data and, as analysts, get frustrated when mis-information about the market is spread. As Jonathan Swift quoted “a lie can travel halfway around the world while the truth is still putting on its shoes” (often wrongly attributed to Mark Twain) and unfortunately it can be the same for mis-represented or factually incorrect statements quoting data.

As the data highlights over the last three decades, there has never been a time when live sheep export volumes have outperformed sheep nor lamb slaughter volumes, not even during the live sheep export peak near 7 million head in 2001.

Forecast volumes for live sheep export flows in 2021 are expected to be 640,000 head, which is about 88% lower than the peak in transports seen in 2001. Sheep slaughter volumes have declined 62% over the same time frame, which is somewhat unsurprising given that the Australian sheep flock has dropped nearly 40% from 2001 to 2021.

Noticeably, lamb slaughter volumes have increased by 11% despite the flock reducing from 110 million head in 2001 to an expected 68 million head for the 2021 season. Clearly, the increased lamb volumes available for slaughter is reflective of the move toward more prime lamb operations, increased focus on ewe management and increased productivity measures introduced into the sheep industry over the last two decades.

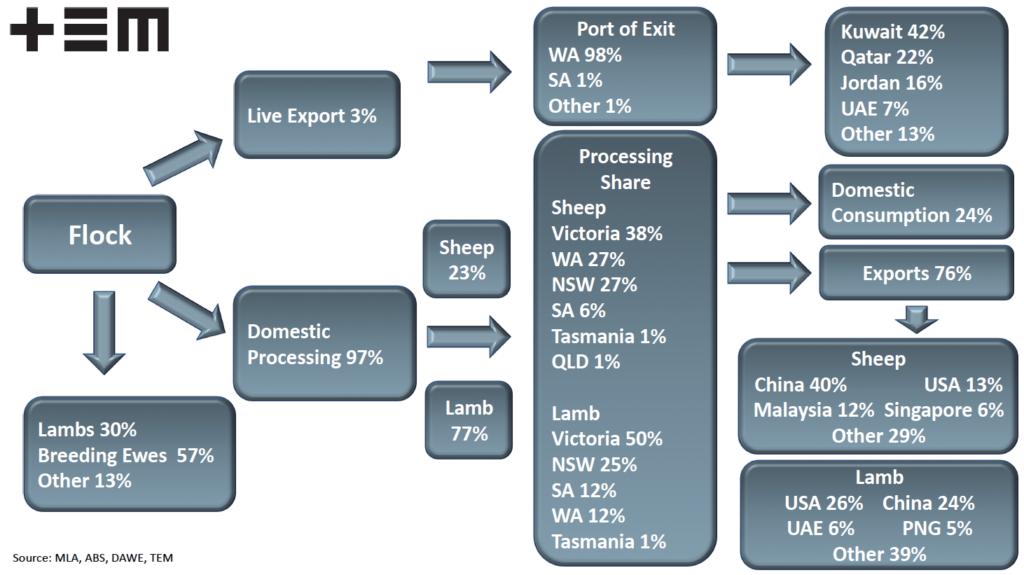

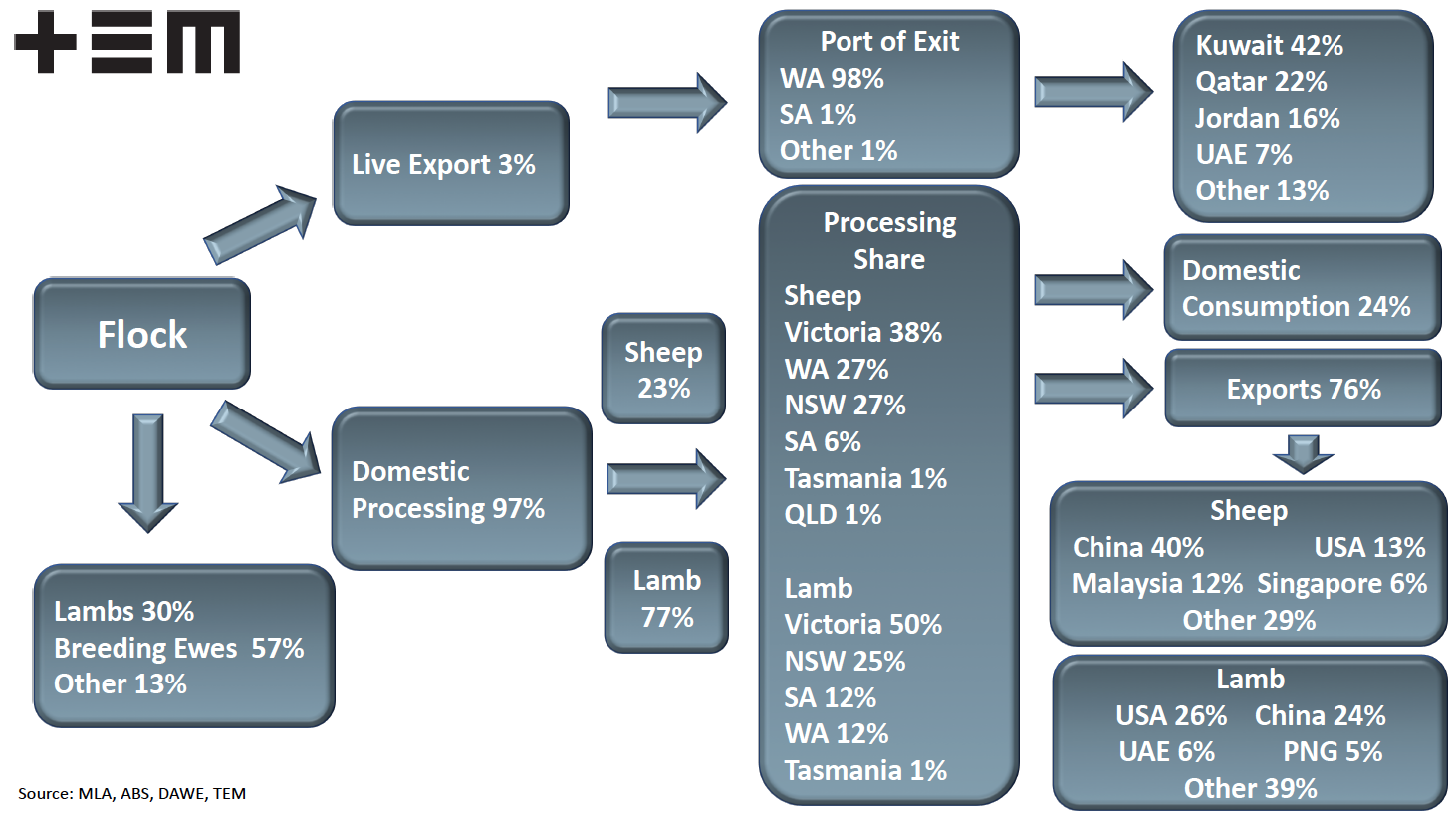

In order to summarise a few of the key aspects of the Australian sheep industry, and to provide a quick data reference point for subscribers, the Episode3 team have created a simple flow chart that outlines the proportions of the main sheep and lamb flows across the sector during the 2020 season.

Live export sheep volumes represent just 3% of the annual turnoff compared to the 97% of turnoff of sheep and lamb that are processed domestically. Western Australia dominates the port of exit for live sheep, with 98% leaving from WA in 2020 and 42% of these sheep destined for Kuwait.

Domestic processing volumes in 2020 comprised of 23% sheep and 77% lamb with Victorian abattoirs dominating both sheep and lamb slaughter at 38% and 50%, respectively. Approximately 24% of the sheep and lamb product processed is consumed locally with the balance exported, mainly to the USA and China.