Aussie, Aussie, Aussie

The Snapshot

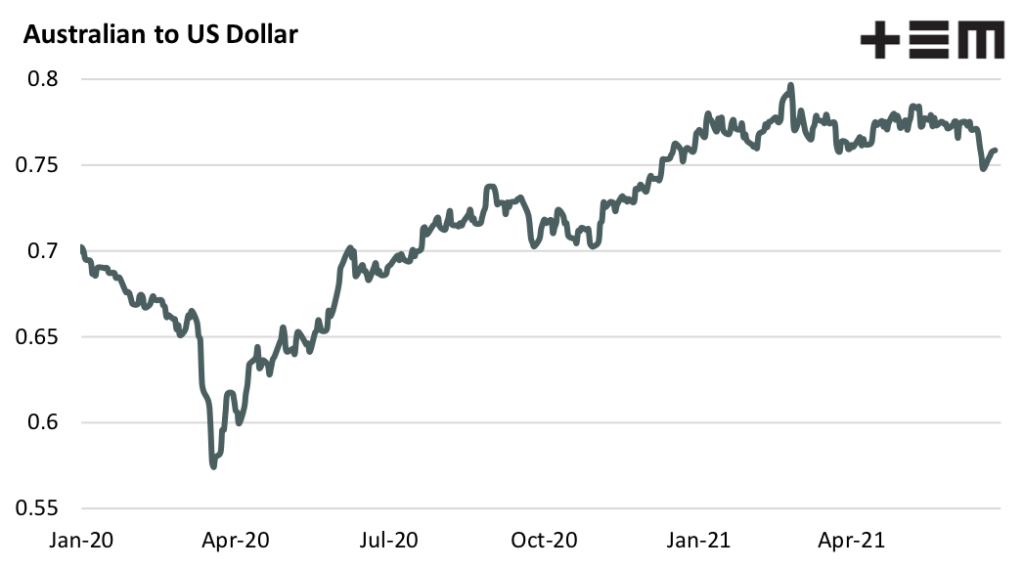

- The Australian dollar reached a peak just above 79US cents in February 2021.

- Recent US dollar strength pushed the Australian dollar back under 75 cents, briefly.

- The prospect of increased interest rates in the USA and stagnant Aussie interest rates has taken some of the shine off the upward trajectory of the AUD/USD.

The Detail

After the initial risk related sell off of the Australian dollar, during the first half of 2020 as the spread of Covid-19 was causing havoc among the world’s economies, the local currency has managed to recover the ground lost during the second half of 2020 and surge ahead of pre-Covid levels into 2021.

Indeed, the limited impact of Covid-19 on the Australian economy prompted some bank economists to revise their forecast upwards for the AUD/USD toward 85US cents during the first quarter of 2021. The Australian dollar reached a peak just above 79US cents in February, however in recent weeks a resurgent strength in the US economy has lent support to the US dollar and taken some of the upward momentum away from the Aussie.

Currency markets are quite susceptible to interest rate sentiment. In the June 2021 meeting of the Federal Open Market Committee (FOMC), which is the US equivalent of Australia’s Reserve Bank (RBA), there was a surprise hawkish tone to interest rates.

Recently an FOMC official, Eric Rosengren, added weight to the notion of a possible interest rate increase in the USA into the later part of 2022 citing inflationary concerns and a move toward full employment in America. While some Australian banks have brought forward their timing of rate hikes in Australia, the official line from the RBA is that an interest rate increase in Australia isn’t on the cards until 2024.

The prospect of the USA entering into a rate hike environment while rates remain stagnant in Australia has seen some pressure return to the AUD/USD in recent weeks with the currency testing back below 75US cents last week.

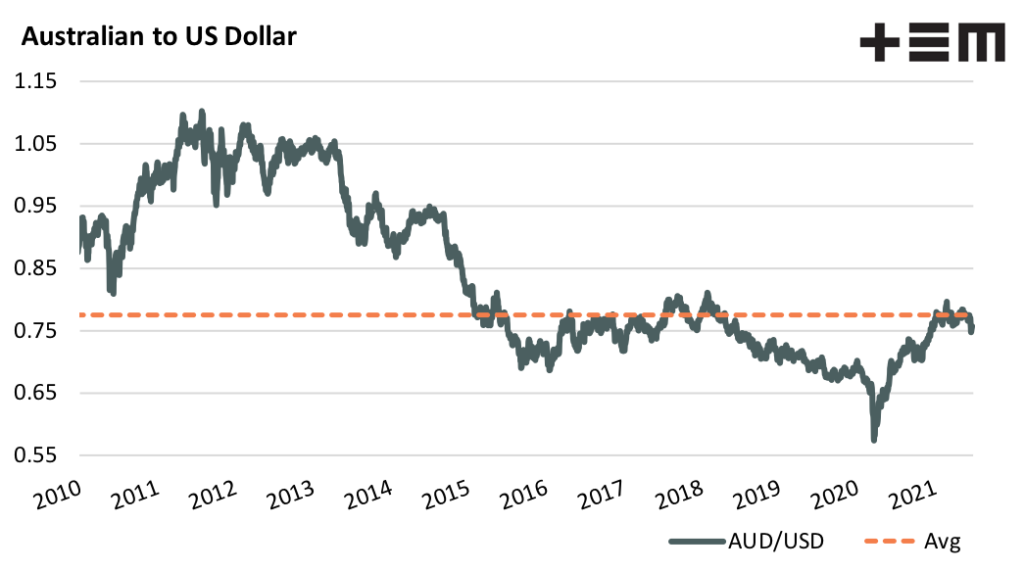

A longer term picture of the Australian dollar highlights that the average level of the currency sits at around 77.5US cents. Australian export competitiveness doesn’t generally get impacted too severely until we start to see the AUD/USD moving above 90US cents. Similarly, the international competitiveness of our exported products gets a boost from the currency once we start heading towards the low 60US cent region, or below.

The next big economic announcement out of the USA that may impact the currency markets is the jobs data due out this Friday (early Saturday morning in Australia). A stronger than expected non-farm payrolls (the market is expecting a 700,000 increase in jobs) will see further pressure added to the Australian dollar, while a softer jobs picture in the USA could give the AUD/USD the legs to probe towards 80US cents again.

As an ex currency trader my personal view is that the Australian dollar is going to sit within a 73-83 cent range for the next 12-18 months, a level which with neither hinder, nor support, our export competitiveness.