Uncertain times

The Snapshot

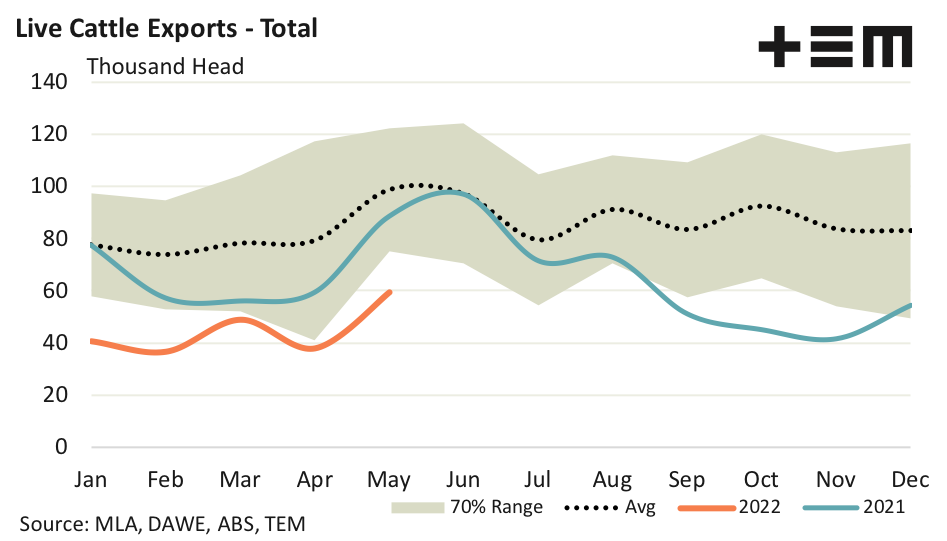

- May 2022 live export cattle volumes are sitting 40% under the five-year average level for May at 59,443 head.

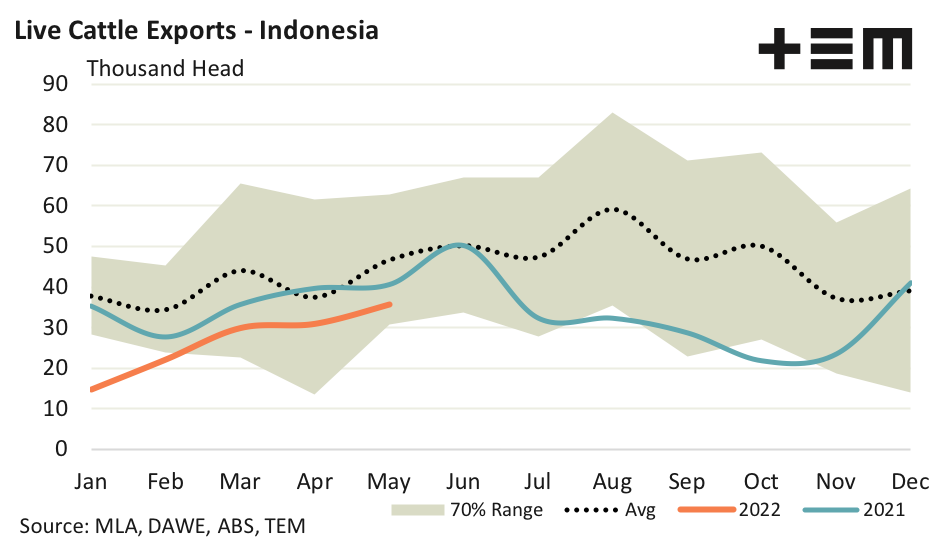

- The export volumes shipped from Australia to Indonesia over May are running nearly 24% below the trend for May, according to the five-year pattern.

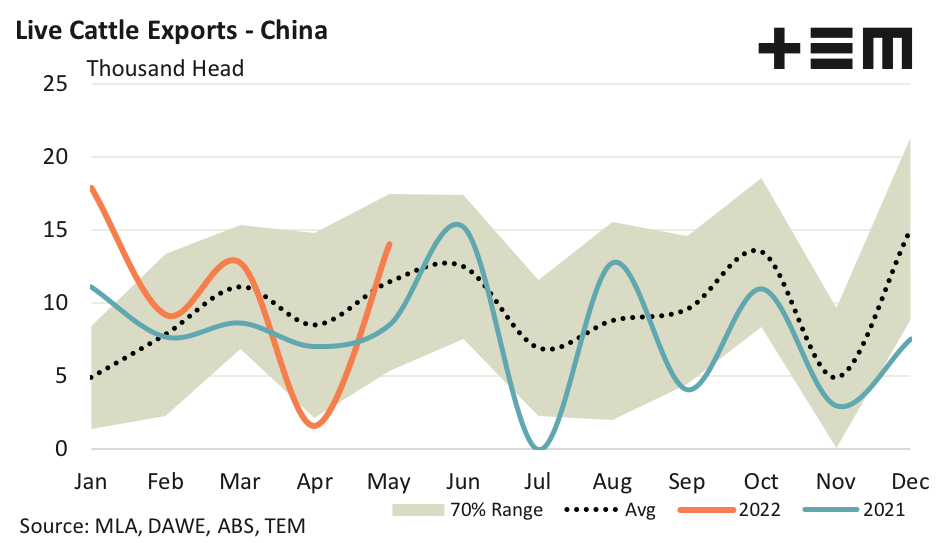

- May 2022 saw 14,024 head of Australian cattle exported to China which represents flows that are nearly 23% above the five-year average levels seen for this month in the year.

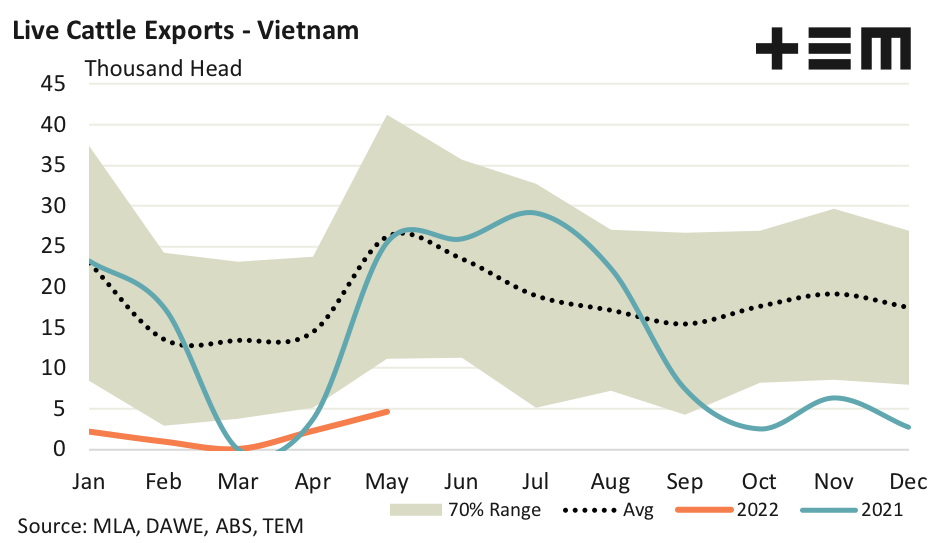

- Meanwhile, May saw just 4,566 head of cattle sent to Vietnam from Australia, which is around 82% under the five-year average.

- There are growing concerns that we will see a sharp decline in the importation of Australian live cattle into Indonesia in the coming months, as Indonesian feedlots will not want to take the risk of buying new cattle to have them exposed to, and infected by FMD and/or LSD.

The Detail

The Department of Agriculture, Water and Environment (DAWE) live cattle export trade flows for May 2022 have shown monthly volumes have hit a peak so far this year at 59,443 head transported. Indeed, this is the highest monthly flows seen since August 2021.

Despite the 57% lift in live cattle exports seen from April to May, the current trade flows are running well below trend and sits under the normal variation in range that could be expected for this time in the year. The shaded 70% range shows where live export flows usually trend over the season during a normal trade environment and the monthly flows for 2022 are yet to move into this normal range. In May 2022 live export cattle volumes are sitting 40% under the five-year average level for May.

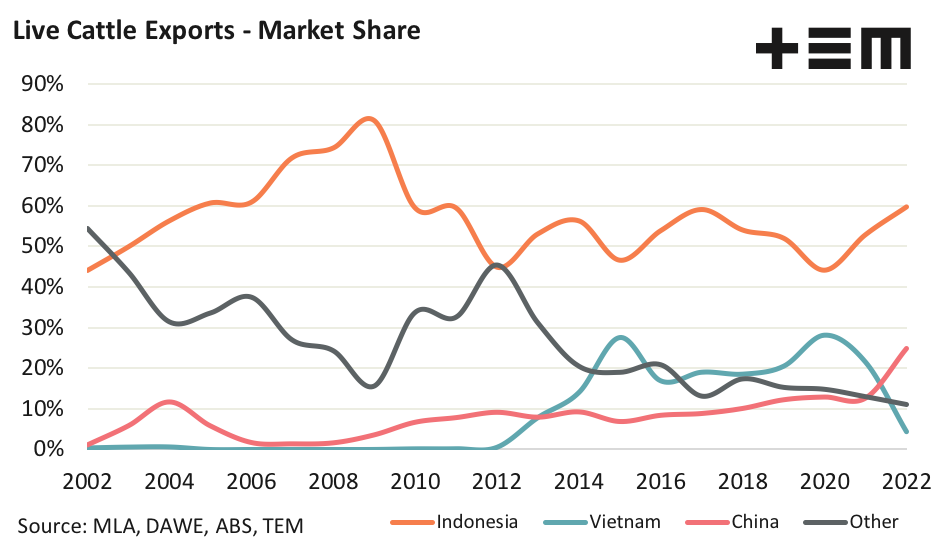

Indonesia continues to take the lion’s share of Australian live cattle exports, holding nearly 60% of the flows so far this year. May 2022 saw numbers increase by 15% on the trade volumes seen during April to hit 35,762 head. The export volumes shipped from Australia to Indonesia over May are running nearly 24% below the average trend for May, according to the five-year pattern.

Recent outbreaks of foot-and-mouth disease (FMD) and lumpy skin disease (LSD) in Indonesia are causing significant concern for Australian cattle (and other livestock) producers. Firstly, there is a huge worry that either/or both of these diseases will penetrate Australia causing an immediate loss of export markets and widespread stock losses.

However, there is also the concern that with these diseases spreading around Indonesia there will be a sharp decline in the importation of Australian live cattle, as Indonesian feedlots will not want to take the risk of buying new cattle to have them exposed to, and infected by FMD and/or LSD. The release of cattle export trade results for June will be eagerly anticipated to see if there is a noticeable drop in Indonesian feedlot demand for Aussie cattle.

Export of live cattle to China saw a strong rebound during May, albeit off of a very low base in April. May 2022 saw 14,024 head of Australian cattle exported to China which represents flows that are nearly 23% above the five-year average levels seen for May.

Unfortunately, the trade of Australian live cattle to Vietnam remains subdued. The second half of 2021 saw Vietnam take a number of cattle export loads from Brazil and this has continued into 2022 somewhat displacing Australian volumes. May 2022 saw just 4,566 head of cattle sent to Vietnam from Australia, which is around 82% under the five-year average trend for May.

Average monthly flows of Australian cattle to Vietnam since the start of 2022 are running nearly 90% below the average trend, according to the five-year seasonal pattern.

The downturn in the trade to Vietnam is very noticeable when comparing market share for key Australian export destinations for live cattle flows. Vietnam’s market share of the trade has dropped from 21.5% in 2021 to just 4.4% this season. However, China has picked up the slack with their market share lifting from 12.5% in 2021 to 24.8% so far in 2022.