Well, well me old China.

The Snapshot

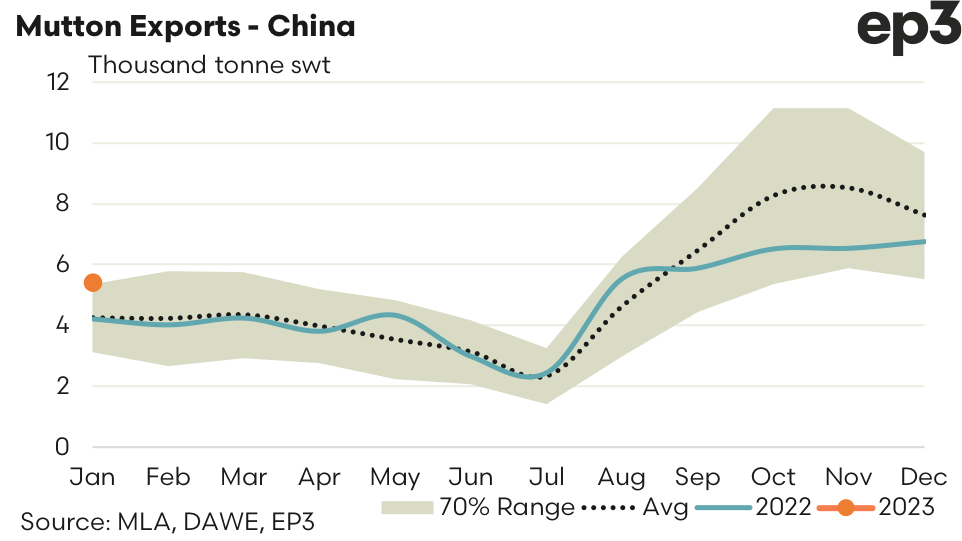

- January 2023 saw the highest Aussie mutton flows for January to China on record, after beating the 4,805 tonnes set in 2019. Current mutton flows to China are sitting 27% above the five-year average for January.

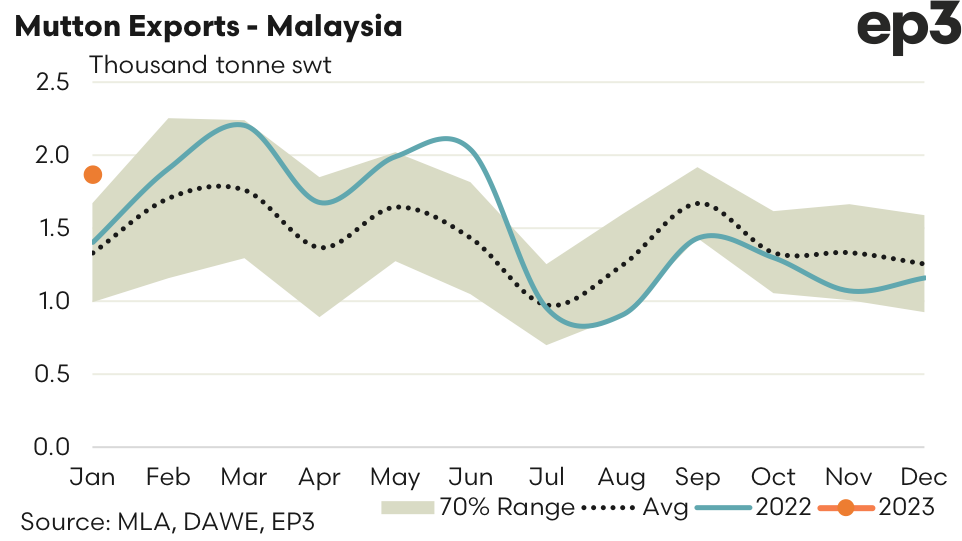

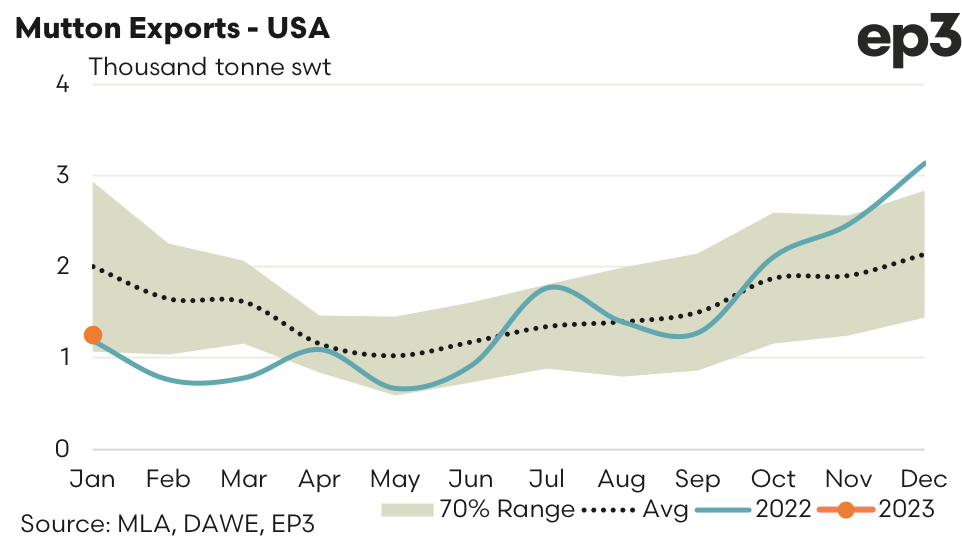

- Malaysia have managed an equally impressive start to 2023 with mutton export volumes that are 40% above the five-year January average. Meanwhile, mutton flows from Australia to the USA are running 37% under trend for January.

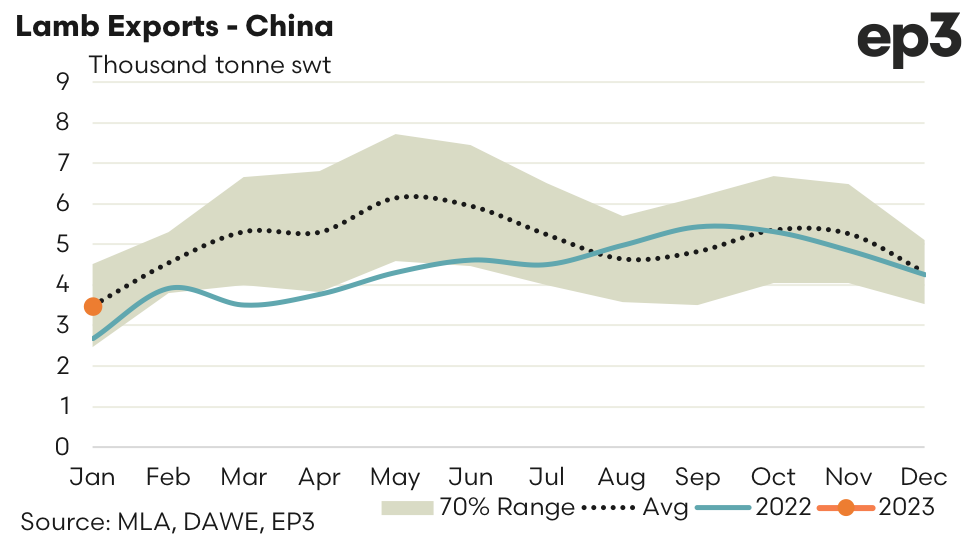

- Lamb export volumes for Australia to China during January 2023 have shown an improvement on the 2022 start to the season coming in 30% higher than last year.

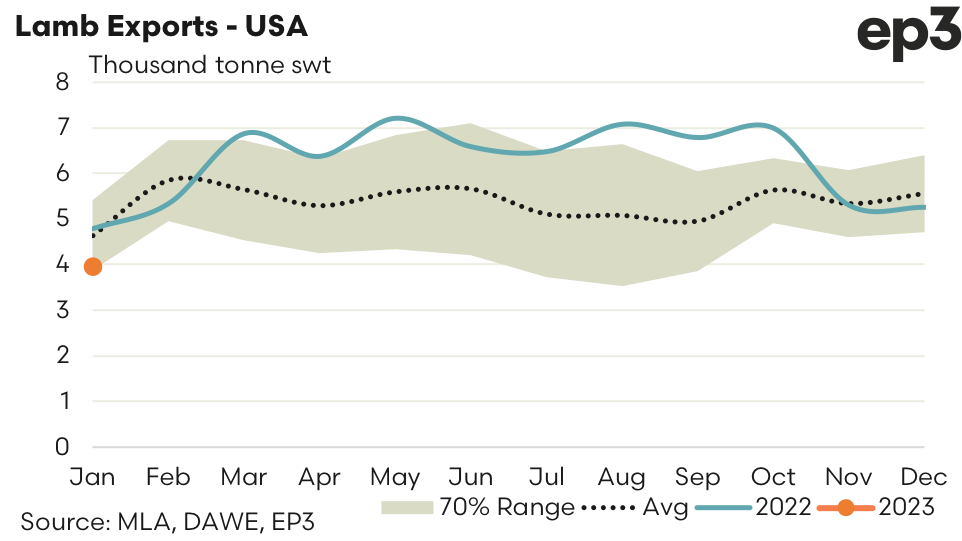

- Unfortunately, after nearly two years of exception demand for Aussie lamb, the USA have started the 2023 season in a relatively poor fashion with lamb trade volumes that are 17% under the flows seen during January 2022 and 14% below the five-year average levels for January.

The Detail

After a bit of a lacklustre end to 2022 China has opened 2023 with some solid demand for Aussie mutton. Export volumes came in at 5,412 tonnes swt for January 2023, which is now the highest Aussie mutton flows for January to China on record after beating the 4,805 tonnes set in 2019. Current mutton flows to China are sitting 27% above the five-year average for January.

Malaysia edged out the USA as second top destination for Aussie mutton during 2022 and they have managed an equally impressive start to 2023 with 1,870 tonnes swt reported shipped over January. This represents levels that are 40% above the five-year January average for Aussie mutton exported to Malaysia.

Meanwhile the USA has opened 2023 in similar fashion to 2022 with regard to their Aussie mutton demand reporting just 1,261 tonnes consigned. Compared to the five-year average for January mutton flows from Australia to the USA are running 37% under trend.

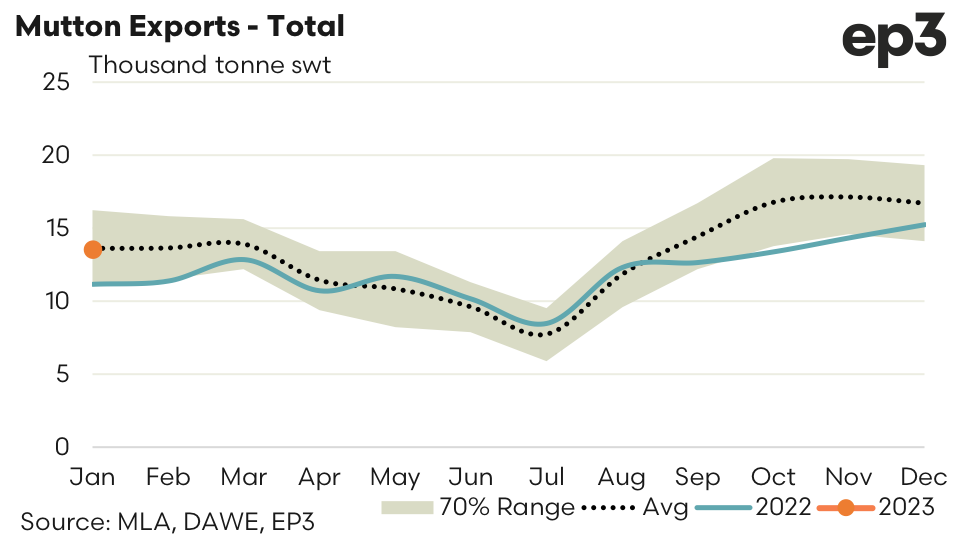

The strong start from China & Malaysia, combined with the below average US demand has placed total mutton exports from Australia during January 2023 at 13,532 tonnes swt. This is less than 1% below the five-year average pattern for January, representing the strongest start to the season since 2020 and is 20% higher than the mutton export volumes seen during January 2022.

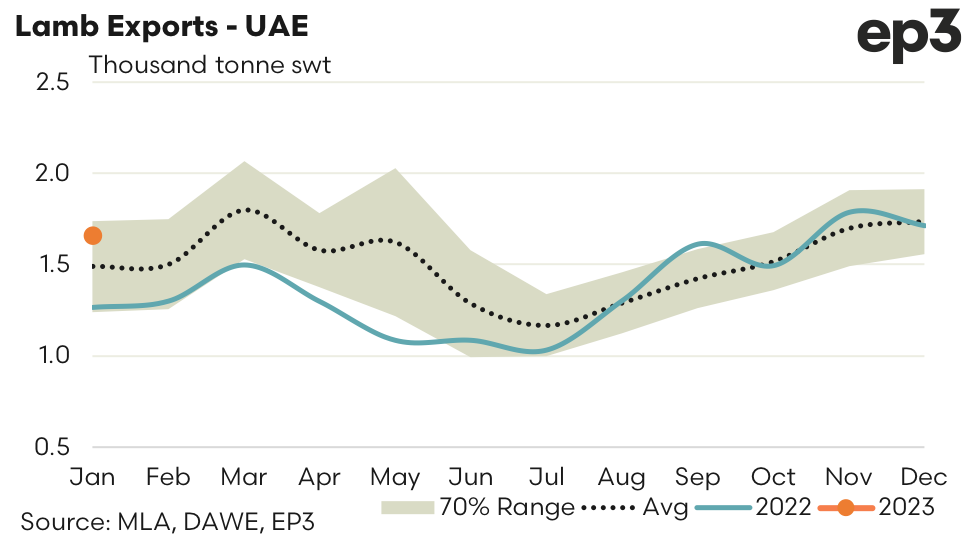

Lamb export volumes for Australia to China during January 2023 have shown an improvement on the 2022 start to the season coming in 30% higher than last year at 3,471 tonnes swt and pretty much bang on the five-year average for January. Meanwhile Aussie lamb exports to the UAE have managed their best opening gambit since 2020 with 1,659 tonnes reported for January 2023. This represents levels that are 11% above the five-year average for January.

Unfortunately, after nearly two years of exception demand for Aussie lamb the USA have started the 2023 season in a relatively poor fashion. There was 3,973 tonnes of Aussie lamb exported to the USA over January 2023, which is 17% under the flows seen during January 2022 and 14% below the five-year average levels reported for January.

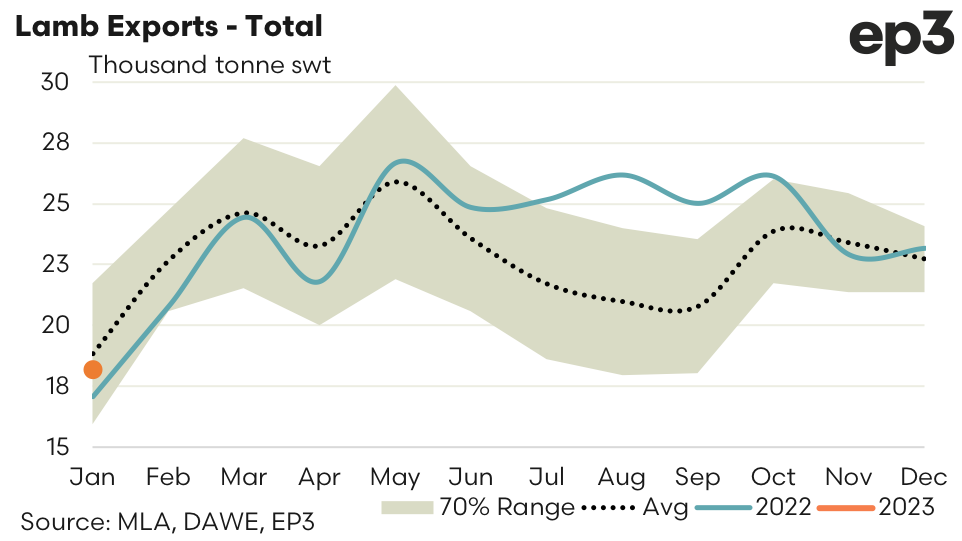

In terms of total lamb exports, the stronger opening from China and UAE has been offset by the below average start from the USA in a bit of a replication of the total mutton export flows. Total lamb exports for January 2023 was reported at 18,189 tonnes swt, nearly 7% above the January 2022 volumes and the strongest start to the season since 2020, but 3% softer than the five-year average for January.