Still entrenched

Market Morsel

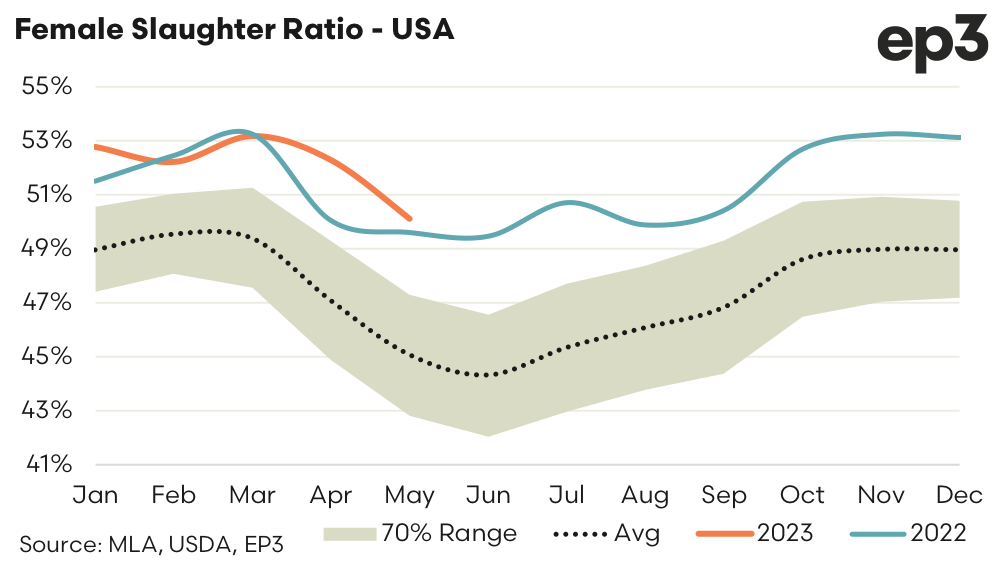

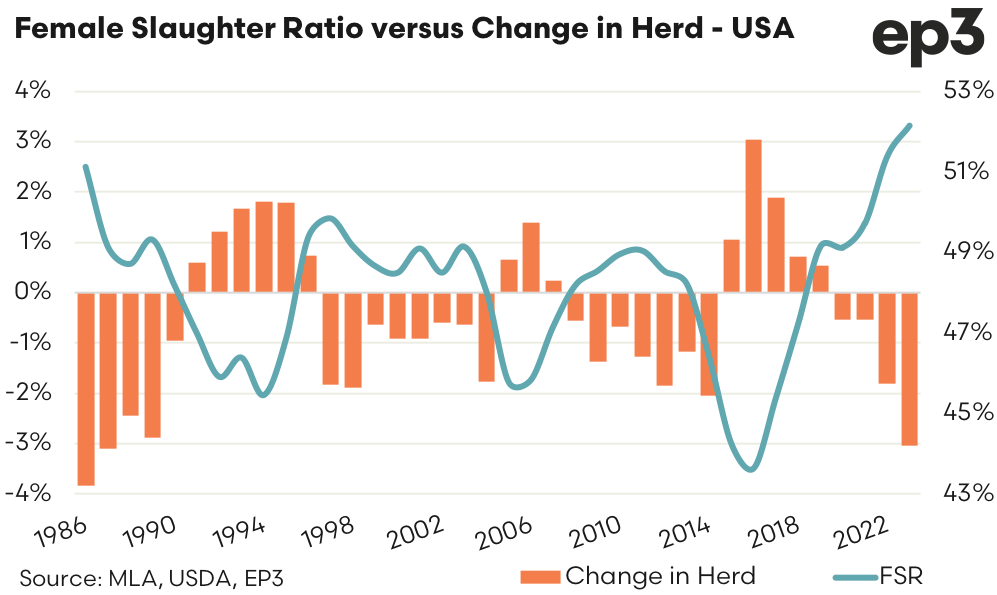

It has been some time since we looked at the USA cattle cycle via the measurement of the female slaughter ratio (FSR). So far in 2023 the US FSR has remained elevated, averaging 52.1% so far this year. In 2022 the US FSR averaged 51.4% for the whole year and also averaged 51.4% for the period January to May. In 2022 the annual average FSR of 51.4% was the highest on record (as far back as 1986) so this year has seen the FSR extend further into liquidation territory, signalling just how strong the pressure to reduce the herd has been in the USA currently.

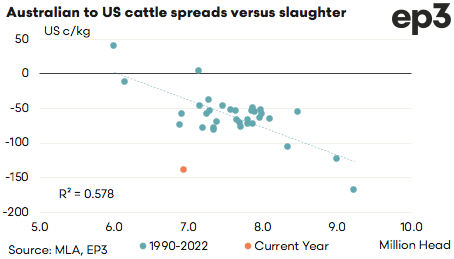

On an annual basis the US cattle herd is set to decline 3% in 2023 down from 92.1 million head in 2022 to 89.3 million head this year, the lowest the US herd has been since 2015. A reduced herd, along with the lower cattle supply and beef production that this entails, has seen US cattle pricing reach record levels this year and has driven the price spread between the USA and Australian cattle to heavily discounted levels akin to what we normally see when Australia is in a drought phase. But we aren’t in a drought in Australia at the moment.

The average annual price spread in USc/kg terms this year is nearer to a 150 US cent discount, but based on the relationship between annual to spread we should be at a discount of about 50US cents. Discounts of 150US cents for Australian cattle versus US cattle usually occur when we are slaughtering more than 9 million head a year due to drought, not when we are still in rebuild mode and slaughtering just 7 million head.