Who’s cutting our lunch?

The Snapshot

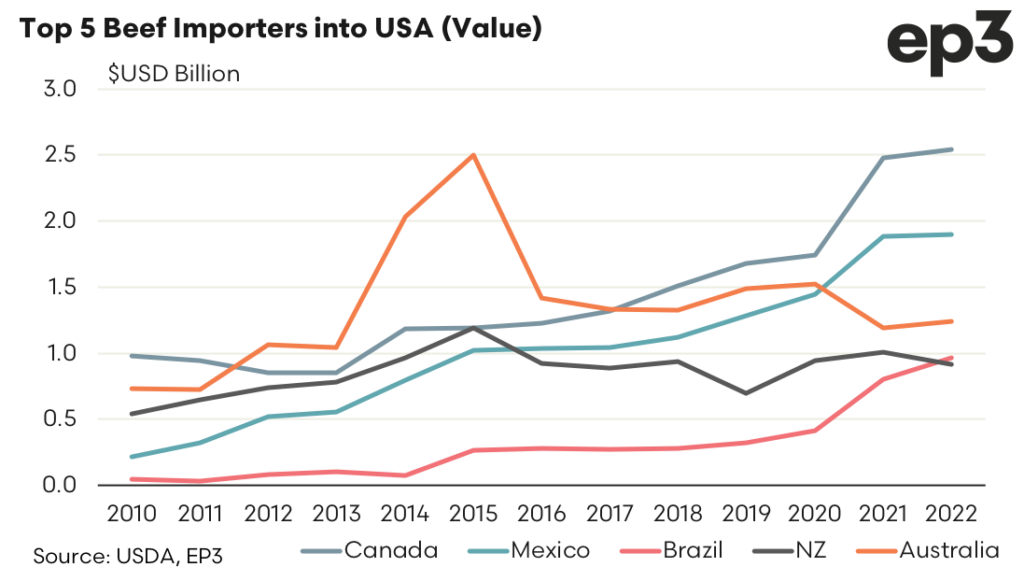

- Australia managed to retain third top beef import source into the USA, despite trade values easing from around $US1.5 billion in 2020 toward $US1.2 billion in 2021 and 2022.

- In 2022 Australia captured 14.5% of the US beef import market, by value, compared to nearly 22% of the market share in 2020, so we have seen some market share eroded.

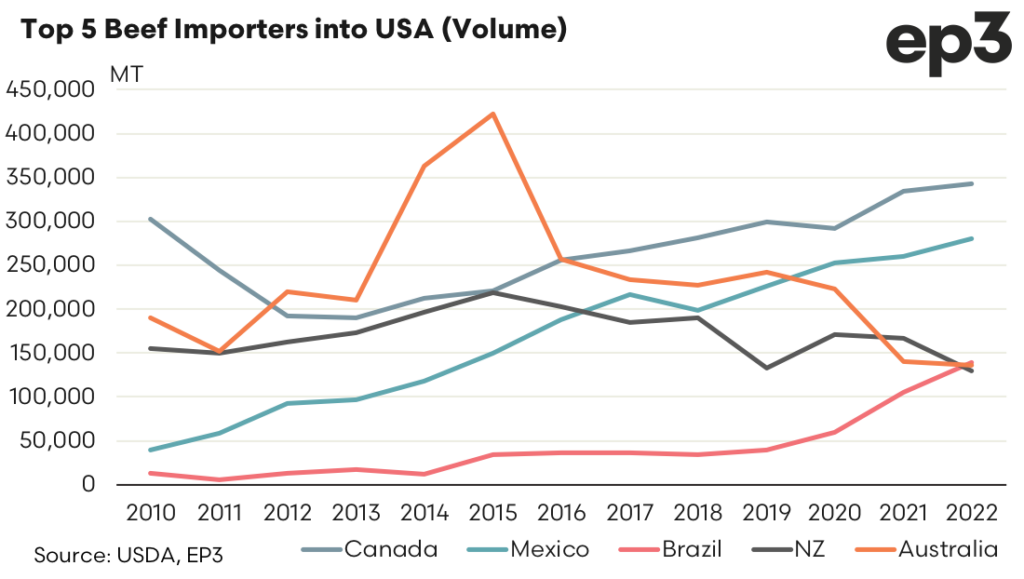

- Analysis of trade flows on a volume basis demonstrate the lost market share more clearly for Australia over the last few years, slipping from third top import source to fourth top source behind Brazil.

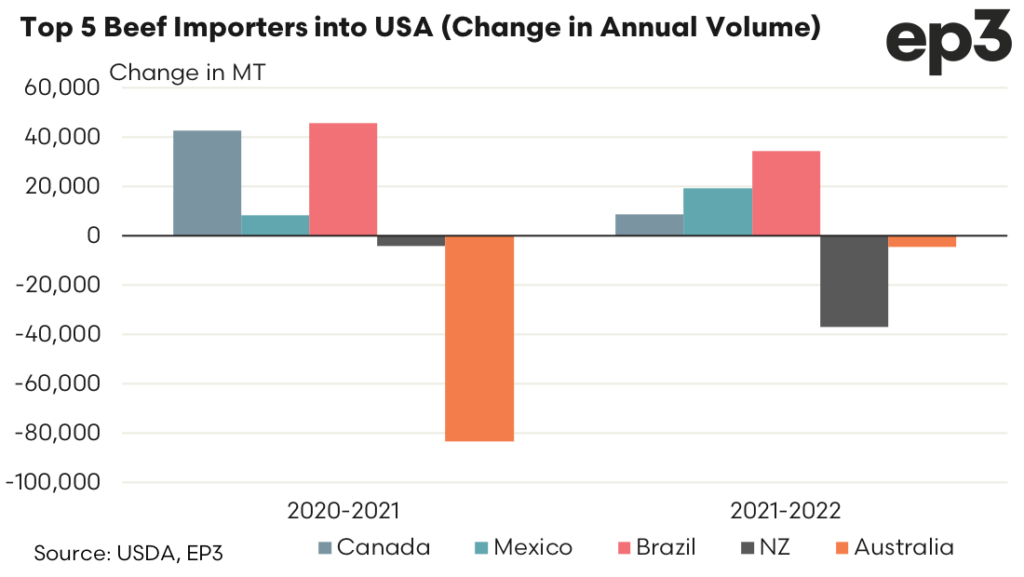

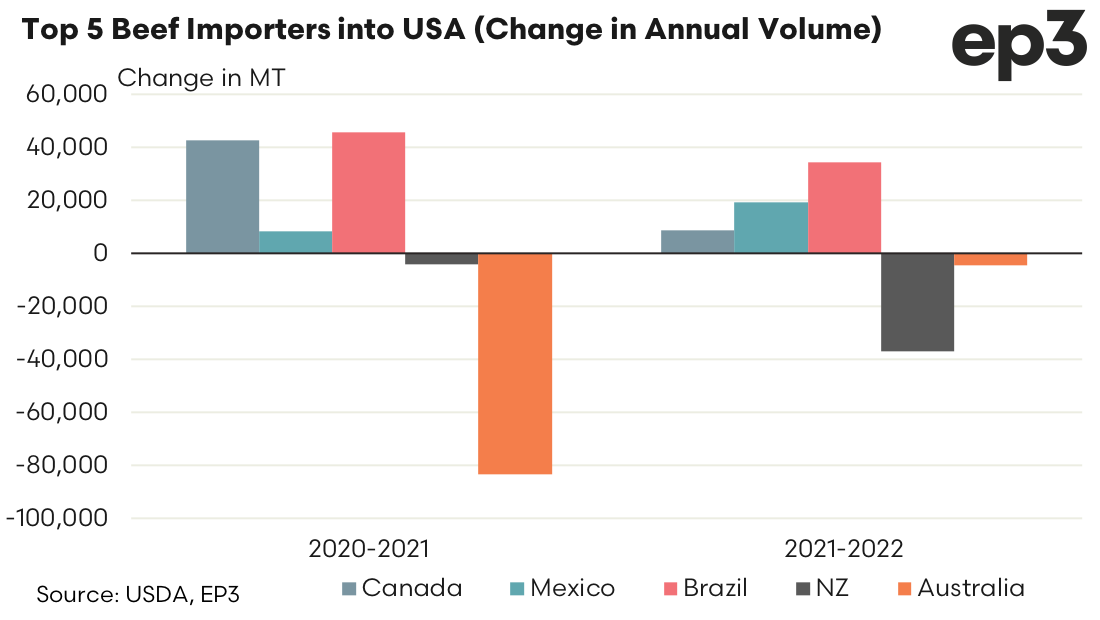

- Aussie beef trade volumes dropped by around 80,000 MT in 2021, replaced by a 40,000 MT lift in volumes from Canada and Brazil, apiece.

The Detail

Beef export flows from Australia to the USA have been in the doldrums for quite some time now. Higher Australian cattle prices compared to global values and low domestic supply over the past few years have taken its toll on some of our export flows to key partners.

However, the situation may begin to change as our cattle prices have corrected to more normal historic levels versus key trading partners like the USA and our supply is on the improve, with herd and slaughter figures projected to continue to rise. Additionally, the recent outbreak of Mad Cow Disease in Brazil, may also help to focus attention back towards Australian beef product.

A look at the top five beef importers into the USA since 2010, on a product value basis, shows that Australia managed to retain third top import source, behind Canada and Mexico, despite trade values easing from around $US1.5 billion in 2020 toward $US1.2 billion in 2021 and 2022.

In 2022 Australia captured 14.5% of the US beef import market, by value. In 2020 Australia held nearly 22% of the market share, by value, so we have seen some market share eroded despite holding onto the third place position. From 2020 to 2022 Canada and Brazil have seen noticeable increased market share on a value basis, from 25% to 30% for Canada and from 6% to 11% for Brazil.

Analysis of trade flows on a volume basis demonstrate the lost market share more clearly for Australia over the last few years, slipping from third top import source to fourth top source behind Brazil. Beef flows from Australia to the USA have dropped from around 225,000 – 250,000 MT between 2015 and 2020 to around 140,000 MT in 2021 and 2022.

In contrast Brazil has gone from import volumes below 50,000 MT pre 2020 to around 140,000 MT in 2022. It’s possible that Brazil could have provided more beef in 2022 but they maxed out their trade quota during the year so had to endure a higher tariff for the last quarter of 2022, which likely impacted flows for the final part of the season.

A focus on annual trade flow changes over the last two years highlights that much of the market share for Australia was lost during 2021. Trade volumes over 2021 dropped by around 80,000 MT, replaced by a 40,000 MT lift in volumes from Canada and Brazil, apiece.

During 2022 the change in trade volumes for Australia was negligible, but the Kiwis lost some ground to the tune of nearly 40,000 MT – much of which went to favour increased beef trade from Brazil to the USA.