The China Syndrome

The Snaphot

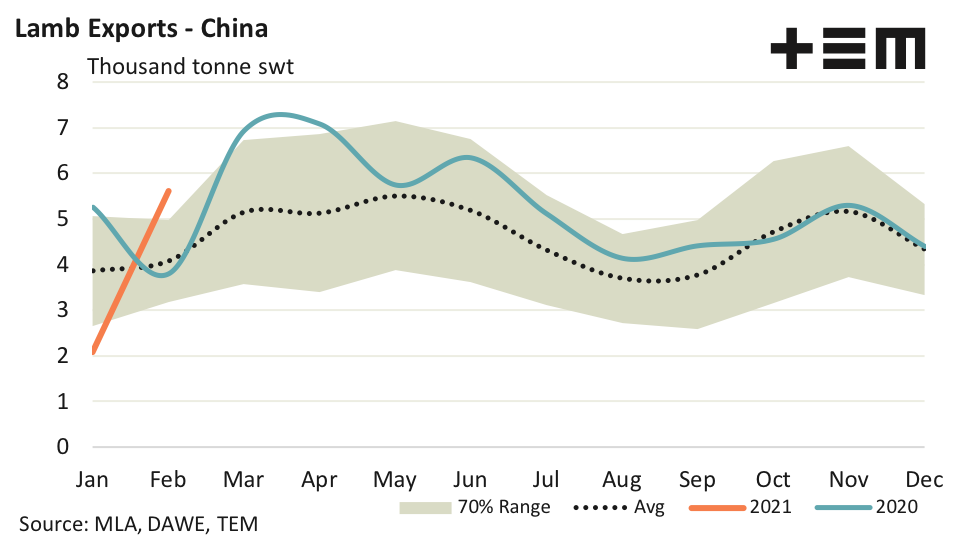

- Australian lamb export to China for February shows a 170% jump in demand over the month to see export volumes hit 5,622 tonnes swt.

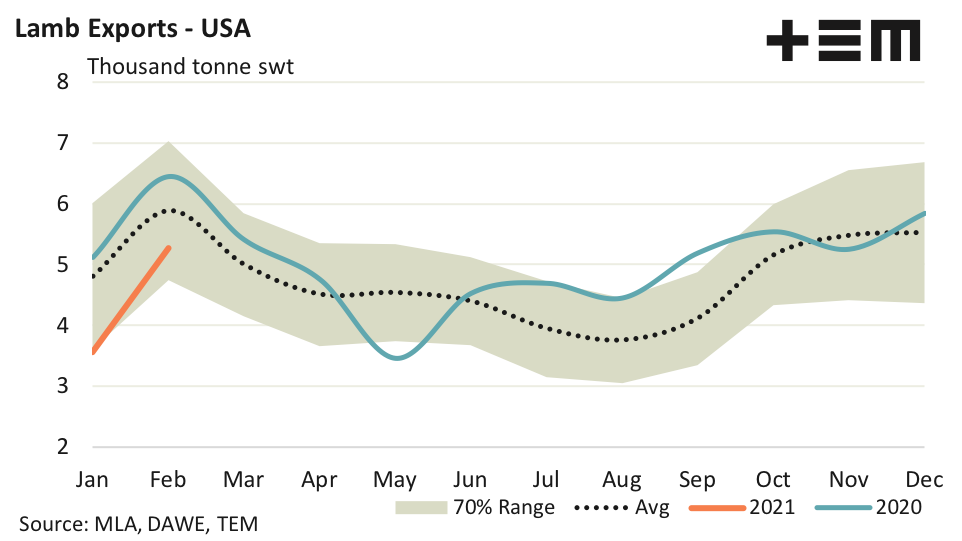

- Meanwhile, lamb export consignments to the USA saw a 48% lift from their January levels to see 5,277 tonnes shipped.

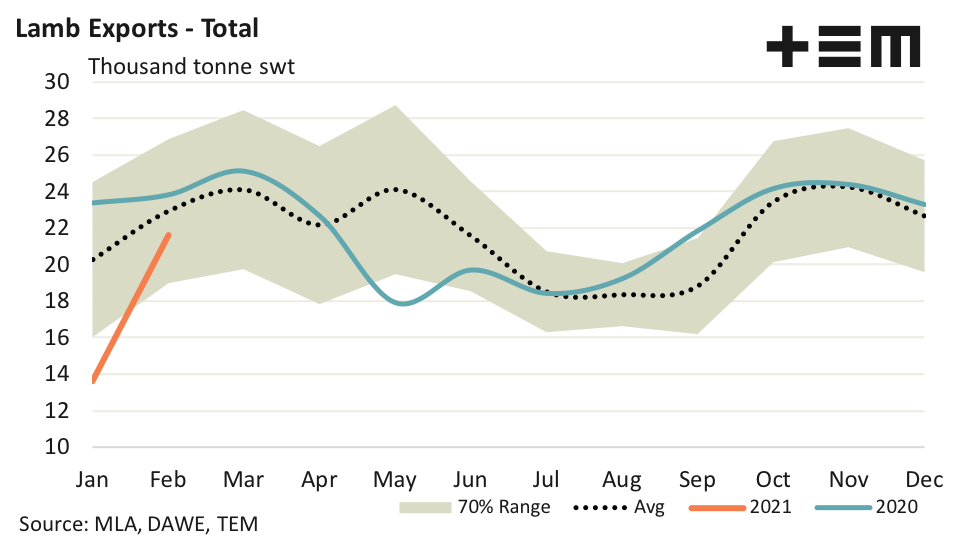

- The strong surge in Chinese and US demand for Aussie lamb puts total lamb flows just 6% under the five-year average seasonal pattern for February.

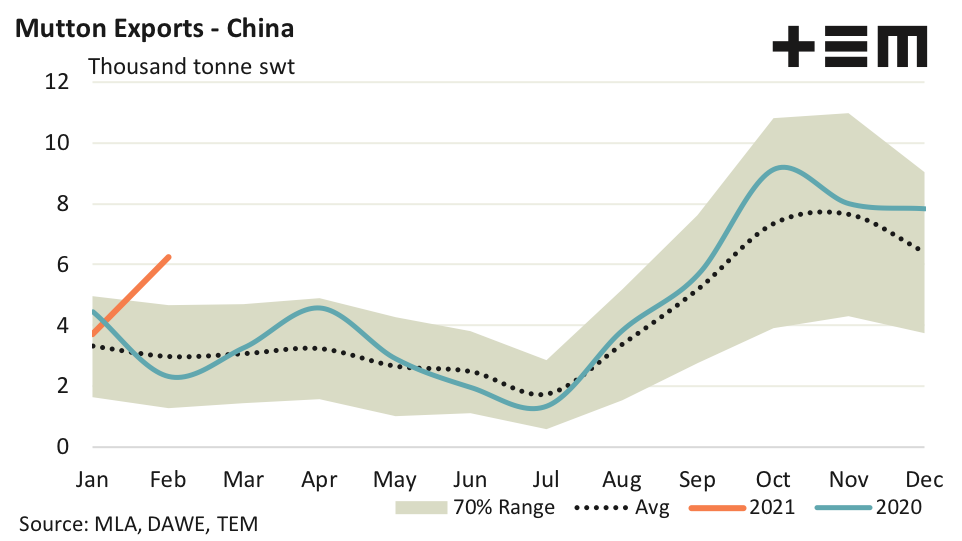

- February mutton volumes to China also performed well, lifting 69% over the month to register 6,242 tonnes swt exported.

The Detail

The release of February sheep meat export figures this week shows a strong uptick in demand from China for both mutton and lamb from Australia. This surge comes as increased reports of a second wave of new types of African Swine Fever (ASF) hitting the Chinese pig herd and setting back their rebuild.

Earlier in the month we outlined why data on the pig herd rebuild in China seemed to be at odds with what the official Chinese government reporting suggested. Now, with the prospect of a delayed rebuild and further complications from ASF it seems the Chinese consumer is out on the hunt for other meat proteins again.

The Department of Agriculture, Water and Environment trade data for February shows a 170% jump in demand for Australian lamb from the January levels to see export volumes hit 5,622 tonnes swt. This is the highest Aussie lamb export level for a February to China on record and represents volumes that are 38% over the five-year seasonal average for February.

Meanwhile, lamb export consignments to the USA saw a 48% lift from their January levels to see 5,277 tonnes shipped. China and the USA are Australia’t top two destinations for lamb exports so it is pleasing to see such a good rebound in both markets during February. Although, despite the strong US performance the February levels remain 10% under the average seasonal pattern for this time in the year.

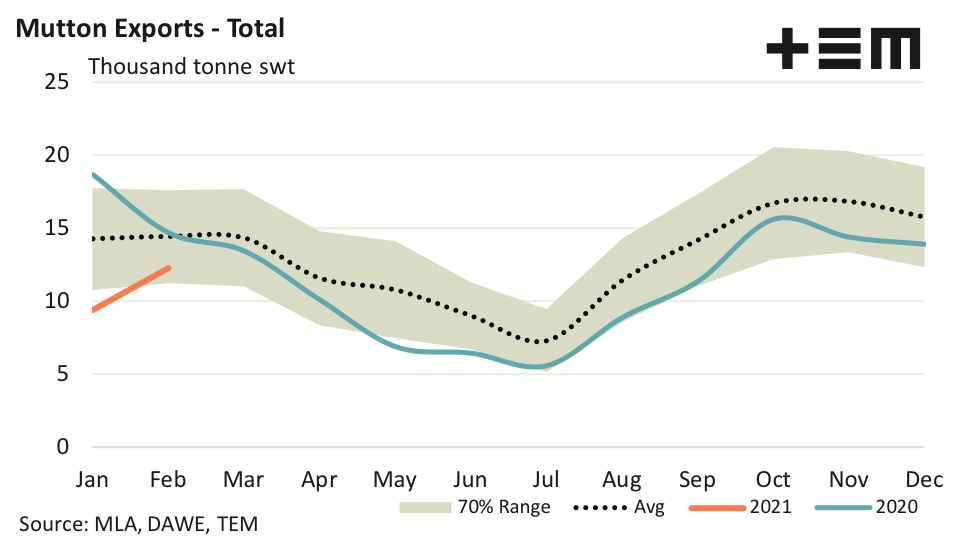

A look at total lamb exports from Australia highlights a strong recovery from the poor start to the season. Total exports lifted 59% over the month to record 21,607 tonnes swt consigned. This represents a level that is just 6% under the five-year average seasonal pattern for February.

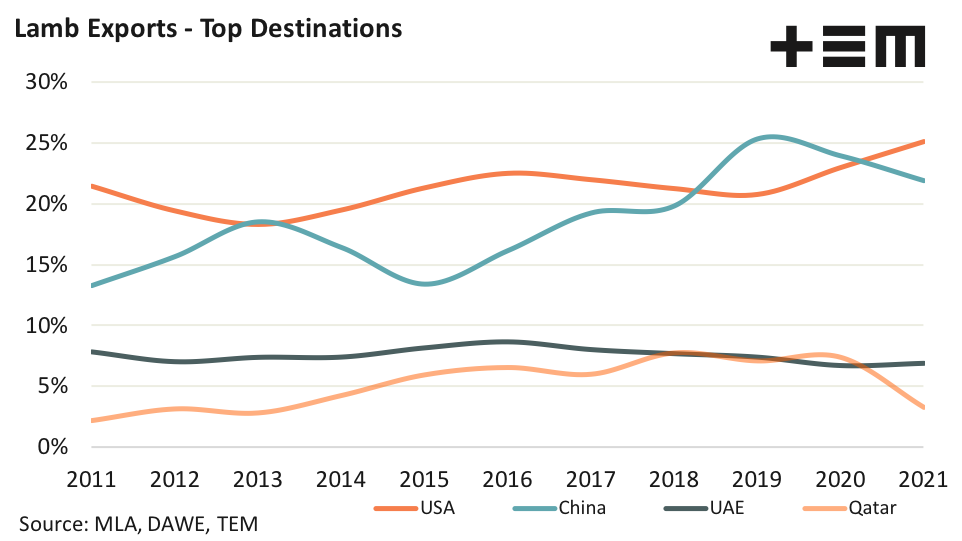

The market share for our top lamb export destinations shows that flows to Qatar since the start of 2021 have eased back to levels consistent with their pre-import subsidy program at 3.3% of total lamb export flows. Last year Qatar ended a subsidy program that favoured Australian lamb earlier than expected and the result appears to be volumes easing with February recording just 423 tonnes of lamb shipped, 42% under the five-year February average pattern.

The Chinese boost to sheep meat exports during February wasn’t just limited to lamb with mutton exports also getting a strong upswing. February mutton volumes to China lifted 69% over the month to register 6,242 tonnes swt exported.

As was the case with lamb exports to China, this is the strongest mutton export volumes to occur during February on record, matching the previous record set in February 2019 when the ASF led demand for meat protein was in full swing. The February 2021 flow of mutton to China is 110% higher than the five-year average trend for February.

The strong lift in Chinese demand for mutton supported a broader increase to total mutton exports from Australia over February to see a 30% gain in total volumes from the January figures. Total mutton shipments recorded 12,228 tonnes swt for February, a level that is 15% under the five-year seasonal pattern for February.