The EYCI or the exy?

The Snapshot

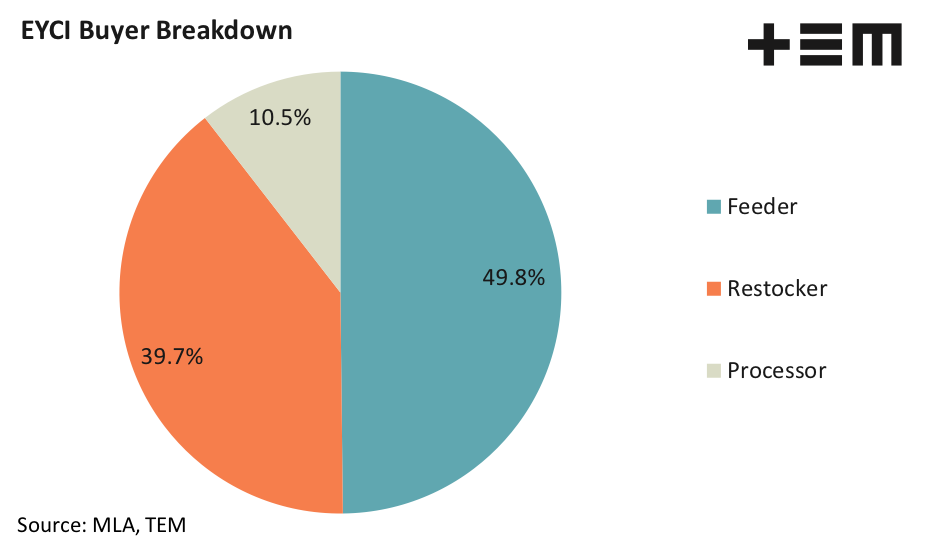

- Feedlot buyers are the largest buyer group of EYCI style cattle at the saleyard with nearly 50% of the sales volumes.

- Restocker buyers are the next key buyer segment, consisting of nearly 40% of the sale yard turnover.

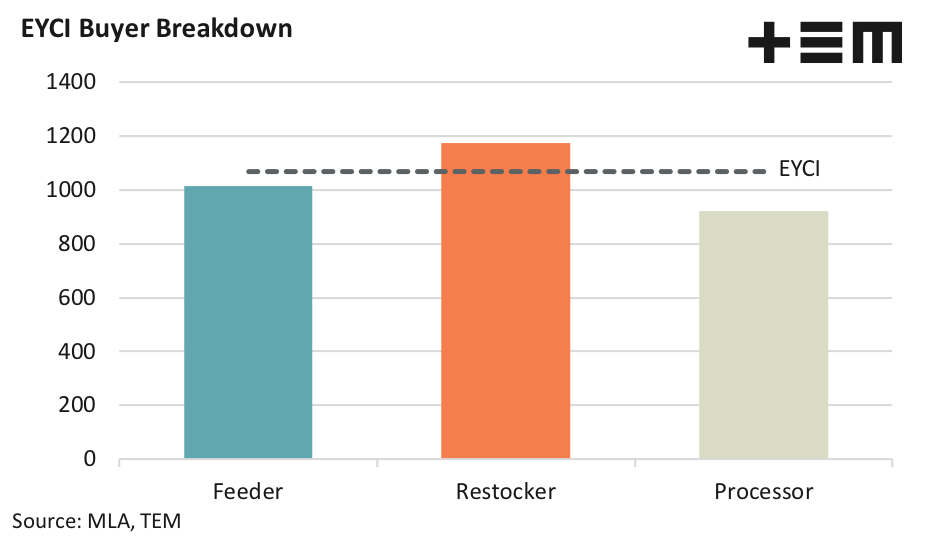

- Restocker buyers are averaging young cattle purchases of about 1175 c/kg . In contrast feeder buyers have paid an average of 1015 c/kg and processor buyers have averaged nearly 920 cents on a carcass weight basis.

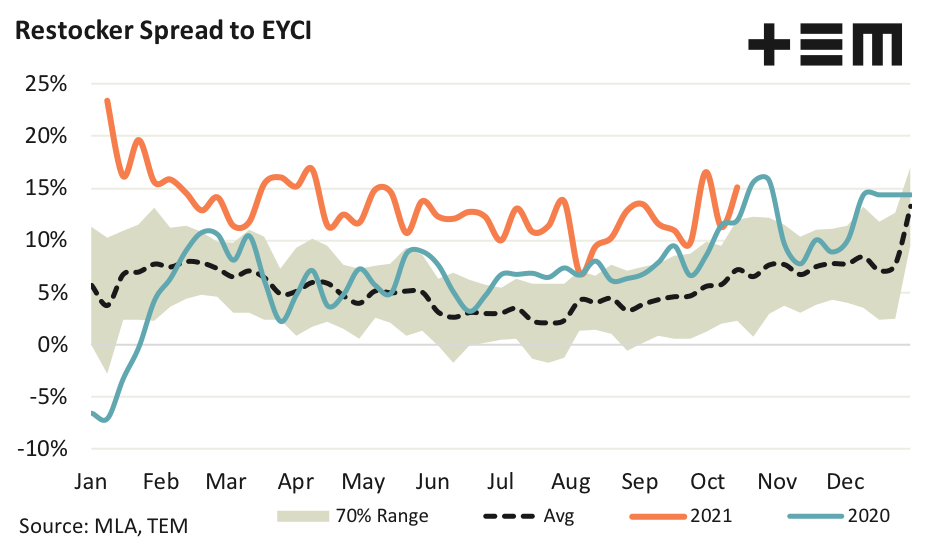

- The seasonal pattern for the restocker to EYCI spread demonstrates how extraordinary the demand for restocker steers has been this year.

- So far this year the restocker spread has average a 13.3% premium and over the last four weeks the restocker spread has widened from a 9.7% premium to hit 15.1% as of the middle of October.

The Detail

Lat week Meat and Livestock Australia (MLA) reported the Eastern Young Cattle Indicator (EYCI) hit a new nominal peak at 1068.4 cents per kilo carcass weight and at these levels it begs the question if we stop referring to this indicator as the EYCI and re-label it the “exy” given how expensive young cattle are becoming.

MLA buyer type data highlights that feedlot buyers are the largest buyer group of EYCI style cattle at the saleyard with nearly 50% of the sales volumes taken up by feeder buyers. Restocker buyers are the next key buyer segment, consisting of nearly 40% of the sale yard turnover. Meanwhile processors account for approximately 10% of the sales volumes.

A breakdown of the average purchase value for these three buyer groups show that while the restockers aren’t accounting for the largest volumes they are certainly responsible for the push higher in pricing, with restocker buyers averaging 1175 c/kg or about a 10% premium above the EYCI. In contrast feeder buyers have paid an average of 1015 c/kg and processor buyers have averaged nearly 920 cents, discounts of 5% and 14% to the EYCI – respectively.

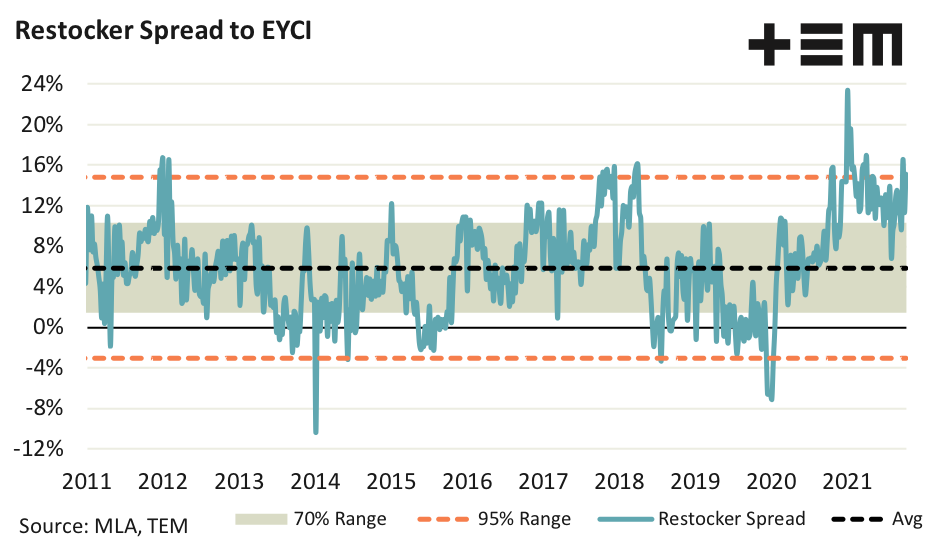

The optimistic approach to young cattle purchases made by restockers since the start of 2021 is evident in the spread of restocker steers to the EYCI. Historically, restocker steers command about a 6% premium to the EYCI, as identified by the long term average spread, with a normal range between a 1.4% premium to a 10.3% premium price spread.

Since the beginning of 2021 the restocker to EYCI spread has barely traded in the “normal” historic range, spending most of the time fluctuating between the upper end of the normal range and the upper extreme range at about a 15% premium. Indeed, the first few months of 2021 saw the restocker to EYCI premium remaining above the extreme upper boundary after starting the year at a premium spread of nearly 24%. Currently, the restocker to EYCI spread sits just outside the extreme boundary at a premium of 15.1%.

The seasonal pattern for the restocker to EYCI spread demonstrates how extraordinary the demand for restocker steers has been this year. Not once has the weekly spread dipped into the normal range boundary, as highlighted by the grey shaded region on the seasonal chart.

So far this year the restocker spread has average a 13.3% premium and over the last four weeks the restocker spread has widened from a 9.7% premium to hit 15.1% as of the middle of October.