Southern sheep and lamb yardings remain tight

Market Morsel

The past two months have marked an important turning point in the sheep and lamb markets, with clear signals emerging from both saleyard yarding index scores and MLA price indicators. July saw the first signs of contraction in supply in several states, and by the third week of August the tightening trend had become far more evident, particularly in the south.

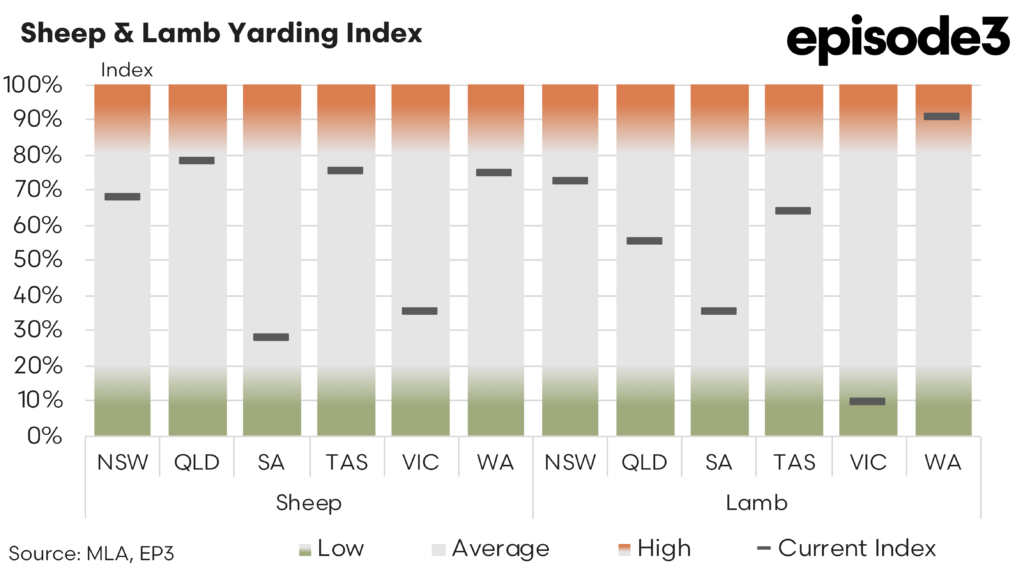

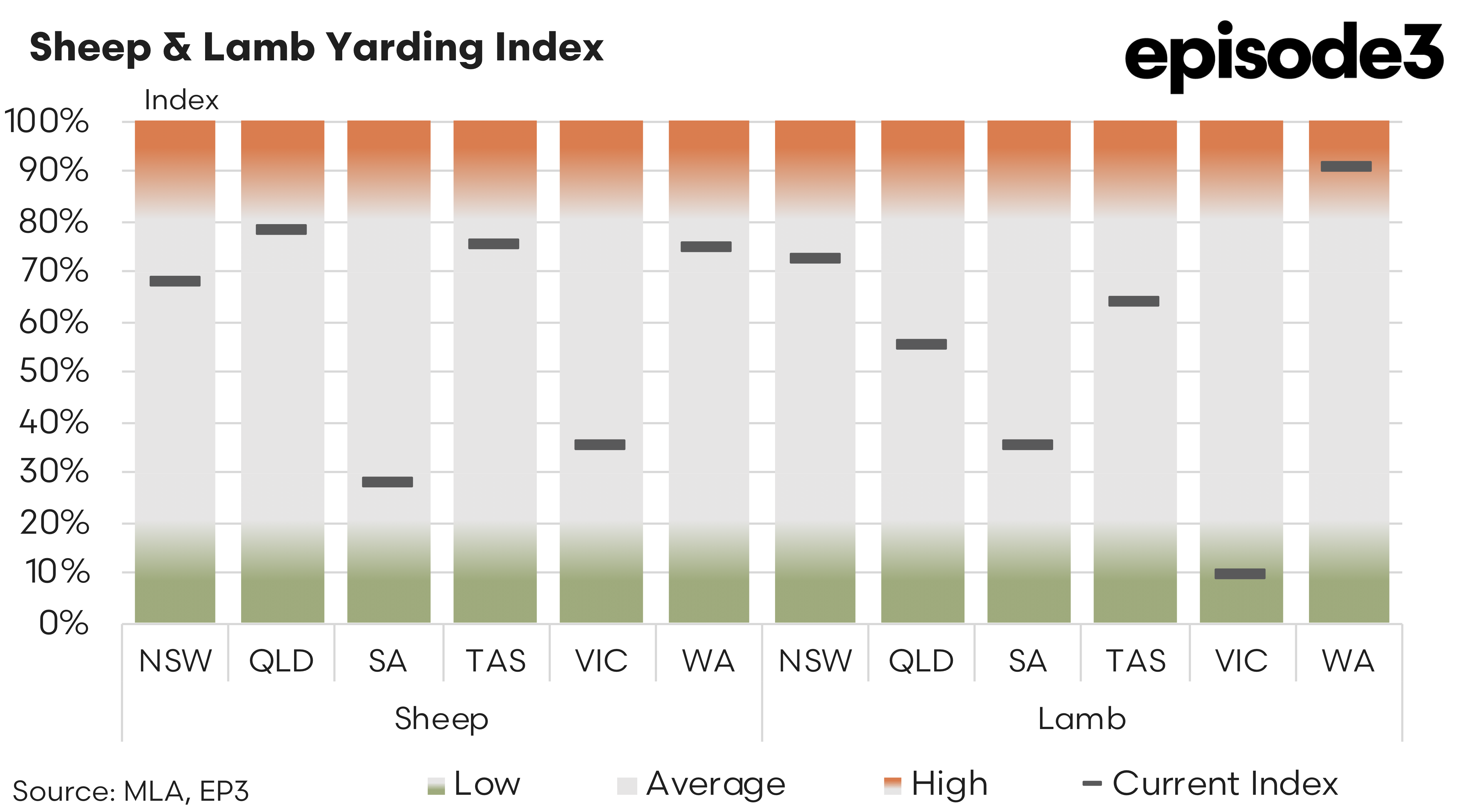

Sheep yardings have moved unevenly across the country, but the overall picture is one of tightening supply. In New South Wales, the index has held broadly steady at 66 percent in July before lifting only marginally to 68 percent in August. Queensland, however, has seen a notable increase in activity with its score rising from 61 percent to 78 percent over the same period, although it is important to note throughput volumes from Queensland are marginal. This contrasts with the sharp contraction in South Australia where sheep yardings fell from 40 percent in July to just 28 percent in August. Tasmania eased slightly from 82 percent to 75 percent, while Victoria has improved from an exceptionally low base, moving from 23 percent to 35 percent. Western Australia has been more active, rising strongly from 56 percent in July to 75 percent in August. These figures illustrate the patchwork nature of supply across the states, with South Australia in clear contraction while Queensland and Western Australia are moving in the opposite direction.

Lamb yardings tell a similar but more sharply defined story. New South Wales has retreated from 82 percent in July to 73 percent in August, while Queensland has tightened even more steeply, falling from 68 percent to 55 percent. South Australia has dropped back from 44 percent to 35 percent, and Tasmania slipped modestly from 65 percent to 64 percent. Victoria, already at very low levels, fell further from 23 percent to just 10 percent, underscoring the extreme scarcity of lambs coming forward in that state. Western Australia, in contrast, has lifted strongly from 86 percent to 91 percent, making it the outlier in a market otherwise characterised by reduced winter lamb supply. The aggregate picture is that lamb yardings are tightening across most states, with the east coast in particular showing sharp declines, while Western Australia stands alone in continuing to present high levels of throughput.

The heavy lamb indicator is currently sitting at 1135 cents per kilogram carcase weight, which represents a decline of 40 cents compared with four weeks ago. Light lambs have followed a similar path, easing by 33 cents this week and 7 cents lower than a month earlier, leaving them at 963 cents. Merino lambs have dropped 64 cents over the past week and now sit at 970 cents. Mutton has given away earlier increases to sit on par with where it was a month ago, leaving the indicator at 704 cents. Restocker lambs have gained 63 cents compared with four weeks ago and are now priced at 1025 cents. Trade lambs have moved lower over the month, losing 62 cents to sit at 1127 cents, with much of that decline coming in the most recent week as processors continue to adjust their activity to best manage the tight winter supplies.

The export sector remains a vital component, with recent export numbers showing a sharp 25% drop in lamb export volumes over July signalling that there is a limit to what overseas consumers will pay for lamb. Nevertheless, processors remain active and competitive, ensuring that limited supplies continue to attract robust bidding.

The combined evidence from yarding indices and price indicators is that the market is entering the traditional spring flush phase with considerable momentum. The contraction in lamb supply in Victoria, South Australia and New South Wales is especially stark, and with Western Australia the only state showing higher availability the national balance is tightening. Prices, while volatile week to week, are trending higher across most categories, with Merino lambs and mutton leading the way. The next stage will depend on how quickly spring lambs begin to flow into the system, but for now the market remains firmly supported by the combination of tight supply despite offshore demand showing some recent reluctance to continue to push prices higher.