Southern sheep supply tightens

Market Morsel

The period covering February to the middle of March 2025 highlights key trends within the Australian sheep and lamb sectors, showcasing important fluctuations in saleyard throughput index scores and subsequent impacts on market prices.

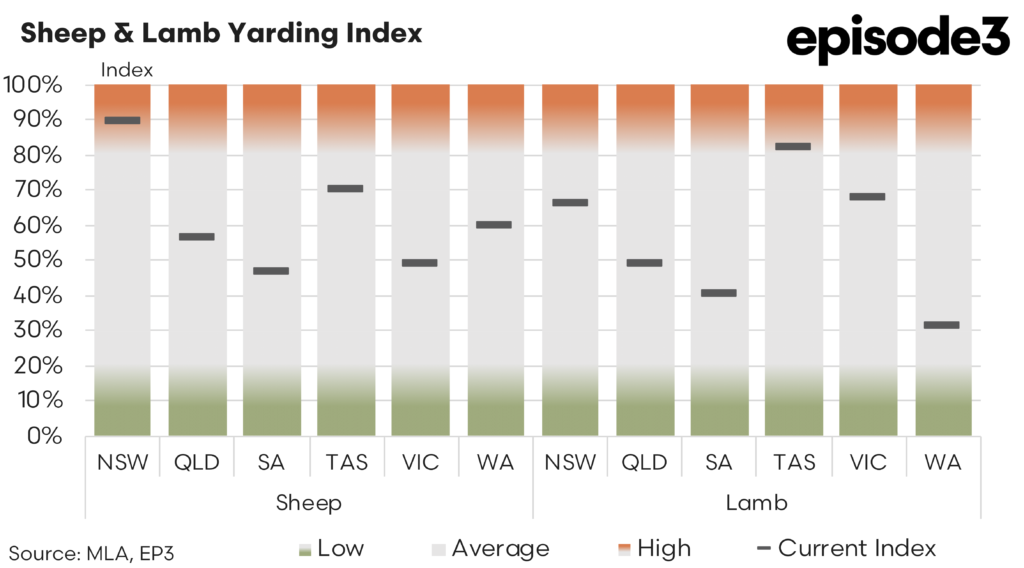

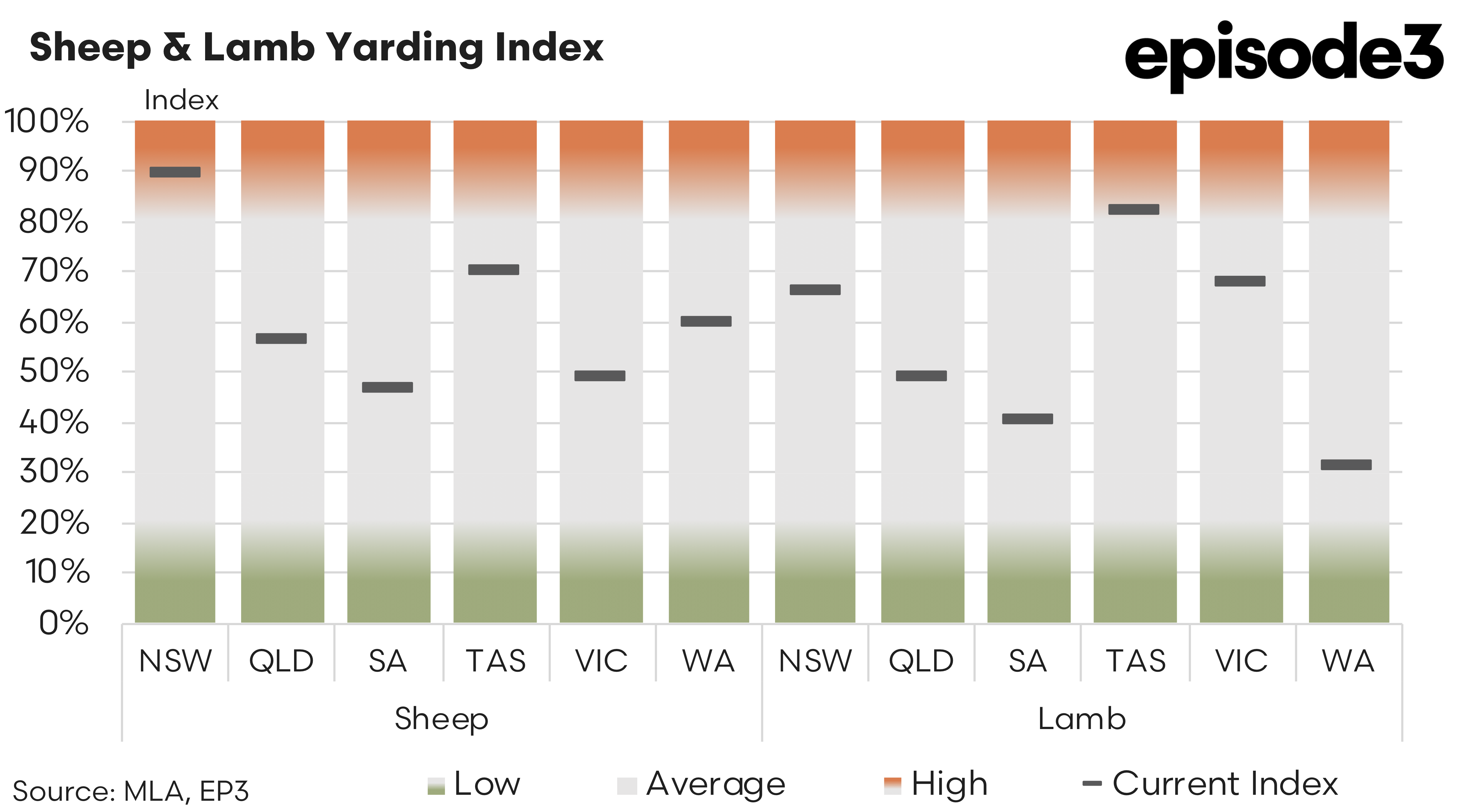

Across most states, the sheep saleyard throughput index scores have shown notable shifts from February to mid-March. In New South Wales throughput climbed modestly from an already high base of 80% in February to reach 89% in March. This 9 percentage-point index score increase underscores robust market activity driven by continued producer offloading and sustained processing capacity. In stark contrast, Queensland experienced a pronounced decline, dropping from a very high 93% index score in February down to 57% in March. This notable decrease likely signals a possible easing in of sheep turnoff in response to earlier heavy selling.

Victoria also saw a substantial reduction in sheep saleyard throughput, falling from 81% to 49%, indicative of sharply tightening sheep supply. Perhaps the difficult seasonal conditions in the south seen through the spring/summer period and elevated turnoff levels are beginning to have an impact on the remaining Victorian sheep numbers.

Western Australia’s index showed significant contraction too, dropping from 78% in February to 60% during March, marking a meaningful decrease in available supply through the state’s saleyards. South Australia, while showing modest improvements from 34% to 47%, remains notably lower than other states, indicating constrained throughput levels persisting in the southern mainland areas. Tasmania’s throughput held relatively steady with only a small rise from 68% to 70%, suggesting stable market conditions there.

Shifting attention to lamb throughput indices during the same period, the picture varies distinctly between states. Most prominently, Tasmania saw a significant uplift from 69% to 83%, the strongest positive movement among all states. This rise points to a late season increase in available lamb numbers, possibly indicative of a delayed ability to finish lambs during the tougher than normal southern spring seen late last year.

Conversely, Queensland and Western Australia have recorded substantial declines. Queensland’s lamb throughput dropped from 75% in February to 49% in March, and Western Australia’s from 69% to just 31%. Such steep reductions strongly suggest tightening supply and may possibly point to the impacts of a significantly reduced flock, particularly in the west.

New South Wales showed modest gains in lamb throughput. New South Wales moved to an index of 66% from a robust 85% February figure, suggesting the supply of lambs in the more northern regions may be heading towards an autumn/winter seasonal lull. Victoria demonstrated a stable saleyard supply at 68% in March, slightly higher than the 65% recorded in February, indicating relatively steady throughput conditions.

Pricing across different categories of lamb and sheep during the last month has been mostly unimpacted by the fluctuations in saleyard throughput. Focusing specifically on lamb prices first, heavy lamb has experienced relative stability over the last month with only a slight positive movement, edging upward marginally by 1 cent per kilogram carcass weight (c/kg cwt), reaching a current value of 790c/kg cwt. This stable but slightly improved pricing suggests ongoing, consistent demand for heavier lamb categories, potentially underpinned by constrained supplies as noted earlier.

Trade lamb prices, on the other hand, have seen a modest increase, up 11 cents over the four weeks, settling at 778c/kg cwt. This indicates reasonable consumer and processor demand within this lamb category, suggesting trade lamb continues to retain a solid market footing amidst variable throughput figures.

Light lamb prices have improved significantly over the past four weeks, showing a considerable rise of 23 cents to a current price level of 707c/kg cwt. The evident price strengthening may suggest robust buyer interest for lighter lambs, possibly driven by restocker activity, seasonal market influences out of the MENA region that support the lighter categories or those chasing a relatively cheaper lamb alternative when compared to the trade and heavier items.

Meanwhile, Merino lamb prices showed an upward movement, increasing by 18 cents over the past four weeks to reach a current price of 637c/kg cwt. Although historically lower valued than other lamb categories, this recent price recovery could reflect increased interest for Merino lambs given the modest rebounds seen recently in wool pricing.

Restocker lamb prices, similarly, have experienced a considerable increase of 30 cents to a current value of 699 c/kg cwt. This noteworthy price improvement implies heightened restocking demand, likely influenced by seasonal conditions encouraging some producers to reset their flock levels in anticipation of the autumn break.

In the mutton category, a remarkable price uplift was observed, with mutton prices strengthening significantly by 47 cents over the past month, pushing the current price up to 404c/kg cwt. This notable increase in mutton pricing reflects strong market demand for export sheep meat.