Sheepmeat export update September 2025

September 2025 - Sheep Meat Export Update

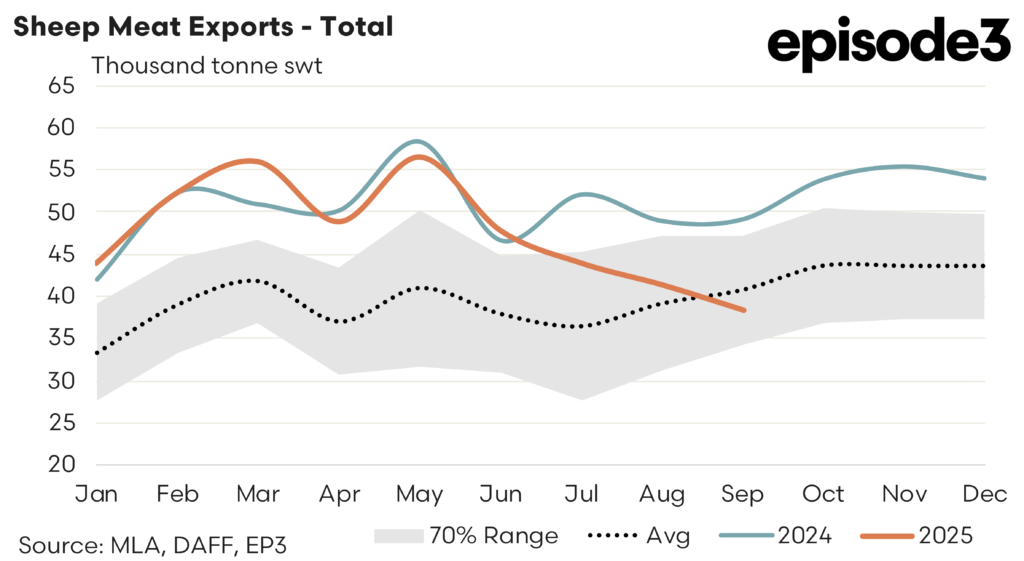

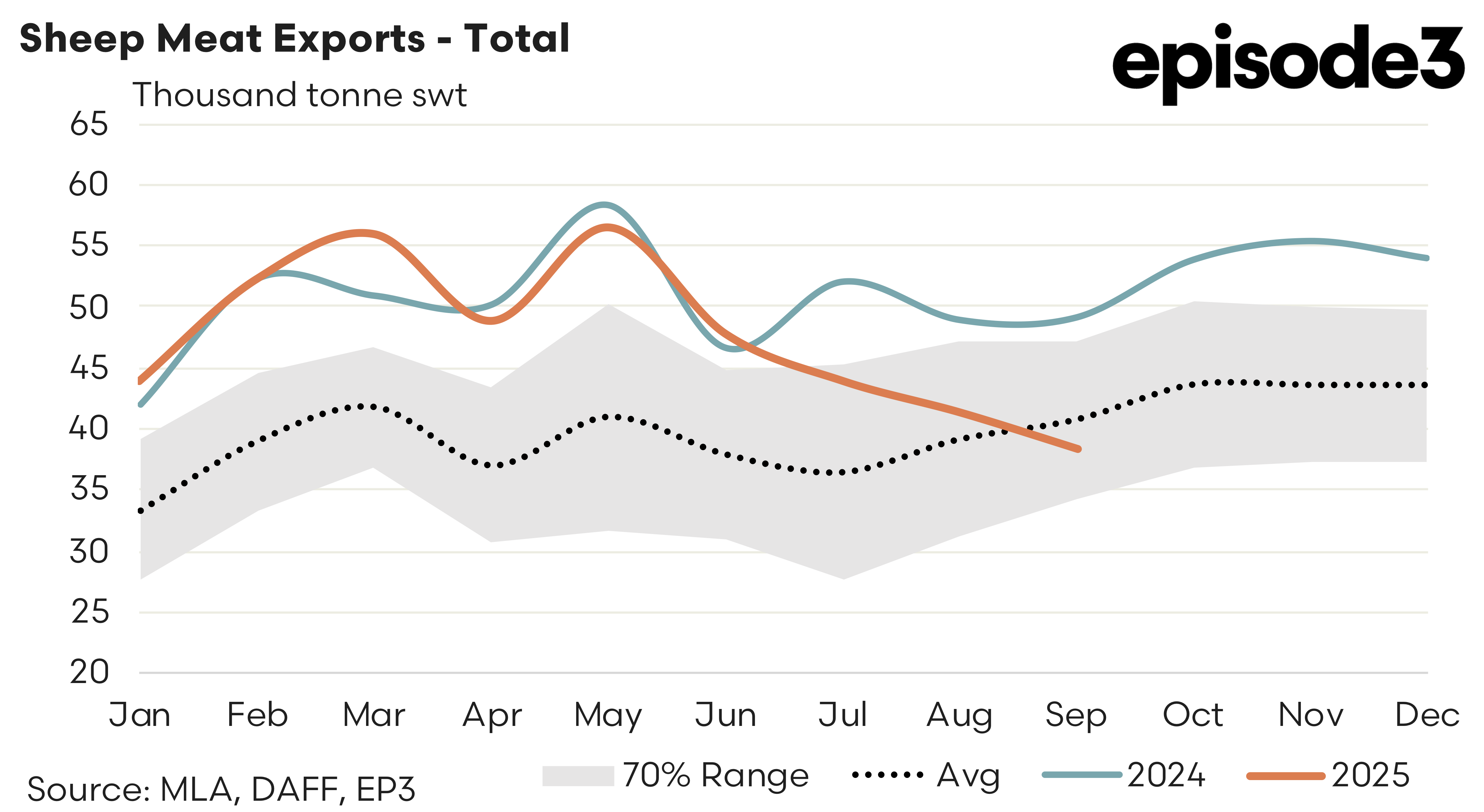

The combined sheep and lamb export volumes from Australia dipped under the five-year average pattern for the first time this season during September with 38,381 tonnes swt exported during the month. Monthly trade flows have been in decline each successive month since May and deviated significantly from last years pattern since winter began. Current September export volumes are running 22% below the levels seen in September 2024. For Q3, 2025 there was a total of 123,705 tonnes of sheep and lamb shipped offshore, this represents levels that are 18% below the Q3 flows seen in 2024, but remain 6% above the Q3 average export flows seen over the last five-years.

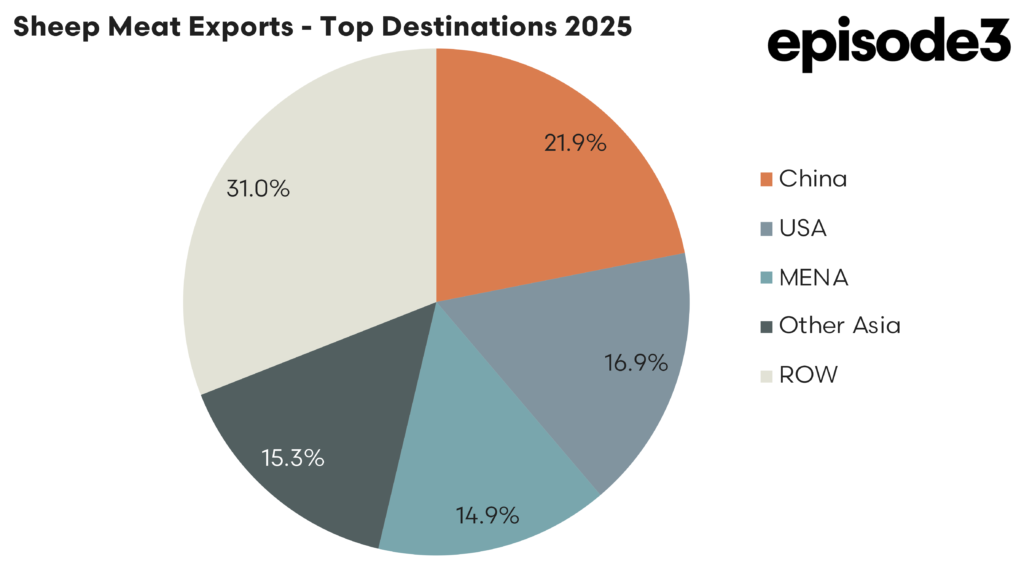

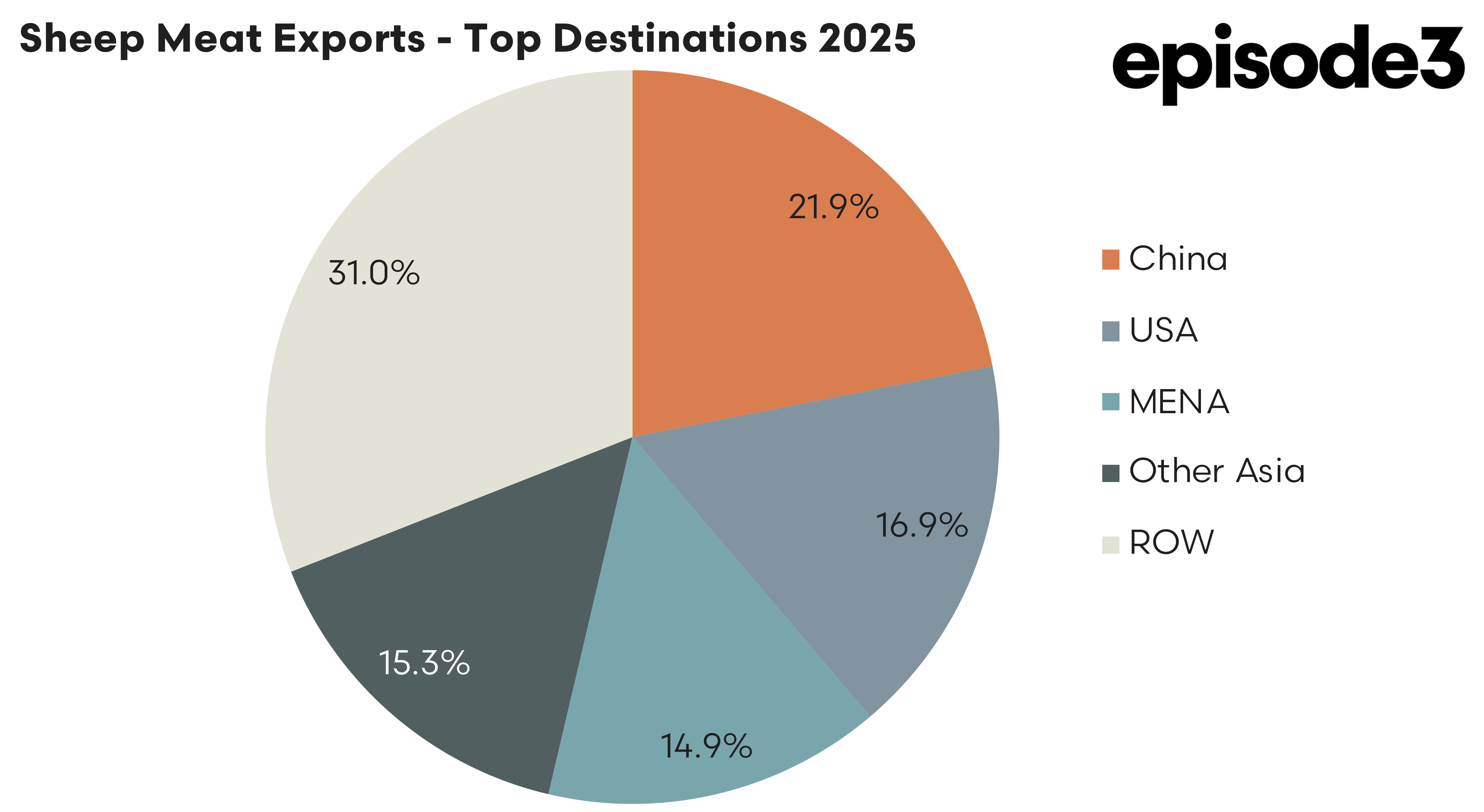

In terms of the top trade destinations for 2025, China accounts for nearly 22% of the trade volumes and the USA sit in second place on nearly 17%. Other Asian destinations account for a little over 15%, meanwhile the Middle East and North African (MENA) region sit just below 15% of the combined sheep and lamb export trade.

In terms of the top trade destinations for Australian sheep meat exports, the following was noted.

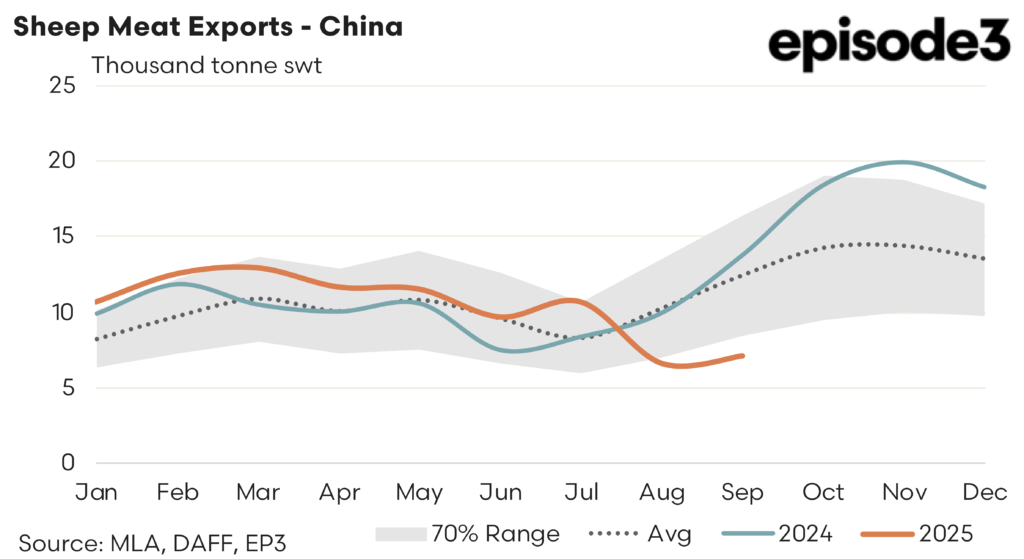

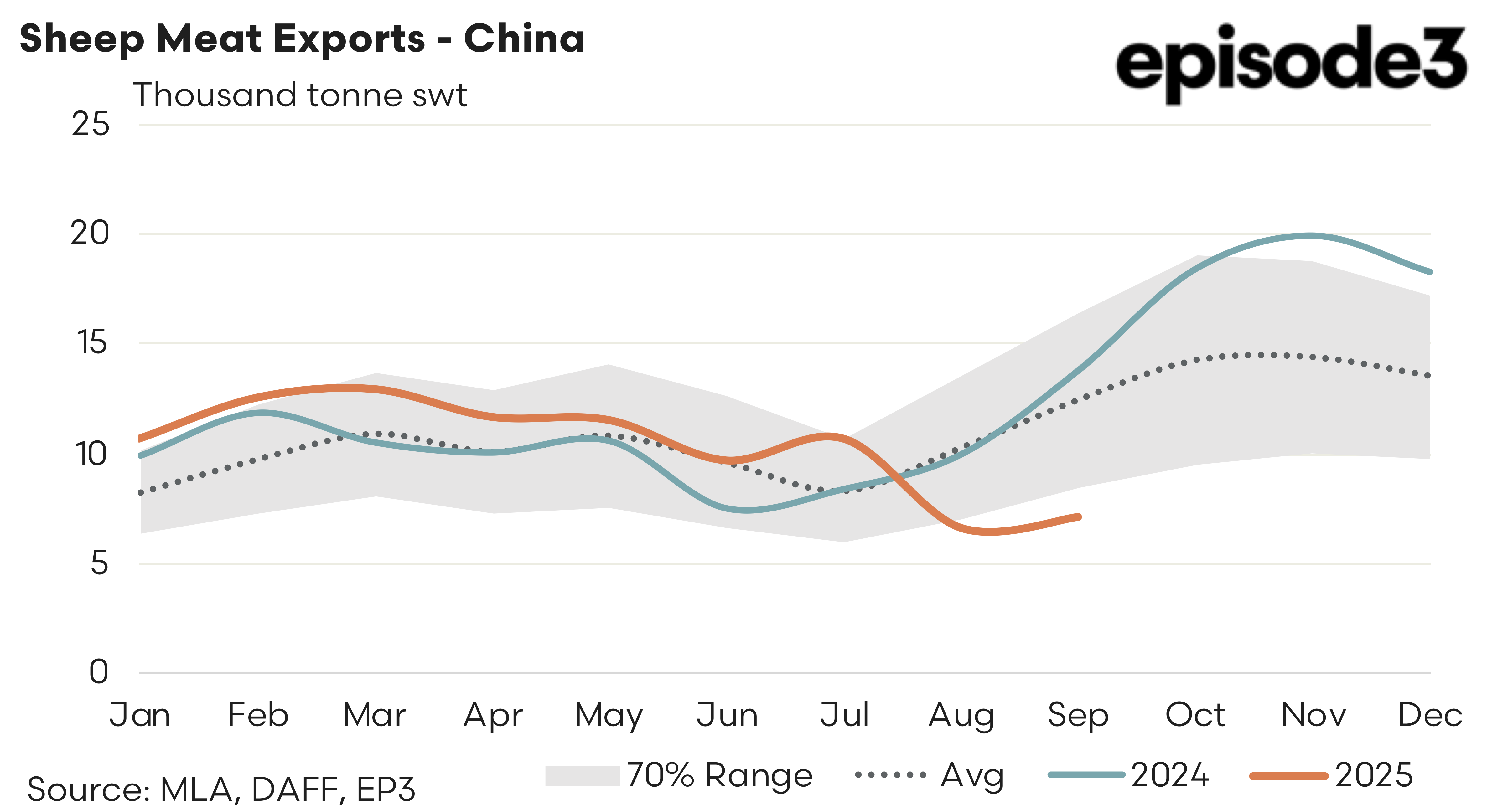

China- Demand from China remains a little lacklustre with volumes sitting below the average flows and the 2024 export levels for August and September. There was 24,598 tonnes of Aussie sheep meat shipped to China in Q3, 2025 which represents levels that are 23% below the Q3, 2024 flows and 21% under the five-year average volumes for the third quarter of the year.

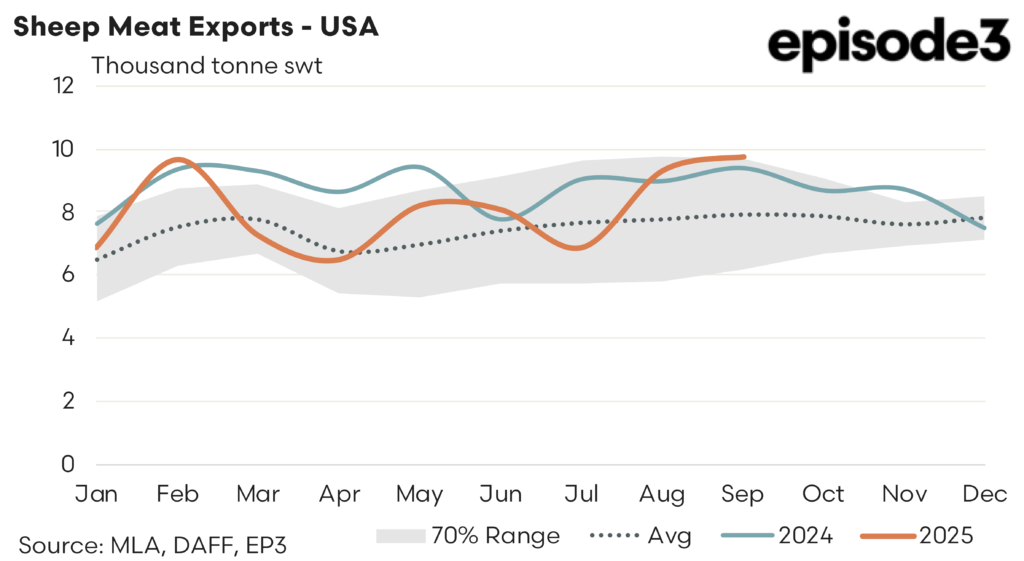

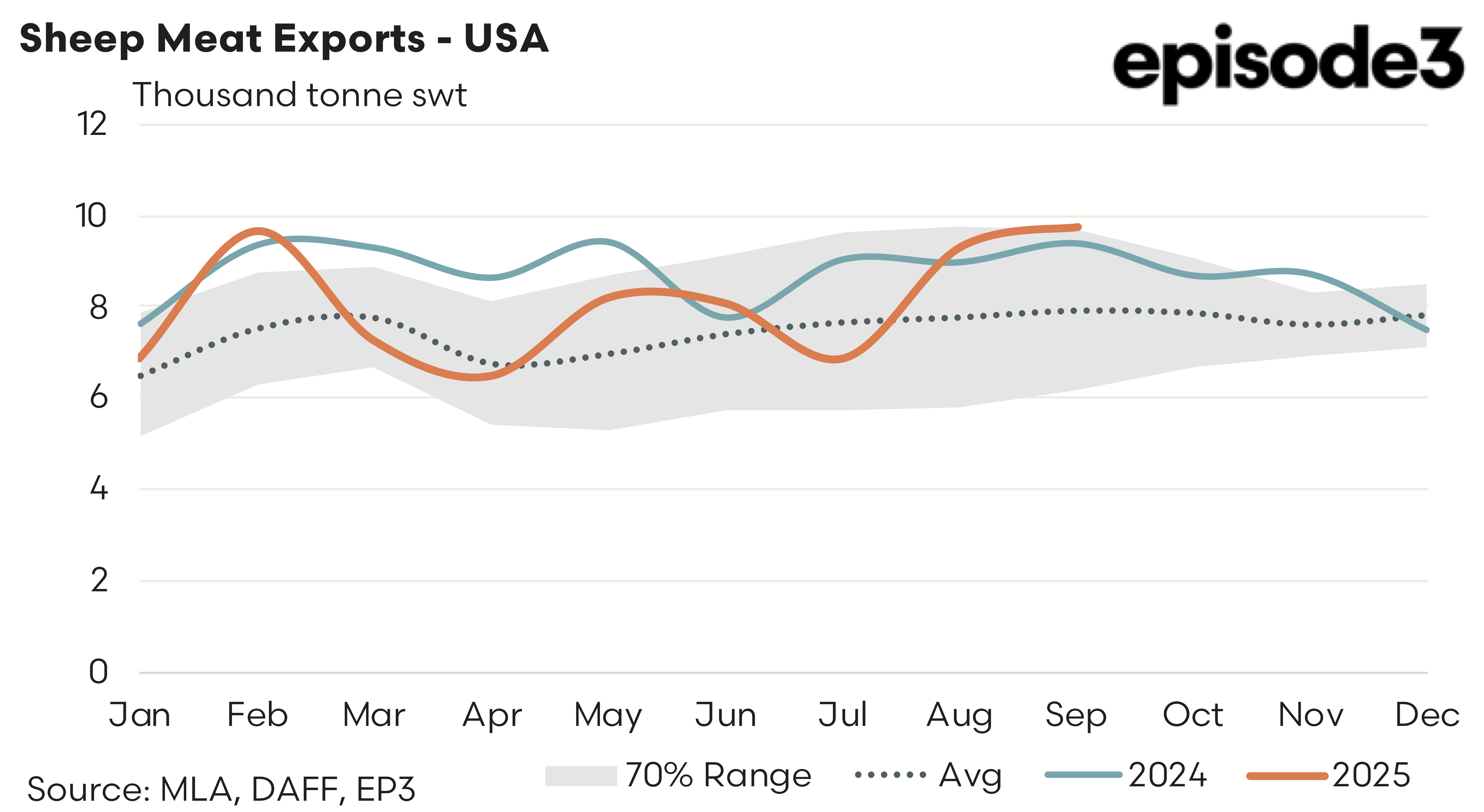

USA – In contrast to China, sheep meat demand in the USA has improved over Q3, 2025. There was 25,908 tonnes of sheep meat shipped during Q3 this year to the USA from Australia which represents levels 11% above the five-year average pattern for Q3. Compared to 2024 the July volumes in 2025 were well below last years levels, but August and September showed stronger flows. Across the entire Q3 period the 2025 export volumes ended up just 5% below the levels exported in Q3, 2024 to the USA.

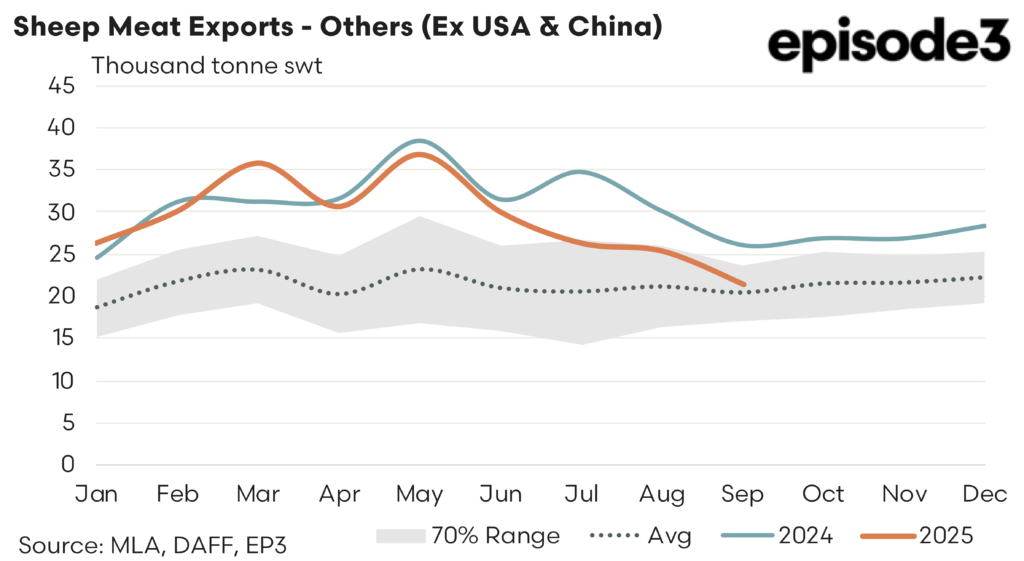

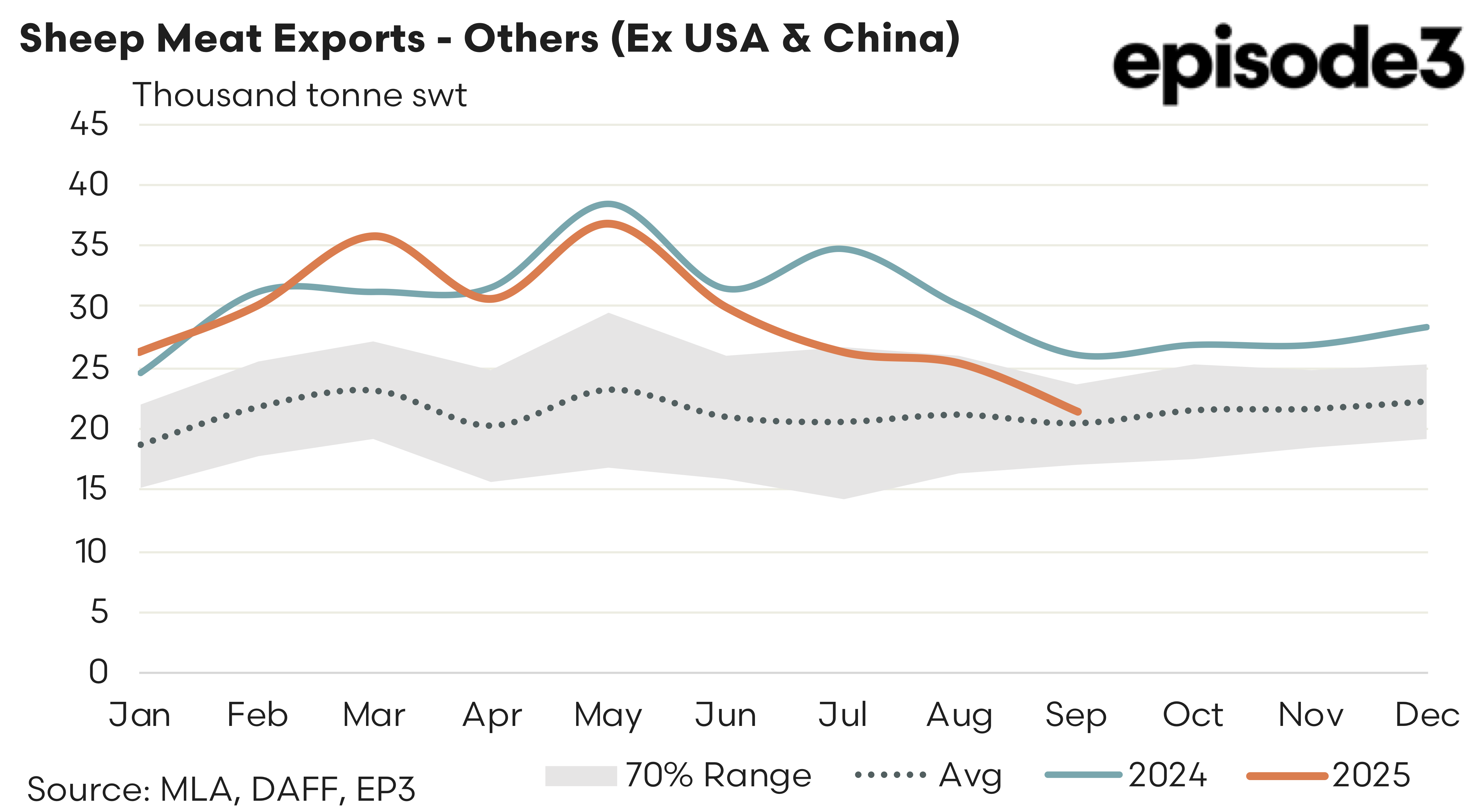

The others – Trade flows to all other destinations (excluding the USA and China) have been in a downward run since May. During Q3, 2025 there was 73,199 tonnes shipped offshore to “the others”, which is 19% below the levels shipped during Q3 last year but still sits 18% higher than the five-year average flows for the third quarter in the season.