Tight spring for sheep meat processing

Market Morsel

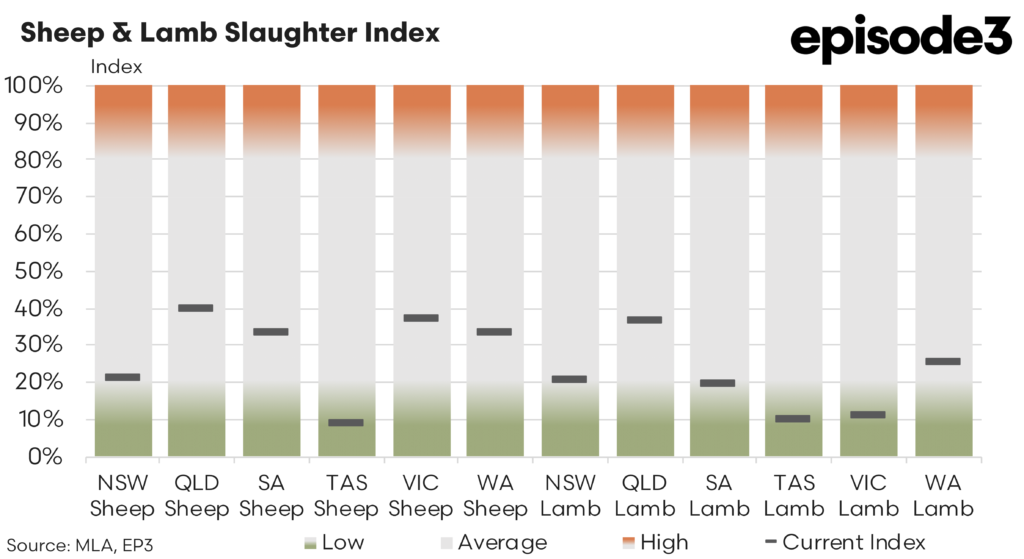

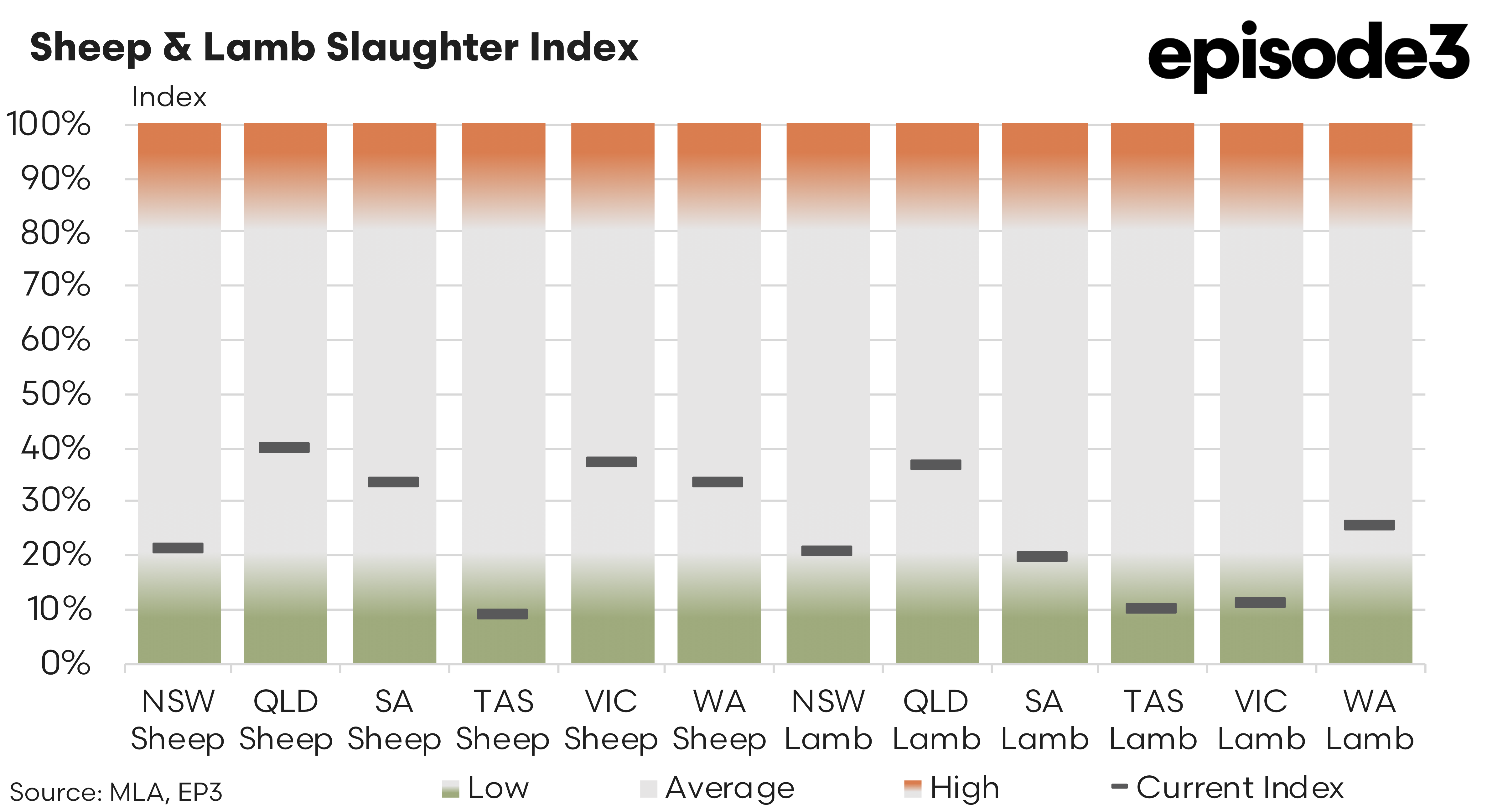

As spring progresses across the Australian sheep and lamb industry, the much-anticipated seasonal lift in slaughter volumes remains sporadic and inconsistent. The latest slaughter index data for September 2025 reveals that while some regions have recorded meaningful increases in processing activity, others continue to struggle with tight supply and low throughput.

This uneven performance is mirrored in the pricing data, with strong demand across both domestic and export markets supporting elevated lamb and mutton indicators, even as availability continues to limit processor capacity.

In the sheep market, changes in slaughter activity varied widely across states. New South Wales saw a marginal decline, slipping from 22 percent in August to 21 percent in September. Queensland recorded a solid lift from 32 percent to 40 percent, reflecting improved availability in northern saleyards. However, South Australia fell from 39 percent to 33 percent, a six-point drop that reflects ongoing supply challenges and producer reluctance to sell.

Tasmania experienced the largest decline in sheep slaughter activity, falling from 19 percent in August to just 9 percent in September. By contrast, Victoria recorded a notable improvement, lifting from 29 percent to 37 percent, an eight-point gain that signals the beginning of more meaningful turnoff in the state’s west. Western Australia also posted a strong recovery in sheep slaughter, rising from 21 percent to 34 percent, likely in response to both seasonal conditions and continued structural shifts in the WA flock as the live export phase-out unfolds.

In the lamb market, the picture is still tight in key processing states, though still far from uniform. Queensland led the recovery with a 15-point lift in slaughter activity, up from 22 percent in August to 37 percent in September. This strong movement suggests processors are having more success accessing finished lambs. South Australia also rose from 12 percent to 19 percent, a seven-point gain that suggests lamb supply is beginning to build. Western Australia lifted from 13 percent to 25 percent, indicating increased availability of either late-season old lambs or the first drafts of new season stock.

Tasmania rose modestly from 7 percent to 10 percent, while Victoria declined marginally from 12 percent to 11 percent. Victoria’s persistently low lamb slaughter index, despite the state being a major lamb-producing region, confirms that the spring flush is delayed. New South Wales recorded a six-point drop, from 26 percent in August to 20 percent in September, further reinforcing the limited lamb availability even as seasonal conditions improve.

These supply constraints continue to support healthy national price indicators. The Trade Lamb Indicator is currently at 1,140 cents per kilogram carcase weight, down 34 cents over the past four weeks. Despite the small decline, prices remain firm by historical standards. Heavy Lambs are averaging 1,104 cents, having eased by 72 cents across the month. Tight supply of finished lambs continues to underpin this category.

The Light Lamb Indicator sits at 1,050 cents, up 10 cents over the past four weeks, reflecting continued processor and restocker competition for lighter stock as the seasonal outlook improves. Merino Lambs are priced at 1,012 cents, down 25 cents for the month. While largely stable, limited availability has kept prices supported. Restocker Lambs are trading at 1,113 cents, dropping 28 cents over the past four weeks. This category remains one of the strongest performer in terms of price movement this past month, somewhat unsurprising given the robust 3-month rainfall outlook from the BOM. The Mutton Indicator is at 766 cents, up 10 cents over four weeks. Mutton continues to provide a critical buffer in processor workflows as lamb supply remains constrained.

Slaughter activity across Australia remains uneven, with clear regional disparities between those states experiencing the early stages of a spring flush and those still lagging behind. Lamb volumes remain constrained in key states like Victoria and New South Wales, while sheep slaughter appears to be picking up in parts of WA and Victoria.

Sheep meat processors remain in a holding pattern, chasing volume where they can find it, leaning on mutton to keep chains moving, and waiting for the broader southern seasonal flush that, for now, remains frustratingly out of reach.