The case of the disappearing discount

The Snapshot

- Compared to equivalent cattle in the USA, the Australian Heavy Steer is currently sitting at nearly a 60 AU cent premium.

- Very low levels of cattle slaughter within Australia is forcing domestic prices to sit at premium spreads that are around 100 US cents (130 AU cents) higher than would normally be expected.

- The annual average price spread of Australian to US steers, in US cents/kg, has fluctuated between a 39 US cent to 81 US cent discount for 27 of the last 32 years.

- A return to higher annual Australian cattle slaughter volumes in 2022 and 2023 could see Australian Heavy Steer values drop back under 300 AU cents/kg live weight.

The Detail

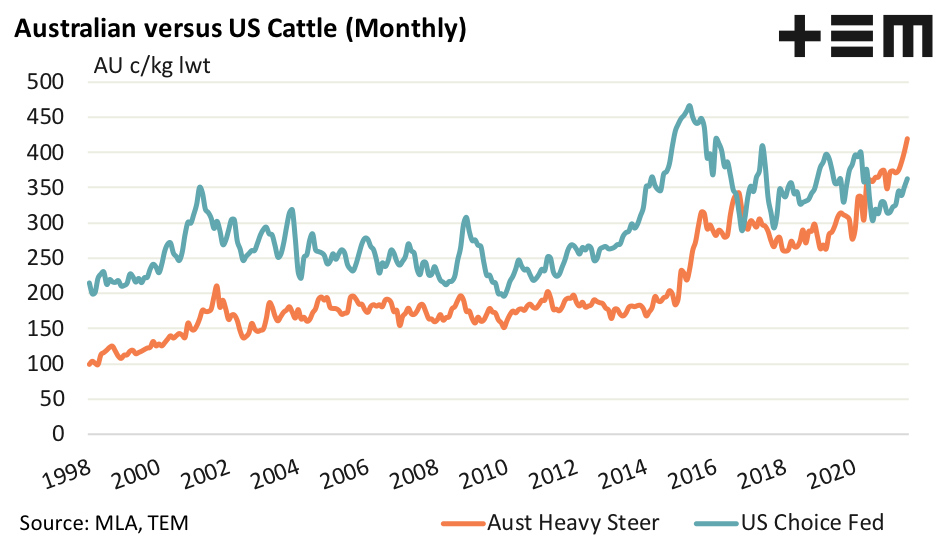

Australian Heavy Steer prices have been holding firm above 400c/kg lwt for a couple of months now, with the July 2021 average price sitting at nearly 420 cents, in Australian dollar terms. Compared to equivalent cattle in the USA the Australian Heavy Steer is sitting at nearly a 60 cent premium, and this is despite US Choice Fed Steer prices gaining 15% since the start of 2021.

When comparing Australian cattle values to the USA it is often useful to assess the prices in US dollar terms as this gives a better understanding as to where our prices sit in a global marketplace and also removes the impact that a fluctuating Australian dollar value has on our cattle price.

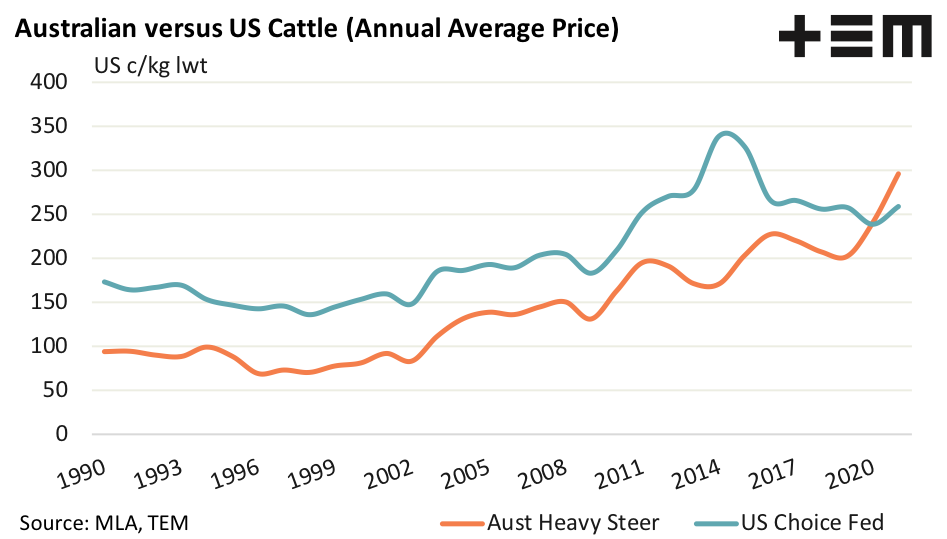

An assessment of the Australian to US steer prices on an annual average basis, and expressed in US dollar terms, highlights two key considerations. Firstly, that Australian prices over the longer term tend to move in sync with US prices and, secondly, that the annual spread between the two prices (expressed in US cents per kilogram) has been reasonably consistent, and normally runs at a discount, up until recently.

For much of the last thirty years annual average prices between Aussie Heavy Steers and US Choice Fed Steers have followed a remarkably similar pattern. One exception was Australian cattle prices deviating from the strong US price gains seen in 2014/15 due to very strong drought induced cattle turnoff in Australia at that time, which kept domestic prices under pressure.

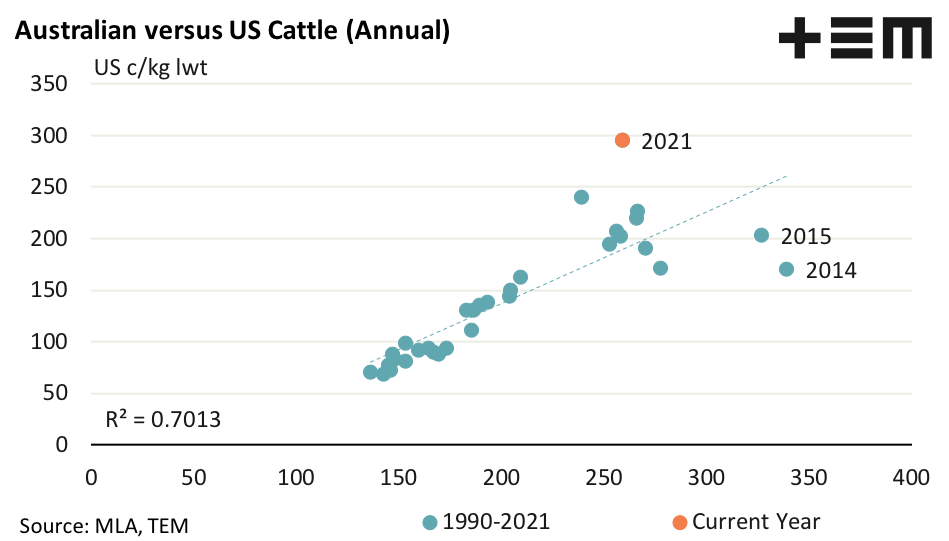

Analysis of the correlation between annual average prices of Australian and US cattle signals a moderately strong relationship with a correlation coefficient of 0.7013. The line of best fit shows how extreme the impact of the 2014/15 drought was on Australian Heavy Steer prices with levels achieved that were 50-100 US cents (65c to 130c in A$ terms) below the levels that could have been expected, based on the prevailing US prices at the time.

Uncharacteristically high annual slaughter in Australia during 2014/15 was driving the wider than normal discount spread to the US. Similarly, the very low levels of slaughter that Australia is currently experiencing is forcing domestic prices to sit at premium spreads that are around 100 US cents (130 AU cents) higher than would be expected, based on current US cattle prices and the normal historic relationship that exists between the two price series.

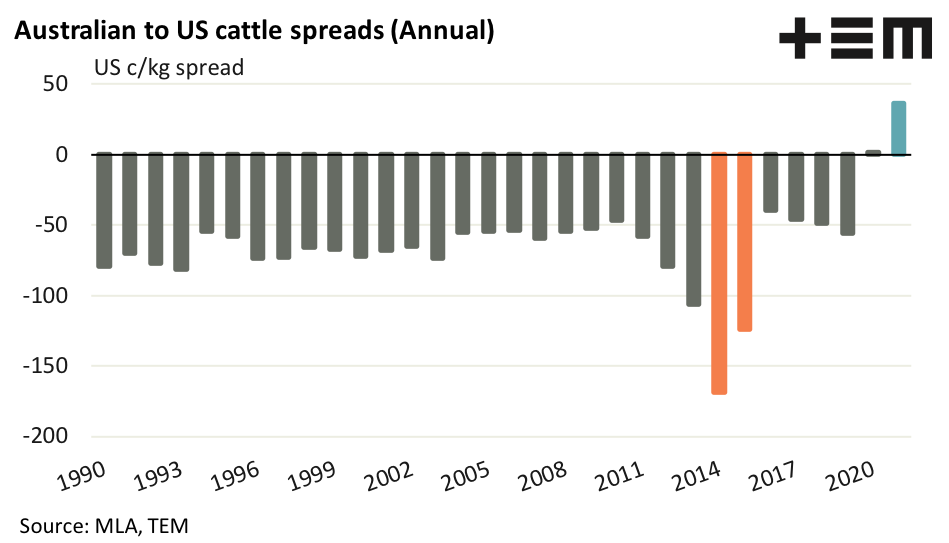

Indeed, the annual average price spread in US cents/kg has fluctuated between a 39 US cent to 81 US cent discount for 27 of the last 32 years. Drought conditions beginning in 2013 saw the spread discount widen beyond 100 US cents, reaching nearly 170 US cents on an annual average basis in 2014, before moving to a 123 US cent discount in 2015.

In 2020 the spread between Australian Heavy Steers and US Choice Fed Steers moved to a very marginal 1.5 US cent premium as an annual average. This year the premium has widened further to hit an annual average of nearly 37 US cents (around 48 AU cents), currently.

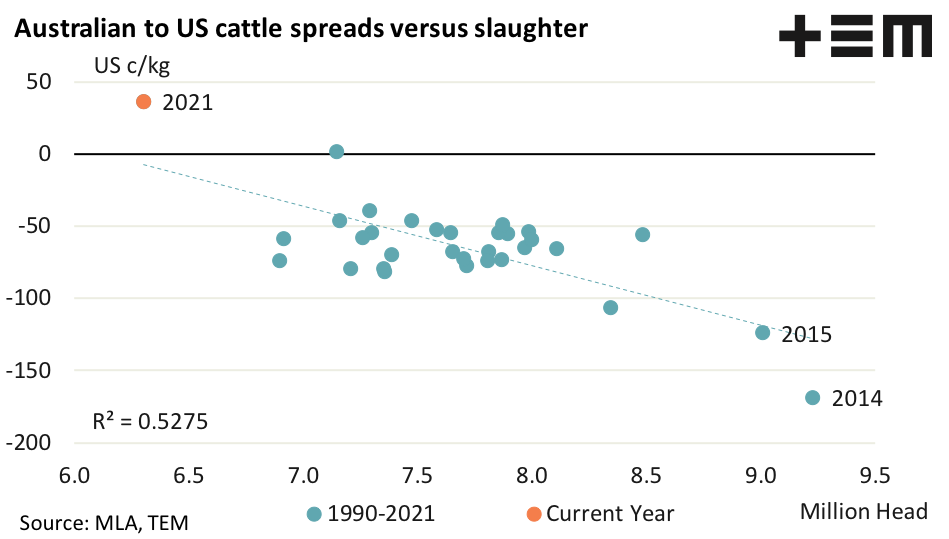

A comparison of the relationship between annual cattle slaughter volumes and the annual average spread between Australian Heavy Steers and US Choice Fed Steers demonstrates a fairly strong correlation, with a coefficient of 0.5275 over the last three decades.

Based on the line of best fit, an annual Australian cattle slaughter of 6.3 million head would be expected to push the spread between Australian and US cattle prices close to parity. In their most recent cattle market outlook Meat and Livestock Australia are forecasting annual cattle slaughter of 6.9 million head in 2022 and 7.4 million head in 2023.

These slaughter levels are likely to push the spread back into discount territory at an annual average of 40 US cents in 2022 and approximately 50 US cents in 2023, based on the line of best fit as a guide. The US Choice Fed Steer currently sits at an annual average of 260 US cents in 2021, which converts to about 335 cents/kg lwt in Australian dollar terms. Assuming similar pricing levels for US cattle into 2022 and 2023 and the spread reverting to more normal discounted levels this could see the annual average Australian Heavy Steer back under 300 AU c/kg lwt in the coming years.