US import surge is mutton on China

The Snapshot

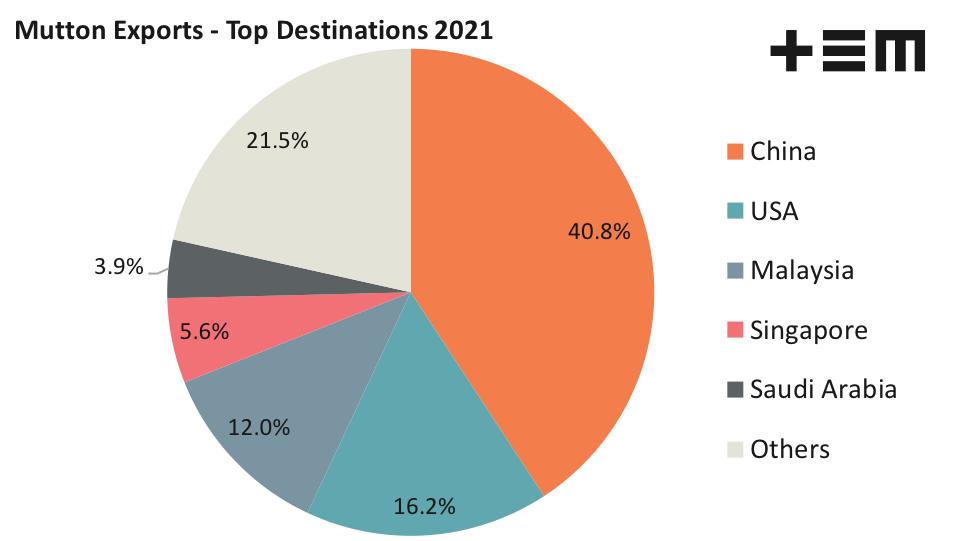

- China dominates the market share of Aussie mutton exports and even managed an increase to their share in 2021 after registering 40.8% of the trade, up from 39.7% in 2020.

- In 2020 the USA sat in second place on 12.8%, but managed a strong 2021 performance to see their market share expand to 16.2% of the total trade.

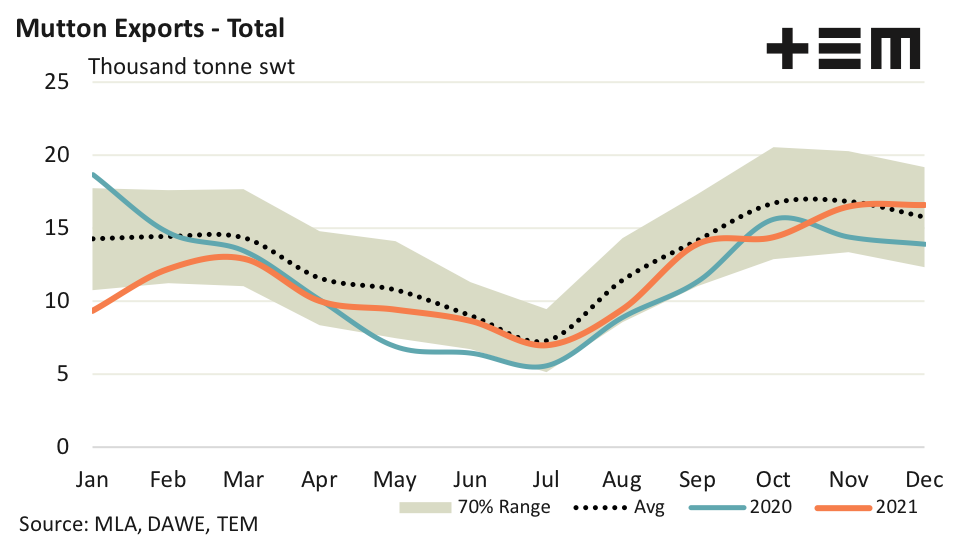

- Total annual mutton trade volumes for 2021 were consistent with the 2020 flows, coming in just 893 tonnes higher than the 2020 season at 140,595 tonnes in 2021.

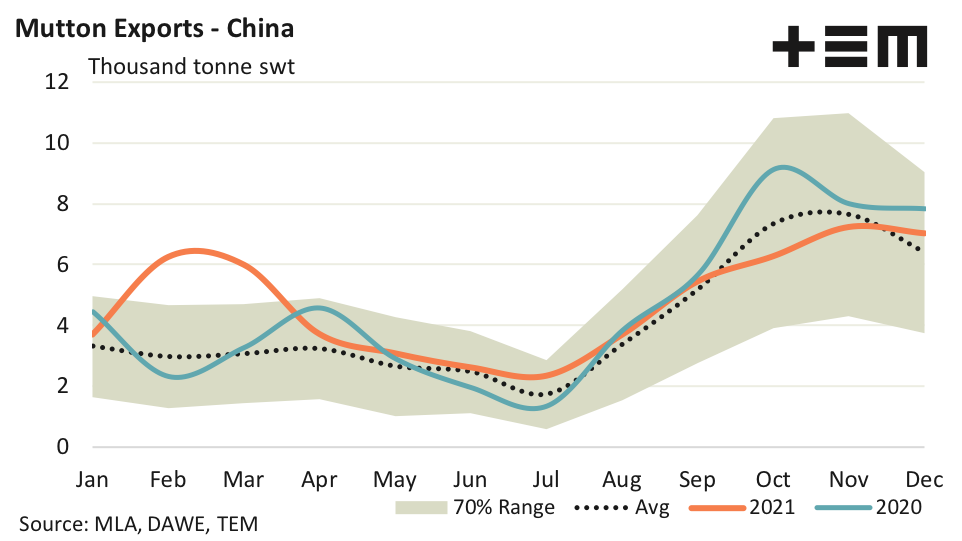

- Total mutton export flows from Australia to China for 2021 were reported at 57,343 tonnes swt, 3.4% higher than 2020 and 16% above the five-year average annual figure.

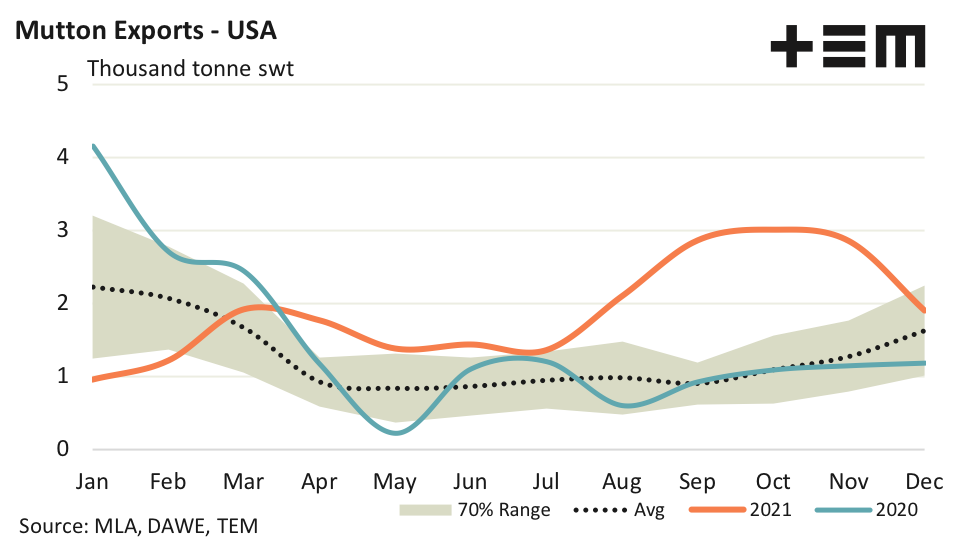

- Total annual mutton exports from Australia to the USA for 2021 was a robust 22,743 tonnes swt. This is the strongest annual mutton export volumes to the USA on record, nearly 27% above the 2020 figures and 48% higher than the annual average, based on the last five years.

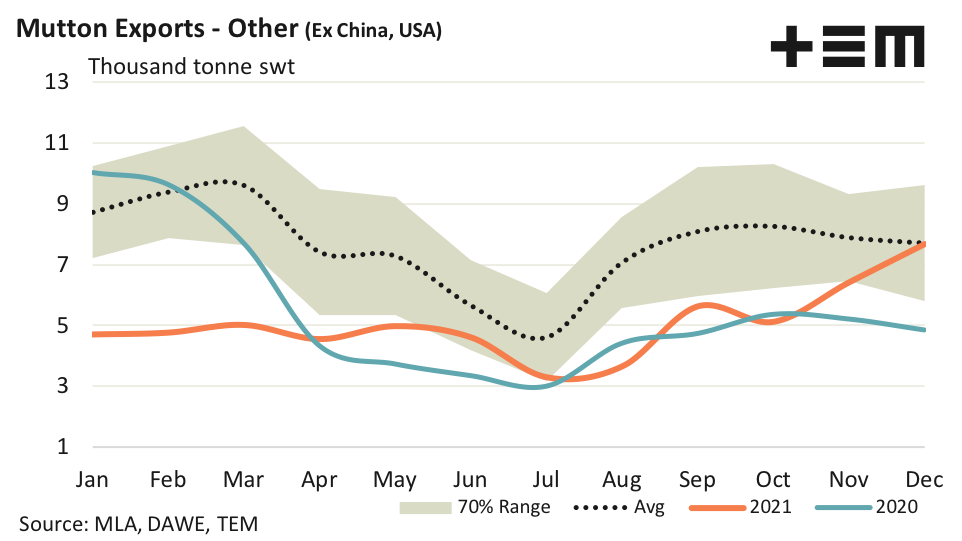

- Total annual mutton exports from Australia to “other destination” ended the 2021 season at 60,509 tonnes, nearly 9% softer than the 2020 trade volumes and 34% below the 91,700 tonnes seen annually, according to the five-year average trend.

The Detail

The 2021 season saw some great gains in market share for Australian mutton exports to the USA, but they remain a minnow compared to China. The Department of Agriculture, Water and Environment (DAWE) trade data highlights that China dominates the market share of Aussie mutton exports and even managed an increase to their share in 2021 after registering 40.8% of the trade, up from 39.7% in 2020. The USA was best on ground in terms of growth of market share though, in 2020 the USA sat in second place on 12.8% but managed a strong 2021 performance to see their market share expand to 16.2% of the total trade.

Malaysia retains their third place position with a small increase in market share from 11.5% in 2020 to 12% in 2021. Meanwhile Singapore and Saudi Arabia saw marginal declines in their share of the trade, from 5.9% to 5.6% and 4.5% to 3.9%, respectively.

Total annual mutton trade volumes for 2021 were consistent with the 2020 flows, coming in just 893 tonnes higher than the 2020 season at 140,595 tonnes in 2021. Much of the 2021 season was spent relatively close to the five-year average pattern, after a slow start in January and February. Compared to the five-year average annual total of 156,521 tonnes the 2021 annual volumes were approximately 10% softer.

Aussie mutton exports to China ended the year as it started, coming in above the five-year average pattern at 7,018 tonnes in December. Total flows to China for 2021 were reported at 57,343 tonnes swt, 3.4% higher than 2020 and 16% above the five-year average annual figure after some strong results were posted in February and March of 2021.

The 2021 season was an exceptional one for mutton exports to the USA. Despite reporting softer flows in December, which eased 33% over the month to record 1,900 tonnes for the final month of 2021, the total annual mutton exports from Australia to the USA for the year was a robust 22,743 tonnes swt. This is the strongest annual mutton export volumes to the USA on record, nearly 27% above the 2020 figures and 48% higher than the annual average, based on the last five years.

Aussie mutton exports to “other destinations” (ex China and the USA) continued to improve with a 20% lift over December to post monthly levels close to the five-year average pattern for the first time in 2021. Total annual mutton exports from Australia to “other destination” ended the 2021 season at 60,509 tonnes, nearly 9% softer than the 2020 trade volumes and 34% below the 91,700 tonnes seen annually, according to the five-year average trend.