The need for feed

The Snapshot

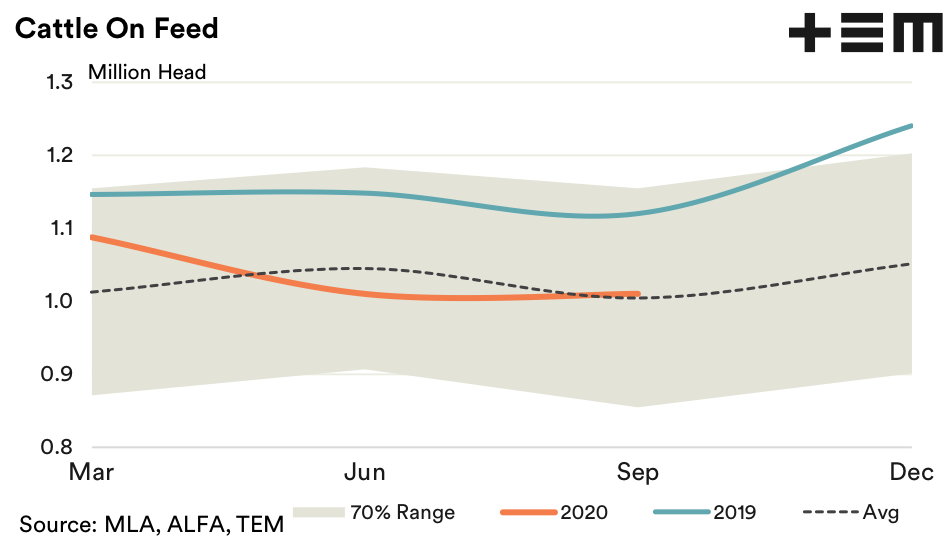

- Cattle on feed numbers have returned to more average levels with the current quarterly levels running just 1.5% ahead of the five-year seasonal trend.

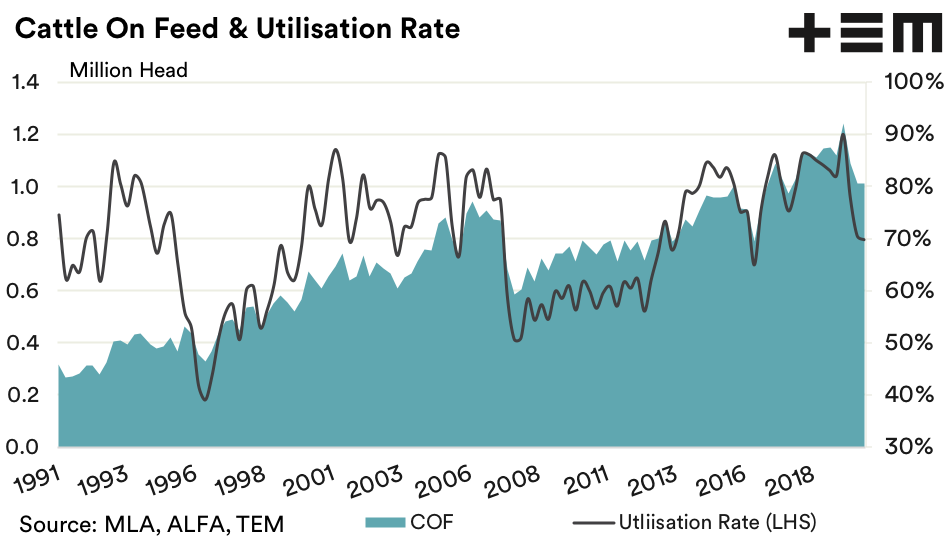

- Reduced cattle on feed numbers have seen the capacity utilisation rates drop from a 90% peak last year to stabilise at 70% over the last two quarters.

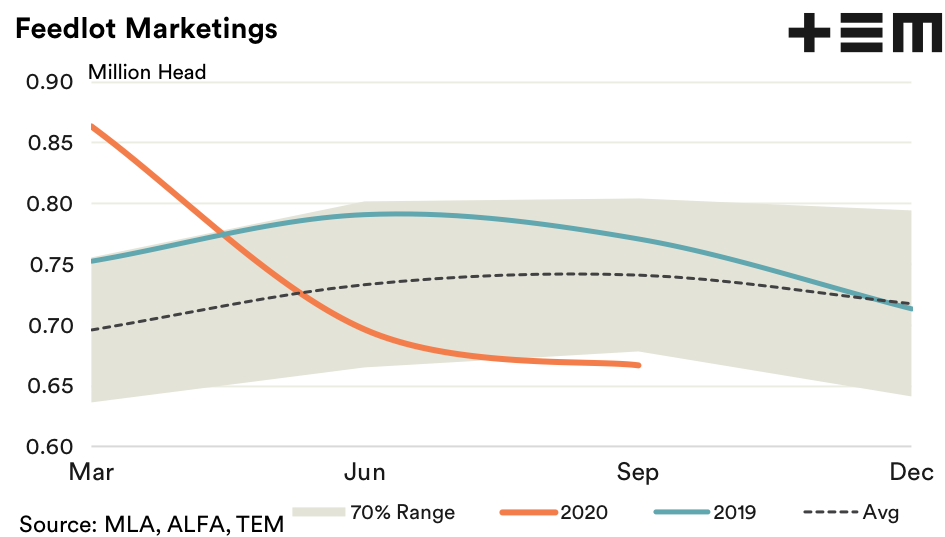

- Average quarterly feedlot marketings are trekking just 2.5% ahead of the five-year trend, but are 3.8% under the levels seen in 2019.

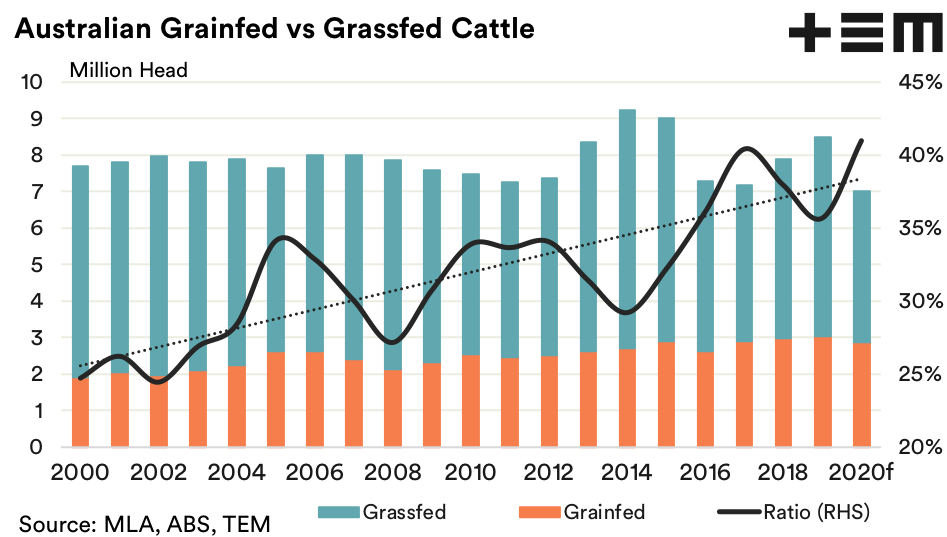

- Despite the lower grain fed turnoff this season, the lowest annual slaughter levels since 1996 mean that the ratio of grain fed to grass fed turnoff is expected to hit a record 41% at the end of the 2020 season.

The Detail

The 2020 September quarter feedlot survey shows that cattle on feed numbers have stabilised at 1,010,320 head, virtually unchanged from the June quarter figures. Although, compared to last season cattle on feed levels are running 9.7% below the September 2019 volumes. The dry conditions pushed record numbers into finishing in the feedlot sector during last year with average quarterly volumes trending 13% ahead of the five-year average pattern and sitting at the upper end of the normal seasonal range for the entire year.

The 2020 pattern has seen cattle on feed numbers come back to more average levels, with the average quarterly cattle on feed numbers just 1.5% ahead of the five-year average seasonal pattern.

Cattle on feed numbers peaked at 1,239,563 during the final quarter of 2019 with the capacity utilisation rate hitting a record 90%. The current cattle on feed volumes represent an 18.5% drop from the December 2019 peak and utilisation has fallen to a rate of 70%.

Feedlot marketings have stabilised at 666,822 head for September 2002, just a 4.2% easing from the June 2020 levels and significantly less than the 19.3% drop seen during the March to June quarters. Marketings are trending at the lower end of the normal seasonal range, but the very strong marketing levels in the March quarter means that average quarterly marketings for 2020 are running just 2.5% ahead of the five year pattern.

A comparison to last season shows that average quarterly marketing levels are running 3.8% under the levels achieved during the first three quarters of the 2019 season.

The trend in lower feedlot turnoff during 2020 is mirrored in lower overall cattle turnoff with combined grass fed and grain fed slaughter expected to come in at 7 million head by the end of the year. Despite the reduced cattle on feed numbers the lowest annual slaughter figures since 1996 mean that the proportion of grain fed to grass fed turnoff is forecast to hit the highest this ratio has been at 41%.

In the last two decades the proportion of grain fed to grass fed turnoff on an annual basis has grown from 25% to more than 40%. Underpinning the growth in the feedlot sector has been the desire to secure more control over the beef supply chain and more effectively manage cattle finishing around climate disruptions such as drought. The likelihood of increased climate volatility in future years is expected to continue to see the ratio of grain fed to grass fed turnoff continue to grow.

Furthermore, the increase in offshore demand for high-value branded grain fed beef, particularly from China in the last decade, has meant that beef finishing systems have favoured a move to more feedlot operations. This is a trend unlikely to diminish in the coming decades.