US beef herd liquidation

The Snapshot

- The female slaughter ratio (FSR) in the USA has moved to the highest annual average level on record at 52%.

- The last time the US FSR was above 50% was in 1986 when the FSR reached 51.1% and the US herd dropped by 3.8% that season.

- The very strong FSR of 52%, seen so far in 2022, suggests that the herd could drop 3.6% this year.

- A fall of 3.6% this year would place the US herd at 90.2 million head, which would be the lowest it has been since 2013.

The Detail

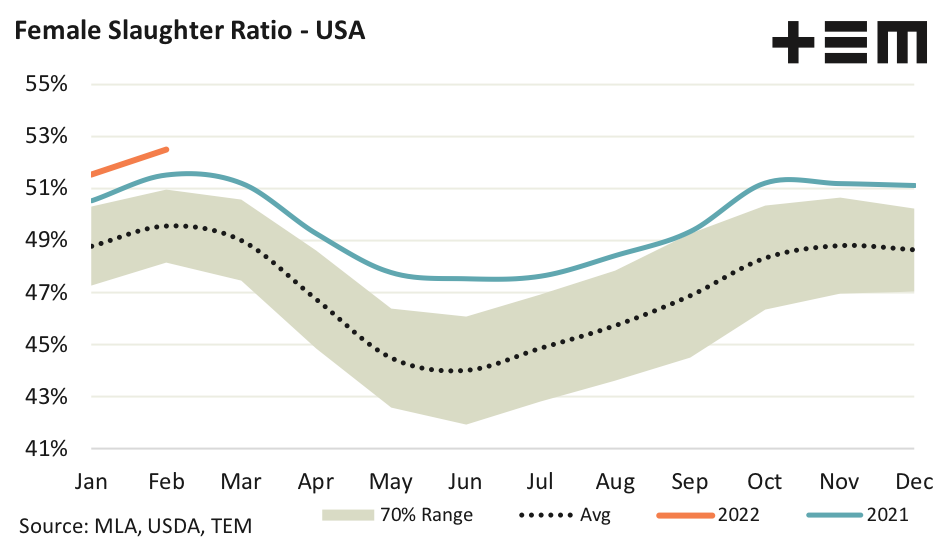

The last time we took a look at the state of the herd liquidation in the USA it was back in the middle of 2021 and their herd was in the midst of a third year of above average female cattle slaughter. Since the start of 2022 the female slaughter ratio (FSR) in the USA has increased even further, moving to the highest annual average level on record at 52% (the US FSR data goes back to 1986).

In 2021 the US FSR averaged 49.7% for the year, which was the highest annual average seen since the late 1990’s when the US herd began an eight year cycle of herd liquidation. This period culminated in the US beef herd dropping from 103.5 million head to 94.4 million head during 1996 to 2004. In 1997 the FSR annual average hit 49.8% and the US herd declined 1.8% that year, then 1998 followed up with an FSR of 49.2% which coincided with a further 1.9% reduction in the US beef herd.

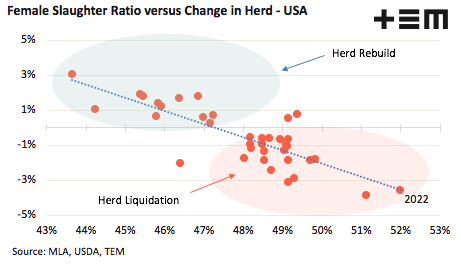

Just like in Australia, an FSR above 47% corresponds to times when the herd goes into liquidation and a similar threshold of 48% seems to apply in the USA. A scatter plot of the USA annual average FSR to the annual herd change highlights how well the FSR predicts US herd decline or rebuild.

The FSR sitting at records levels of 52% in 2022 suggest the decline in the US herd this year could be significant, to the tune of 3.6% according to the line of best fit on the scatter plot. The last time the US FSR was above 50% was in 1986 when the FSR reached 51.1% and the US herd dropped by 3.8% that season.

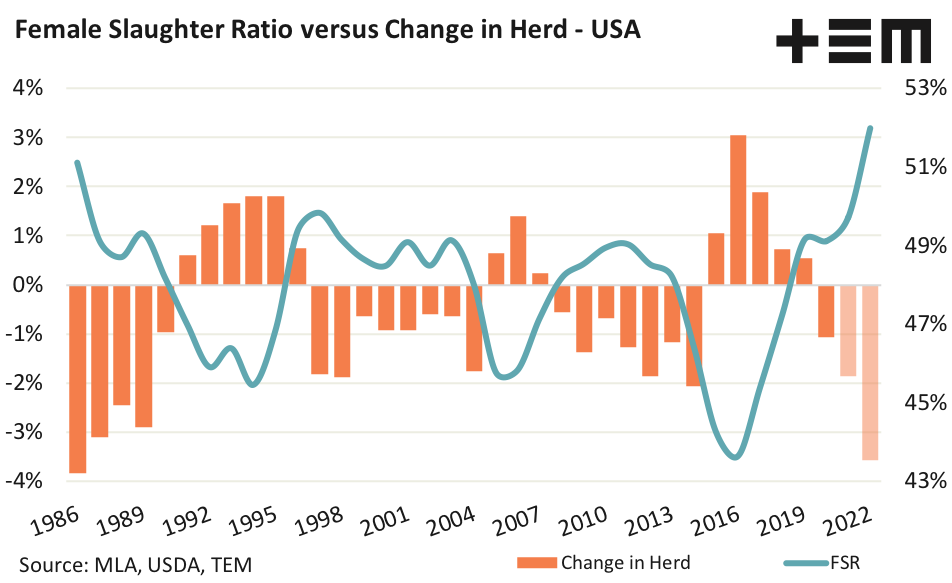

A comparison of the annual US FSR and herd change highlights how good at predicting the likelihood of herd liquidation or rebuild is, when using the 48% threshold as an indicator of herd rebuild/liquidation status. Periods when the FSR is below 48% align with the US herd in rebuild phase, meanwhile an FSR above 48% corresponds to periods of US herd decline.

The very strong FSR of 52%, seen so far in 2022, suggests that the herd could drop 3.6% this year. The USDA are predicting a 1.7% decline to their beef herd this year from 93.6 million head to 92.0 million head. However, an elevated FSR of around 52% and a decline closer to 3.6%, as the very high FSR is suggesting, would place the US herd at 90.2 million head this year which would be the lowest it has been since 2013.

It’s interesting to note that 2013 was the final year of the US herd liquidation cycle for that particular liquidation/rebuild phase. The following five years saw the US herd begin to rebuild and in the early years of the rebuild annual average US cattle prices lifted by more than 20% as producers chased the tight supplies.

The 2014/15 seasons coincided with a significant drought event in Australia and during this time the combination of strong US beef demand and limited US beef supplies saw the USA become Australia’s number one destination for beef exports. It will be interesting to see how the dynamic plays out this time around.