The Korean won

The Snapshot

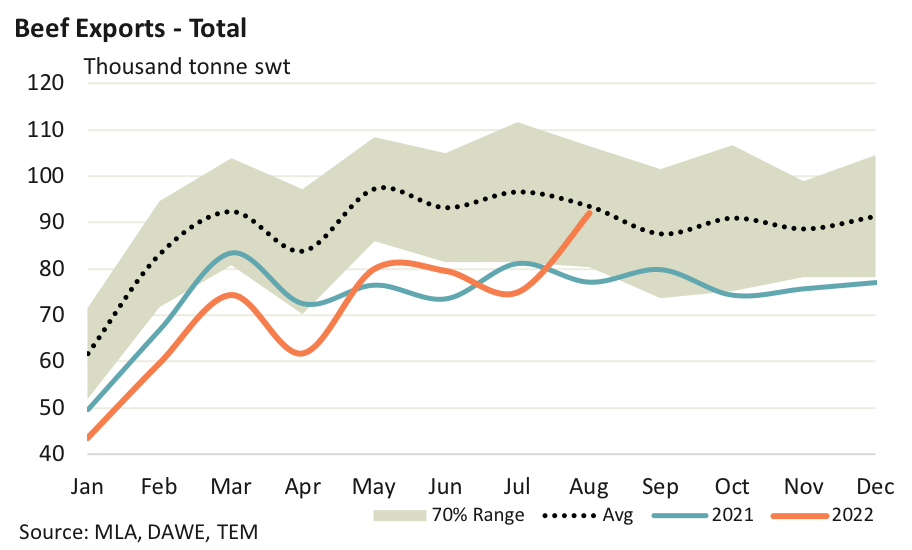

- Total Australian beef exports lifted nearly 23% over August.

- Current total beef trade volumes for August sit just 1.5% under the August five-year average.

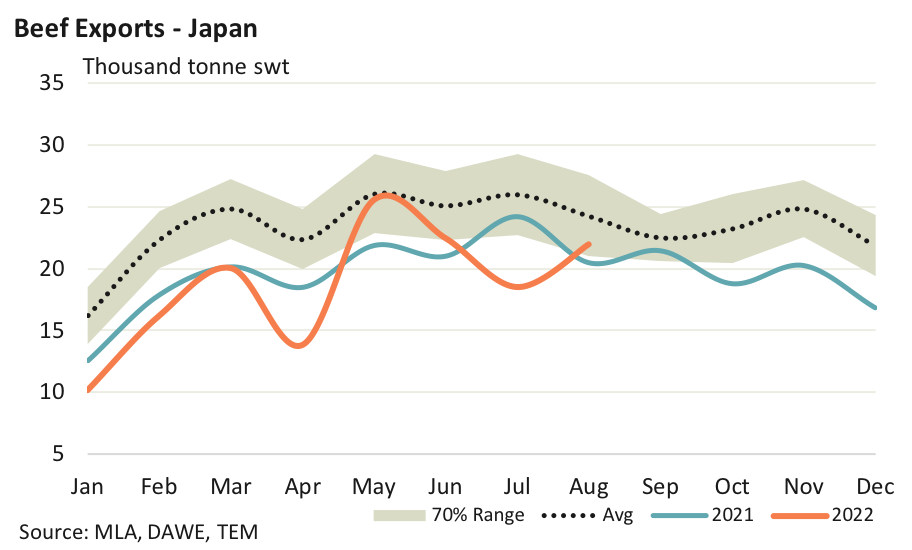

- Japan managed a 19% gain in beef export volumes over August but compared to the five-year August average current levels are sitting 9% under trend.

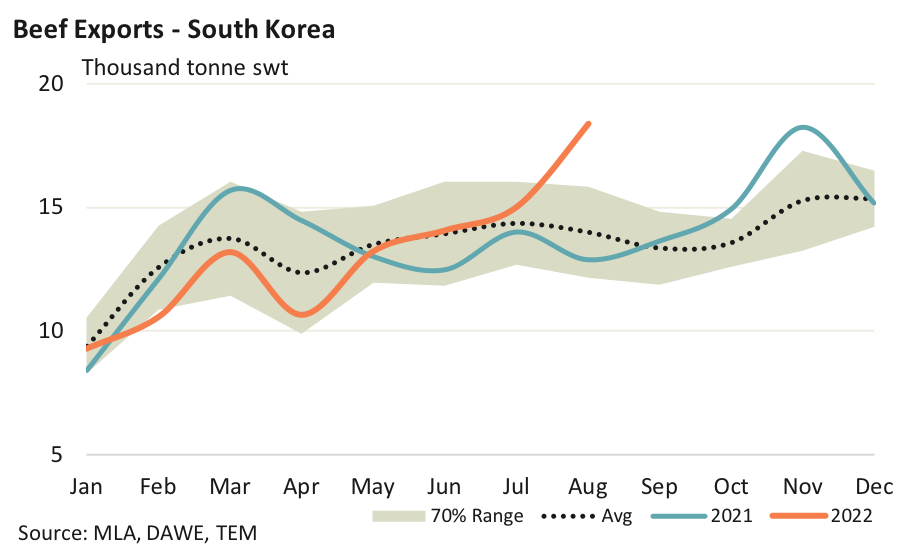

- South Korean beef trade volumes from Australia lifted 22% over the month to sit 32% above the August average level.

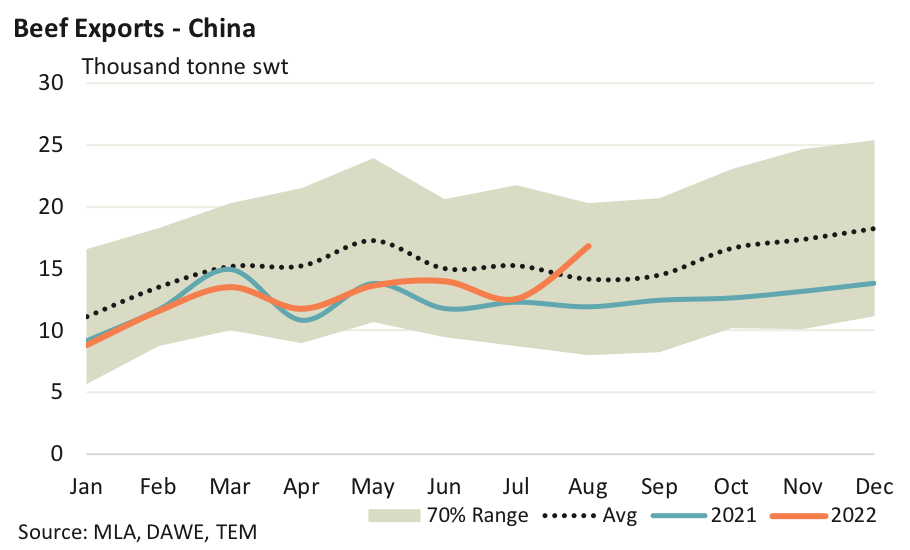

- China managed to post a 34% gain during August. Current beef trade volumes to China represent levels that are 19% above the August five-year average pattern.

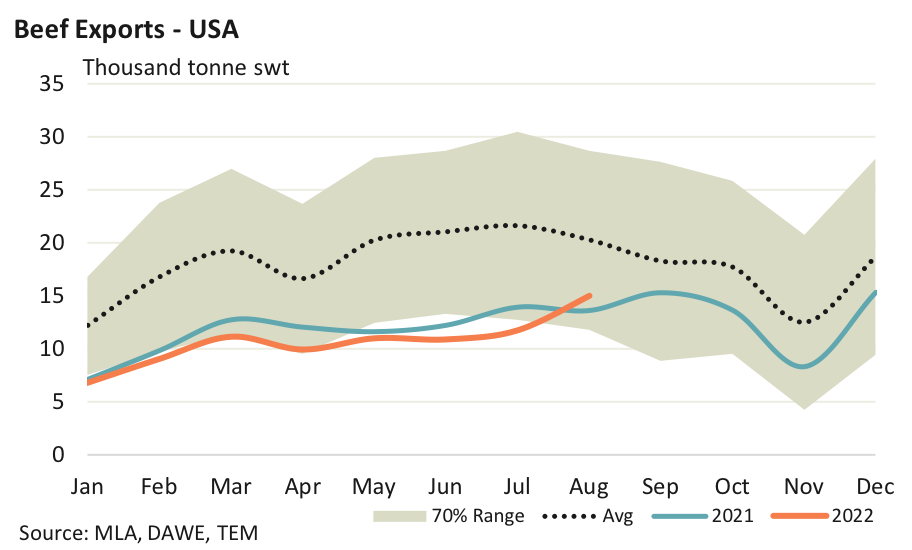

- The USA are starting to show signs of life too with August beef export volumes from Australia lifting 28% over the month.

Total Australian beef exports lifted nearly 23% over August as tariff adjustments and trade quotas worked in our favour. There was 92,019 tonnes swt of beef exported over the month and the first time since the middle of 2020 that monthly beef trade volumes have been anywhere near the monthly average pattern, according to the five-year trend.

Current beef trade volumes for August sit just 1.5% under the August five-year average. So far this year (from Jan to July) beef export volumes have been running 22% under the five-year pattern, so the lift in August is a good recovery.

Japan managed a 19% gain in beef export volumes over August to see 20,007 tonnes consigned. Compared to the five-year August average current levels are sitting 9% under trend.

South Korean beef trade volumes from Australia lifted 22% over the month. Concerns about food inflation in South Korea saw the government suspend tariffs on a range of imported food products including beef and the result of cheaper imported beef has seen the Korean consumer go on a bit of an Aussie beef binge. August saw 18,386 tonnes of Aussie beef shipped to South Korea, which is the second highest month on record. You would have to go back to November 2016 to see a higher monthly flow, when the Aussie beef export level to South Korea hit 19,797 tonnes.

A comparison of current beef trade volumes to average seasonal levels has Korean consumers as the big winners with their beef flows from Australia sitting 32% above the average pattern for August, according to the last five years of trade data.

China managed to post a good lift in August with beef trade volumes from Australia gaining 34% to sit at 16,803 tonnes swt. Current beef trade volumes to China represent levels that are 19% above the August five-year average pattern.

The USA are starting to show signs of life too with August beef export volumes from Australia lifting 28% over the month to 15,036 tonnes. There had been large volumes of Brazilian beef entering the US market in 2022 after they regained access for fresh beef product in February 2022, but by the middle of the year they maxed out their beef quota. Now that they are outside the quota for the rest of the season Brazilian beef into the USA will attract a 26.4% tariff so this will likely increase the competitiveness of Aussie and Kiwi beef exports again.