Where’s your sheep at?

The Snapshot

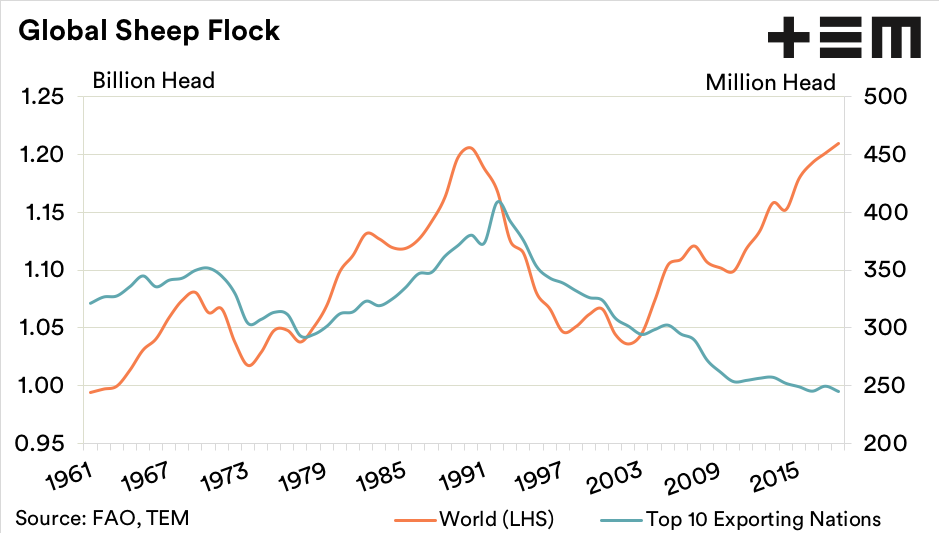

- The global sheep flock has increased nearly 17% over the past two decades to a record high of over 1.2 billion head of sheep.

- China holds the largest sheep flock at nearly 165 million head, or about 13% of the global flock.

- Despite having the world’s largest sheep flock China is the top importer of sheepmeat with their volumes outweighing sheepmeat imports into the USA and France, combined.

- The “global export flock” has been in decline since the early 1990s from 400 million head to just under 250 million head.

The Detail

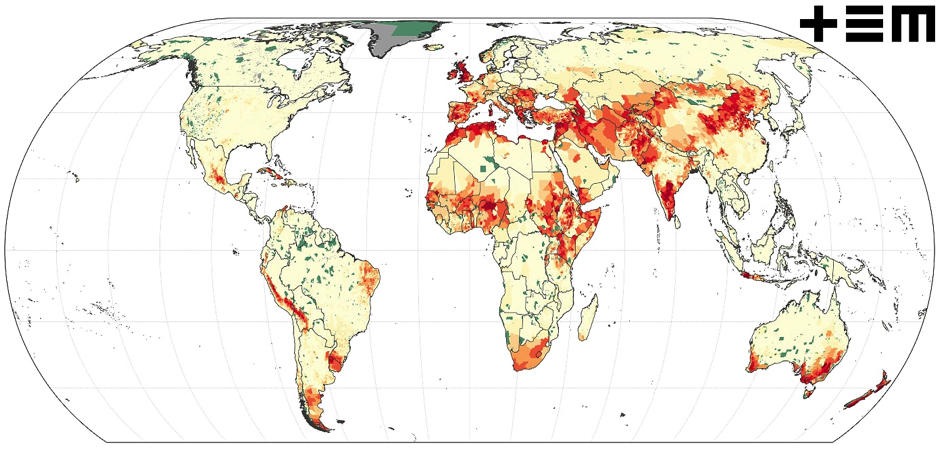

The distribution of sheep globally is highlighted by the heat map, which shows significant flocks in Australia, China, India, Africa, UK and the Middle East.

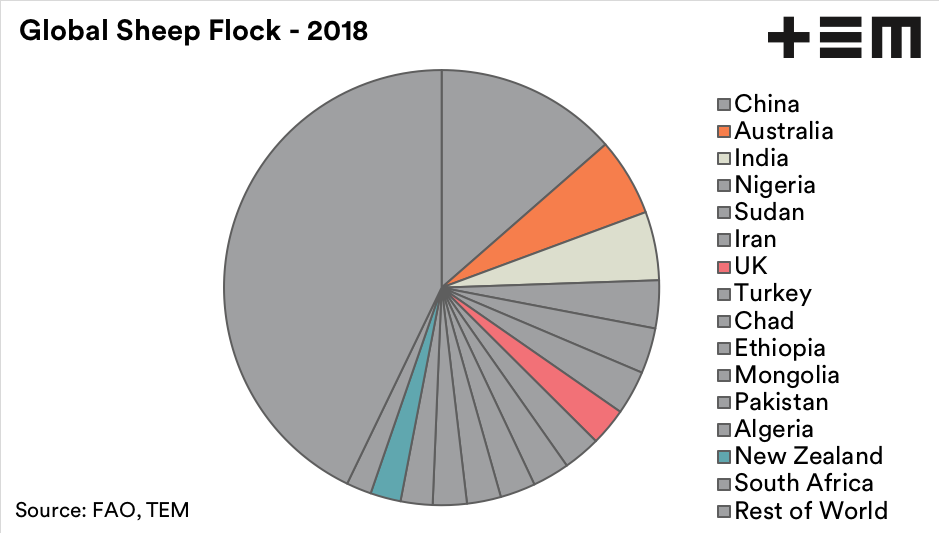

An analysis of flock size by country shows China holds the largest sheep flock at nearly 165 million head, or about 13% of the global flock. Australia holds second place with 6% of the global flock followed by India at 5%.

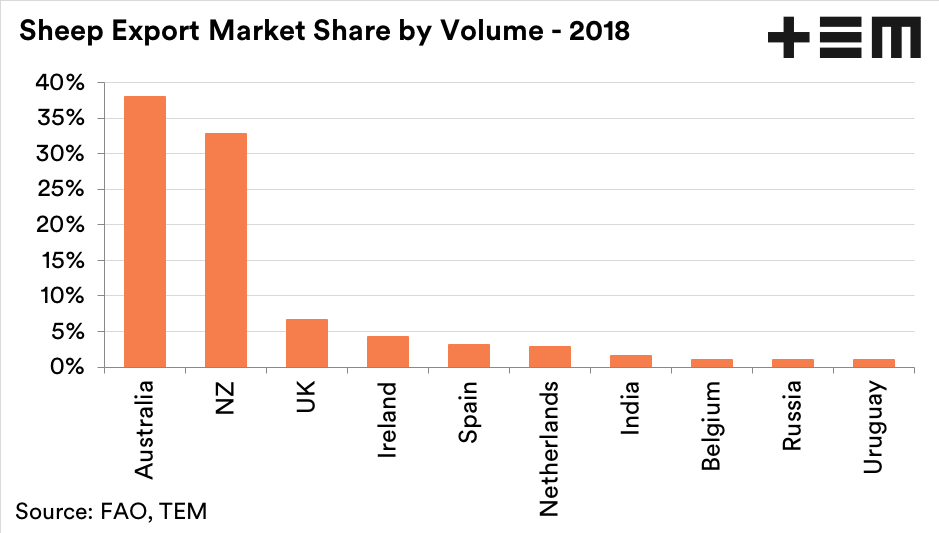

The top fifteen countries for sheep flock size account for around 57% of the global flock. Interestingly we can see that only four of these nations are in the top ten sheepmeat exporting nations; Australia, India, UK and New Zealand.

The UK holds around 3% of the global flock and New Zealand has closer to 2%. While the UK are a significant exporter of sheepmeat, sitting in third spot behind Australia and NZ, at around 7% of the global trade they are also a significant importer of sheepmeat.

Indeed, the UK imports around 70% of the volume they export and usually place in the top five sheep meat importing nations globally.

The key to this conundrum is twofold. Certainly, there has been an increasing appetite for meat protein in the developing world over the last few decades, which has been turbo charged in recent years by the African Swine Fever pork void in China since 2018. The growing demand for all meat protein has included an increased appetite for sheepmeat.

Over the last six decades the Chinese sheep flock has added around 100 million head growing from 60 million head in the early 1960s to nearer 165 million head in recent years. While the supply of sheep has increased steadily within China the demand for sheepmeat has grown faster.

Despite having the world’s largest sheep flock China is the top importer of sheepmeat with their volumes outweighing sheepmeat imports into the USA and France, combined. This is no mean feat as the USA and France are the world’s second and third top sheepmeat importing nations.

Analysis of the sheep flock of the ten top sheepmeat exporting nations gives a clue to the strong sheepmeat prices being achieved as the “global export flock” has been in decline since the early 1990s from 400 million head to just under 250 million head.

While there has likely been production efficiencies in key sheepmeat exporting countries such as Australia and NZ, enabling them to produce more sheepmeat with a lower flock size it just hasn’t been enough supply to keep up with the demand.