Taking off like a lamborghini

The Snapshot

- Total Australian lamb exports for June increased by 4% to reach 27,100 tonnes swt, the largest monthly flows in just over two years.

- Lamb exports to the USA recorded a 19% gain on volumes from May. This is the largest monthly volume of Aussie lamb exports to the USA on record and signifies volumes that are 78% higher than the five-year June average.

- Lamb exports to China lifted 1% over the month and at 7,312 tonnes represents the third highest monthly trade total on record.

The Detail

Department of Agriculture, Water and Environment (DAWE) monthly trade statistics highlight good underlying strength in demand for Australian lamb across several trade destinations. Lamb export trade flows to the USA were particularly strong, but a solid result to China and “other destinations” also helped support the total trade volumes.

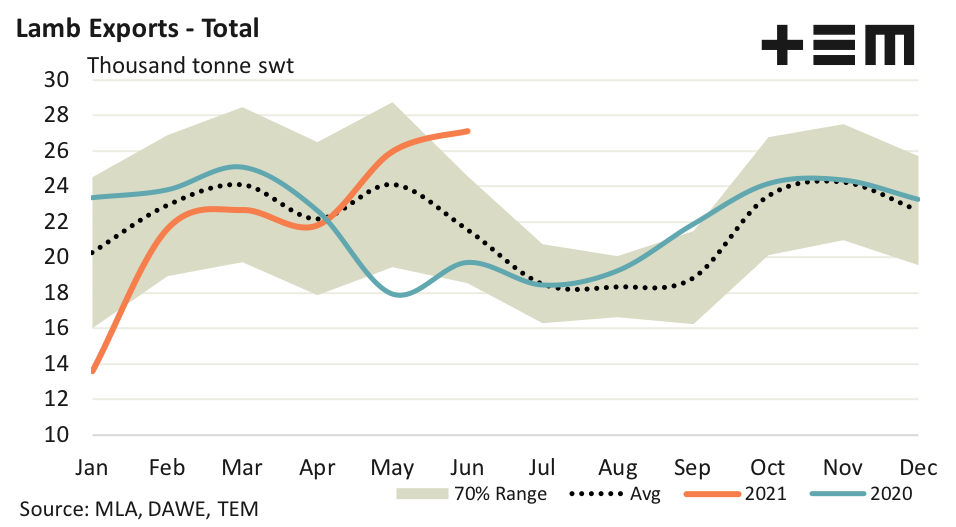

Total Australian lamb exports for June increased by 4% to reach 27,100 tonnes swt, the largest monthly flows in just over two years. Normally, a combination of higher lamb prices and reduced supply during Winter puts some pressure on lamb export volumes, but not during this June. The current monthly flows are sitting at levels nearly 26% ahead of the five-year average pattern for this time in the year.

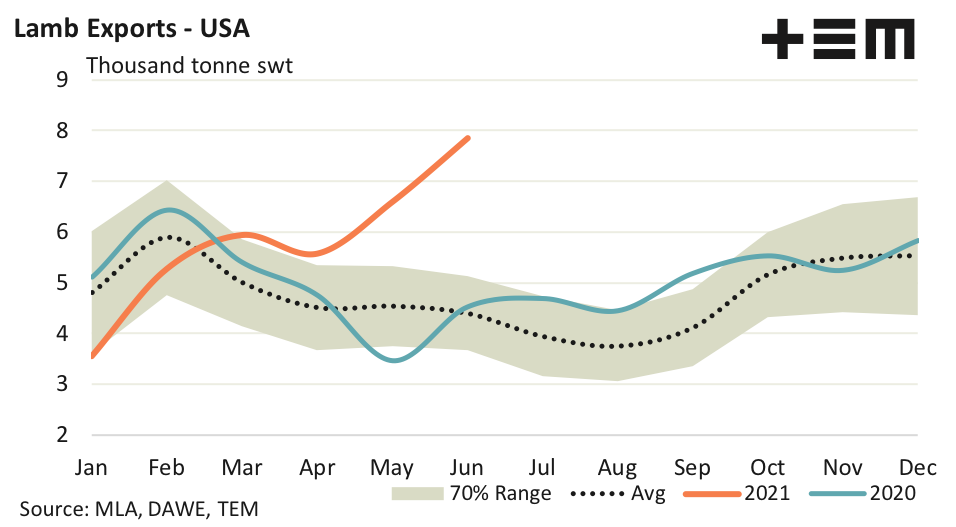

Lamb export consignments from Australia to the USA are the stellar performer over June, posting a 19% gain on volumes from the May result to see 7,842 tonnes shipped. This is the largest monthly volume of Aussie lamb exports to the USA on record and signifies volumes that are 78% higher than the five-year average seasonal pattern for June.

Given that approximately 60% of Australian lamb exports to the USA end up in the food service sector, and 60% of this food service trade is destined for the fine dining restaurants in America, it is a signal that economic confidence has returned to the USA and the American consumer is happy to be out spending on special occasions. Clearly, a huge boost to the hospitality sector in the USA with the successful Covid-19 vaccine rollout allowing for higher restaurant capacity.

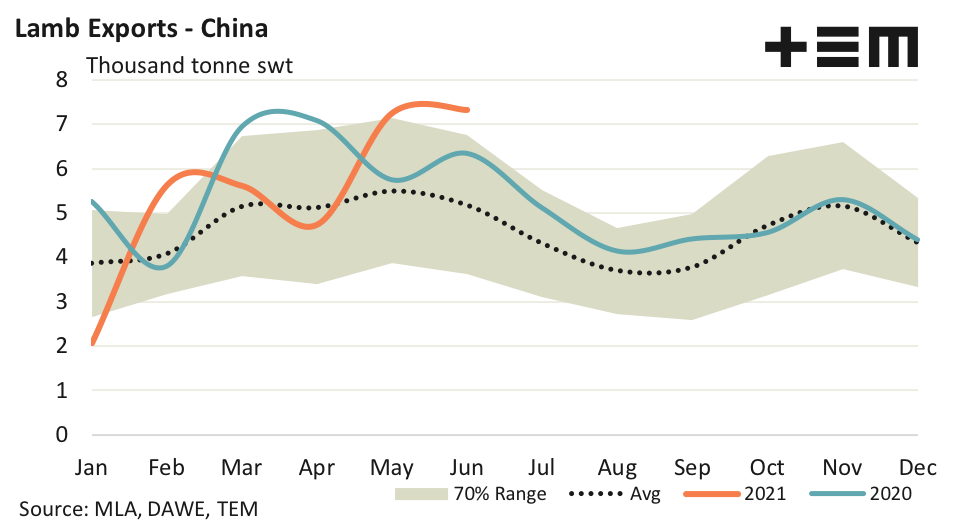

Thankfully lamb export demand isn’t just a one horse show, with Chinese consumers also demonstrating some solid interest. The June 2021 lamb export volumes remained outside the upper end of the normal range hitting 7,312 tonnes swt, a rise of 1% on the previous month.

This is the strongest month of Australian lamb exports to China in twenty months and represents the third highest monthly trade total on record. The June 2021 lamb trade volumes to China are sitting 41% ahead of the five-year average for June.

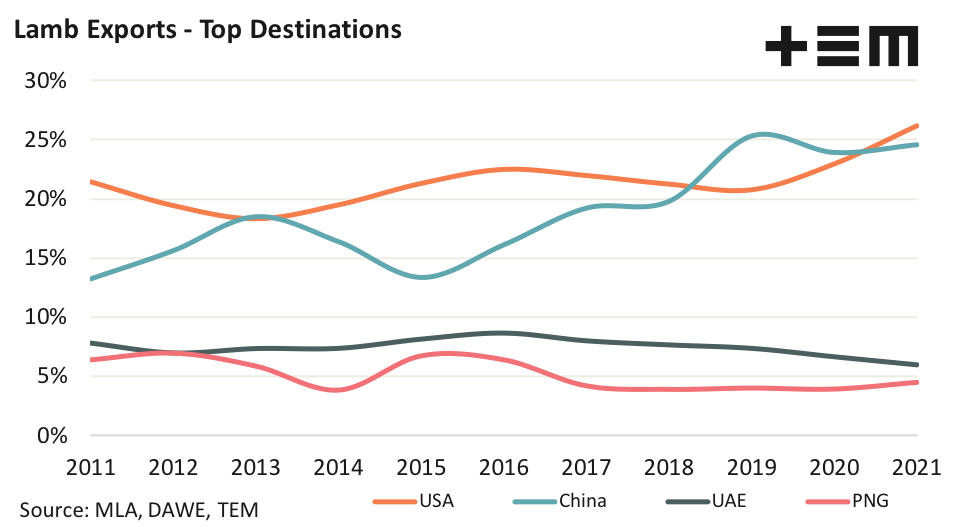

At the half way point of the 2021 season it is probably a good time to provide an update to the market share of top destinations for Aussie lamb. The strong surge in American demand in recent months has propelled the USA to sit at top spot, accounting for 26.2% of total lamb export flows.

Although China isn’t far behind in second place with 24.6% of total flows this season. The United Arab Emirates (UAE) hold third place on 6.0% of market share ahead of Papua New Guinea (PNG) on 4.5% of total lamb trade flows for 2021.