Sheepmeat export update August 2025

August 2025 - Sheep Meat Export Update

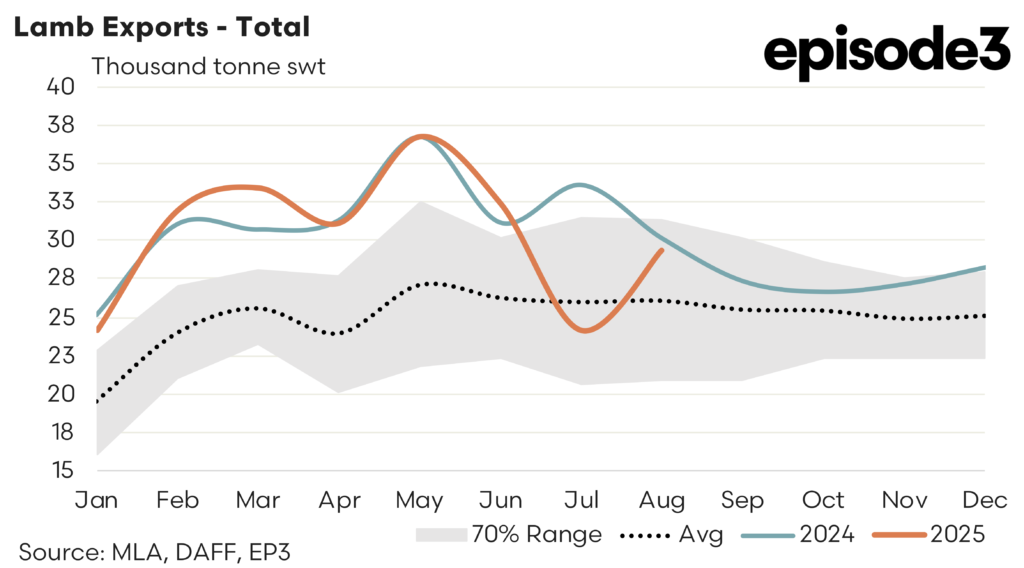

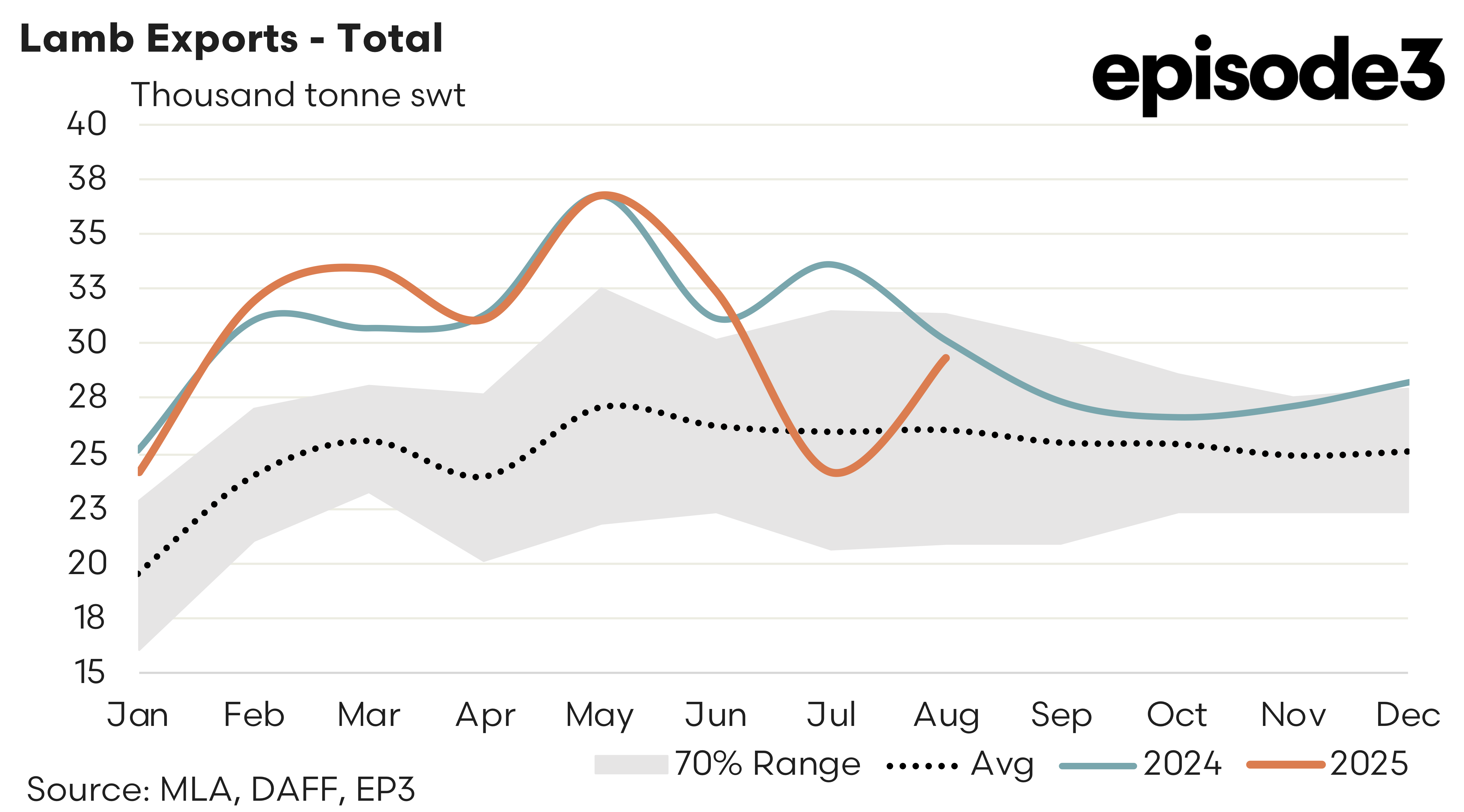

Total Australian lamb export volumes lifted 21% during August 2025, after a lower reset to trade volumes seen in July. There was 29,366 tonnes reported shipped offshore in August, which represent trade flows that are 12% stronger than the five-year average for August.

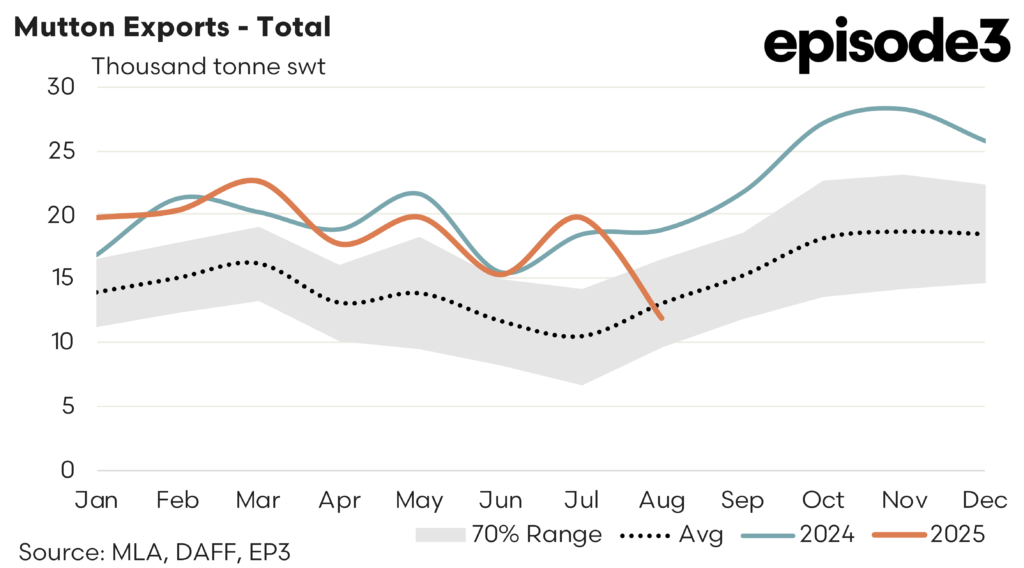

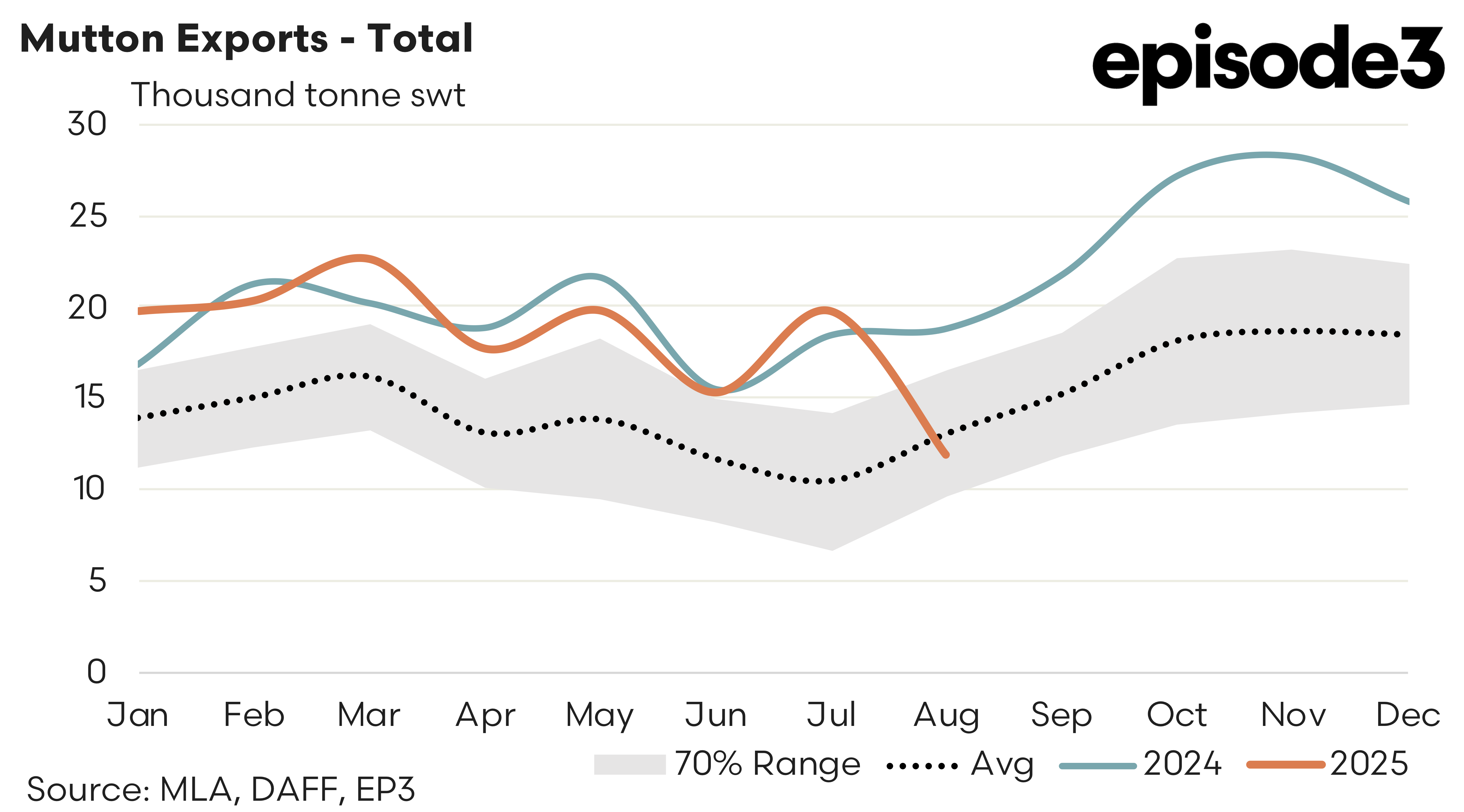

Total mutton export volumes were less favourable with a 39% dip in flows during August to 12,004 tonnes, the lowest monthly figure since June 2022. This slowdown places mutton export volumes 8% below the seasonal average for August, based on the last five years of the trade.

In terms of the top trade destinations for Australian lamb exports, the following was noted.

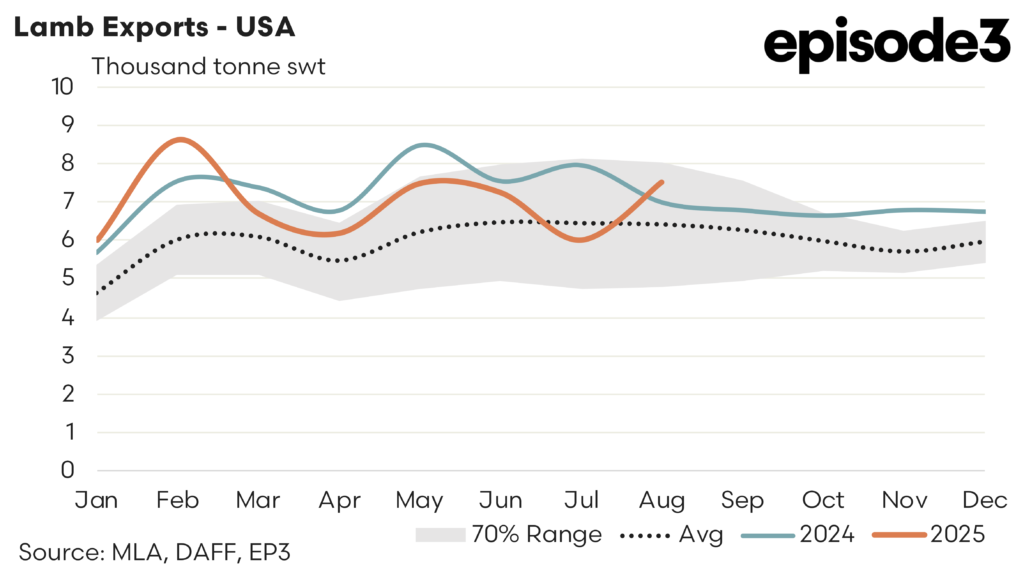

USA- There was a 25% rebound in Aussie lamb trade volumes to the USA in August to see 7,521 tonnes exported. Compared to the five-year seasonal trend this puts current flows 17% above the August average pattern.

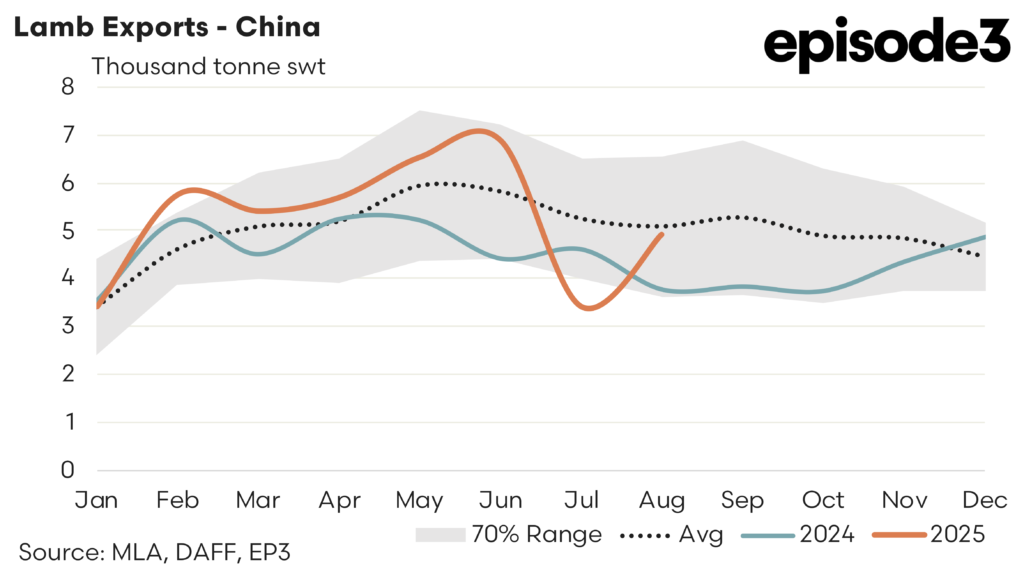

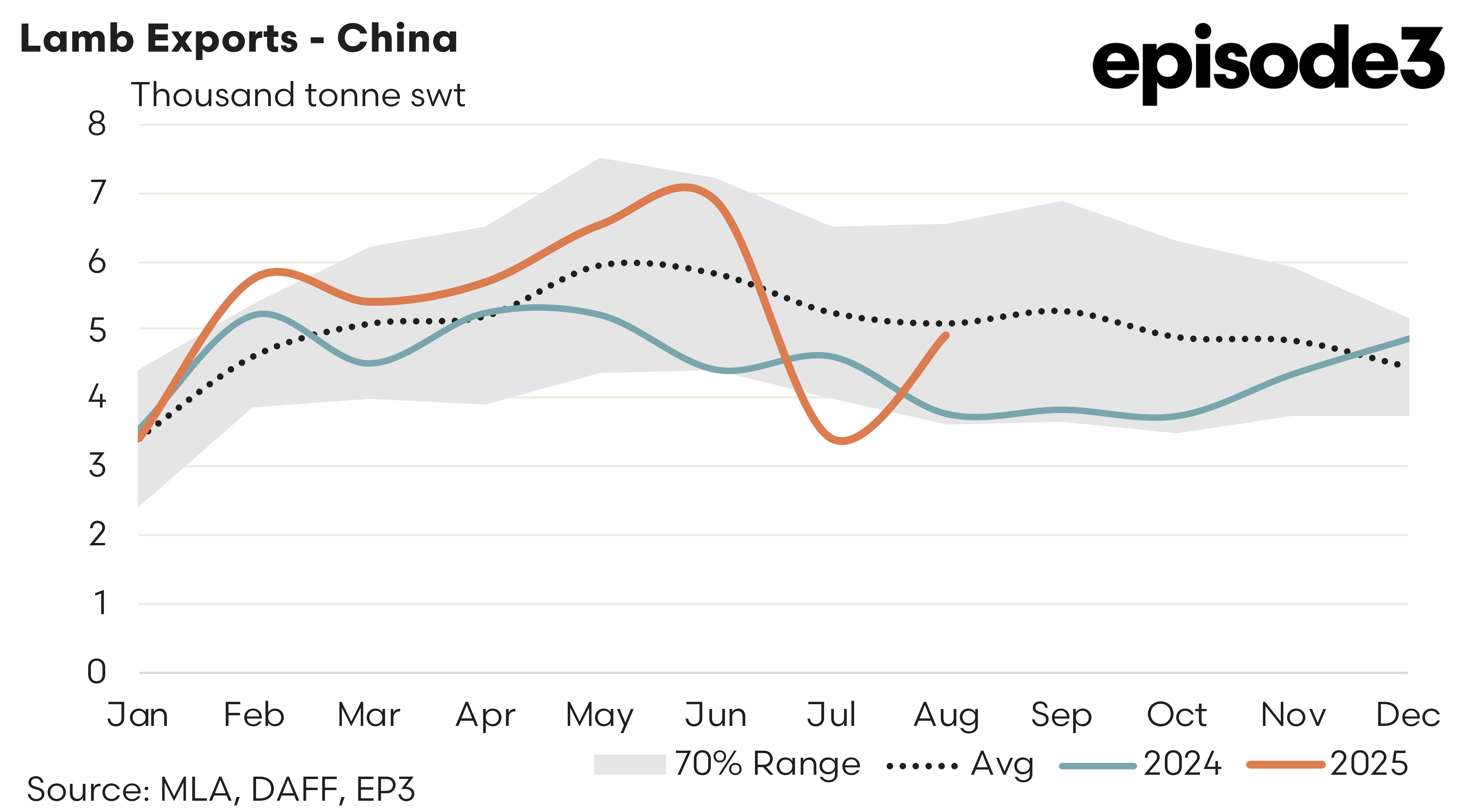

China – There was a 44% recovery in lamb flows to China in August after the July 50% drop in the trade. August saw 4,907 tonnes shipped to China to get just 4% below the five-year average trade flows usually seen in August.

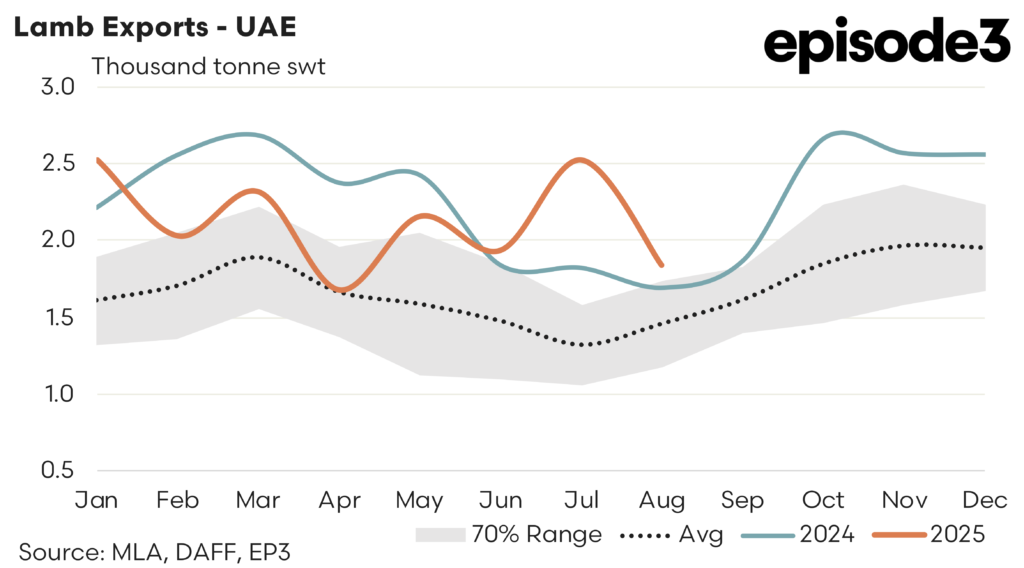

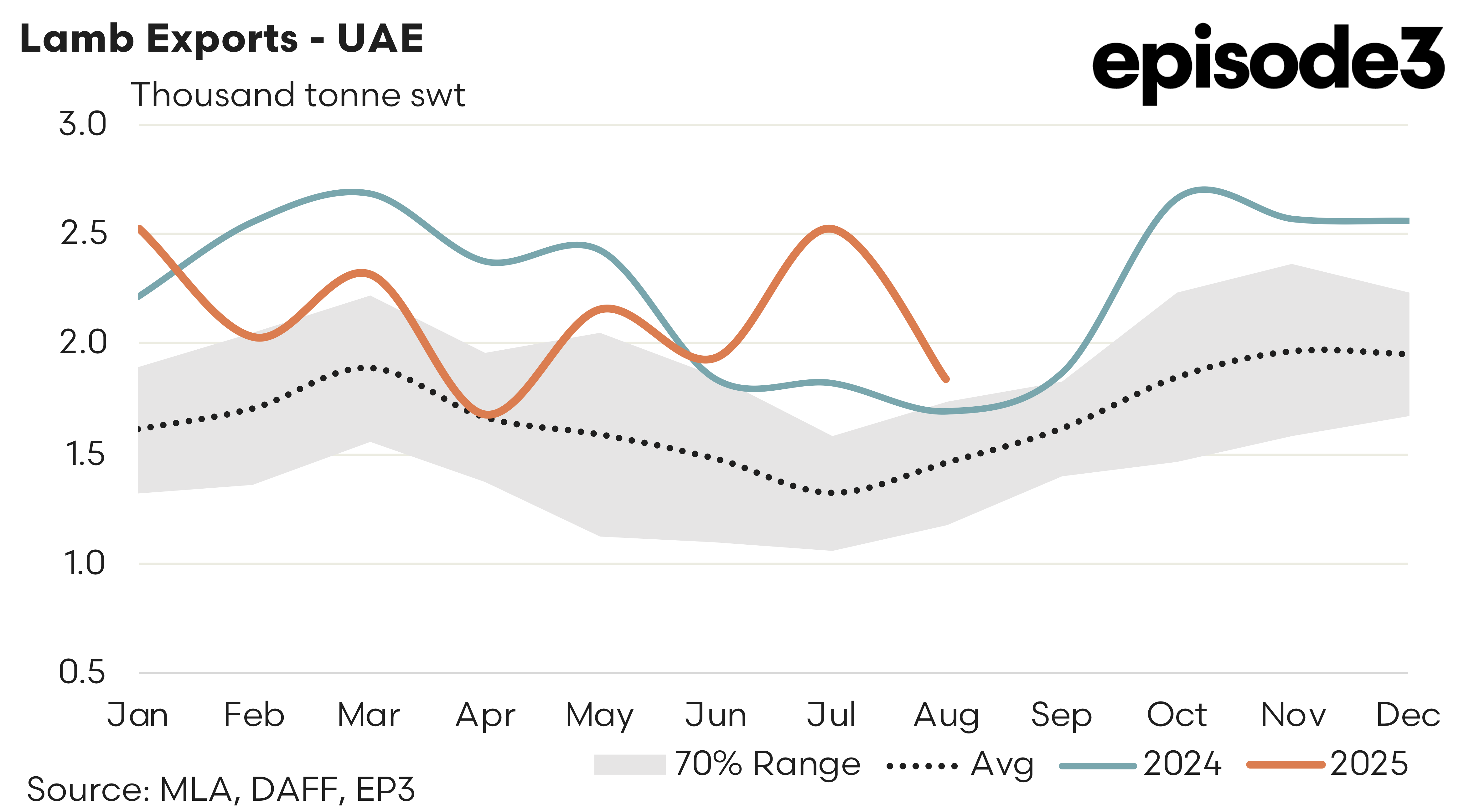

UAE – Aussie lamb exports to the UAE dipped 27% during August to 1,842 tonnes swt. Despite the drop in trade activity these levels still sit 26% above the average seasonal trade levels for August, based upon the last five years of the trade.

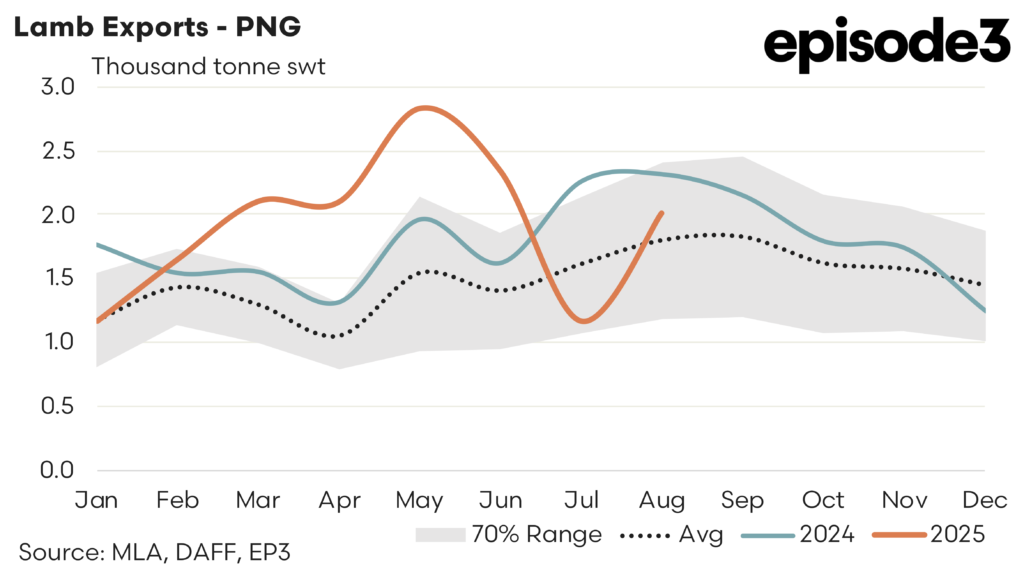

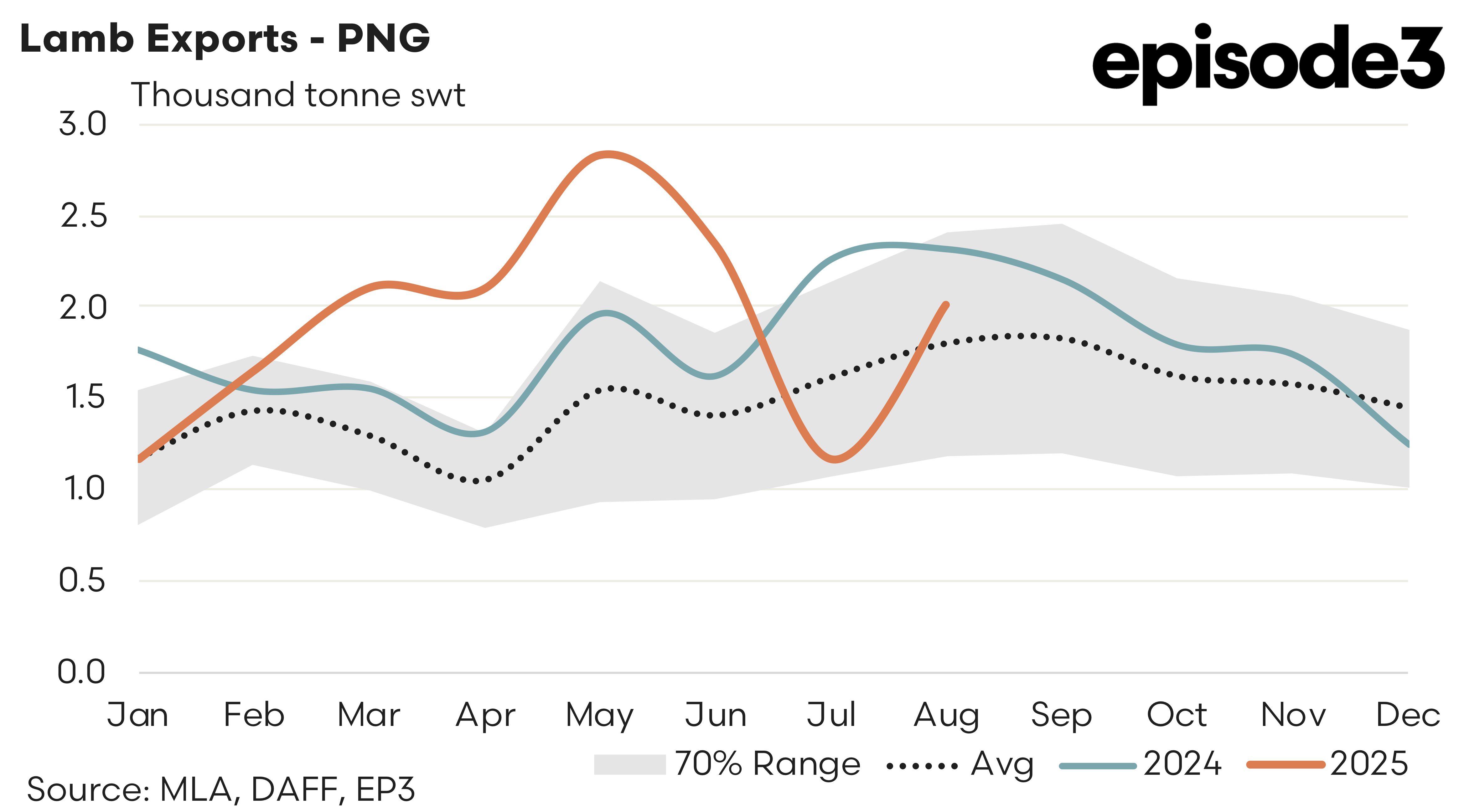

PNG – After a 50% drop in export volumes in July to PNG there was a 72% rebound during August with trade flows reported at 2,011 tonnes. Compared to the five-year average for August this places the trade to PNG back above the average trend by 12% for this time in the season.

In terms of the top trade destinations for Australian mutton exports, the following was noted.

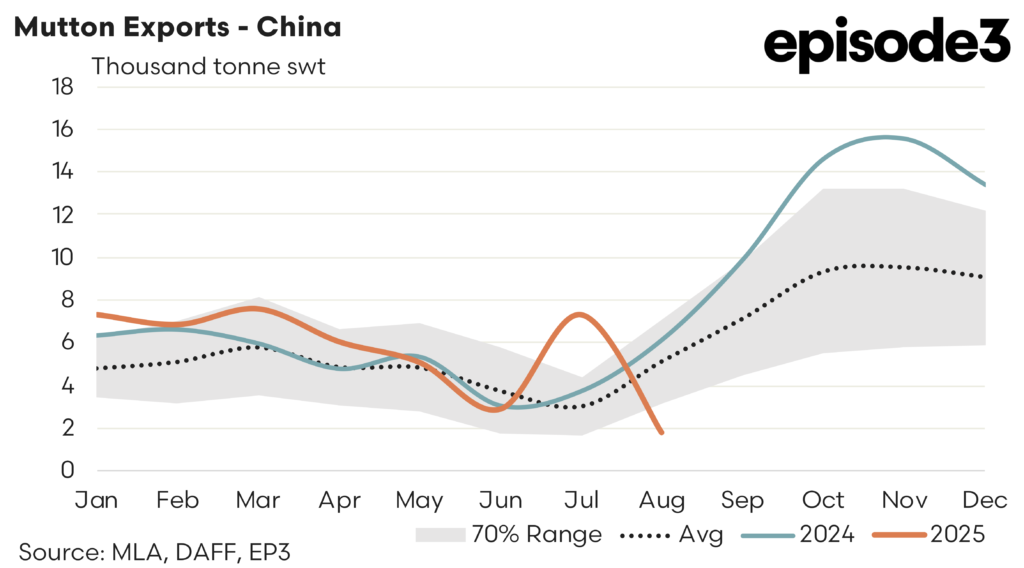

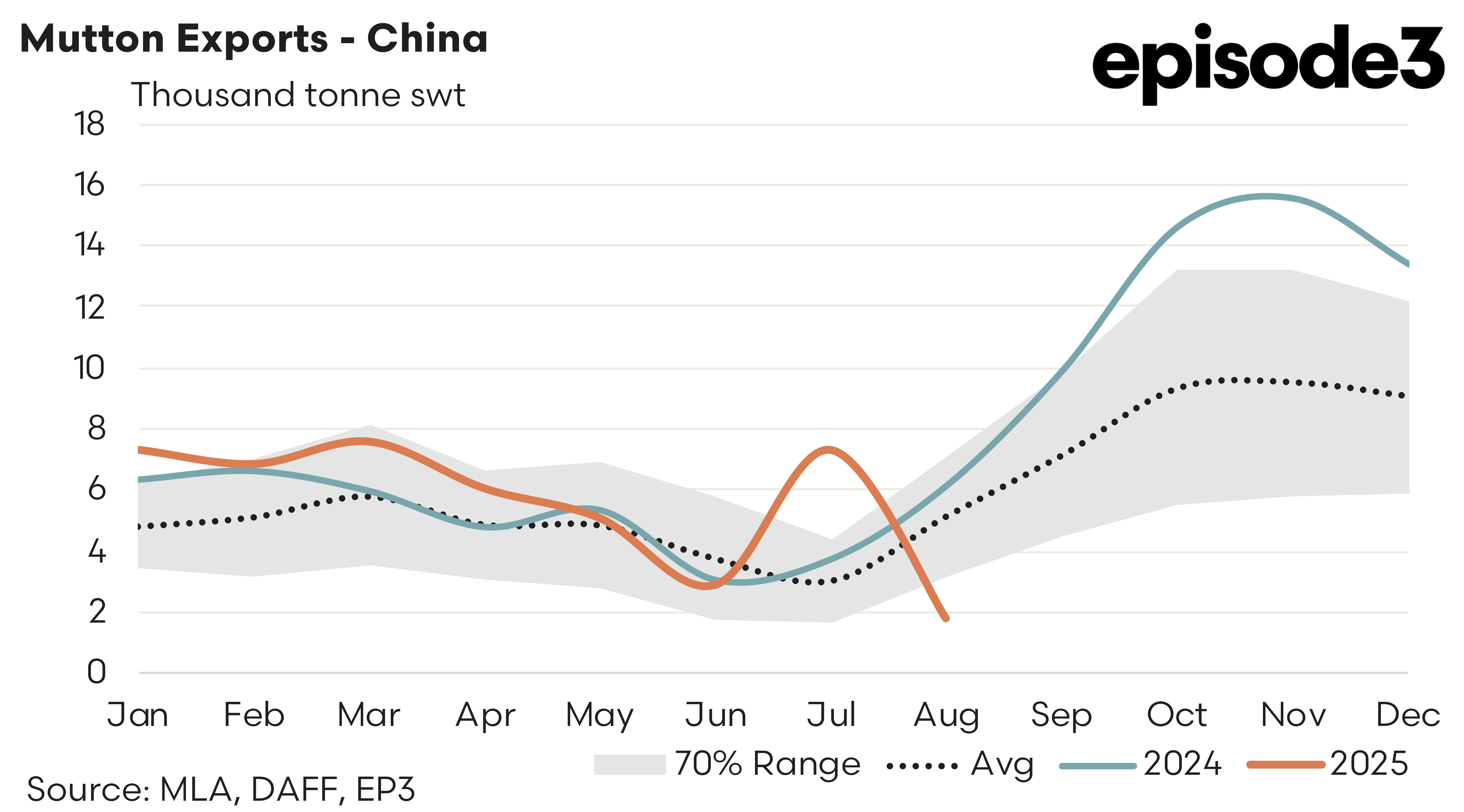

China – There was a 76% drop in Aussie mutton flows to China in August with just 1,776 tonnes reported shipped. This is the lowest monthly trade volumes since July 2020 and sits 66% under the five-year average for August.

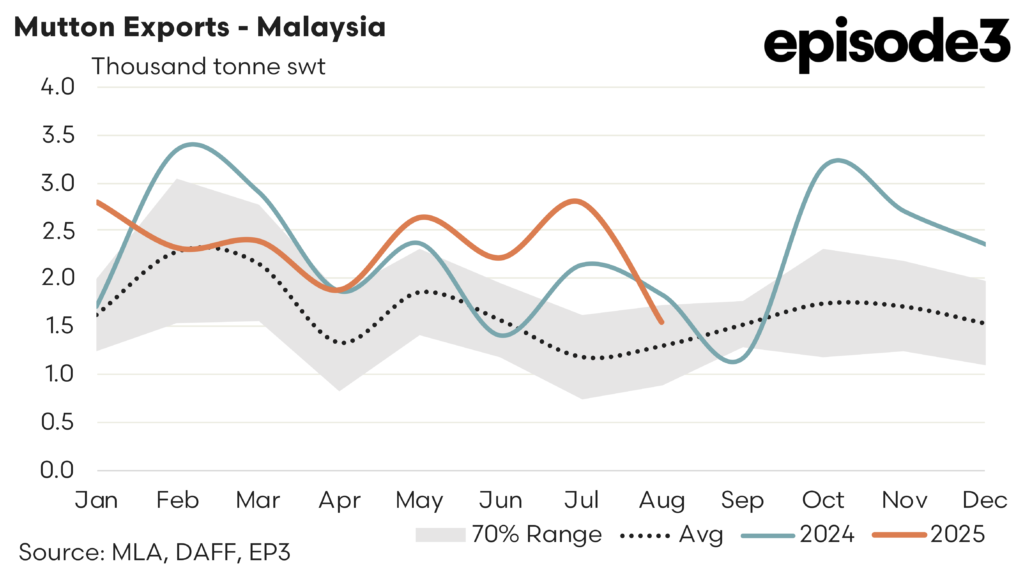

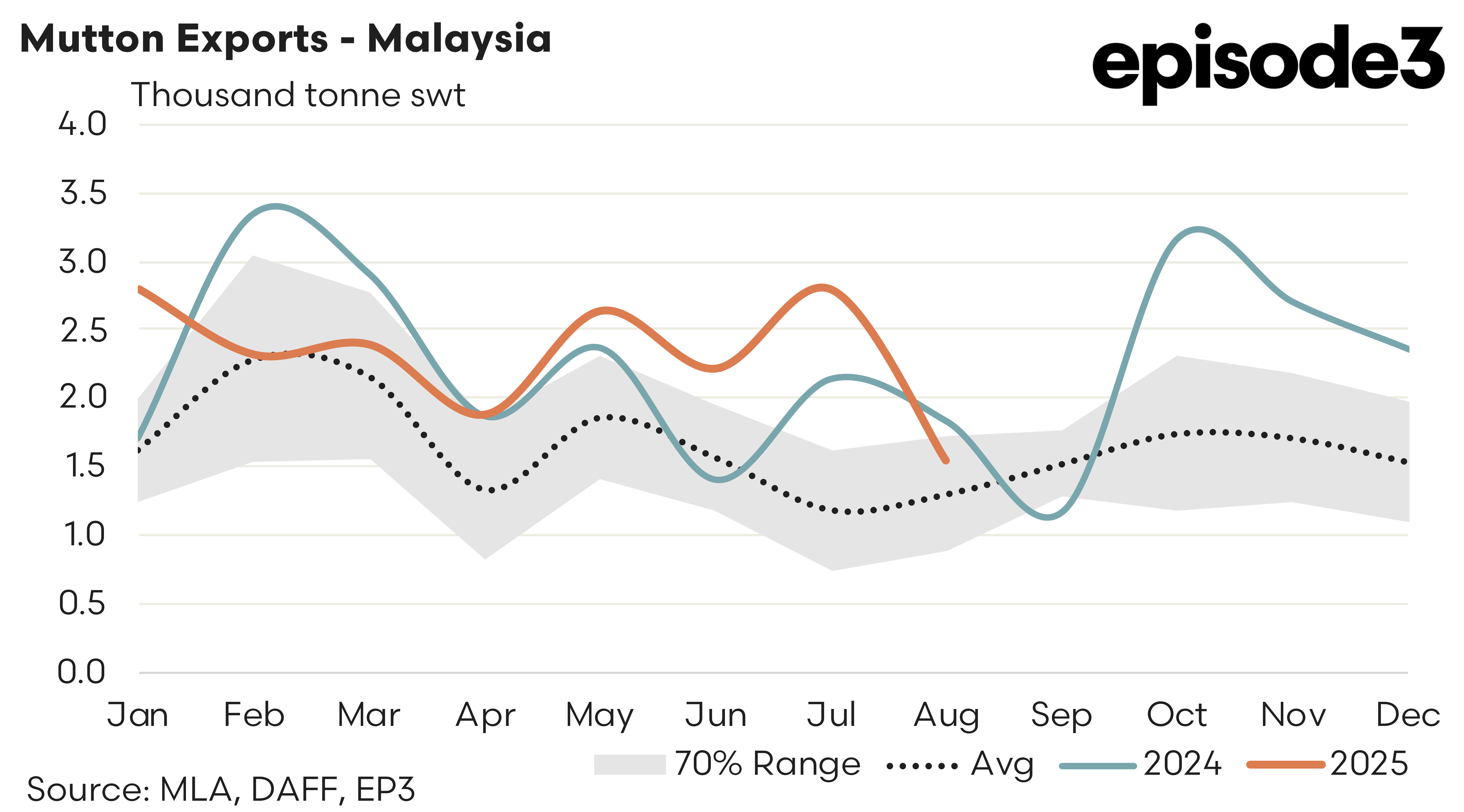

Malaysia – Mutton to Malaysia also drifted lower in August with a 44% drop noted to 1,558 tonnes. Despite the easing trade the current flows to Malaysia sit 19% above the August five-year average trend.

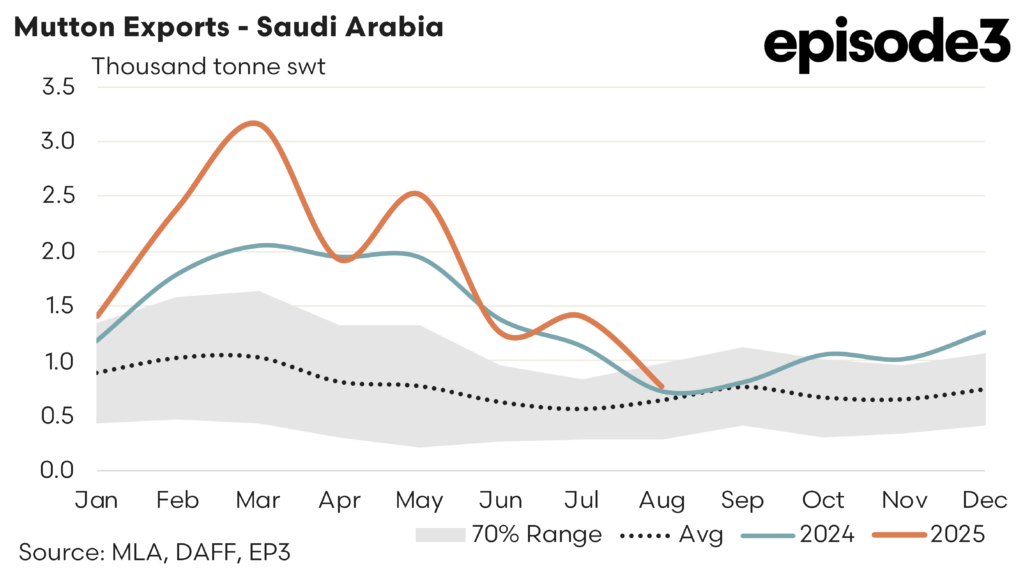

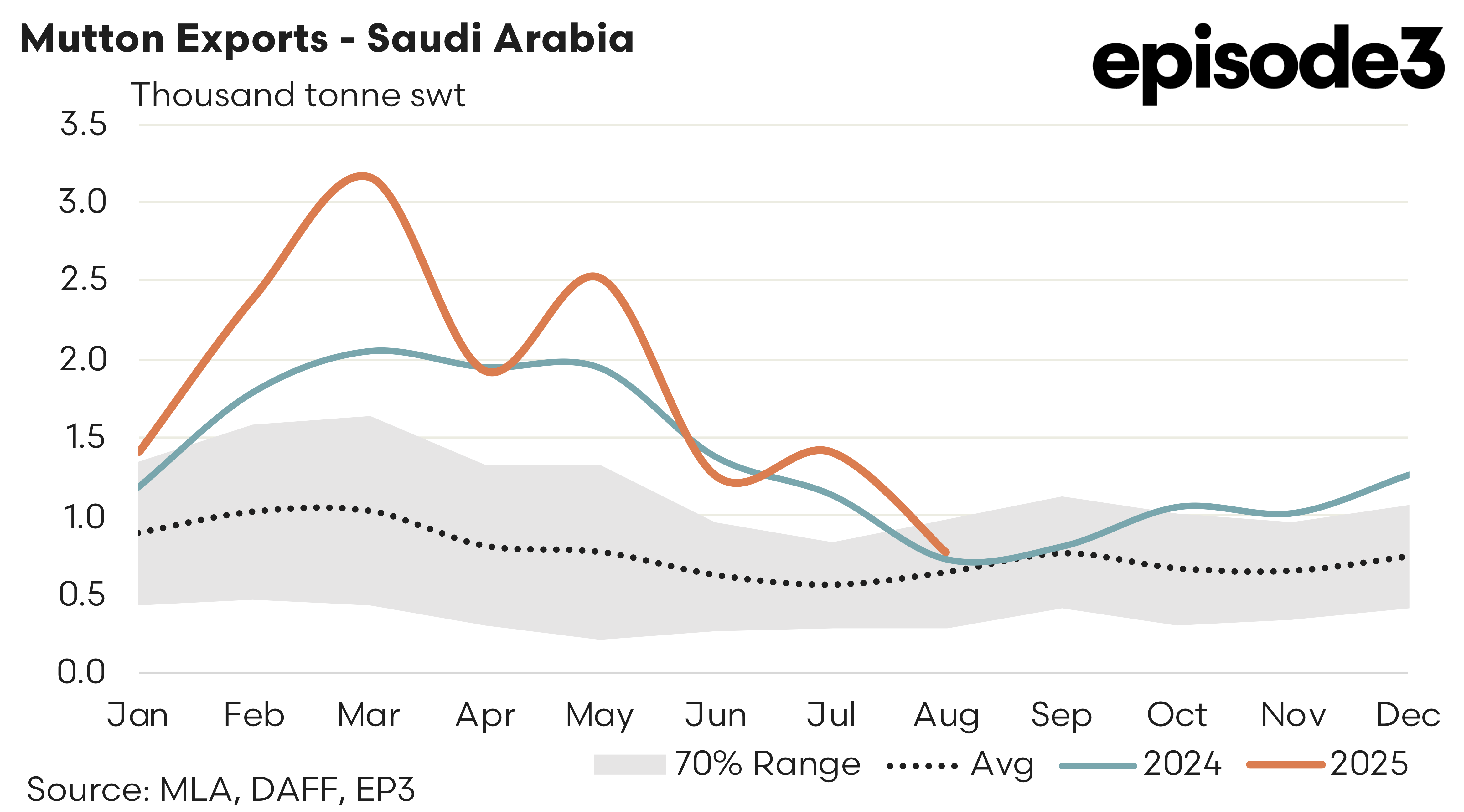

Saudi Arabia – Mirroring the Malaysia declines the Aussie mutton trade to Saudi Arabia dropped 45% from July to August, reaching just 777 tonnes swt. Just like Malaysia, despite the trade decline the August figures still sit 21% above the five-year average trend for this time in the year.

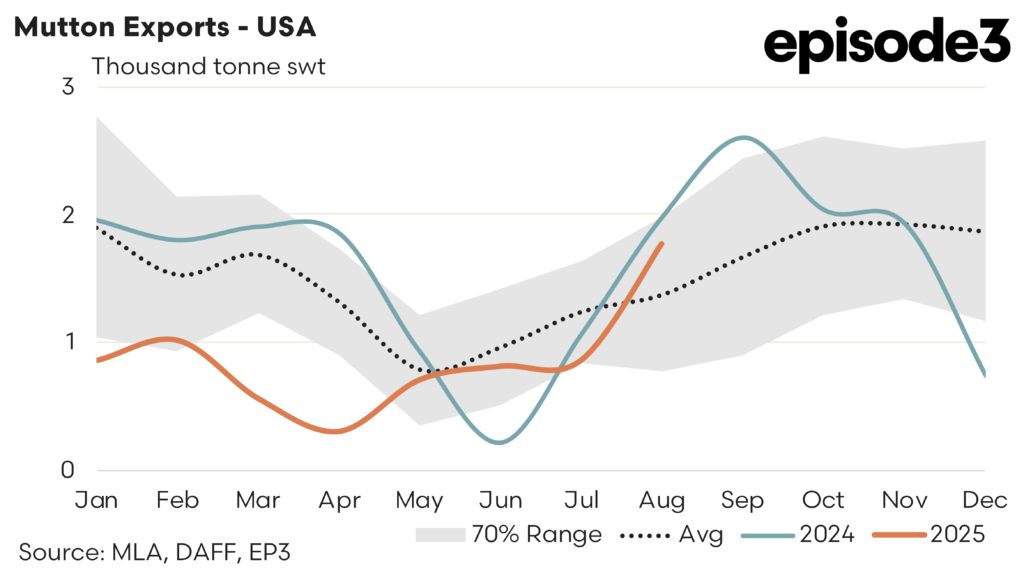

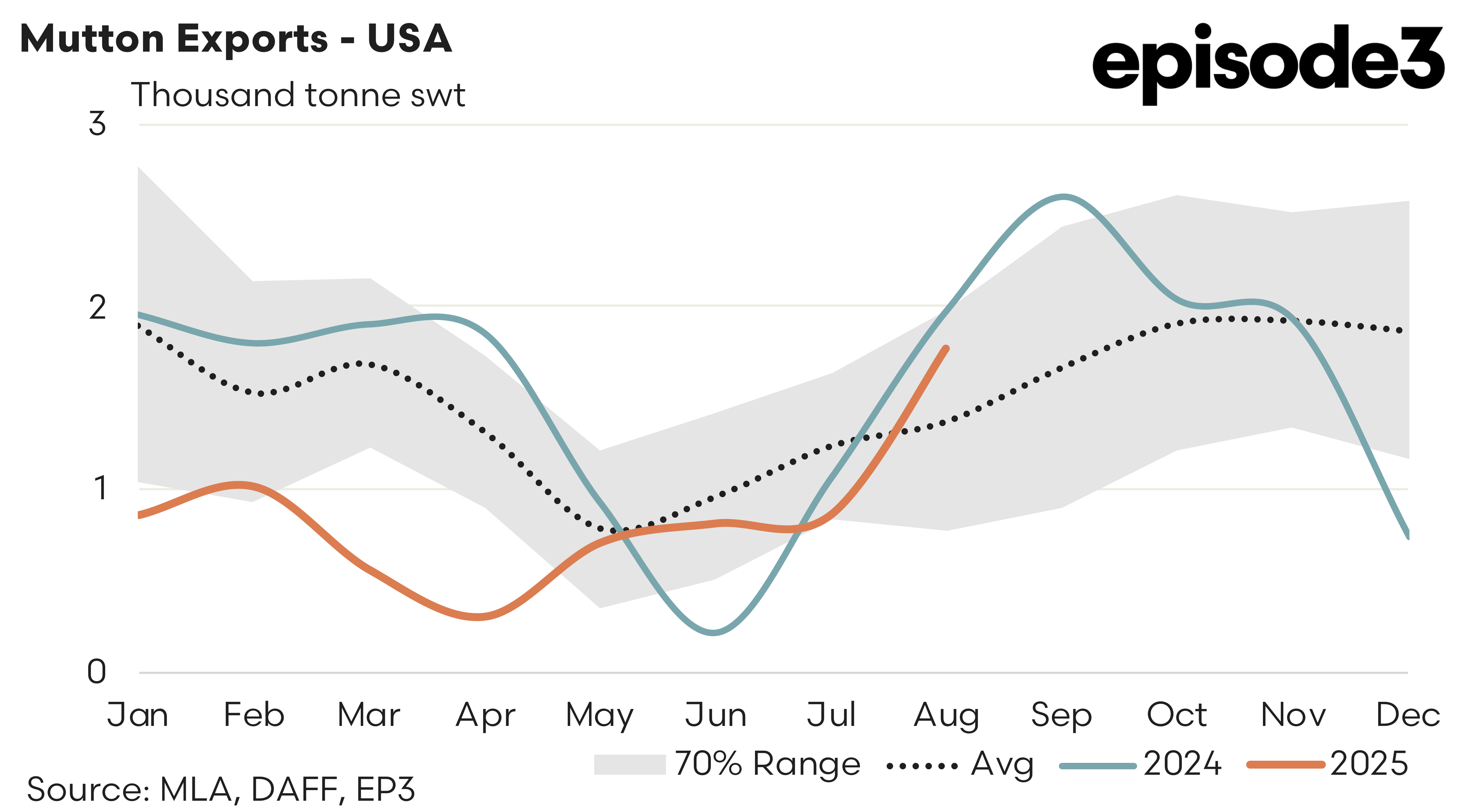

USA – US demand for Aussie mutton was one bright spark in the top trade destinations with a 105% rebound in flows during August. Coming off a low ebb in July there was 1,774 tonnes shipped to the USA in August, representing trade flows that are 29% higher than the five-year average for August.