What’s fair?

Market Morsel

The Heavy Steer Indicator Model and the Trade Lamb Indicator Model, developed by Episode 3, aim to estimate fair value price ranges for these commodities. These models incorporate key variables influencing supply and demand, including exchange rates, seasonal production patterns, and macroeconomic conditions. While both models provide useful insights, their past performance reveals certain limitations, particularly in anticipating unexpected price movements. Examining their accuracy in 2023 and 2024, and considering their forecasts for 2025 and 2026, provides a clearer picture of their reliability and potential adjustments needed for future predictions.

The Heavy Steer Indicator Model considers factors such as global beef demand, cattle slaughter and beef production rates, processing margins and weather. The Trade Lamb Indicator Model, utilises seasonal supply fluctuations in lamb slaughter, export demand, currency levels and rainfall patterns, which can significantly impact pasture availability and farmer decision-making. Both models rely on normal climatic conditions to generate forecasts, though the variability of weather patterns introduces inherent uncertainty. While economic indicators and global trade data can be analysed with some degree of certainty, the unpredictable nature of seasonal conditions means that actual price movements can sometimes diverge significantly from forecasts.

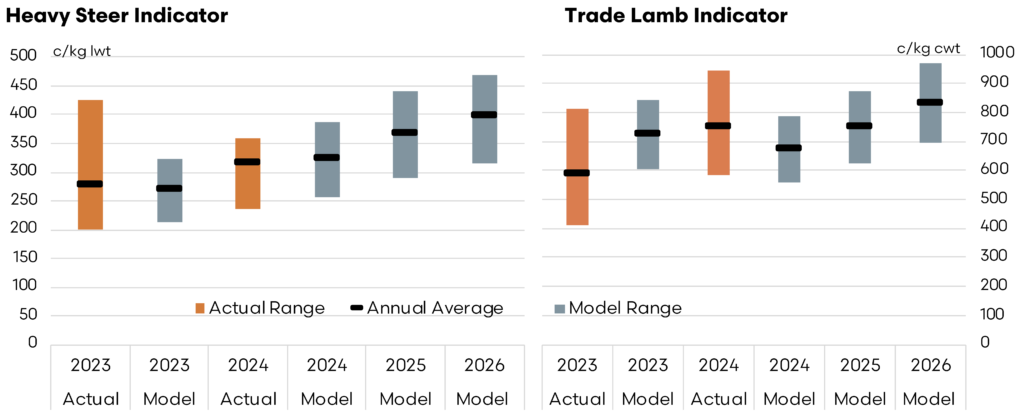

The performance of these models in 2023 and 2024 illustrates both their strengths and their limitations. The chart comparing actual price ranges and annual averages with model forecasts shows that, while broad trends were captured, the exact fair value range in prices were not always accurately predicted. In the case of heavy steers, the actual market range in 2023 exceeded the model’s forecast, suggesting greater volatility than expected. For 2024, the model projected a price range of 256 to 386 cents per kilogram, but actual prices fluctuated between 237 and 360 cents. The annual average of 314 cents, however, was close to the model’s estimate of 321 cents, indicating that while extreme movements were difficult to anticipate, the overall trend was reasonable. This suggests that, while supply and demand fundamentals were well-accounted for in the model, unexpected external pressures influenced price outcomes.

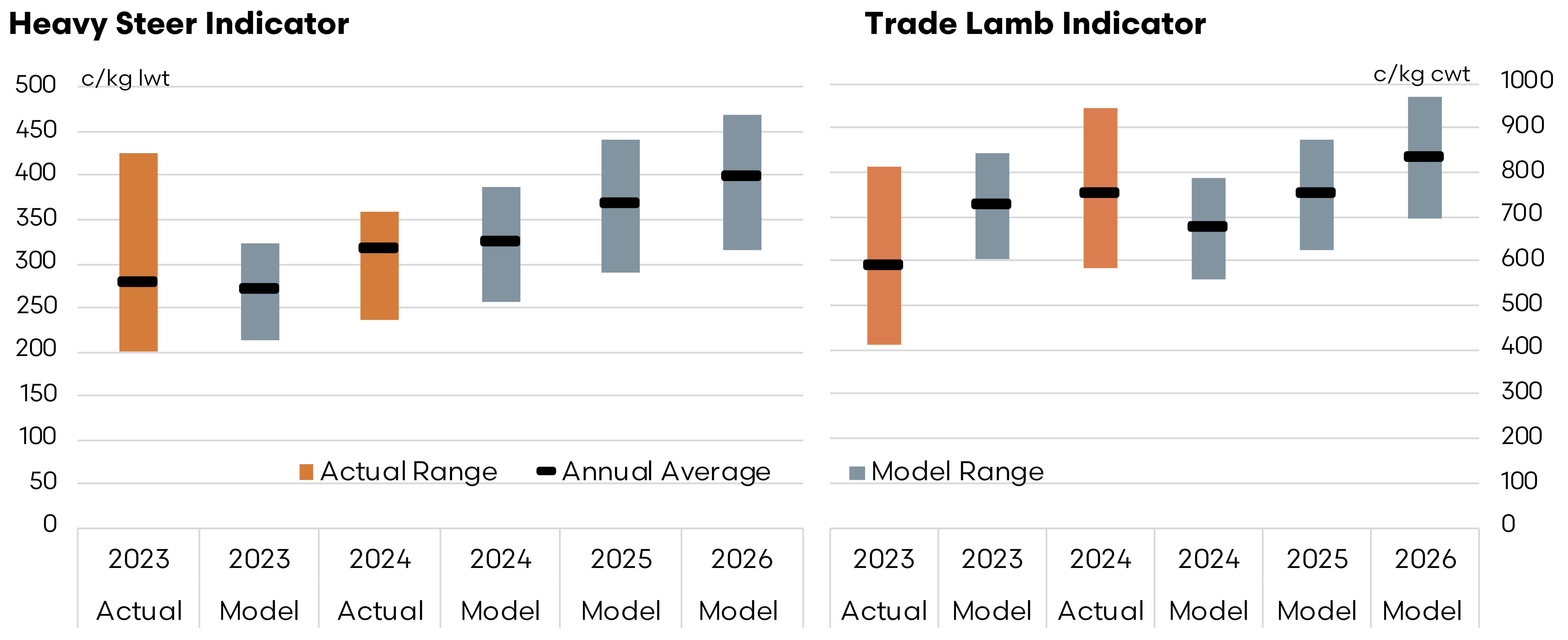

The trade lamb market experienced similar forecasting challenges. The model’s fair value range for 2024 was set at 560 to 785 cents, but the actual price range stretched from 584 to 946 cents, largely due to an unexpected summer rally that pushed prices significantly higher than anticipated. This rally resulted in an annual average of 751 cents, which was about 12 percent above the model’s forecast of 672 cents. The model’s underestimation of the late-year surge highlights the difficulty of predicting sudden market shifts driven by unanticipated factors.

Looking ahead, the models project a generally positive trend for both livestock markets in 2025 and 2026, assuming normal seasonal conditions. The Heavy Steer Indicator Model forecasts an annual average of approximately 350 cents per kilogram in 2025, with a fair value range between 290 and 440 cents. In 2026, this range is expected to rise slightly to between 315 and 470 cents, reflecting potential improvements in global beef demand amidst tight supplies. However, any significant changes in export market conditions or domestic supply due to climatic factors could push prices outside these expected bounds. Given that beef markets are sensitive to trade agreements and shifts in consumer preferences, there remains potential for deviation from these forecasts should external conditions change more rapidly than anticipated.

For trade lambs, the model forecasts an annual average of 750 cents in 2025, with a range from 625 to 875 cents. In 2026, the predicted average increases to 832 cents, with a fair value range extending from 695 to 970 cents. The impact of seasonal conditions on lamb pricing is particularly pronounced, and the model acknowledges that higher-than-average rainfall could drive prices above 1000 cents, potentially reaching 1100 cents in a much wetter than average outcome. Conversely, drought conditions could suppress prices to the mid-500s, demonstrating the significant influence of environmental factors on market outcomes.

Both models provide valuable guidance for producers, processors, and supply chain participants, helping them navigate an inherently volatile marketplace. However, their past performance suggests that while broad price trends can be reasonably estimated, short-term deviations remain challenging to predict. While no model can predict every fluctuation, understanding the underlying drivers of price movements allows for more informed decision-making.

Despite these challenges, the models remain useful tools for planning and strategic decision-making. They offer a structured approach to understanding how market fundamentals interact, even if precise short-term movements cannot always be forecasted. As the livestock sector moves into 2025 and 2026, industry stakeholders should use these fair value projections as a reference point rather than a fixed expectation.