Sheepmeat processing lifts as saleyards tighten

Market Morsel

As winter edges closer, the Australian lamb and sheep markets are reflecting a distinct shift in supply dynamics and processor activity. The latest data on slaughter indices and weekly yarding movements presents a clear picture of intensified processing during May, supported by firmer saleyard prices underpinned by tightening availability.

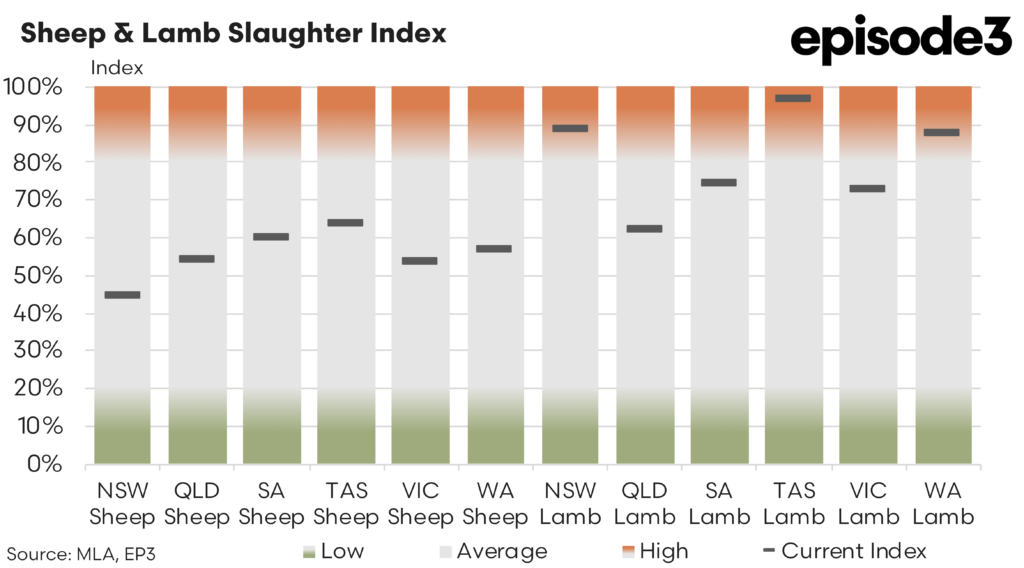

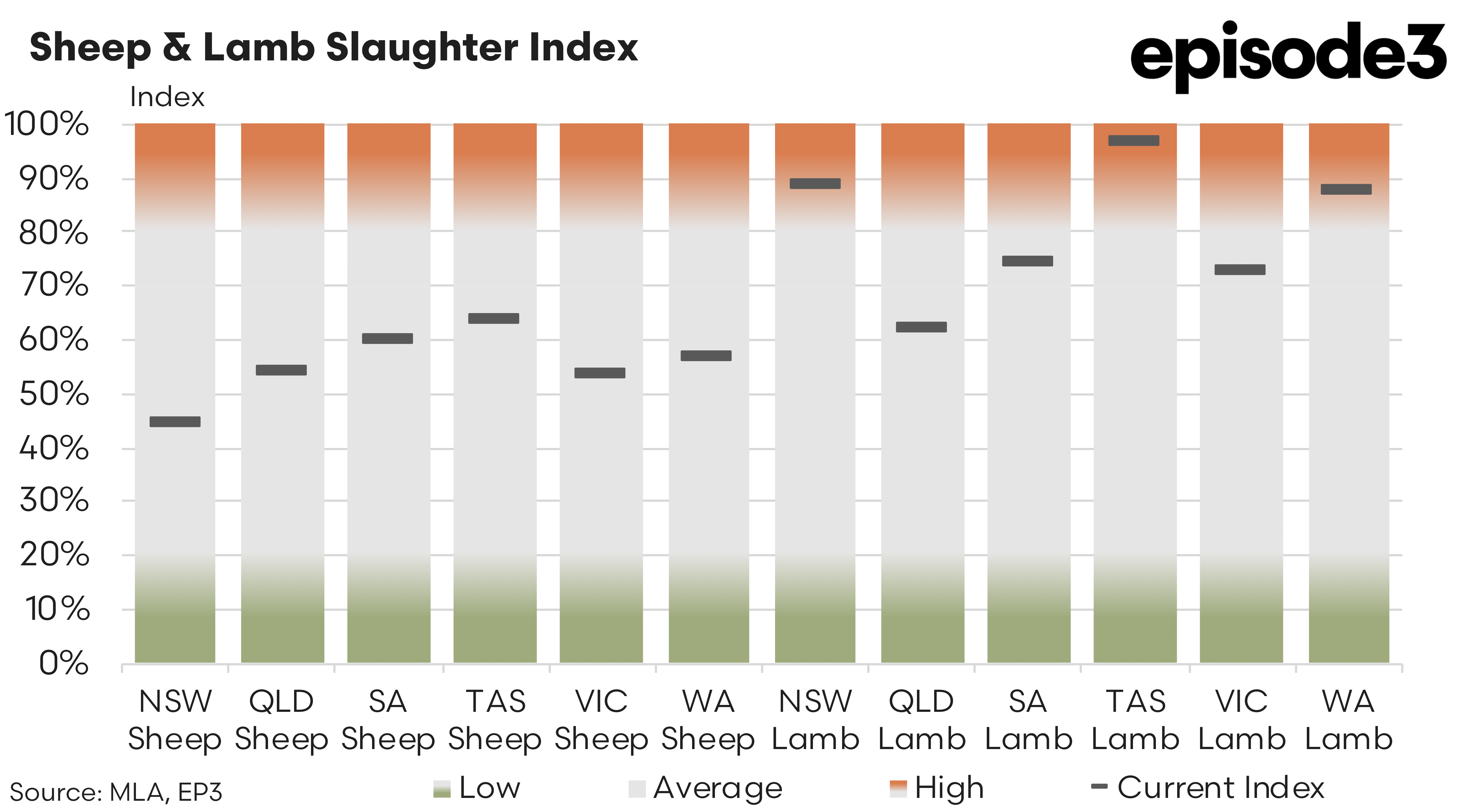

With processor indices acting much like a rainfall decile indicator, where 100% indicates full utilisation and 0% a complete shutdown, the recent uplift in index values across most states points to a strong resurgence in processor throughput compared to April. This seasonal push, coupled with reduced saleyard volumes, is now feeding into upward pressure on pricing.

May saw a marked increase in slaughter index readings across both sheep and lamb categories, particularly in the major producing states. New South Wales sheep processing lifted to 44%, up from 34% in April, while lamb processing surged from 52% to a high 89%, one of the strongest readings nationally. Similarly, Western Australia posted a substantial rise in lamb activity from 55% to 88%, while Queensland moved from 47% to 62%. These increases suggest processors have significantly stepped up activity, likely in a bid to capitalise on remaining autumn supplies ahead of the expected winter lull.

Even Victoria, which had posted subdued slaughter figures earlier in the year, lifted its sheep index from 39% to 54%, and lamb from 51% to 73%. Tasmania maintained already elevated levels of activity, particularly in lamb, with the index at 97% for May, indicating near full utilisation. The only region to show relatively modest growth was South Australia, where sheep lifted from 55% to 60%, while lamb increased from 46% to 75%.

The May surge is especially notable given its timing. This is a period when seasonal constraints typically start to impact supply, suggesting that processors are front-loading kill activity while stock remains accessible. It also hints at improved confidence in export market conditions and greater scheduling continuity following the disruptions seen around public holidays earlier in the season.

While processor activity ramped up over May, weekly saleyard volumes have started to contract, in line with seasonal expectations. According to Meat & Livestock Australia (MLA) yarding data, significant week-on-week declines were recorded across all categories.

During the third week of May the Mutton Indicator saleyard headcount fell by 38,724, while Restocker Lambs dropped by 30,119 head. Light and Heavy Lambs also recorded sizeable declines of 14,423 and 13,857 respectively, reinforcing that the typical winter tightening phase is well underway. These reductions are broadly consistent with the expected supply contraction as colder conditions reduce turnoff rates. Recent weekly yarding levels have continued to show fewer numbers presented to the end of May.

What is emerging is a classic scenario: processors are lifting activity just as supply is tightening, a confluence that typically supports firmer saleyard prices, something clearly evident in the pricing data.

Weekly pricing indicators have responded in kind to the shifting balance between processor activity and supply availability. The Heavy Lamb Indicator rose by 72c/kg cwt over the past week, with an even sharper 156 cent lift over the past month. Year-on-year, this category has climbed an impressive 304c/kg, underscoring the broader structural recovery occurring across lamb markets.

Light Lambs have mirrored this performance, gaining 94c/kg over the past week and 350c/kg over the year. Trade Lambs were up 95c/kg on the week and nearly 148c for the month, with an annual lift of 307c/kg. Even Merino Lambs gained 86/kg over the week, showing broader pricing resilience.

Mutton, often a good indicator of supply-side pressure, rose 36c/kg over the week, and nearly 309c/kg from year-ago levels. The fact that mutton values have remained strong in light of a monthly correction suggests buyers are positioning for tighter supplies ahead.

Restocker Lambs have joined the trend too, recording a weekly lift of 73c/kg a month-on-month rise of 57c/kg, and sit 333 cents higher than this time last season.

The May figures offer a preview of what might lie ahead. Processor indices suggest strong near-term demand, while saleyard volumes indicate the typical winter dip is well underway. The result is a positive pricing environment, at least for now, with scope for further upside if supply tightens faster than expected.

However, the durability of this rally will depend on how quickly the winter supply slowdown bites and whether processor demand can be sustained as killable stock diminishes. For now, the May slaughter indices and weekly pricing movements point to a market finding its feet. Supply is tightening. Processor demand is active. And prices, for most categories, are finding support.