Solid lamb

The Snapshot

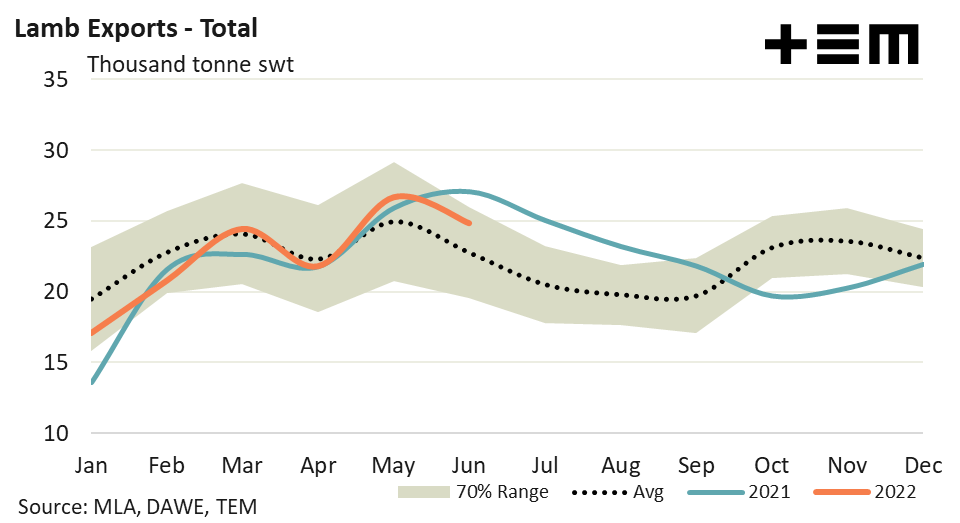

- Current total export levels sit 9% above the five-year average for June.

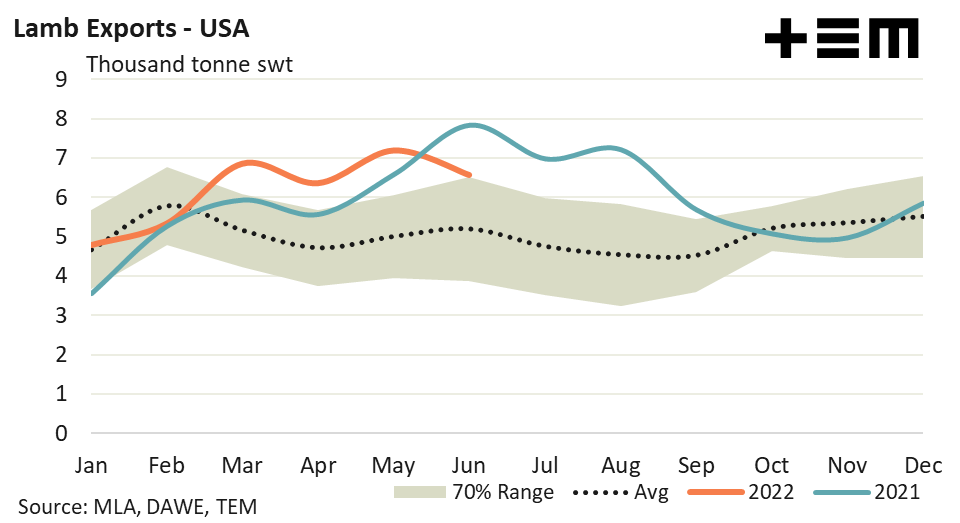

- As a monthly average across the first half of 2022 lamb export flows to the USA are running nearly 22% ahead of the five-year seasonal pattern.

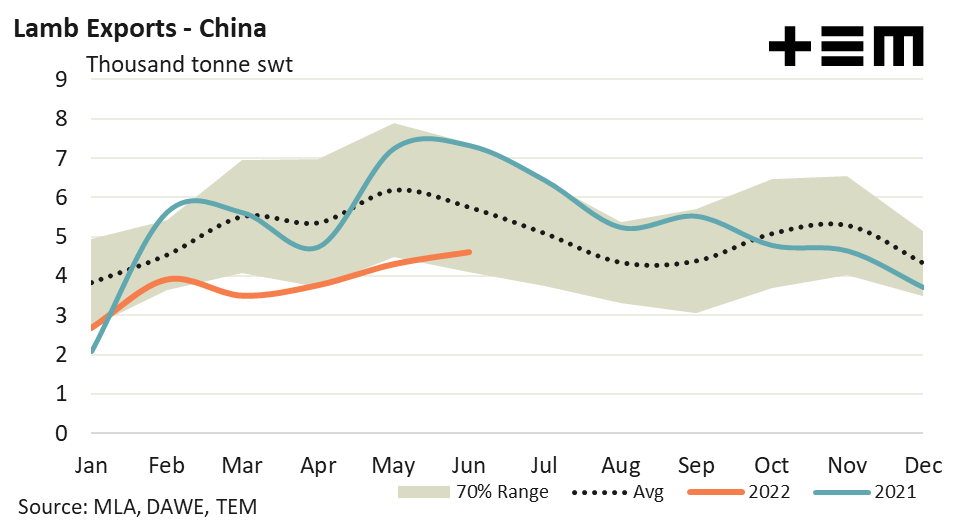

- China maintains second place for Aussie lamb demand, but average monthly volumes for 2022 are running 27% under the average seasonal pattern.

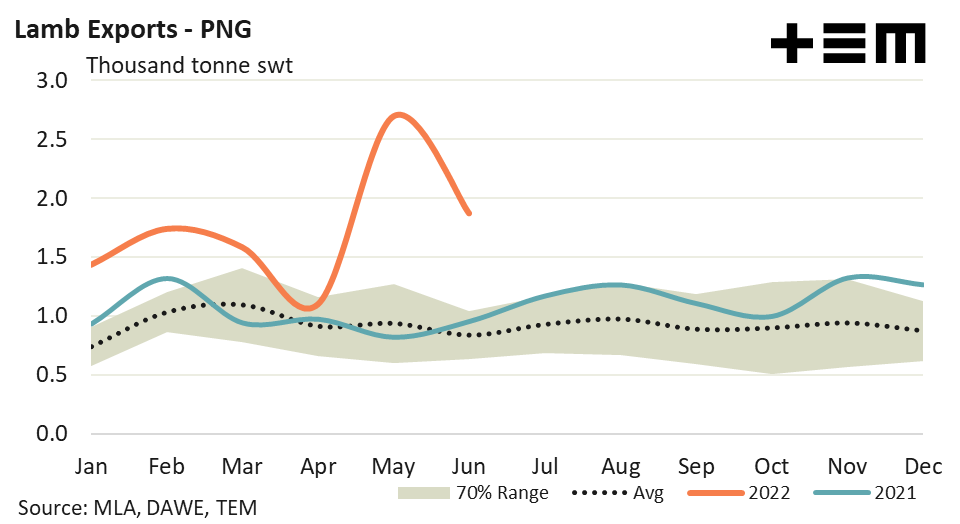

- Average monthly Aussie lamb export flows to PNG are running 87% above the five-year seasonal pattern for the first half of 2022.

The Detail

Total Australian lamb export volumes declined by 7% during June 2022 to see 24,857 tonnes swt consigned. Despite the reduced monthly flows, current total export levels still sit 9% above the five-year average for June.

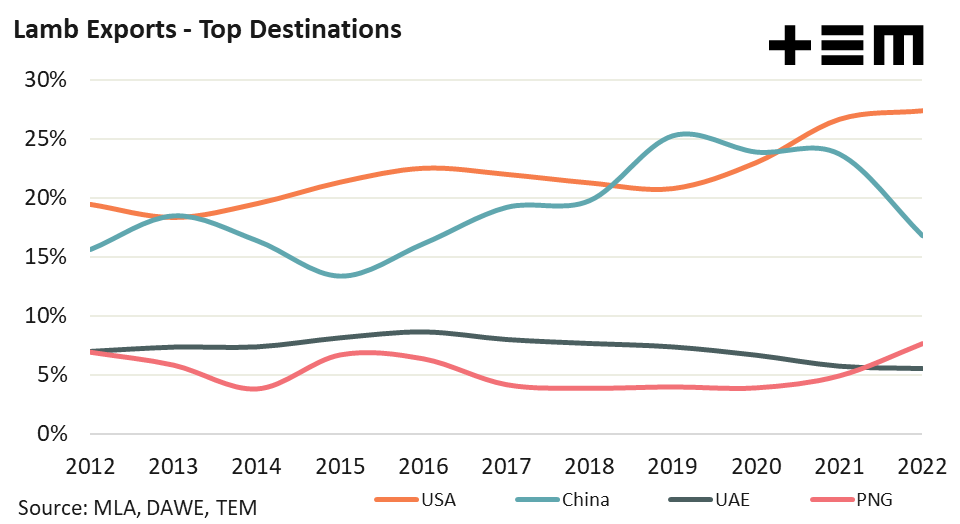

Lamb export flows to the USA from Australia continue to perform strongly over 2022 holding 27.4% market share of total lamb export volumes, up from 26.7% market share in 2021. China sits is second place, as one of the top destinations for Aussie lamb at 16.8% of market share in 2022, which is down from 23.7% in 2021.

Meanwhile, Papua New Guinea (PNG) has shifted into third top position for market share of Aussie lamb export volumes, increasing from 4.9% in 2021 to 7.7% this year.

Monthly lamb export volumes from Australia to the USA eased nearly 9% over June to 6,580 tonnes swt. However, despite the decline volumes are still sitting 27% above the five-year average levels for June.

As a monthly average across the first half of 2022 lamb export flows to the USA are running nearly 22% ahead of the five-year seasonal pattern. In 2021 average monthly volumes ended up 23% above the five-year trend, so demand for Aussie lamb from the USA in 2022 is shaping up to be as strong as last year.

China maintains second place for Aussie lamb demand but average monthly volumes for 2022 are running 27% under the average seasonal pattern. June 2022 has seen the strongest monthly demand this year for Aussie lamb from China at 4,617 tonnes swt, which represents levels that are nearly 20% below the June average level, according to the five-year trend.

PNG has seen very solid demand for Australian lamb in 2022. Average monthly flows are running 87% above the five-year seasonal pattern for the first half of 2022. Volumes to PNG in June eased nearly 31% but it was coming off an incredibly high base in May of 2,692 tonnes.

June 2022 saw 1,869 tonnes of Aussie lamb shipped to PNG, which is 122% above the five-year average for June.