The triple threat

The Snapshot

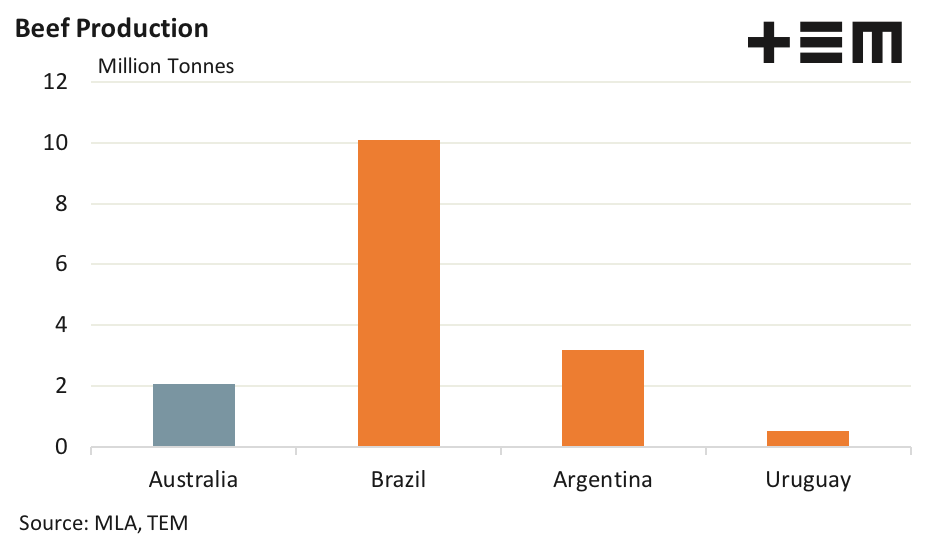

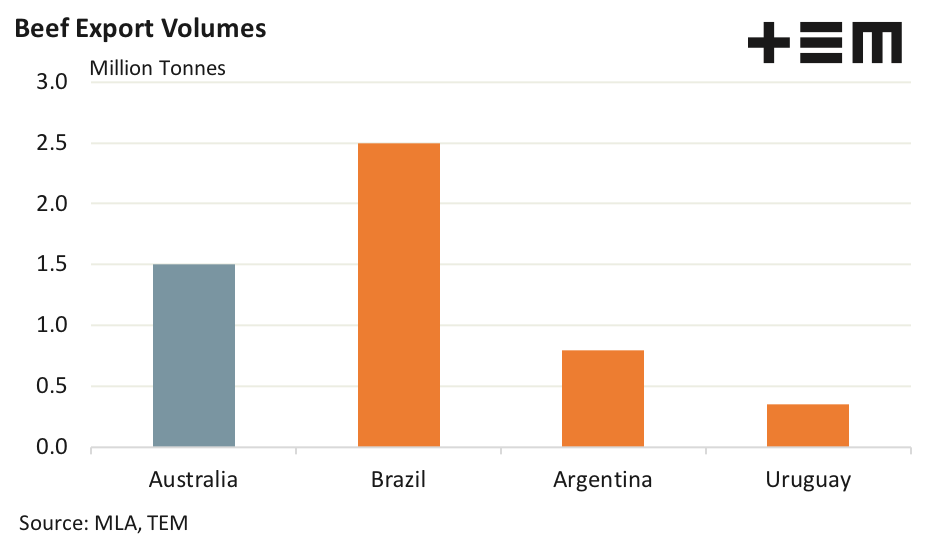

- Brazil produces around five times the volume of beef than Australia and exports about 65% more.

- Argentina produces about 50% more beef than Australia, but only exports half of the volume that Australia sends offshore.

- Uruguay produces of around 25% of the beef production volumes that Australia contributes annually and exports about 50% of the Australian beef export volumes.

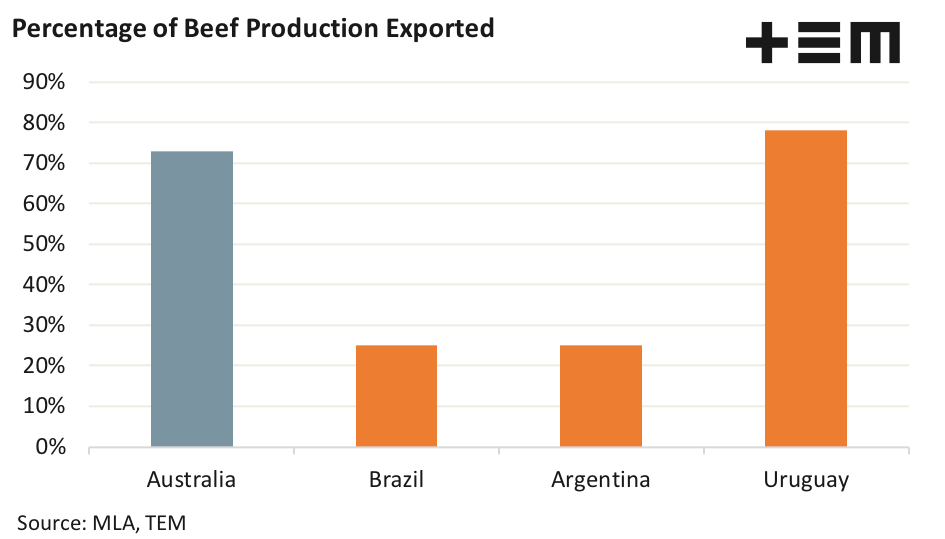

- Australia and Uruguay are heavily export orientated at 73% and 78% of production exported, respectively. Argentina and Brazil export just 25% of the beef they produce.

The Detail

Beef export flows from Argentina and Brazil have been in the news recently and for differing reasons they may have provided an opportunity for Australia to hit the reset button with regard to our beef trade with China. In the Argentinian case, beef exports continue to face export restrictions as the government attempts to control food inflation. Brazil, on the other hand, has temporarily suspended their beef exports to China due to two cases of bovine spongiform encephalopathy (BSE) – commonly known as “mad cow disease”.

The emerging threat of South American beef exports has been an issue that many within the Australian beef industry have kept an eye on in recent years, so the Episode3 team decided to provide some comparative analysis between Australia and the three main South American beef exporters; Brazil, Argentina and Uruguay.

Brazil is one of the powerhouses of the global beef industry with production levels second to the USA at over 10 million tonnes cwt per annum and topping the global beef export volumes at around 2.5 million tonnes cwt. Their beef production levels dwarf Australia, which sit around 2 million tonnes cwt per annum. However, unlike Australia, Brazil have a huge population to feed at nearly 245 million head so much of their beef production gets consumed at home.

Argentina produces about 50% more beef than Australia, at around 3.2 million tonnes per annum, but due to their larger population (nearly 55 million head) and high proportion of domestic beef consumption only export about half of the volume that Australia sends offshore at around 0.8 million tonnes cwt.

In production terms, Uruguay is very much the minnow of the South American beef producers with annual production of around 25% of what Australia produce. Although with a much smaller population, of just 3.5 million citizens, have a significant beef export focus.

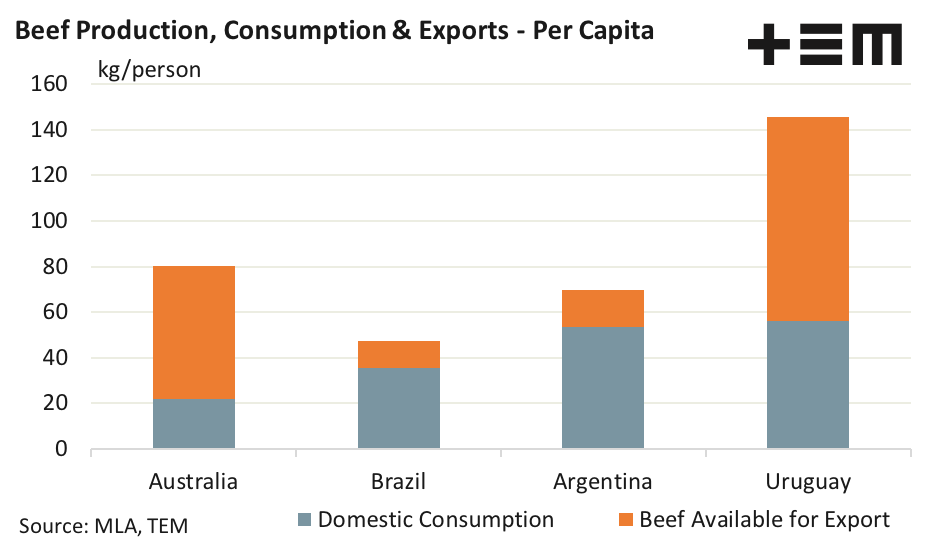

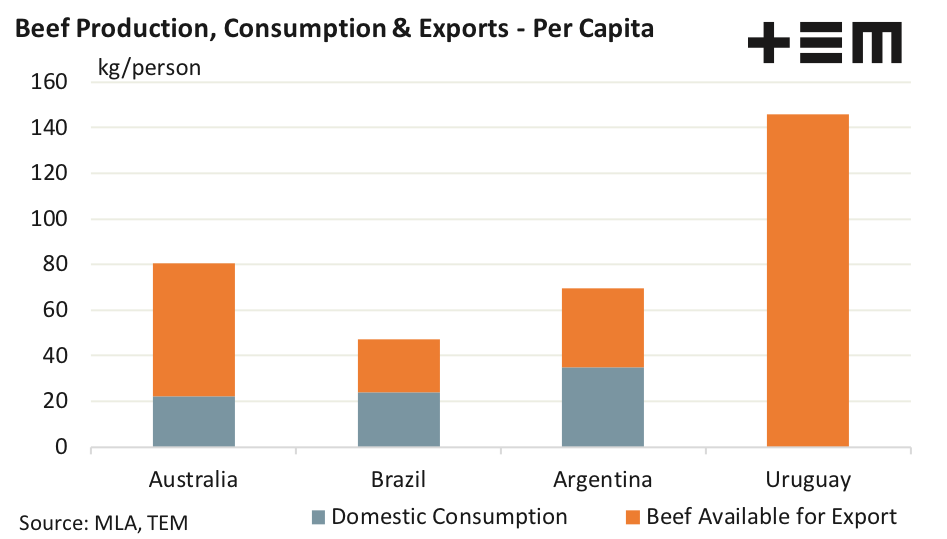

Looking at beef production, domestic consumption and beef exports on a per capita basis we can see the proportional distribution between export and domestic beef use in each country. Australia produces about 80kg of beef per person each year, but the domestic consumer only takes about 22 kg per person which leaves about 58kg per person available for export.

The three amigos all have very high domestic beef consumption on a per capita basis; Brazil at 35 kg, Argentina at 53 kg and Uruguay at 56kg per person. High domestic beef consumption levels in Brazil and Argentina, combined with their larger populations, means there is only 12 kg in Brazil and 16 kg per person in Argentina available for export.

In contrast, the much smaller population in Uruguay means that they have a whopping 146 kg per person beef production available each year to distribute. Even accounting for the very high Uruguayan appetite for beef this leaves nearly 90kg per person available for export.

Beef export volumes as a proportion of production highlights the different focus of each nation with Australia and Uruguay being heavily export orientated at 73% and 78%, respectively. Argentina and Brazil export just 25% of the beef they produce.

An interesting hypothetical analysis is the capacity for the three South American players to double their export volumes. Brazil and Argentina have the beef production capacity to double their exports but the population in each country would need to eat less beef per person each year.

Theoretically, Brazil could expand their annual beef export volumes to 5 million tonnes cwt and still have about 23 kg of beef available per person for domestic consumption each year. A level that almost mirrors Australia’s current per capita beef consumption levels. Meanwhile, Argentina could lift their export volumes to match Australia’s, at around 1.5 million tonnes cwt per year and still have about 35kg of beef per capita available for their domestic consumption needs.

Uruguay is not as fortunate. They don’t produce enough beef domestically to be able to double their export volumes. Currently Uruguay produce about 500 tonnes each year and export about 0.35 million tonnes cwt. A doubling of their export volumes would mean that no beef could be consumed domestically – a recipe for anarchy in my view.

Argentina and Uruguay have a cattle herd that reflects the Australian proportions with about 7-8% of the herd as dairy cattle and the balance as beef cattle, predominantly Bos Taurus European breeds. In contrast, Brazil has a much higher dairy proportion in their cattle herd at about 43% and they favour the Bos Indicus breeds. The different breed/cattle type mix means that for Brazil we often target different market segments within a country and often focus our attention on entirely different export destinations when it comes to our key markets for beef exports.

In terms of Australia’s key export markets of Japan, South Korea, China and the USA it is really only the China that is targeted heavily by Brazil and Argentina. Meanwhile Uruguay lists China and the USA as their top export destinations.

Given the small size of the Uruguayan beef footprint they are unlikely to be a huge threat to the Australian beef export sector. Argentina could be a threat in some markets if they reconsidered their export focus and removed their current restrictive regime on beef exports, but this seems unlikely at least in the short to medium term. Brazil remain a credible threat in markets where commodity beef is dominant, like Indonesia, the Phillipines, Malaysia and the Middle Eastern North African region but are unlikely to trouble us in our key premium beef markets.

The biggest benefit that may evolve out of Argentina’s and Brazil’s current beef export woes is that it could encourage Chinese officials to reconsider their approach to the Australian beef export trade to allow the Chinese consumer increased access to the safe, traceable, reliable, premium beef supply that Australia is renowned for.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.