The basis of risk

Market Mosel

Attending the University of New England Feeder Steer school in Armidale last week prompted an interesting chat over the dinner table about price risk management for producers and beef supply chain participants.

The relatively new StoneX Feeder Swap was referenced by a keen producer, trying to assess the usefulness of this price risk management tool, given a story mentioned in Beef Central in late December 2024 about Nigel Kerin who utilised the StoneX swap to hedge his cattle price exposure.

The StoneX Australian Feeder Cattle Swap is a cash-settled financial derivative that enables participants to hedge against price fluctuations in the feeder cattle market. Each contract covers 10,000 kilograms of feeder cattle, with prices quoted in Australian cents per kilogram of live weight. Contracts are available for all 12 months, allowing users to lock in prices up to a year in advance. Settlement is based on the monthly average of the Argus Australia Northern Feeder Cattle Delivered Pricing Index, which reflects transactions within a 300 km radius of Dalby on the Darling Downs.

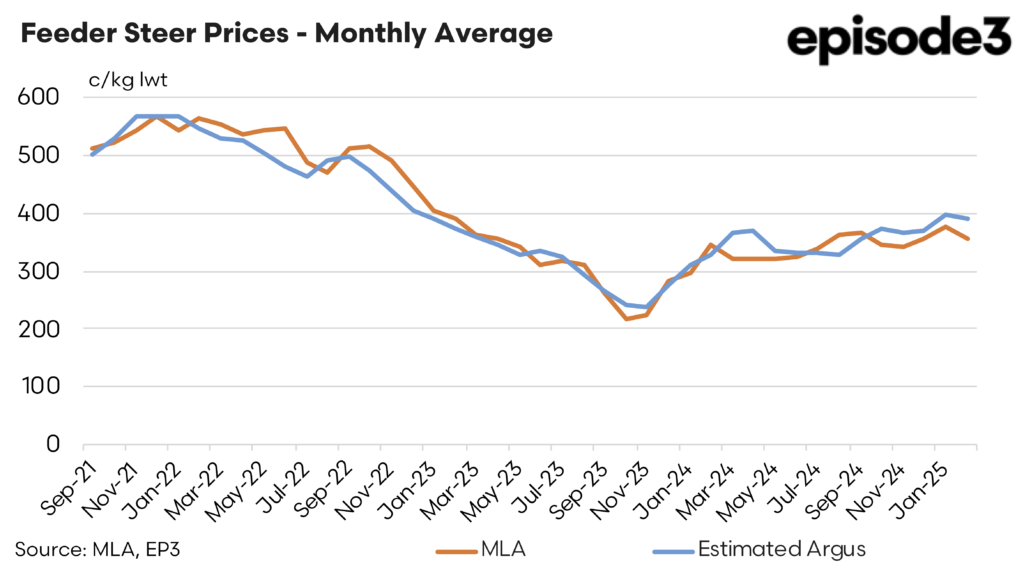

The chart below shows the average monthly MLA national feeder indicator versus a monthly average estimate for the Argus settlement index. The Argus index has been estimated from publicly available information, as the actual data is not reported publicly and sits behind a paywall, unlike the MLA saleyard index data and information on open access websites like Episode 3.

As the broad trend demonstrates the national MLA feeder indicator closely maps the trend of the Argus estimated levels. However, there are sometimes when the two indicators are out of sync, which can have implications for how well the swap will work for the producer.

In Mr. Kerin’s case, in September 2024 he entered into 20 swap contracts for 500 heifers at an agreed swap price of 365 cents per kilogram live weight. At the end of the contract period in November 2024, the settlement process involved comparing the agreed swap price to the actual average settlement price, as determined by the Argus index.

If the Argus settlement price exceeded 365 cents/kg, Mr. Kerin would pay the difference; if it was lower, he would receive the difference. The settlement price in November 2024 was 366.75 cents.

As can be seen by the Table 1 the settlement price for the swap was 1.75 cents above the original contracted price for the swap, so Mr Kerin had to pay StoneX the difference, equating to a $3,500 payment to them.

However, this isn’t the end of the story. As the StoneX contract is not deliverable – it is cash settled. Mr Kerin still had to physically sell his cattle either direct to a feedlot or via the saleyards/agent. The price he actually received for this physical sale is also important.

To be useful, the swap should have the underlying physical price trend matching up to the settlement price trend. So, in an ideal world, the extra 1.75 cents Mr Kerin paid out on the swap is reflected in a higher physical price he actually receives for his cattle. This risk of the physical price matching up with the settlement price is often referred to as “basis risk”.

As an example take a look at the difference in MLA feeder price trends over 2024, for Queensland feeders versus Victorian Feeders. At the start of 2024 Victorian feeders were at a price discount, then in the middle of the year the two indicators closely matched each other in terms of average price level and trend.

However, toward the end of the year the Victorian feeder steer dropped away while the Queensland feeder steer increased. Indeed from September to November 2024 the Queensland indicator increased from 350 to 353, meanwhile the Victorian indicator slipped from 348 to 311.

Assuming Mr Kerin was based in Queensland the extra 1.75 cents he paid on the swap was more than covered by the extra 3 cents he gained, on average, in the increase to actual feeder prices in Queensland from September to November. In actual dollars, he paid out $3,500 on the swap and gained an extra $6,000 in the physical trade.

However, due the basis risk factor, if Mr Kerin was located in Victoria instead of Queensland this would have meant that his actual physical feeder steer price achieved deteriorated from 348 to 311, a fall of 37 cents. So he paid out 1.75 cents on the swap ($3,500) and also lost out on the physical trade to the tune of $74,000.

Swaps can be a very useful tool in hedging price risk exposure. But understanding how they work and determining how well the price trends in the actual physical market that you interact within corresponds to the trends seen in the settlement indicator is important, so that you are not just replacing one risk (price risk) with another (basis risk).

At Episode 3 we are often asked about price risk management strategies and can demonstrate with long term data how well aligned certain physical markets are to their swap equivalents. If you are seeking an independent, objective and data backed assessment of these matters feel free to reach out to us.