Where will it end?

Market Morsel

Analysis on the WA sheep turnoff ratio from earlier in the week noted that there has been a sharp increase in the ratio of sheep being turned off in the west in recent years, suggesting that the WA flock could be heading towards 8-9 million head in the next few years as sheep producers there exit the sector in droves.

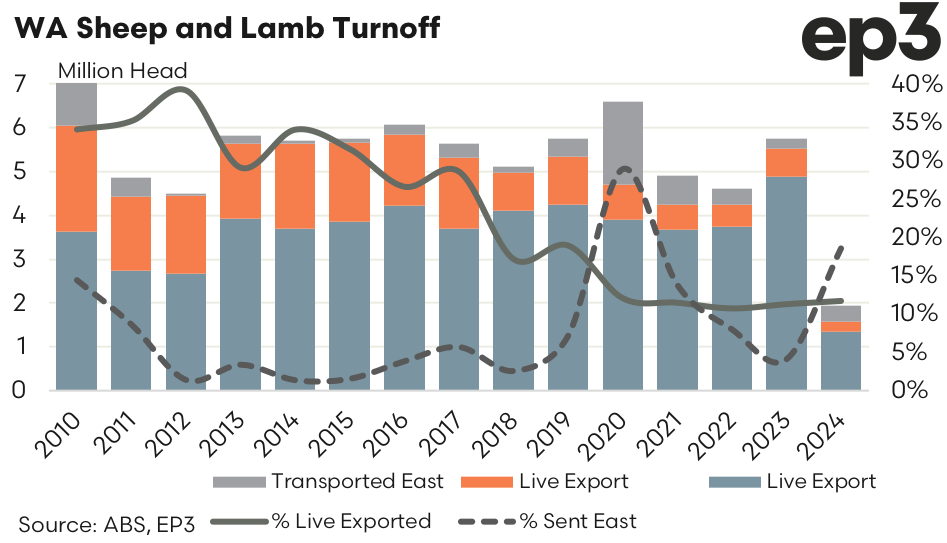

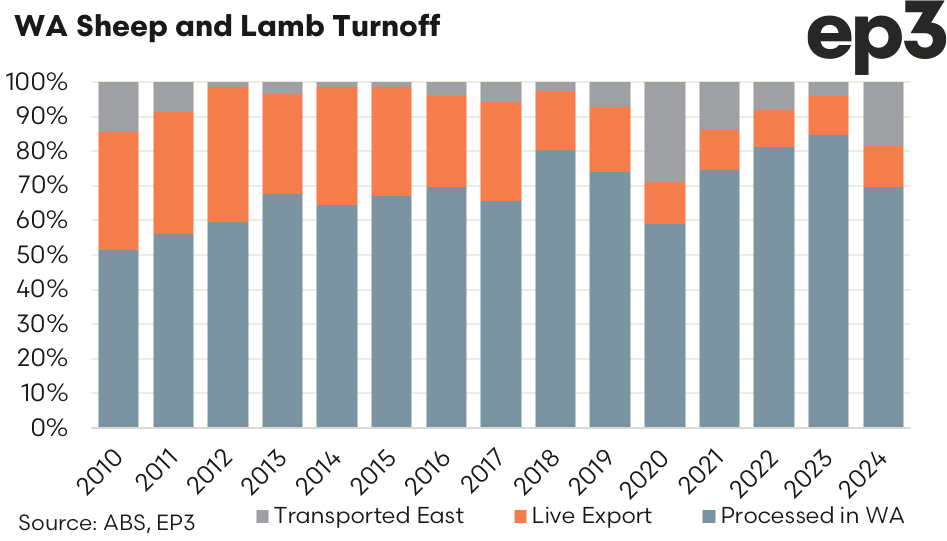

Updated data for Q1 2024 on WA slaughter, live export flows and transport east shows that the option for eastern transport has increased significantly this year. Turn off of WA sheep by trucking them east has lifted from 4.0% in 2023 to 18.5% so far this year. Meanwhile, the proportion of WA turnoff into the live export avenue has increased from 11.3% in 2023 to 11.7% in 2024. In contrast, the proportion of WA sheep being turned off into domestic processing within WA has dropped from 85% last year to 70% this year.

It feels like WA sheep producers are currently exiting the sector any way they can. There have even been several posts on social media in recent weeks of sheep being euthanised on farm due to lack of feed, low livestock pricing and limited avenues for farmers to reduce stock numbers in an economically viable manner.

The announcement of the timeline for the live sheep export phaseout, which has been set for 1 May 2028, could be the end of the road for many WA sheep producers. Episode 3 have been consistently against the decision to phase out the trade, but concede that if managed appropriately (in terms of allowing an extended timeline – see here), the sector could have been transitioned successfully to focus toward the growth expected to be seen in the boxed sheep meat trade.

I fear that this is the big risk now. WA producers, frustrated with an inadequate timeframe for the supply chain to adjust and limited funding available for industry transition, will elect to exit the sector entirely. This outcome would pose a risk for the WA wool industry and supply chain, the WA processing sector if available livestock numbers diminish, and associated livestock agency, wool broking, transport, shearing and farm consulting operations – not to mention the broader rural community impact as job opportunities decline and towns become smaller or less economically resilient.