Is the higher A$ hurting our exports?

The Snapshot

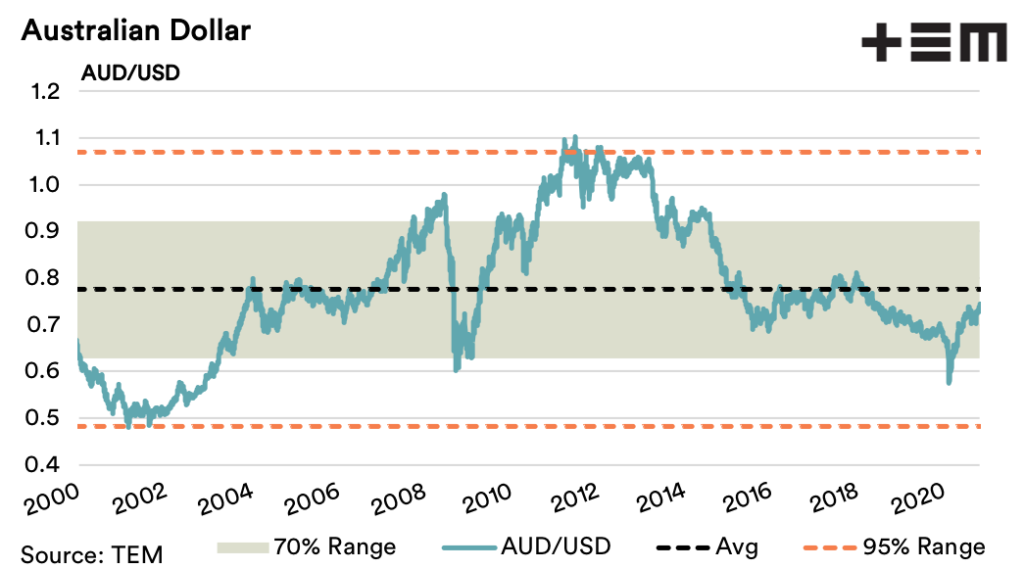

- The Australian dollar is currently trading above 74US cents, rebounding nearly 30% from the lows seen during March 2020.

- On a 20 year basis the AUD/USD is still below the long term average of 77.5US cents.

- Historically the AUD/USD has traded between 62-92US cents for 70% of the time.

- Movements below 48US cents or above 107US cents would be considered extreme, trading outside this range for less than 5% of the time in the last two decades.

The Detail

On a conference call this morning I was asked to put out a quick update on the recent Australian dollar movements and the risk this may pose to some of our key agricultural commodity exports, such as wool. It may not be well known but I started my career trading currencies, spending time on the Australian dollar trading desk for a major Australian bank both domestically and in London.

After a sharp sell off on the back of Covid-19 and global growth concerns earlier in the season the Australian dollar has staged a strong recovery. Indeed, since the seasonal lows below 58US cents seen in March 2020 the Australian dollar to the US dollar (AUD/USD) has improved nearly 30% to hit an 18 month high this week above 74US cents.

While this bounce in the AUD/USD is impressive, the currency is yet to get above the long term average level of 77.5US cents. Taking a look at the last two decades of AUD/USD movement we can see that 70% of the time the Australian dollar has traded between a 62-92US cent range. This region could be considered the “normal trading range” for the Aussie dollar.

From an export perspective an AUD/USD under 60US cents generally starts to make our commodities look more competitive on the global marketplace. Meanwhile, it isn’t until we start heading over 90US cents that the high currency values start to hurt our export sector. Mind you, a higher AUD/USD isn’t all bad news as it can make imported inputs such as fertiliser, fuel and machinery a bit cheaper.

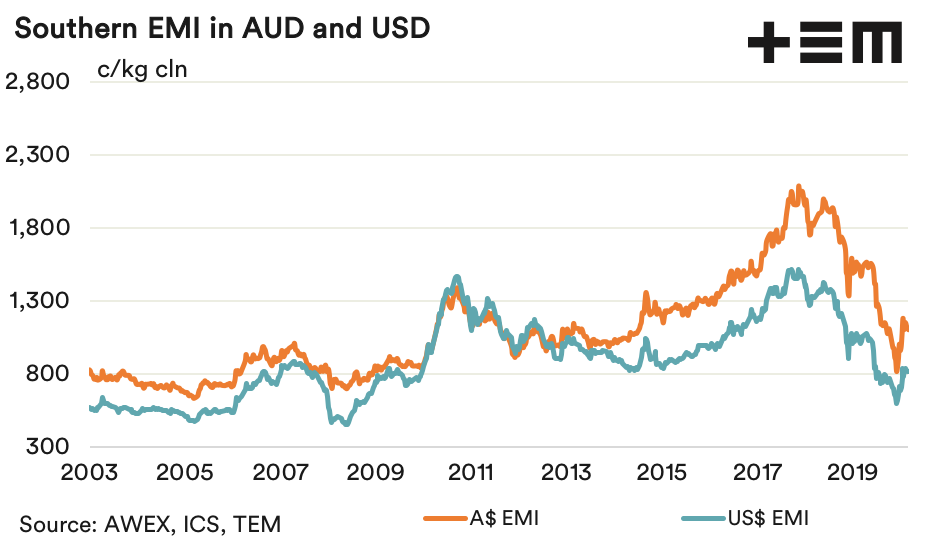

Wool prices in Australian dollar terms have eased 30% since the start of 2020, so the appreciating Australian dollar hasn’t impacted the offshore competitiveness of wool with the price in US$ terms still declining 24% since the start of the year.

Comparing the US$ wool price on percentile terms since 2003 highlights the limited impact of the appreciating Aussie dollar on this commodity for the current season.

While there has been a recent rebound wool prices in US$ terms, they are still sitting at the 40th percentile and remain at the lowest percentile levels in more than a decade.

Looking at the current record high prices for cattle and sheep we can acknowledge that the appreciating Australian dollar isn’t ideal, as this is adding pressure on export competitiveness in these markets. However, from a historic perspective the AUSD/USD isn’t really at extremely high levels at the moment. So the real blame for our uncompetitiveness on a global sphere for beef and sheep meat has to be laid at the foot of our tight supply and the exceptional season, fuelling the restocker demand.

As the historic AUD/USD pattern shows, movements below 48US cents and above 107US cents are what would be considered extreme – and we aren’t anywhere near parity with the US dollar yet. Given the relatively high interest rate levels within Australia (I know we are at record lows, but compared to offshore economies interest rates the Australian rates are still high) and the prospect of a rebounding economy into 2021 due to our limited Covid-19 spread, there is a good chance the AUD/USD will continue to appreciate into the coming year.

Don’t be surprised to see an AUD/USD into the high 70US cent region or even above 80US cents in the later part of 2021. During the 2008 Global Financial Crisis the Australian dollar was sold aggressively initially, but then rebounded strongly lifting above 90US cents and over parity into 2011, once it was clear our economy was continuing to outperform other nations. Although, from an export competitiveness perspective we shouldn’t be hitting the panic button until we start to see the AUD/USD reaching above 90US cents, and that is a long way off at the moment.