Soft sell

The Snapshot

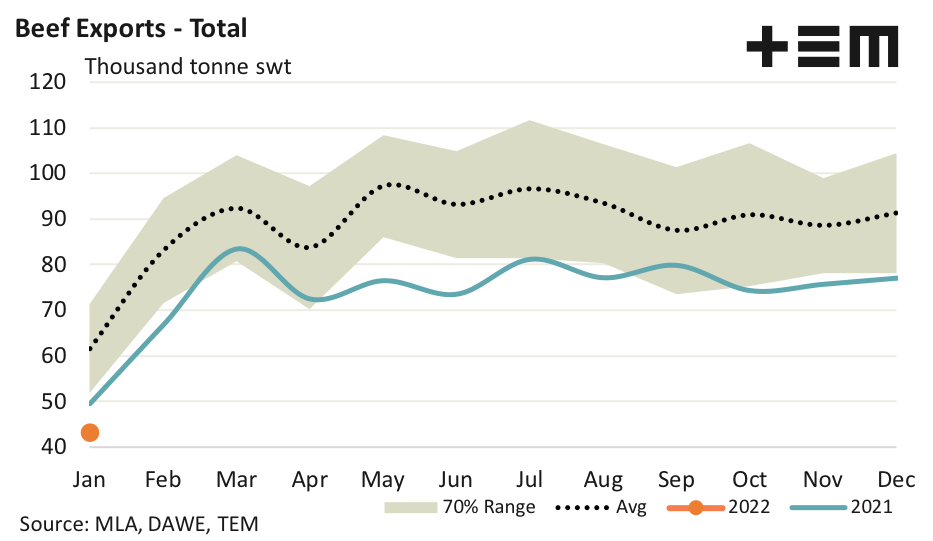

- January 2022 total beef export volumes have come in 13% softer than last year and 30% under the five-year average trend for January.

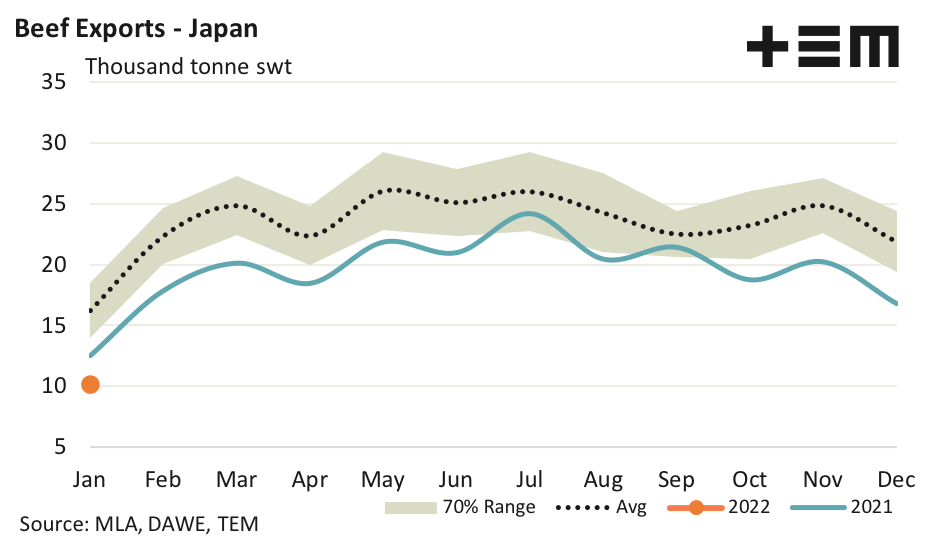

- Beef exports to Japan in January are 19% under the flows seen during January 2021 and are 37% below the five-year seasonal average pattern.

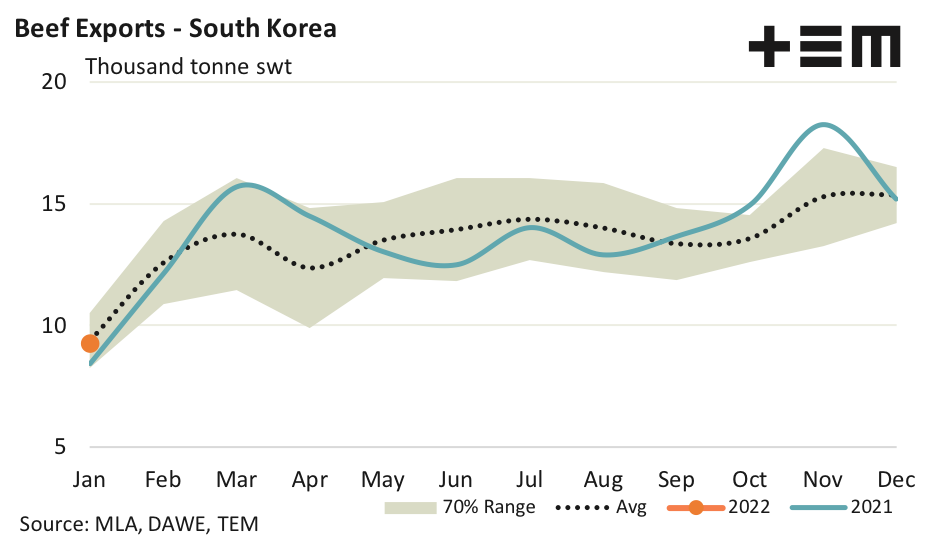

- Volumes for January 2022 to South Korea came in 10% higher than in 2021 and just 1% under the five-year average for January.

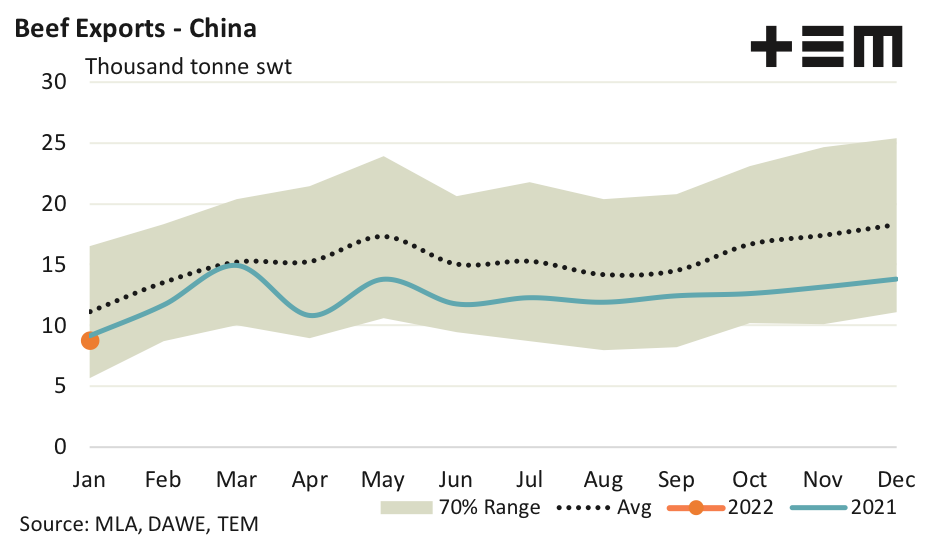

- January 2022 saw relatively stable volumes of beef consigned to China, just 4% under the levels set in 2021. Although they remain 21% below the five-year January average levels.

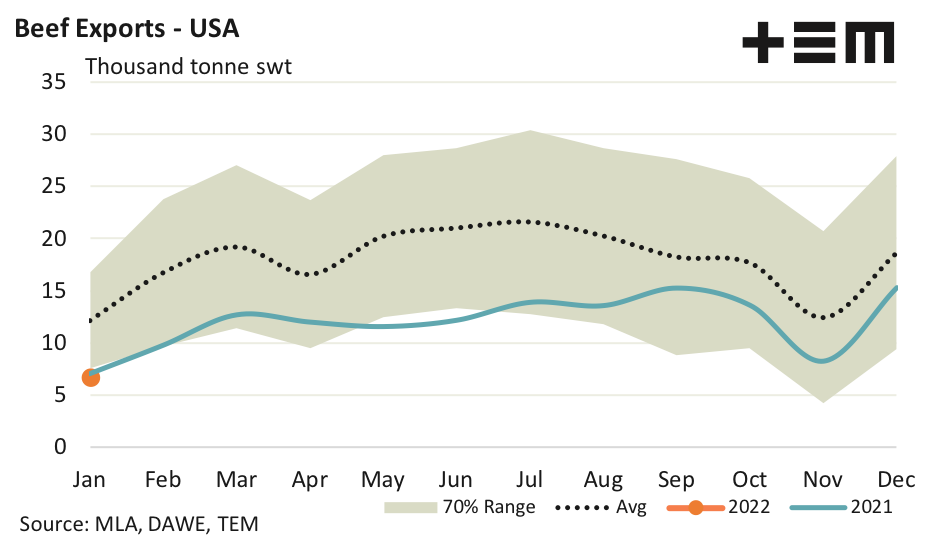

- Meanwhile the USA have started the season meekly with levels that are 4% lower than the volumes seen during January 2021 and 44% below the five-year average seasonal pattern.

The Detail

It’s definitely a case of “tainted love” for Aussie beef exports in January 2022 with trade volumes starting the season meekly. I’m afraid I was born in the 70s so you will just have to get used to pop culture references from my youth. Total monthly beef exports were reported at 43,362 tonnes swt, the lowest start to the season for beef exports since January 2011.

January 2022 total beef export volumes have come in 13% softer than last year and 30% under the five-year average trend for January, reflective of the high global price for Australian beef cattle and the continuing tight domestic supply scenario.

Australian beef exports to Japan recorded the lowest monthly figure since January 2002 with a meagre 10,214 tonnes shipped in January 2022. Despite the soft start to the season Japanese flows account for the largest market share for Australian beef exports so far in 2022 at 23.6%, ahead of South Korea in second place with 21.4%.

Beef exports to Japan in January are 19% under the flows seen during January 2021 and are 37% below the five-year seasonal average pattern. In contrast, South Korean demand for Aussie beef remains pretty solid and has started 2022 relatively well. Volumes for January 2022 to South Korea came in at 9,288 tonnes swt, 10% higher than in 2021 and just 1% under the five-year average for January.

Despite ongoing trade tensions and the suspension of another Australian export abattoir Australian beef export flows to China continue to hold up remarkably well. January 2022 saw 8,780 tonnes of Aussie beef consigned to China, just 4% under the levels set in 2021 and 21% below the five-year January average levels.

Meanwhile the USA have started the season as poorly as it began 2021 with Aussie beef exports of just 6,758 tonnes, which represents levels that are 4% less than the volumes seen during January 2021 and 44% below the five-year average seasonal pattern for this month in the year.

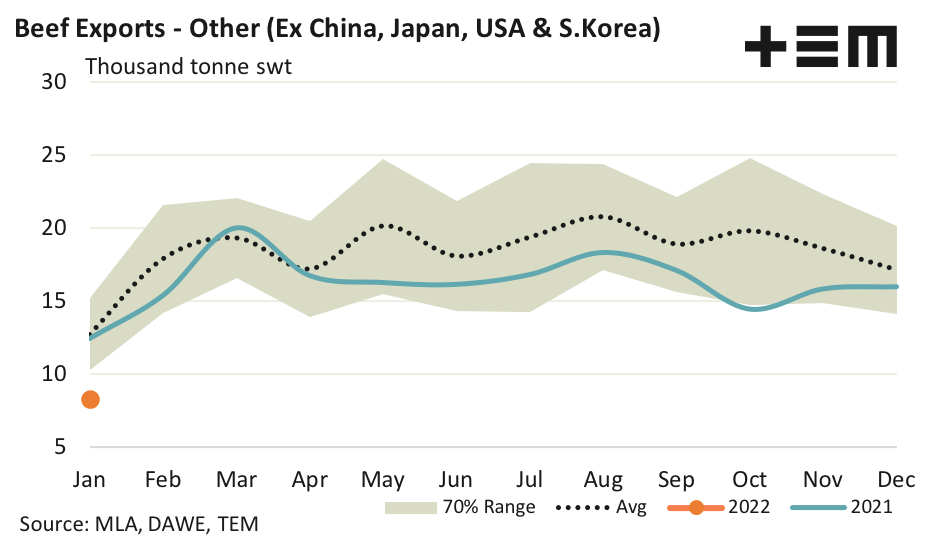

Australian beef flows to the remaining offshore destinations (excluding the top four trade locations of Japan, South Korea, China and the USA) started 2022 in a underwhelming fashion with just 8,322 tonnes reported shipped. This is 33% lower than the volumes seen during January 2021 and has come in 35% below the five-year average for January.