Stabilised, but still in the red

The Snapshot

- The average processor margin for September 2020 came in at a $255 loss per animal processed.

- Expensive cattle input costs have been making for a difficult trading environment for beef processors this season.

- Analysis of the relationship between annual slaughter levels and the annual average processor margin shows that currently the low herd numbers and tight slaughter environment is pushing the margin toward record negative territory.

The Detail

The Episode3 beef processor model for September shows average monthly margins improved slightly from the $258 per head loss calculated for August*. The average processor margin for September came in at a $255 loss per animal processed. This places the average annual margin for the 2020 season at a loss of $115 per head.

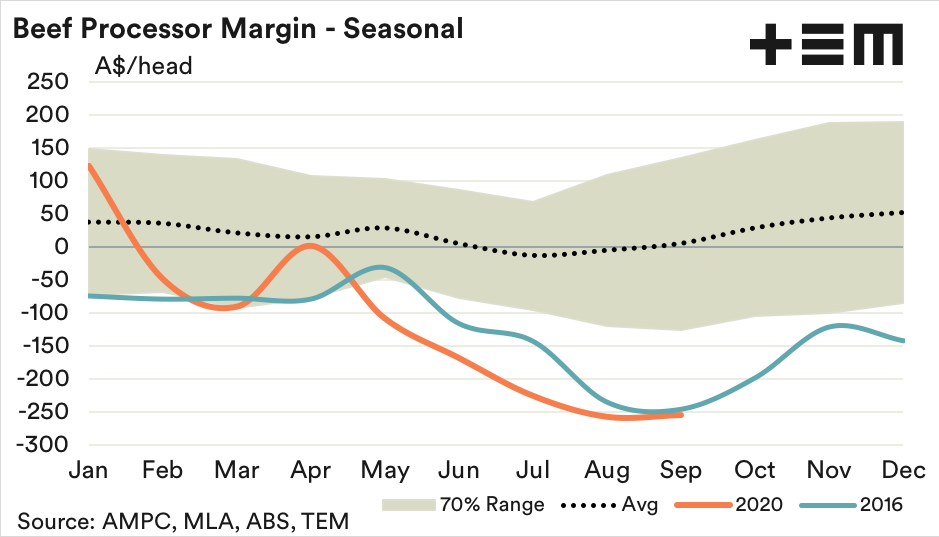

Tight domestic supply of cattle and a favourable season, which is fuelling restocking intent, have been the two key drivers underpinning strong saleyard cattle prices this season. The expensive cattle inputs have been making for a difficult trading environment for beef processors with the trend in the margin this year remarkably similar to the previous rebuild phase for the Australian cattle herd that began during 2016.

As the seasonality chart highlights, during 2016 the processor margin deteriorated from around a $50 loss in May towards a $250 loss by September. Aggressive restocking activity throughout quarter three of 2016 saw the Eastern Young Cattle Indicator (EYCI) peaking at 725c/kg cwt.

Fast forward to 2020 and another bout of restocking has driven the EYCI toward new record highs at 795/kg cwt last Wednesday. It isn’t just young cattle that are breaking record highs this season, with the tight cattle supply driving finished cattle to record levels back in June at 382c/kg lwt.

Just last week the national heavy steer closed not far off the record at 377c/kg and the persistent high cost of cattle heading into meatworks during the tight season are seemingly wreaking havoc with processor margins.

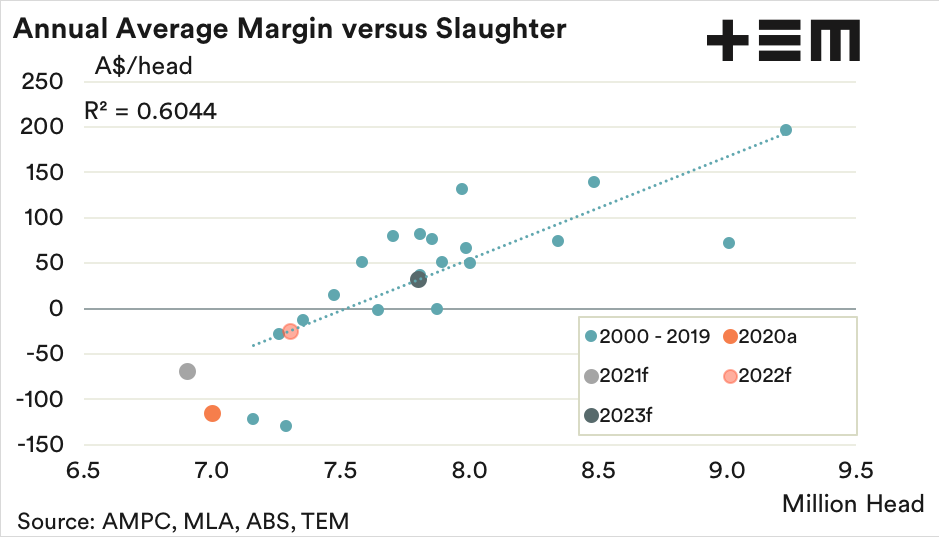

Analysis of the relationship between annual slaughter levels and the annual average processor margin shows that currently the low herd numbers and tight slaughter environment is pushing the margin toward record negative territory.

In 2016 the annual average margin finished the season at $129 loss per head of cattle processed, while the 2017 season saw margins average a loss of $121 per head. The 2020 season is shaping up to record similar levels of negative annual average margins to what was seen during 2016/17 and with the projection of even tighter slaughter in 2021 it appears processors are in for an extended period of tough trading conditions.

Concerns over tighter beef supply in the US heading into the final quarter of 2020 may see a lift to beef export prices for Australian processors. This could encourage further improvement in processor margins as we head toward the end of the year, but it is unlikely to be enough to get them back into positive territory over the short term.