US turn a bit sheepish

Market Morsel

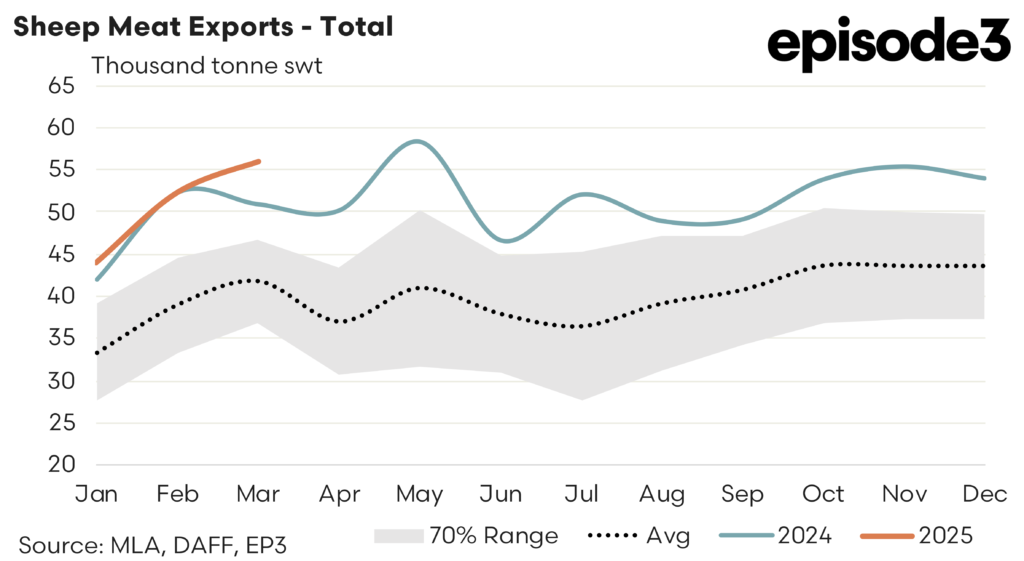

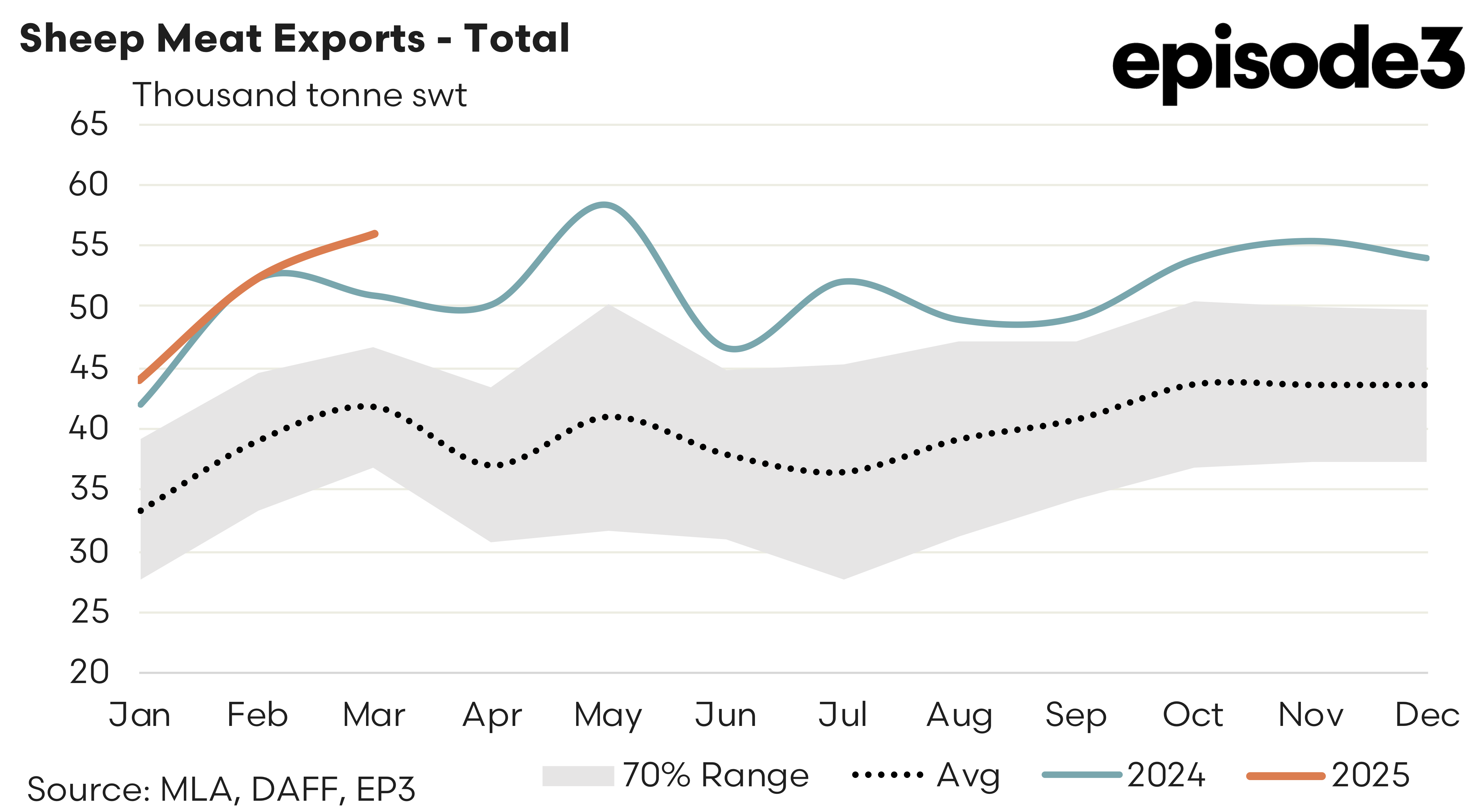

March 2025 saw a sharp downturn in sheep meat exports (lamb & mutton exports combined) from Australia to the USA. Thankfully for the Australian sheep meat sector other trade destinations have picked up some of the slack so total export volumes saw steady gains in volumes as the first quarter of 2025 progressed.

Since the start of the season total exports lifted from nearly 44,000 tonne to 56,000 tonnes and for the entire quarter there was 152,292 tonnes of Aussie sheep meat shipped offshore. This represents a 5% increase on the volumes exported during Q1, 2024 and 33% stronger than the Q1 average for the last five years of the trade.

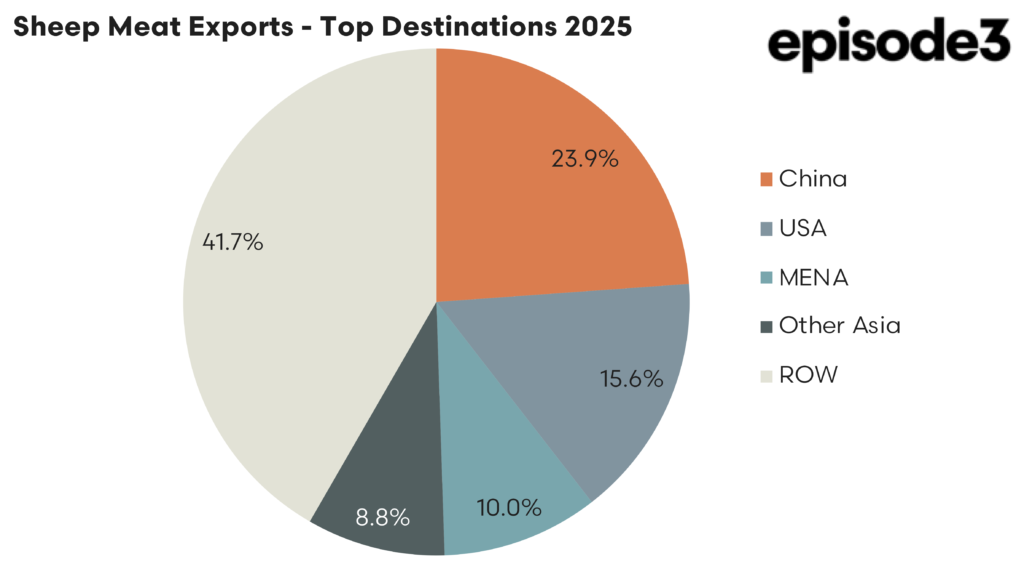

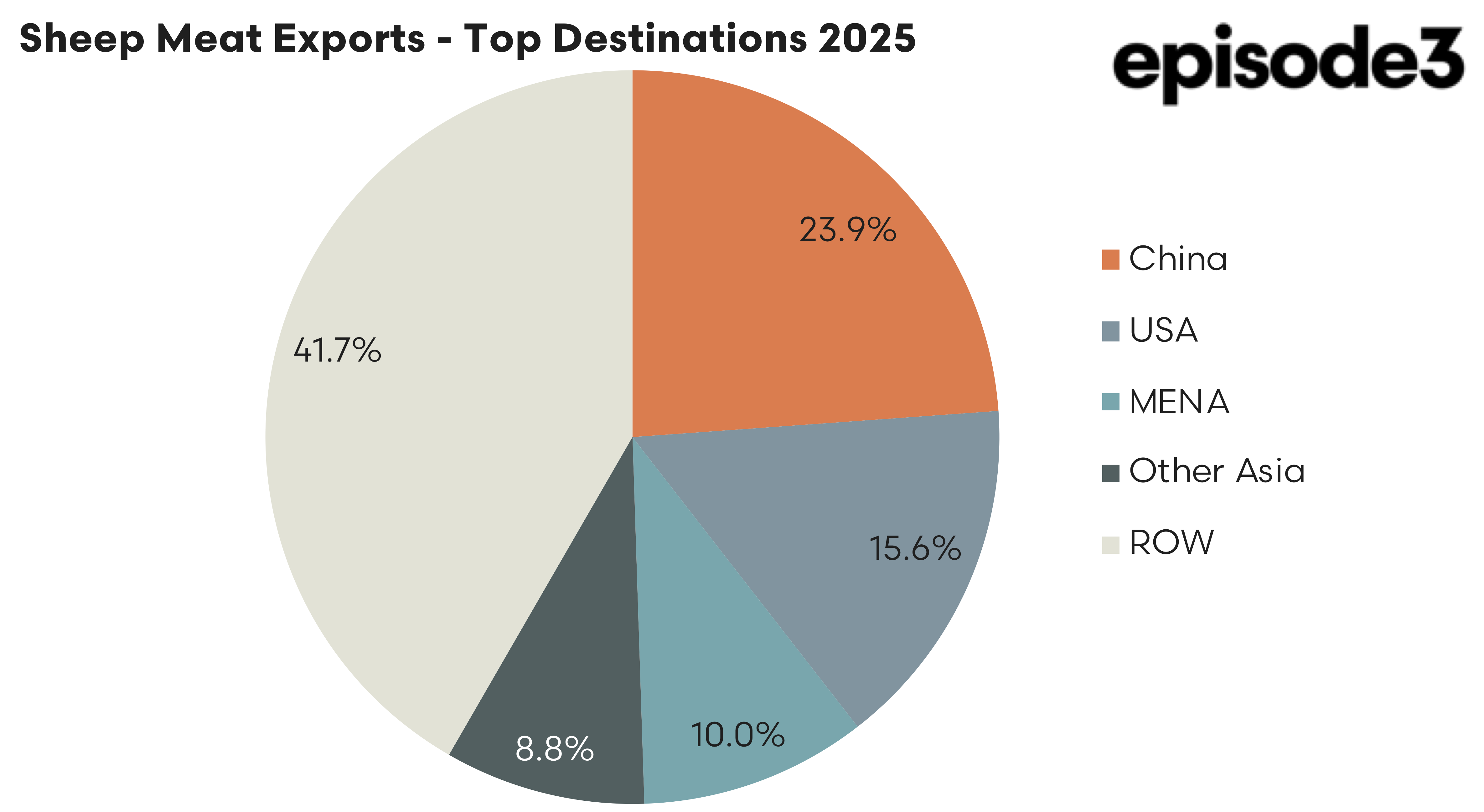

In terms of market share, China retains top trade destination for Aussie sheep meat by volume with nearly 24% of the export flows. The USA sit in second place with 15.6% and the Middle East & North African (MENA) region are in third place on 10%. MENA countries such as the United Arab Emirates, Qatar and Saudi Arabia have all seen above average trade flows for 2025 helping to support export flows to “the other” destinations (excluding China and the USA).

In terms of the top trade destinations for Australian sheep meat exports, the following was noted.

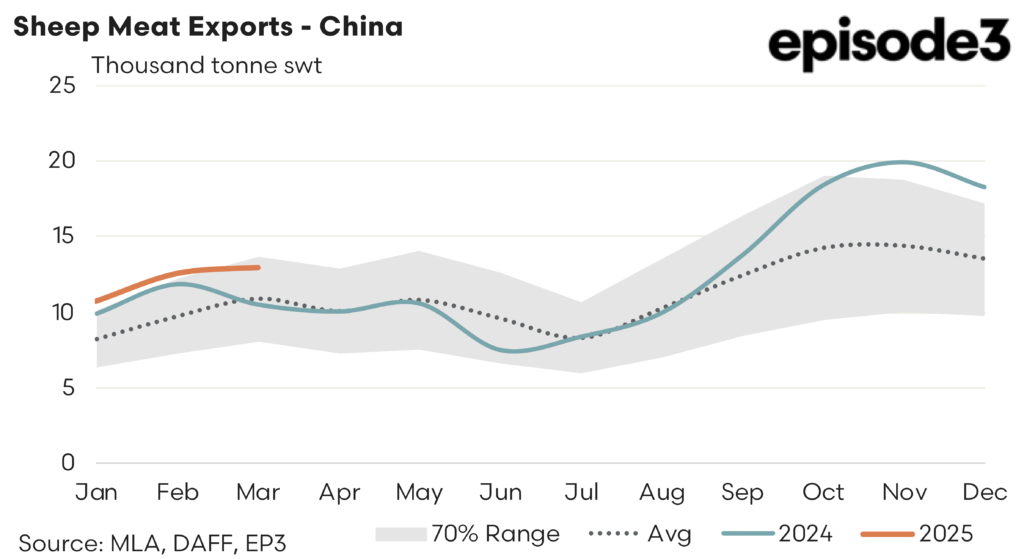

China – Sheep meat exports to China for Q1, 2025 reached 36,336 tonnes swt. Compared to the first quarter of 2024 the current trade volumes are running 13% stronger. Hugging the upper end of the normal range, as per the 70% shaded area on the chart, Q1 sheep meat exports to China are sitting a solid 26% above the average seasonal pattern, based on the last five years of the trade.

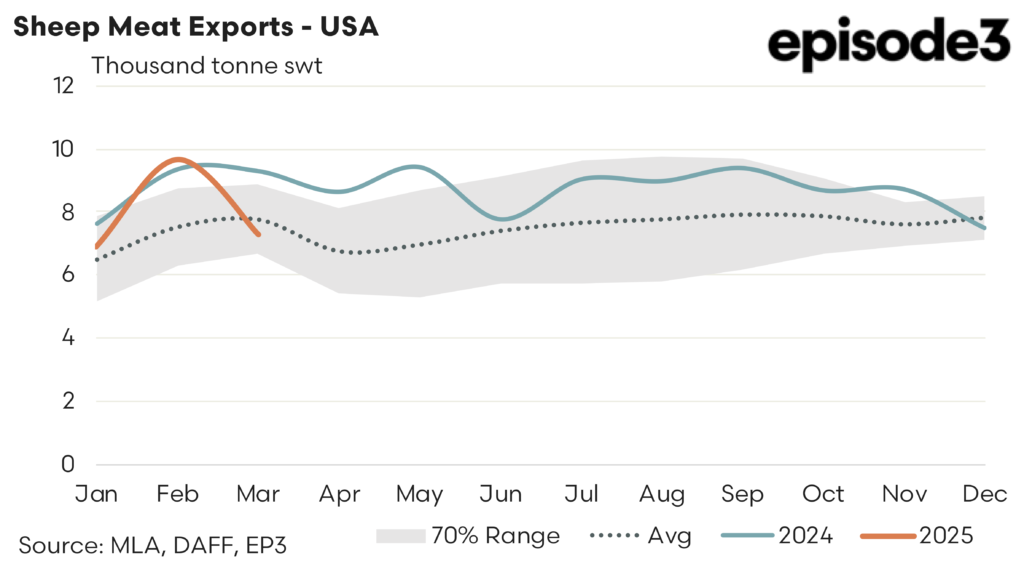

USA – On a month to month basis the first quarter of 2025 started out reasonably well with export volumes to the USA climbing from January to February. However, uncertainty about the impending April tariff announcement from the Trump administration saw the export volumes during March take a bit of a slide, dropping by nearly 25% over the final month of Q1. Over the entire first quarter of 2025 sheep meat exports to the USA from Australia was recorded at 23,793 tonnes, a 9% decrease on the volumes sent during Q1, 2024. However, compared to the five-year Q1 average flows the current trade volumes to the USA still sit 9% higher than the average levels.

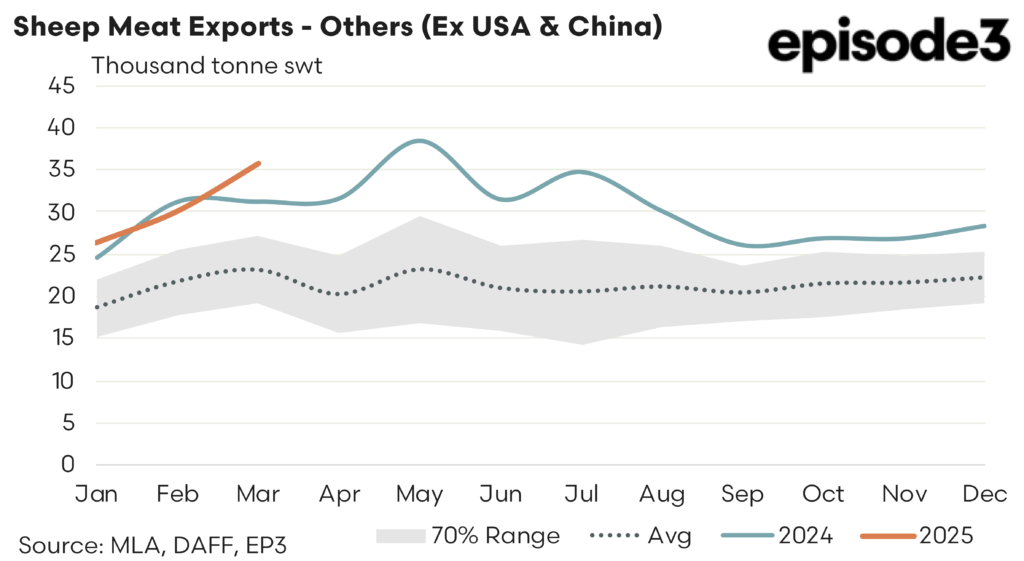

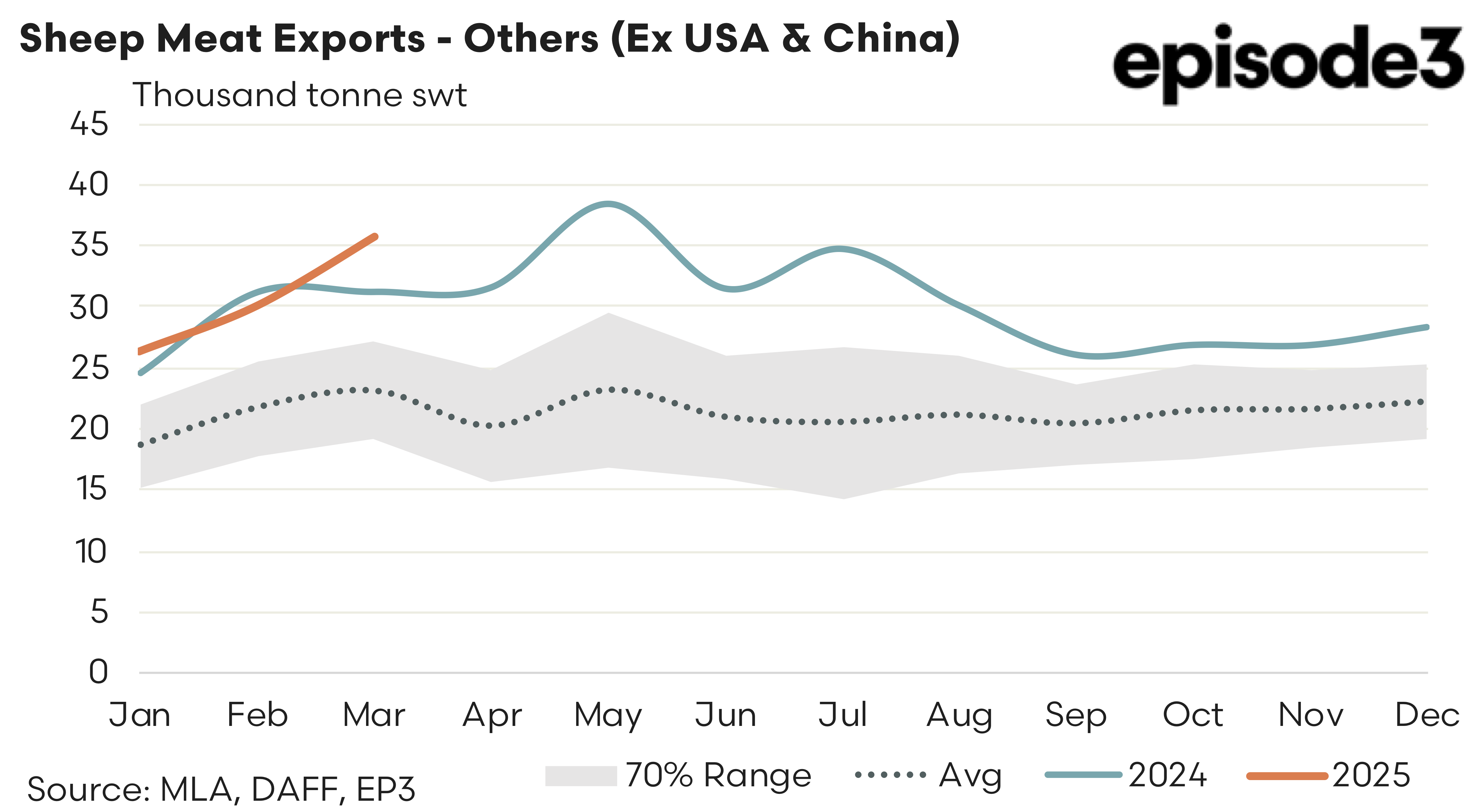

The others – As for the “other” trade destinations around the world, excluding the USA and China, the picture for Aussie sheep meat exports remains robust. Over Q1, 2025 the volumes have increased steadily rising from around 26,000 tonnes to nearly 36,000 tonnes over the quarter. In total the trade to “others” hit 92,162 tonnes for the first quarter of 2025. This represents a 6% increase on the volumes sent in Q1, 2024 and is a huge 45% higher than the five-year average for Q1 sheep meat export volumes.