Sheepmeat export update June 2025

June 2025 - Sheepmeat Export Update

Record high prices at the saleyard into winter have taken their toll a little on offshore demand for Aussie sheep meat export flows over June with reduced trade to several key destinations, albeit coming off quite elevated trade levels.

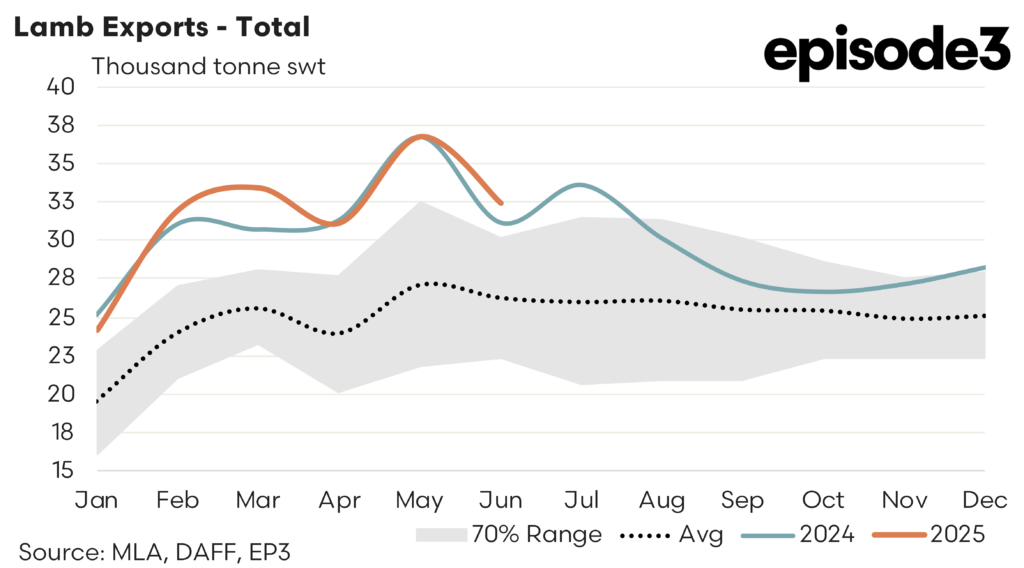

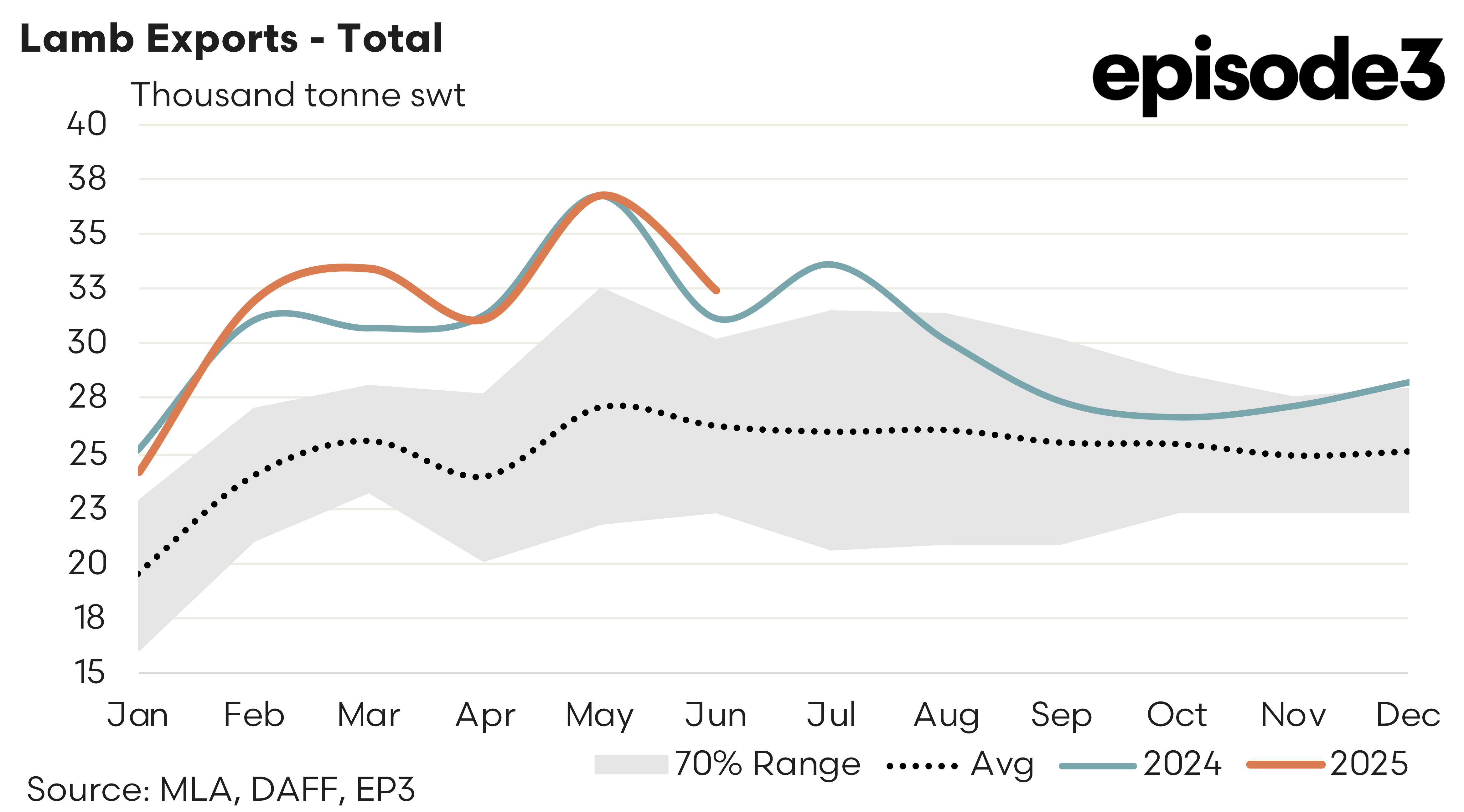

Total Australian lamb export flows eased by 12% to see 32,437 tonnes shipped offshore over the month. Despite the easing in the trade the flows seen during June 2025 still outperformed June 2024 by 4% and remain at levels that are 23% higher than the five-year average lamb export levels for the June period.

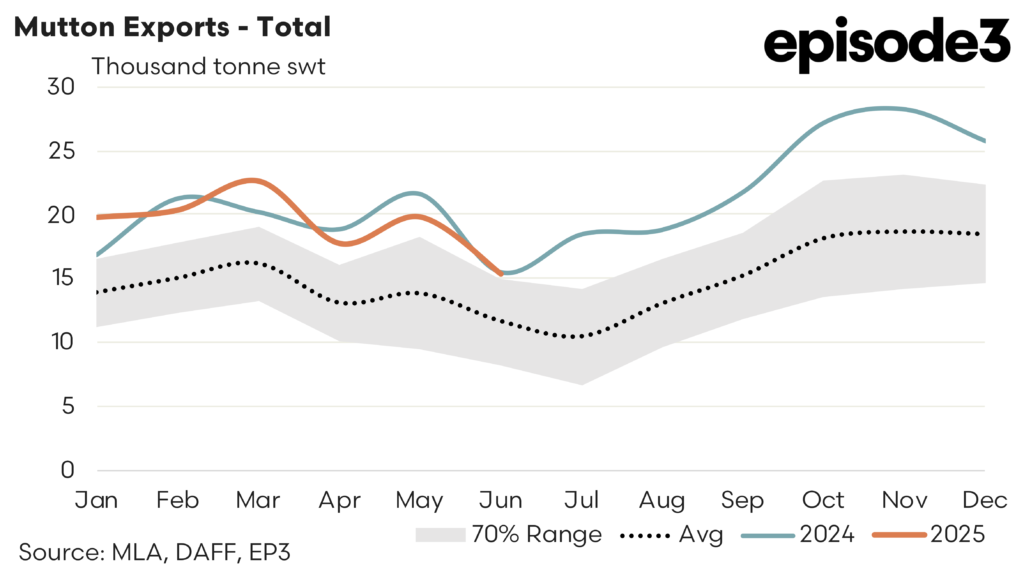

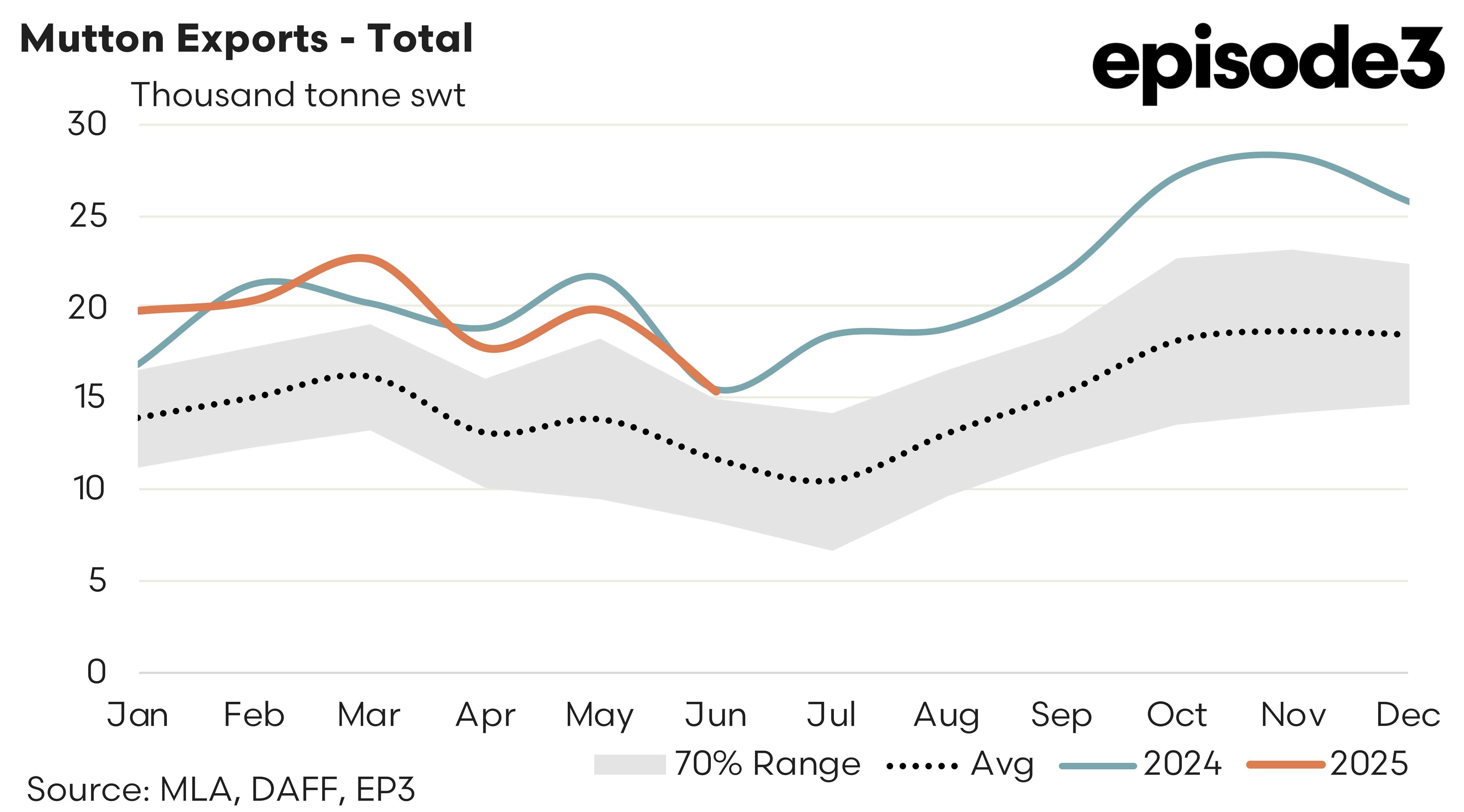

Total mutton exports from Australia had a stronger reaction to lamb to the higher livestock pricing with a 22% drop in mutton exports noted over June. At 15,374 tonnes shipped during June the current mutton export flows have closely matched the trade levels seen during June 2024 and are trading at levels 32% higher than the normal June average flows, based upon the last five years of the trade.

In terms of the top trade destinations for Australian lamb exports, the following was noted.

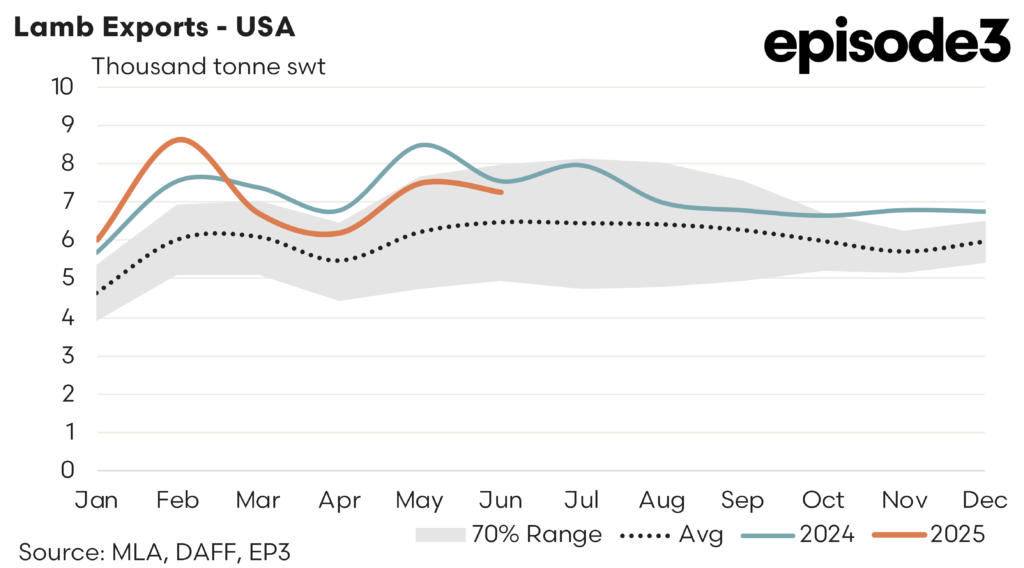

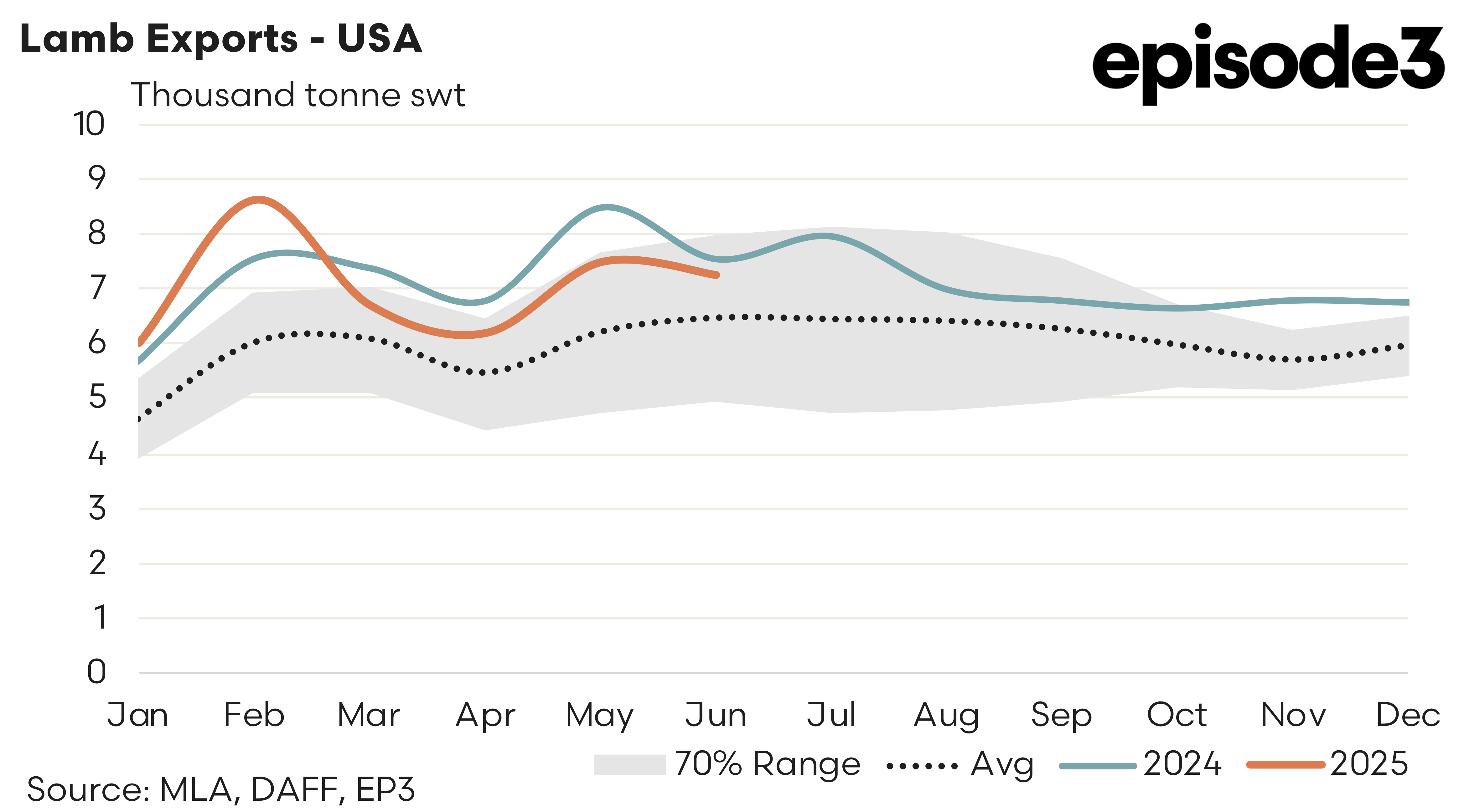

USA- There was a mild 3% easing in Australian lamb exports to the USA during June to see 7,255 tonnes sent offshore. Despite the slight decline the trade remains reasonably healthy sitting at levels that are 12% higher than the five-year average for June.

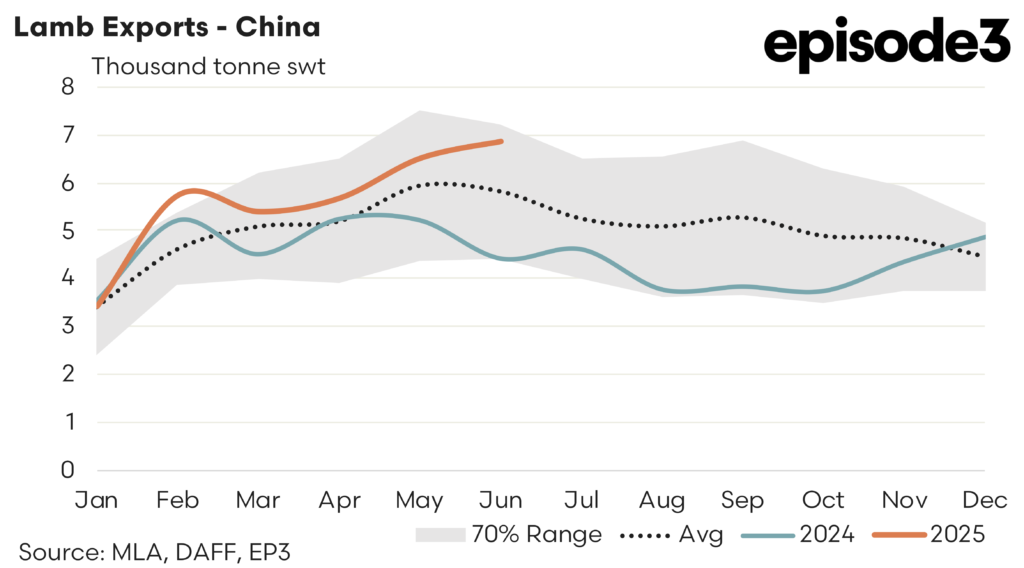

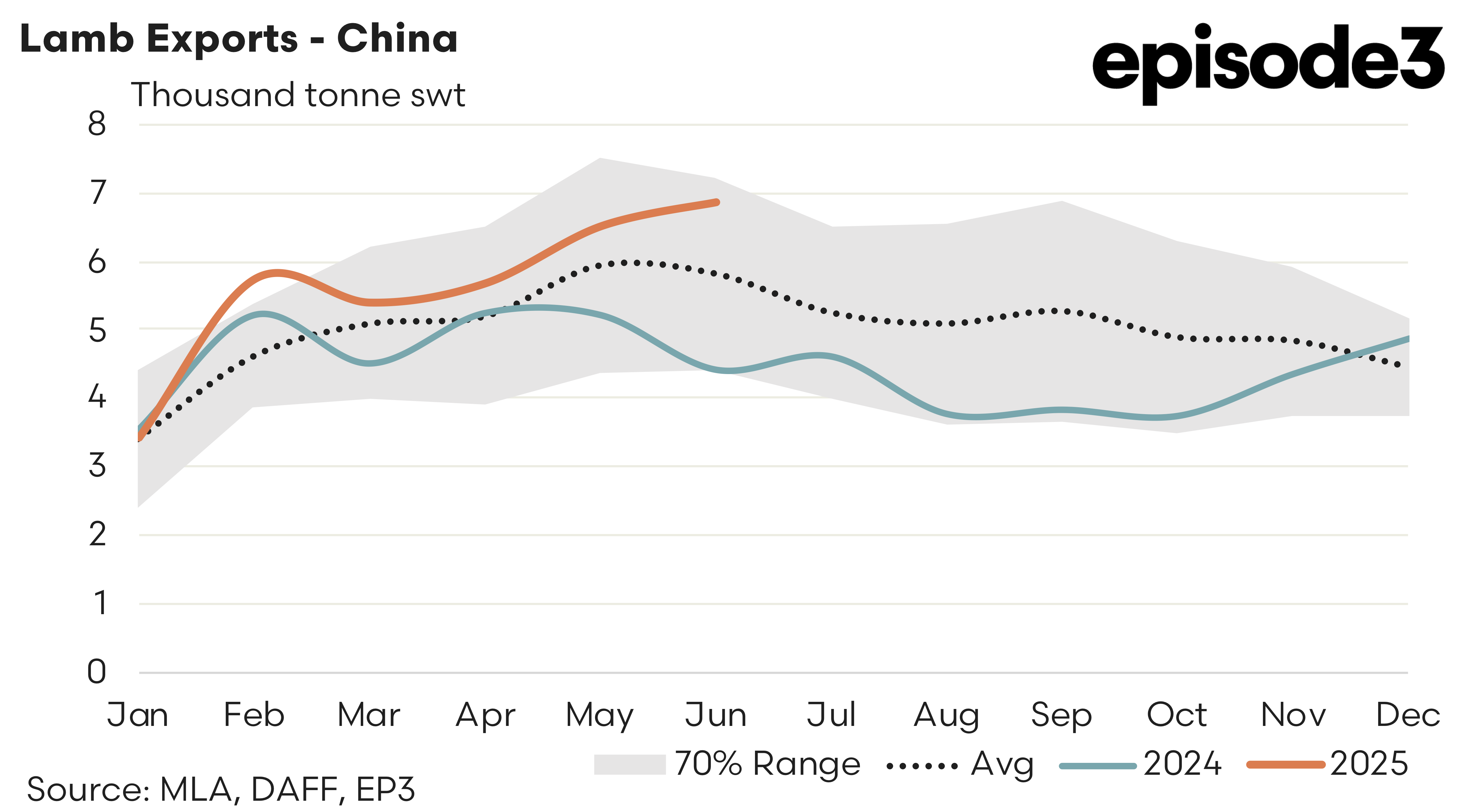

China – Lamb trade flows to China bucked the broad trend for June with a 5% lift reported to hit 6,868 tonnes shipped over the month. This represents lamb export flows that are 18% above the June average lamb trade levels, based upon the last five years of the trade.

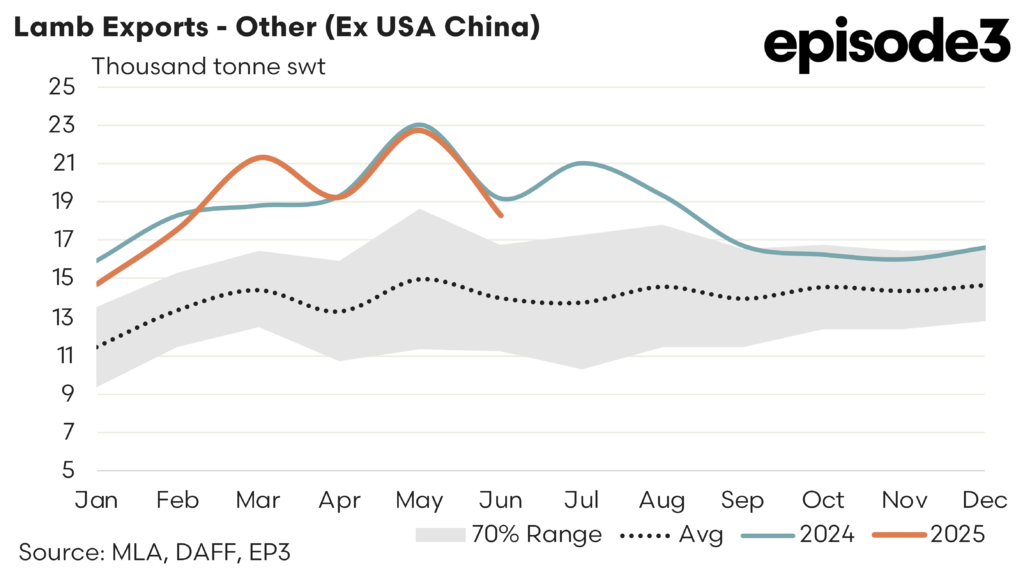

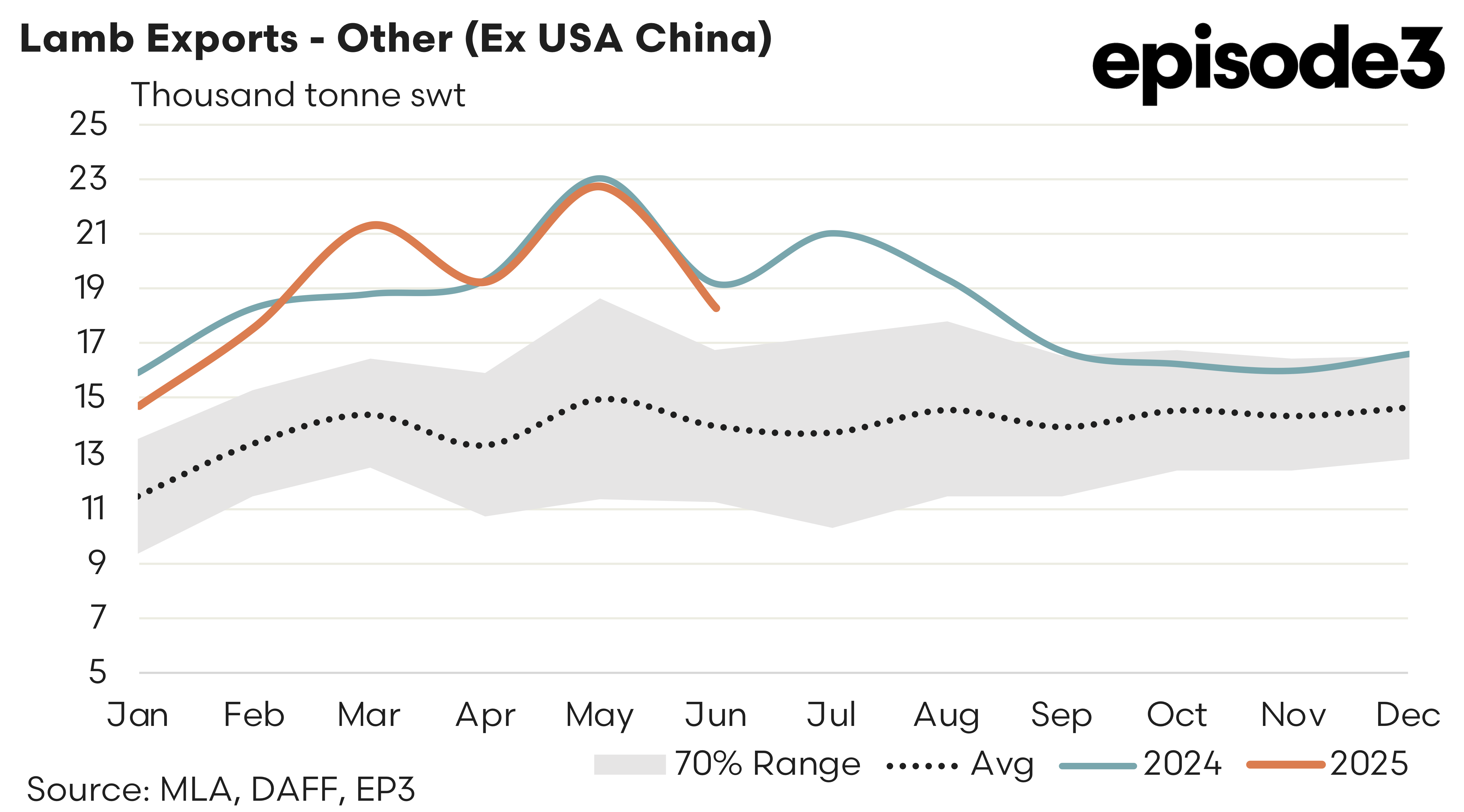

The others – Trade to other destinations (ex China and the USA) is broadly mirroring the trend set last season with a 20% drop in the trade to 18,314 tonnes. Overall, demand from the “others” remains strong though on a historic basis with the current flows sitting 31% above the June five-year average trade levels.

In terms of the top trade destinations for Australian mutton exports, the following was noted.

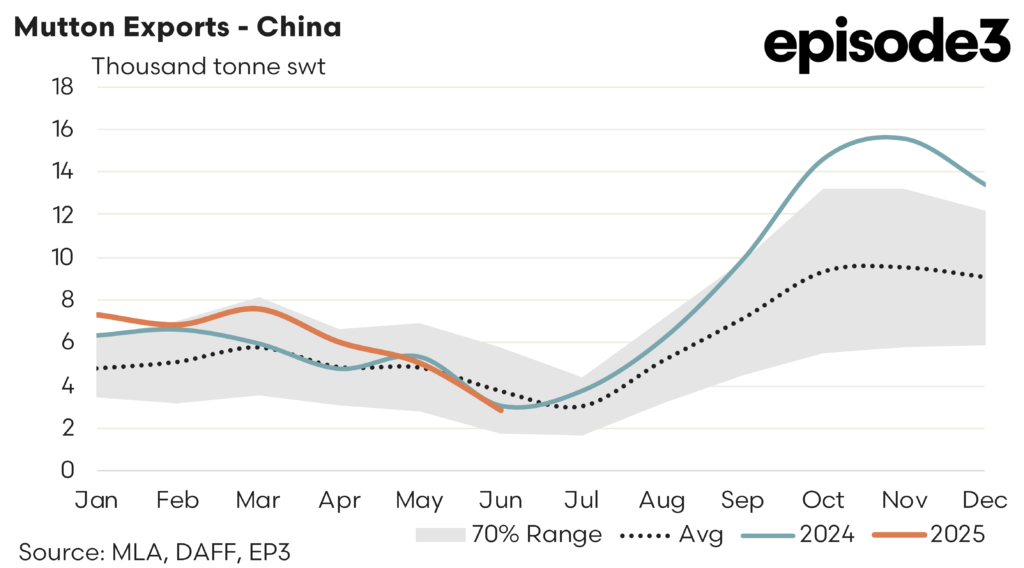

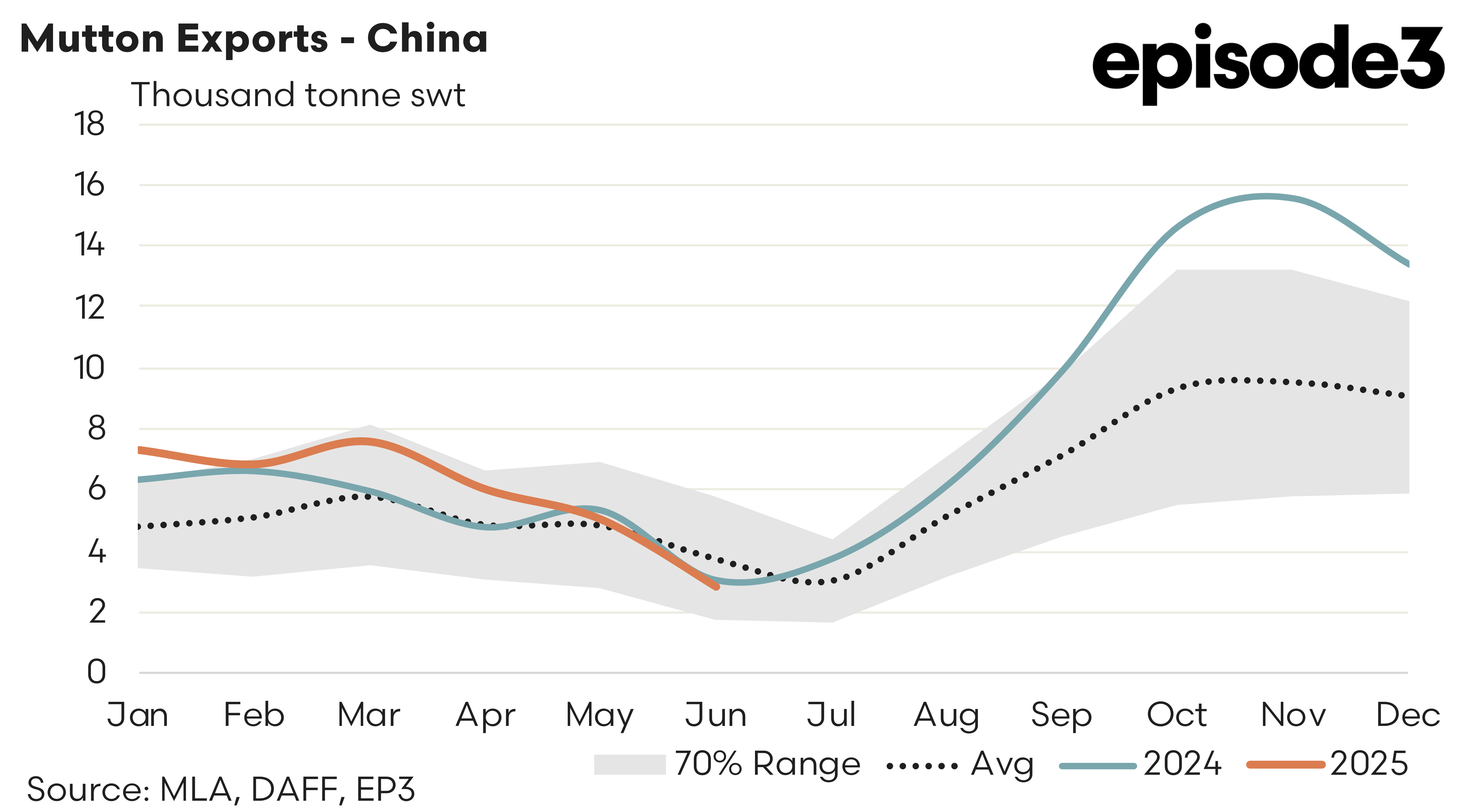

China – The mutton export flows from Australia into China are following the normal seasonal easing we usually see into winter with June recording a 43% drop in the trade to 2,880 tonnes. Current trade levels are sitting 24% below the June average pattern, based on the last five years of the trade, but as the seasonal average trend shows it is not uncommon to see the lowest seasonal trade levels occurring over the Australian winter given that this usually coincides with livestock seasonal price peaks.

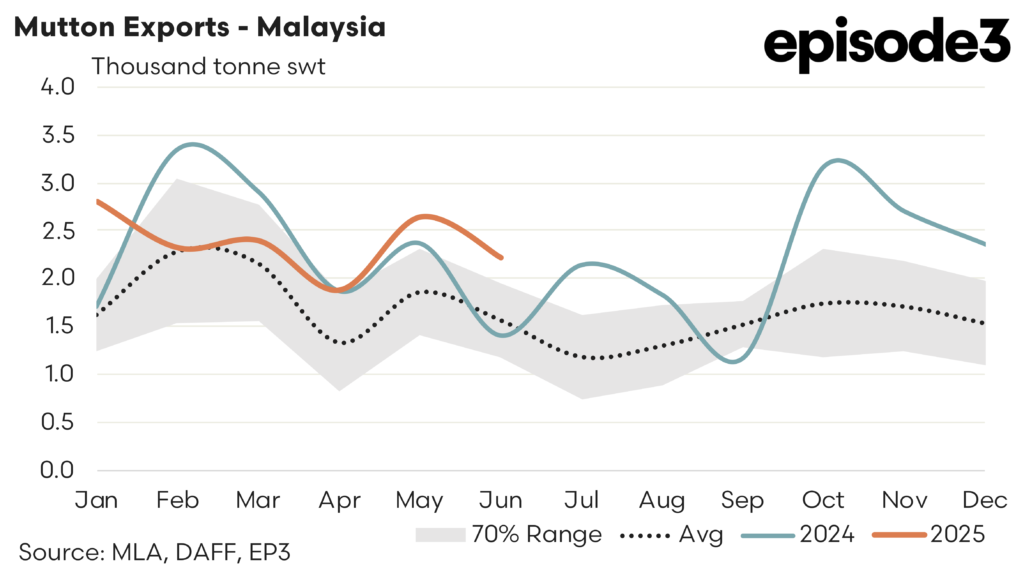

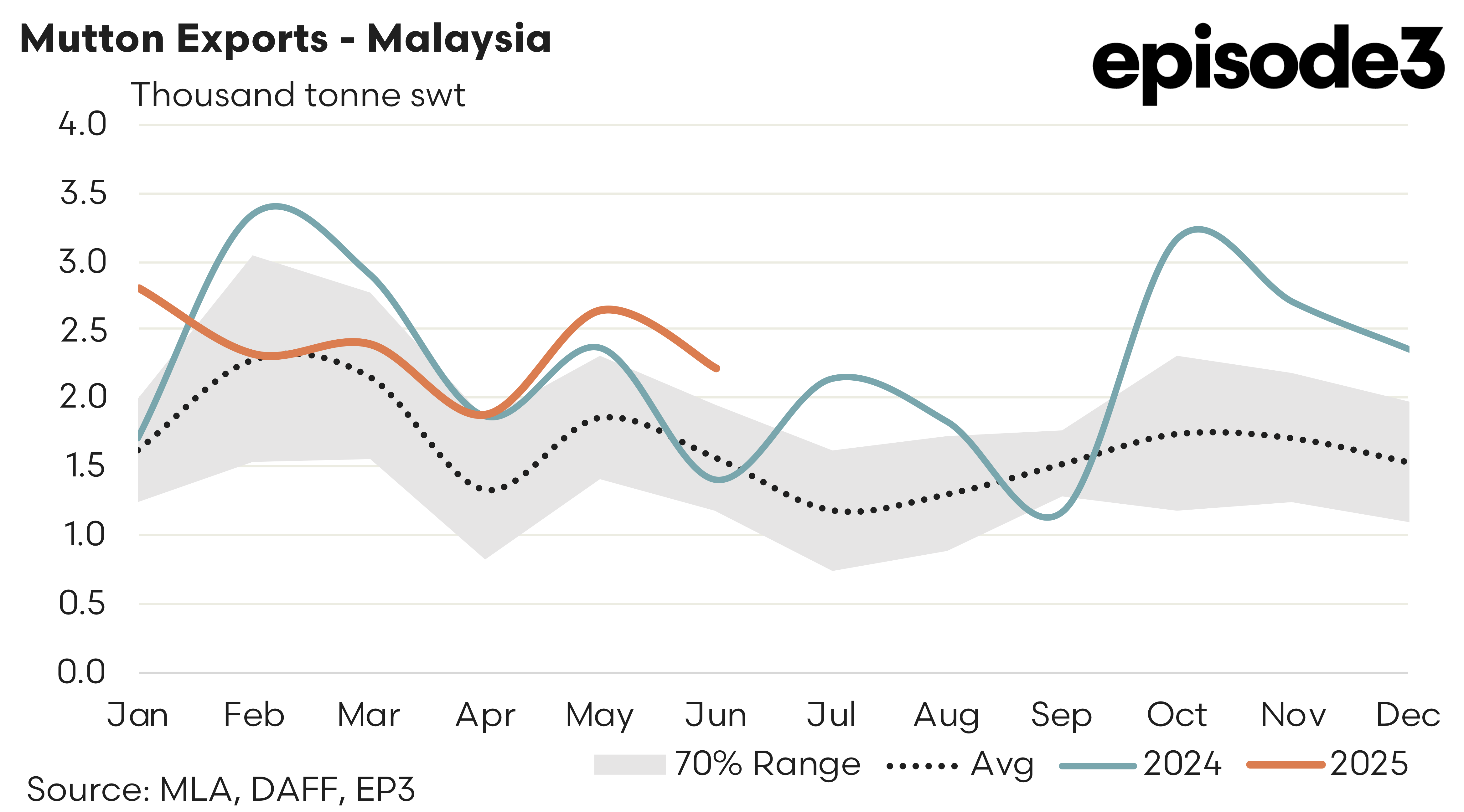

Malaysia – The Aussie mutton trade to Malaysia eased by 16% during June to see 2,220 tonnes shipped over the month. Despite the reduced flows this still represents relatively strong Malaysian demand for Australian sheep meat with the trade volumes sitting at a healthy 41% above the five-year average trend. Indeed, this it the third consecutive month that trade flows of Aussie mutton to Malaysia have been 41% higher than the five-year average monthly levels.

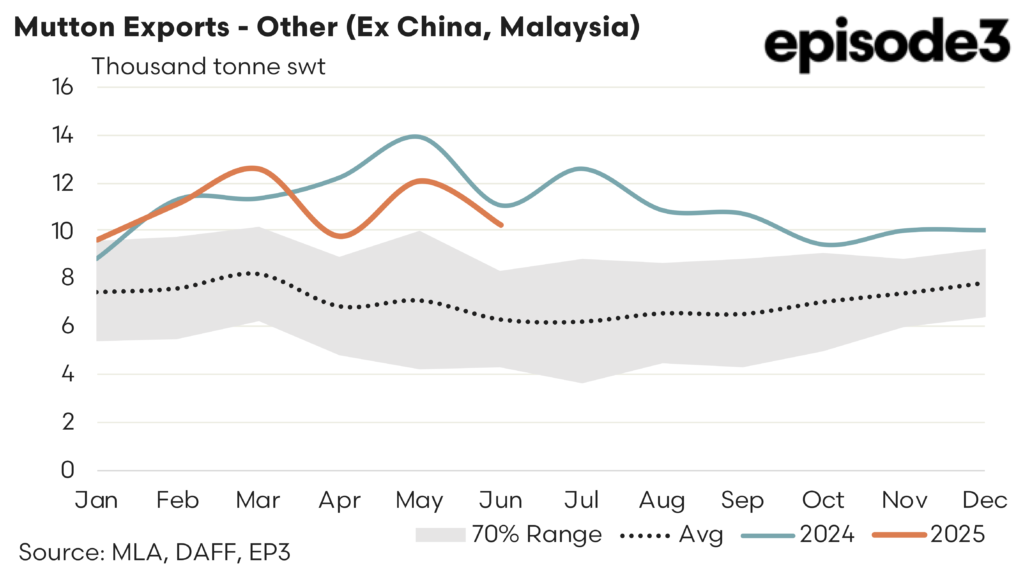

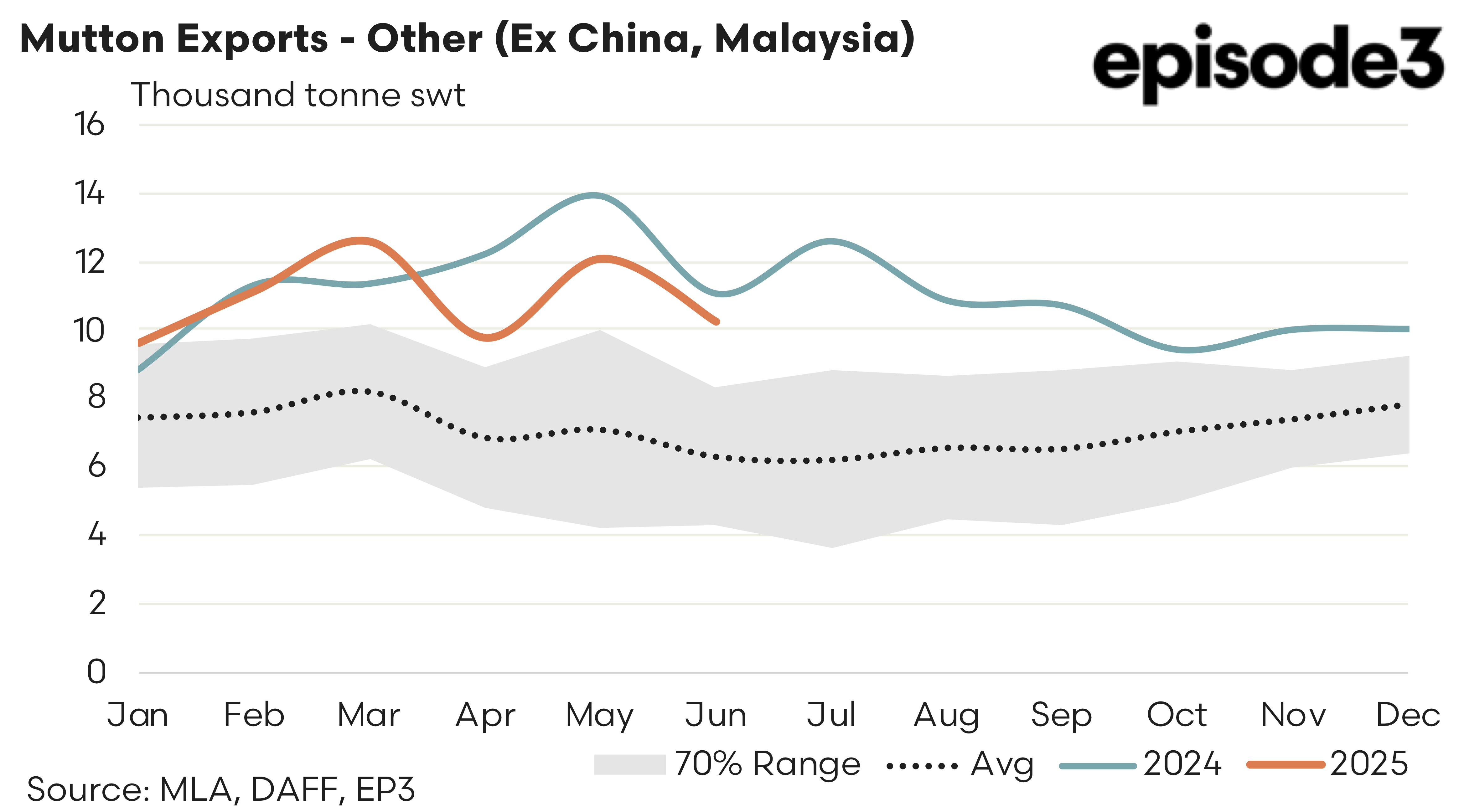

The others – Trade to other destinations (ex China and Malaysia) also backed off, but from relatively high levels. There was a 15% drop in the mutton export flows to the “others” in June pulling the monthly volumes back to 10,273 tonnes. Overall, from a historic perspective the demand from the rest of the world remains in pretty good shape though with trading volumes running at levels that are 62% above the five-year average for June despite the 15% pullback seen.