Tightening Supply Supports Prices

Market Morsel

As winter arrives, the Australian sheep and lamb market is entering a period of seasonal tightening, clearly reflected in the recent saleyard yarding index scores and accompanying price movements. The combination of reduced yardings and firm to sharply higher prices across most categories points to a market responding to lower supply availability, as is typical for this time of year.

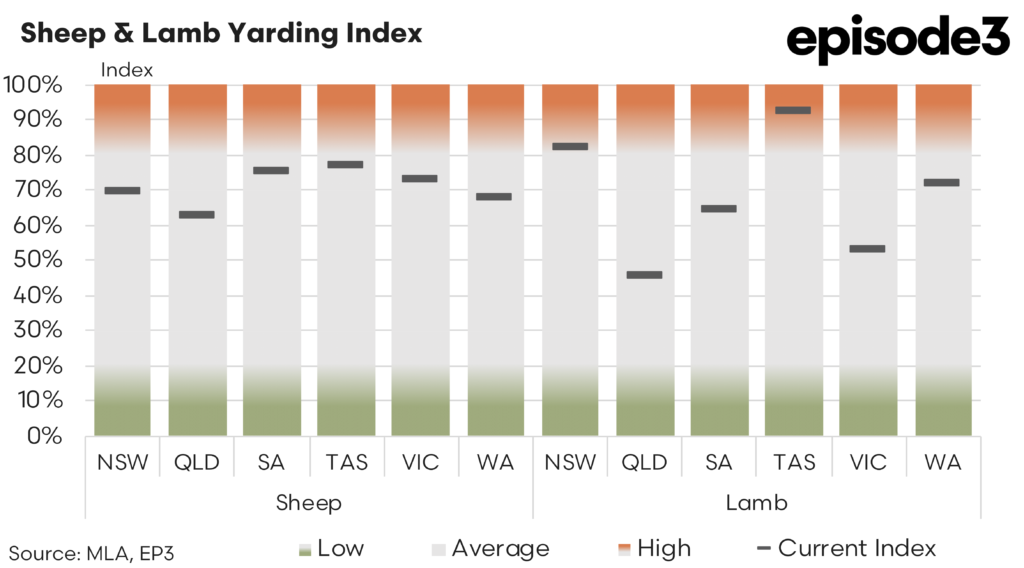

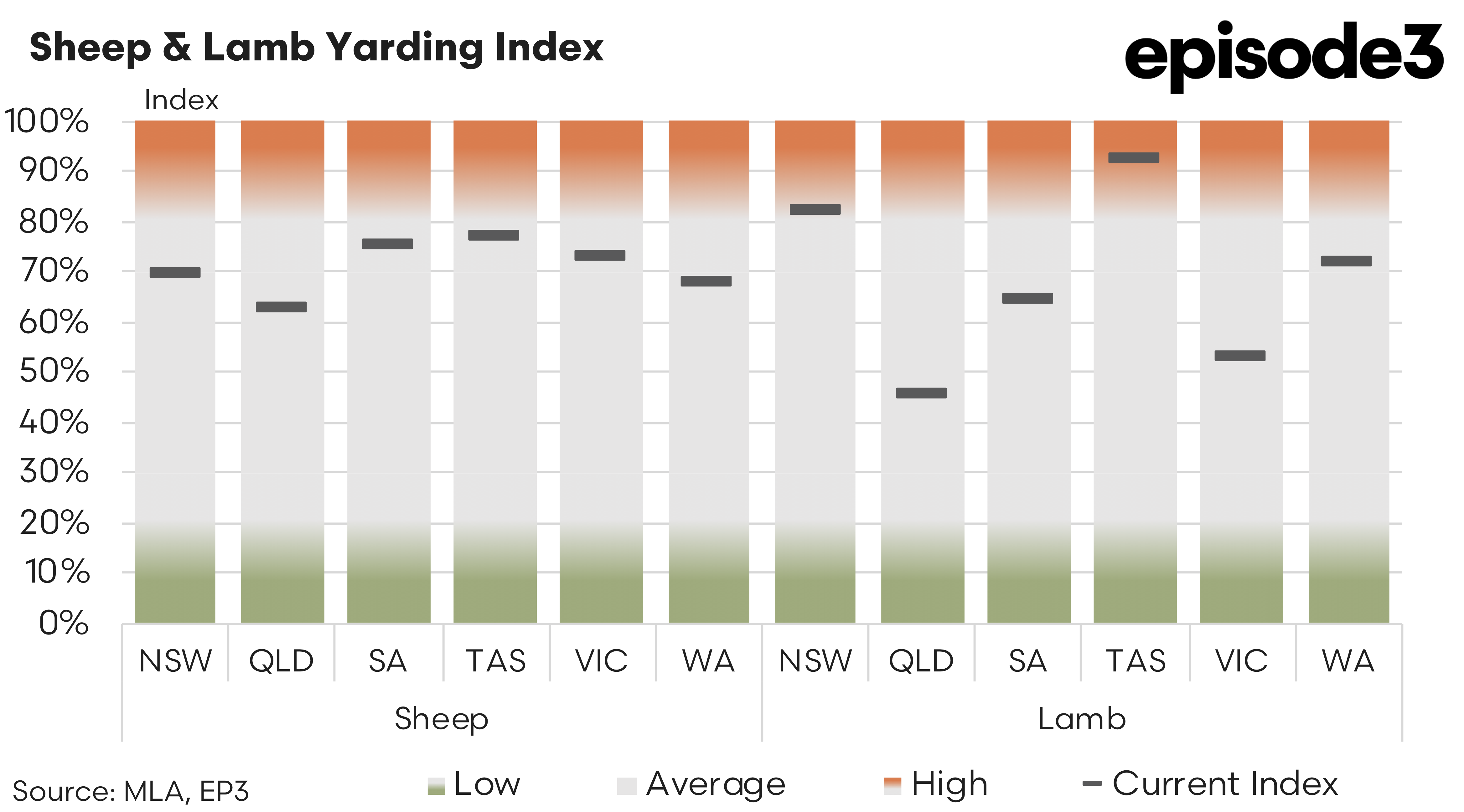

The saleyard yarding index scores, which can be viewed similarly to a decile-based rainfall gauge, offer a useful relative measure of throughput compared to historical norms. An index score of 50% would reflect average yardings for the time of year, while higher or lower percentages reflect yardings above or below those longer-term levels. This structure allows for an easy visualisation of how supply is tracking seasonally, regardless of absolute volumes.

For the first fortnight of June, sheep yardings have shown a general contraction across most states compared to May. In New South Wales, the sheep index eased from 89% in May to 70% in June. Queensland similarly recorded a decline from 84% to 63%, while South Australia posted a marginal lift from 72% to 75%, indicating relatively steady throughput. Tasmania saw a small reduction from 82% to 77%. Victoria, after softer numbers in May, actually recorded a mild increase from 67% to 73%, while Western Australia saw one of the larger moves, falling from 93% to 68%. Collectively, these shifts reflect the onset of winter and declining turn-off as flock rebuild intentions continue to work through the system and seasonal lambing programs start to dominate flock management decisions.

Lamb yardings followed a broadly similar trend, though with more variability between states. New South Wales lamb yardings slipped from 89% to 82%, while Queensland saw a sharp tightening from 75% to just 46%, indicating a notable reduction in lamb numbers moving through the saleyards. South Australia softened from 75% to 65%, and Western Australia edged lower from 76% to 72%. Victoria remained largely steady, rising slightly from 51% to 53%. The standout exception was Tasmania, where lamb yardings surged from 53% in May to 93% in June, likely reflecting timing differences in southern lamb programs, or delayed sales coming to market as winter feed availability and market conditions align.

This broader tightening of supply has been met with price resilience and, in many cases, further upward movement across the MLA’s sheep and lamb indicators over recent weeks. The pricing data for the second week of June shows strong support across nearly all categories over the past month.

The Heavy Lamb Indicator currently sits at 1,044c/kg carcase weight, up 62c/kg over the past four weeks. This equates to an increase of around 22% in just one month, reflecting robust processor demand, tighter finished lamb supplies, and resilient processor activity as winter procurement becomes increasingly competitive. Similarly, the Trade Lamb Indicator has climbed 77c/kg over the same period, now sitting at 1,016c/kg cwt, supported by similar supply-side tightening and steady domestic and export demand.

The Light Lamb Indicator has also strengthened, gaining 59c/kg over the past month to reach 884c/kg cwt, while the Restocker Lamb Indicator has increased by 67c/kg to 856c/kg cwt. These gains reflect a strong appetite from both restockers looking for young lambs to background and finish into spring, as well as processors competing for lighter weights as finished lamb supplies become less abundant.

Merino lambs have similarly firmed, with the Merino Lamb Indicator lifting 29c/kg over the past four weeks to sit at 805c/kg cwt. Although this category typically lags the crossbred indicators slightly, the solid price movement suggests that the merino portion of the lamb market is also benefitting from the broad seasonal tightening.

In the mutton market, prices have followed suit, though at a slightly more moderate pace. The Mutton Indicator has lifted by 53c/kg over the past month, now sitting at 646c/kg cwt. This reflects continued processor demand for ewes and sheep meat as lamb supplies become tighter, though volumes remain adequate relative to the more pronounced tightening seen in lamb categories.

Underlying these price shifts is not just the seasonal decline in saleyard volumes, but also the broader export demand fundamentals that have evolved over the past year. Sheep meat demand, particularly from the United States, Middle East and parts of Asia, remains firm, providing added price support for both lamb and mutton categories.

The winter tightening phase is well underway, with yarding index scores across most regions now displaying a tightening trend from May to mid-June. As winter progresses, the combination of limited supply and competitive processor demand is likely to continue to underpin firm pricing levels. Concerns still exist within the processing sector on their ability to secure adequate supply into August.