Stagnant demand? Not likely!

Beef Export Summary September Quarter 2024

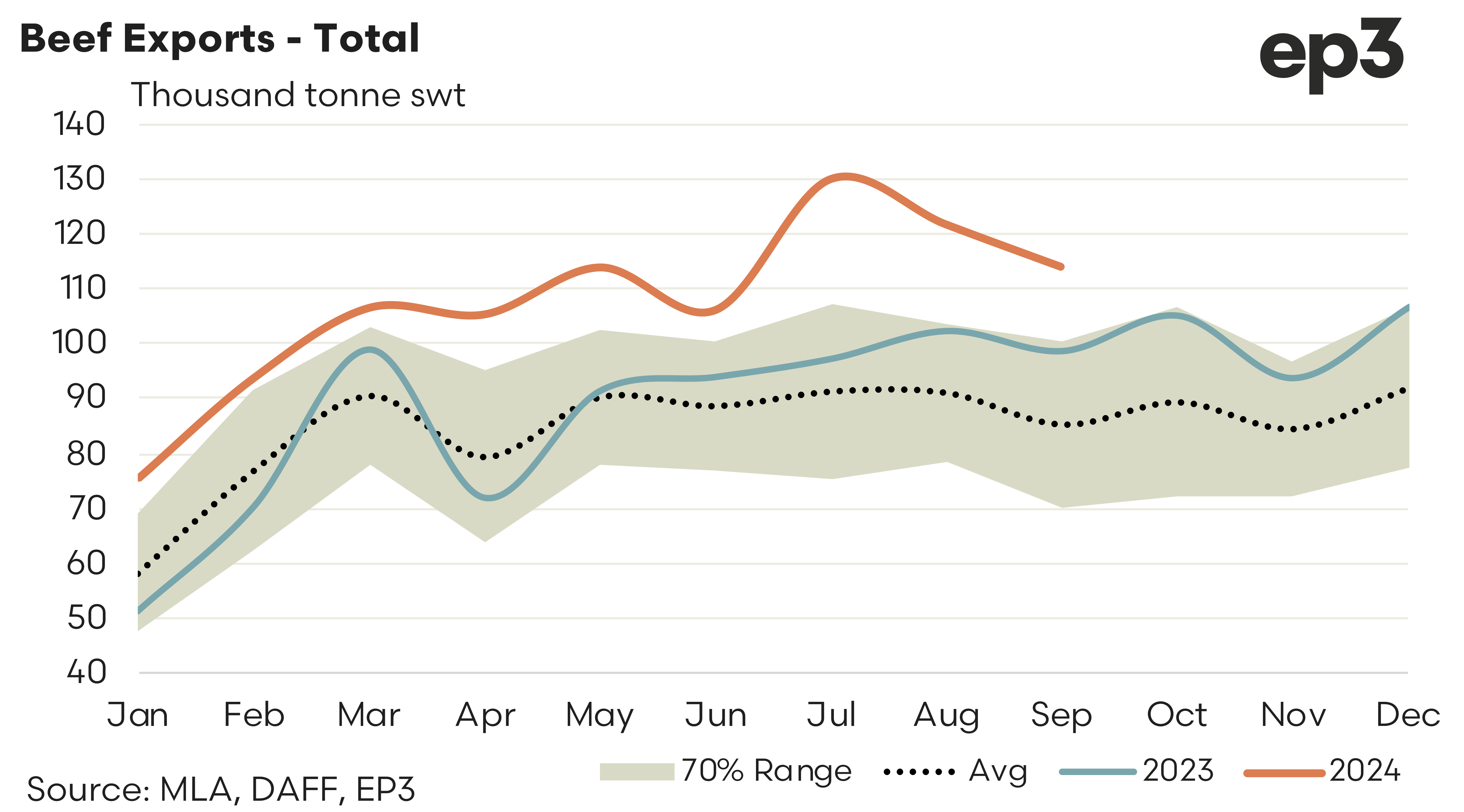

We recently saw an analysis piece that described the beef export offshore demand as stagnant and did a huge double take as it has been very robust all season and the September quarter 2024 total export flows from Australia remain well above average levels.

There was 365,840 tonnes of beef shipped out of Australia during the third quarter of 2024, which is a new record volume for the September quarter. It represented levels 12% higher than what was shipped out in Q2, 2024 and nearly 37% higher than the Q3 quarterly average volumes seen exported over the last five-years. To describe offshore demand for Aussie beef as stagnant is rather perplexing.

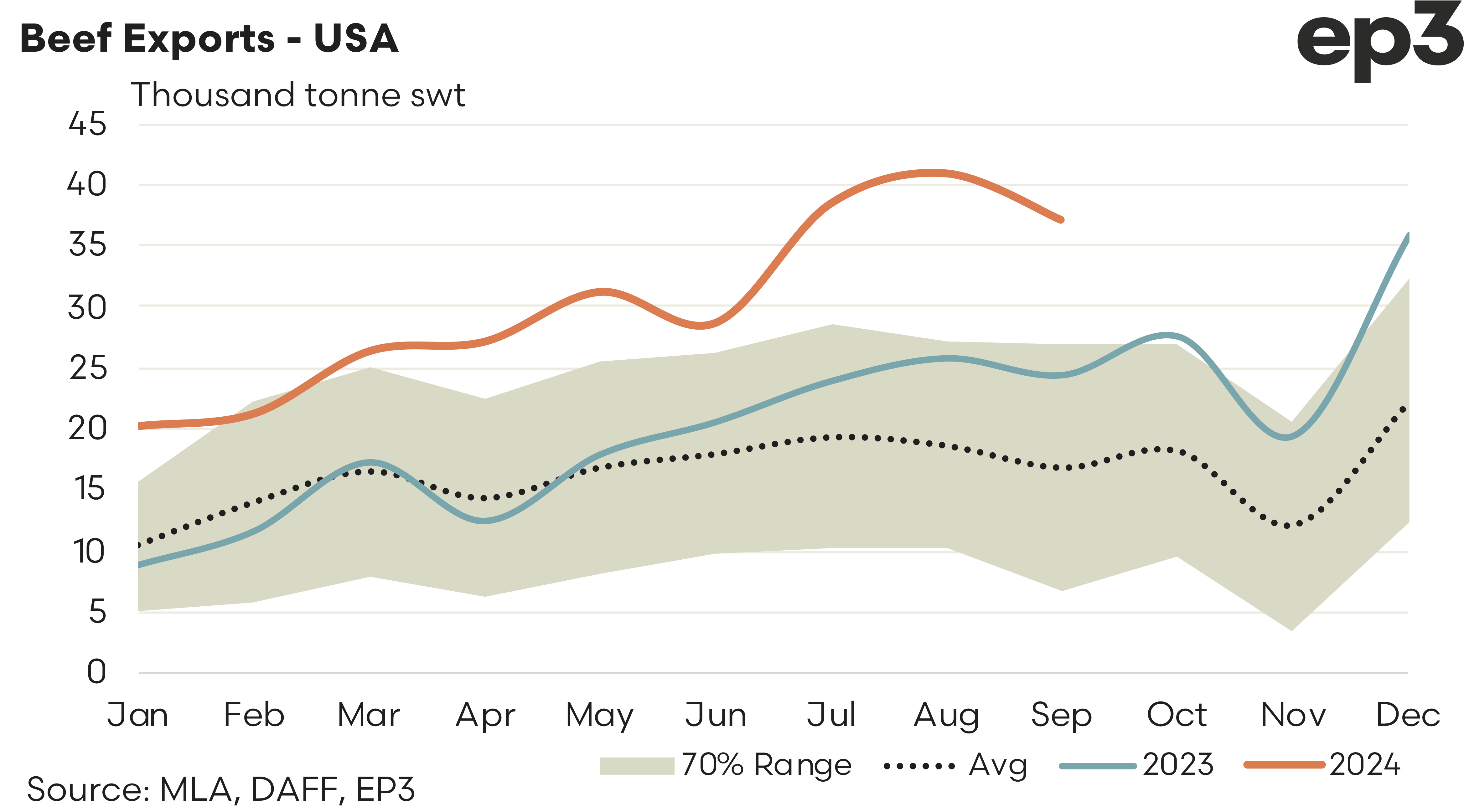

Although, the recent dock workers strike in the USA may slow down volumes to this destination over the last quarter of 2024 if the situation cannot be resolved in an efficient manner. But it is very early days to call the situation as stagnant.

A summary of the trade flows to the top beef export destinations is as follows.

USA – Exports of Aussie beef to the USA saw a 34% increase from Q2 to Q3, 2024 to hit 116,117 tonnes. This makes the recent quarter the strongest trade volumes since Q2, 2015. Current quarterly volumes to the USA are nearly 58% higher than Q3 last year and 112% above the five-year quarterly average levels.

Japan – After a strong first half of 2024 the Q3 flows to Japan have eased over the September quarter to hit a seasonal low of 17,104 tonnes in September. For the whole of Q3, 2024 flows have pulled back to 63,076 tonnes which is 13% down on the Q2, 2024 volumes and very close to the five-year Q3 average levels. Current Q 3 exports to Japan sit 1.5% above the five-year average levels.

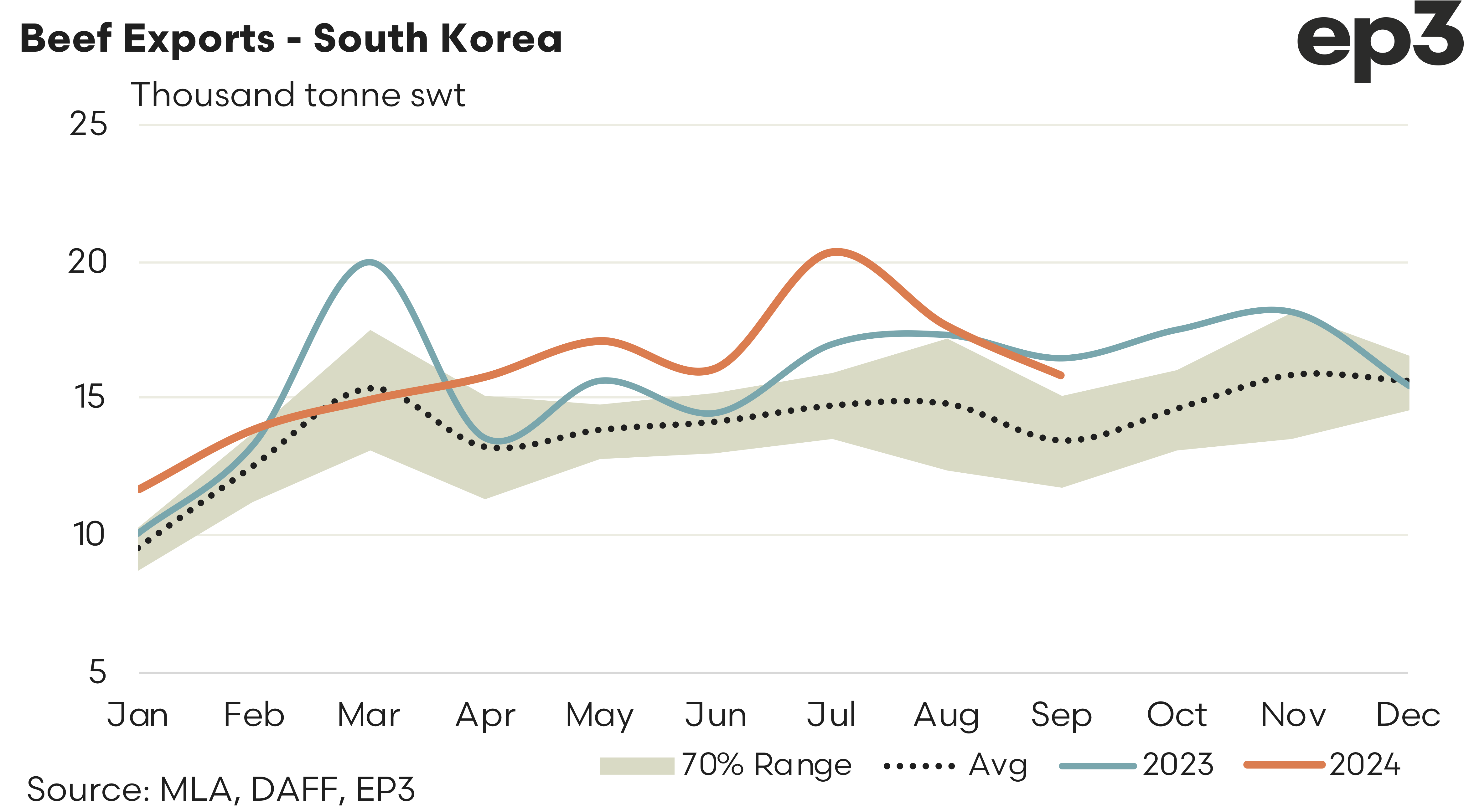

South Korea – Demand for Aussie beef from South Korea remains firm for Q3, 2024 with an 11% lift from the volumes shipped during Q2, this year. There was 53,850 tonnes exported to South Korea over Q3, which is 6% higher than Q3, 2023 and 25% above the five-year average flows seen during the September quarter.

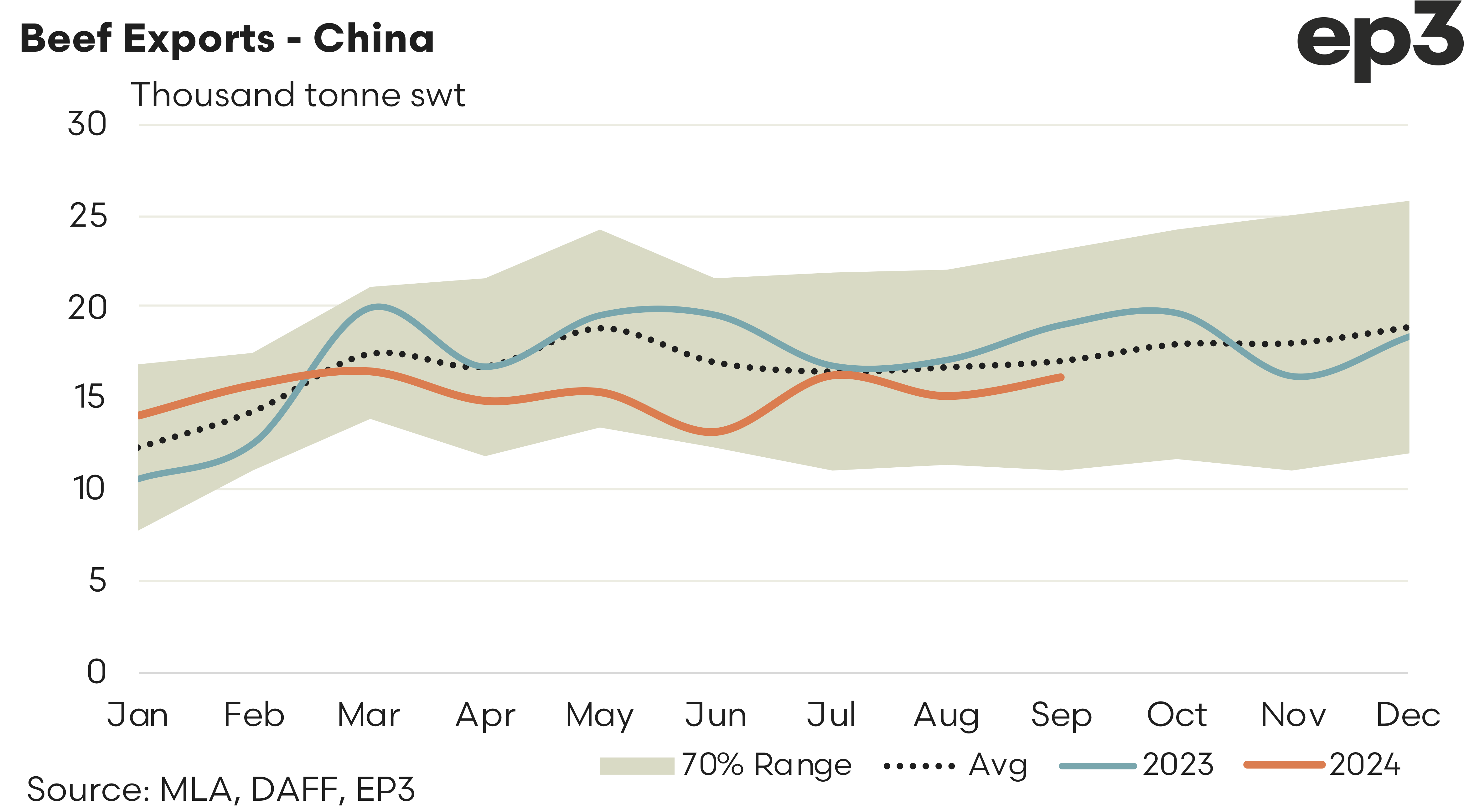

China – There was an increase to Chinese demand over Q3 too but current quarterly volumes, sitting at 47,558 tonnes, remain about 10% below the levels seen during Q3, 2023 and about 5% under the five-year average levels for the September quarter.