The Hunt for A Red October

Market Morsel

October has witnessed consistently strong slaughter records for cattle in Australia during the 2024 season, particularly in abattoirs based within Victoria and Queensland. The final week in October saw 143,300 cattle slaughtered across the eastern seaboard which is the highest weekly beef processing volumes seen so far this year. Compared to the five year weekly average for this time in the season the current processing levels are 23% stronger and more reminiscent of slaughter levels seen during the 2019 drought when cattle turnoff was particularly robust.

This surge in production, bolstered by favourable conditions and additional staff, is indicative of a busy fourth quarter, potentially the most productive since late 2019. The expansion in staffing has been particularly noticeable at processing facilities in Victoria and Queensland, many of which have introduced a second shifts, and is set to elevate the industry to near full capacity as we approach the end of the year.

Nationally the industry has processed nearly 50,000 more cattle during October 2024 compared to the same timeframe last year, supported by a significant increase in grain-fed cattle finishing their feeding programs. The most recent cattle on feed report from the June quarter highlights the growth in the grain fed sector this year with cattle on feed numbers hitting a fresh record of 1.42 million head and average quarterly feedlot turnoff running nearly 12% higher than seen during 2023. All eyes are awaiting the September quarter cattle on feed report, due for release shortly, to see if the surge in the sector is being maintained as we round out the year.

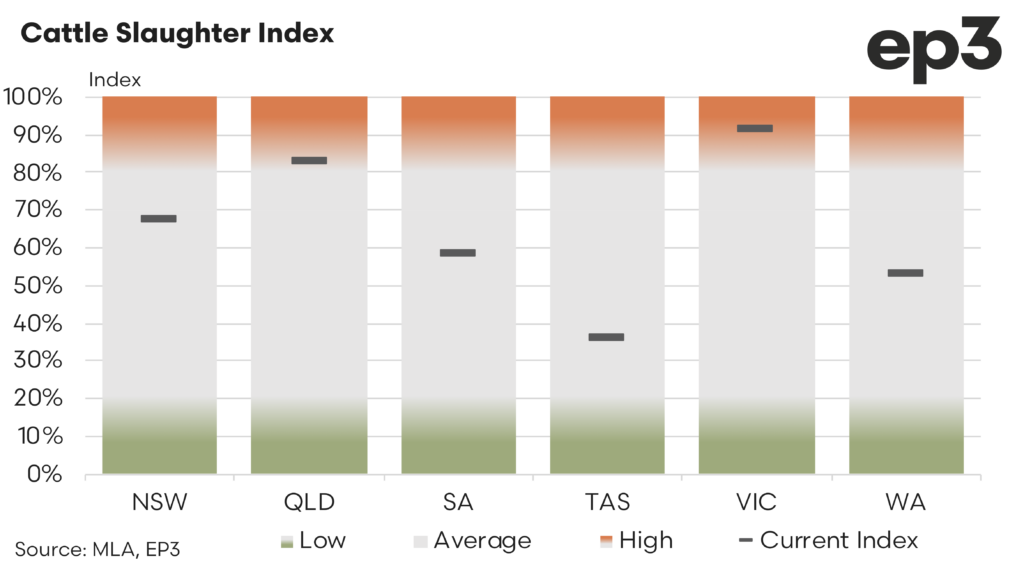

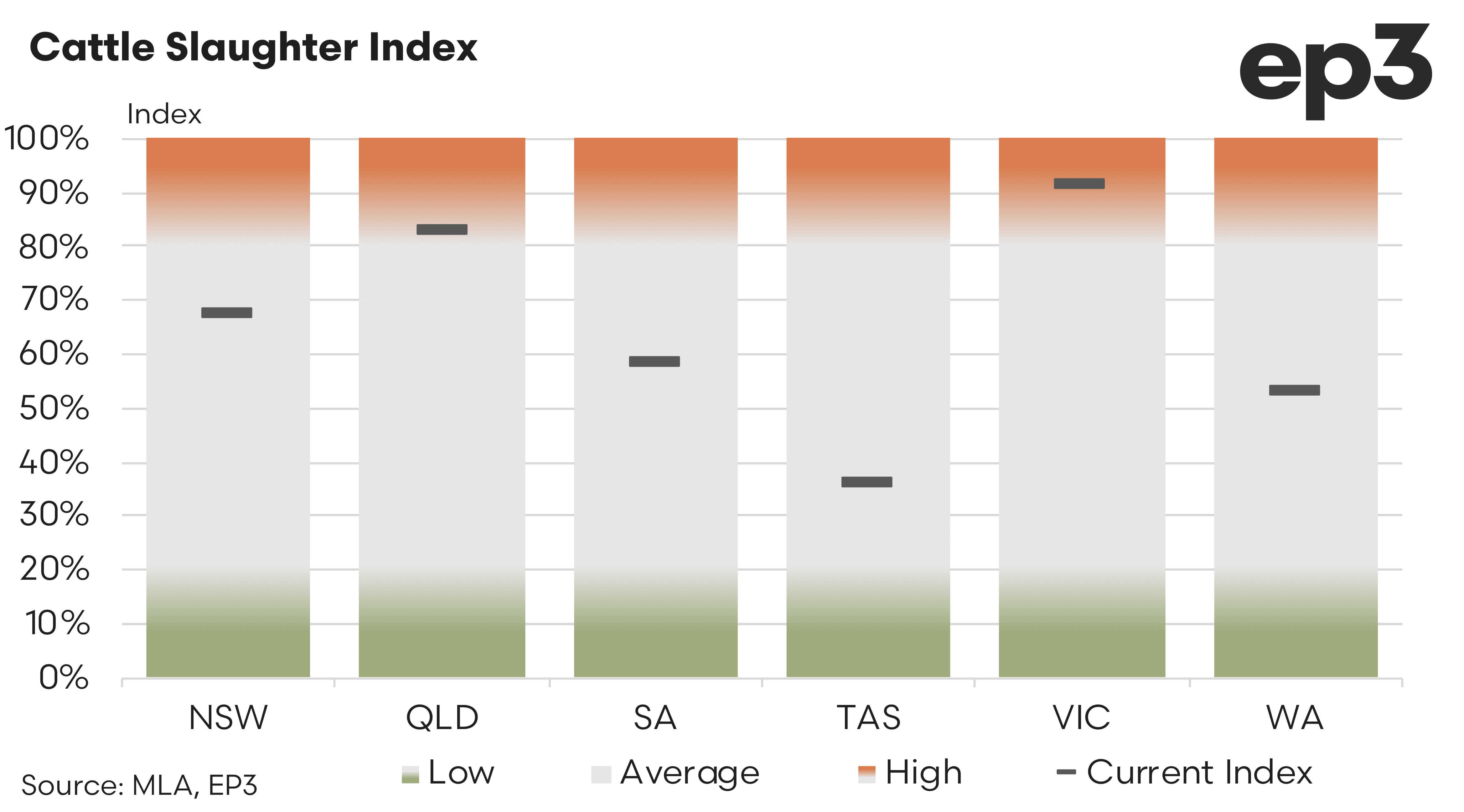

An assessment of the cattle slaughter index across the nation demonstrates the strong performance of Victorian and Queensland based beef processing facilities. The weekly Victorian cattle slaughter index score averaged 91% during October demonstrating that current cattle processing volumes in Victoria are running at levels that are 91% higher than previous weekly records going as far back at 2007. Beef plants in Queensland are seeing similar strong results with the average weekly cattle slaughter index sitting at 83% during October. It is probably important to note that a short operating week in Queensland in early October weighed down their slaughter index score which would have sat closer to 96% had the sector been in full swing throughout the month.

New South Wales beef processing levels also suffered from a shorter operating week in early October dragging on their average cattle slaughter index over the month, taking the score down from 83% to 67%. Remaining mainland states of South and Western Australia not as productive as the eastern seaboard meat works with cattle slaughter index scores of 58% and 53%, respectively during October.

Tasmanian beef processors demonstrating the most available capacity with an average weekly slaughter index score of just 36% during October, indicating that current processing volumes are sitting lower than 64% of all historic weekly records extending back to 2007.

The stability of slaughter grids this week underscores the sustained high throughput and ample spring cattle supplies, with no significant changes in pricing noted across major Queensland slaughter grids and only minor adjustments in some southern states. Processor capacity seems well managed, with sufficient stock covered until mid-November. However, recent rains in Queensland have caused minor scheduling adjustments without severely disrupting operations. Pricing for forward contracts on grain-fed cattle for the early part of next year has shown slight decreases, reflecting the dynamic pricing adjustments based on current supply conditions.

In terms of Meat & Livestock Australia reported pricing during October the national heavy steer indicator has been trending mostly sideways, reflecting the relative stability in grid pricing. As at early November the national heavy steer sat at 328 cents/kg liveweight, just 3 cents higher than it was in early October.

Filtering the price data for northern and southern markets underscores the change in supply seen during October with increased cattle availability in the south putting some pressure on Victorian heavy steer pricing. In early November the Victorian heavy steer sat at 340 cents/kg live weight, 15 cents softer than where is began in early October. In contrast the Queensland heavy steer saw a mild lift over October of nearly 8 cents to sit at 320 cents/kg live weight as at early November.

Reduced processing activity in Tasmania having a noticeable impact upon finished cattle pricing over October with the Tasmanian heavy steer sliding by 36 cents during the month to finish at 301 cents/kg as at early November.