Market Morsel: Agriculture under or overappreciated?

Market Morsel

At EP3, we like to delve into the data. There has been a lot of action in markets over the past couple of months, especially in commodities.

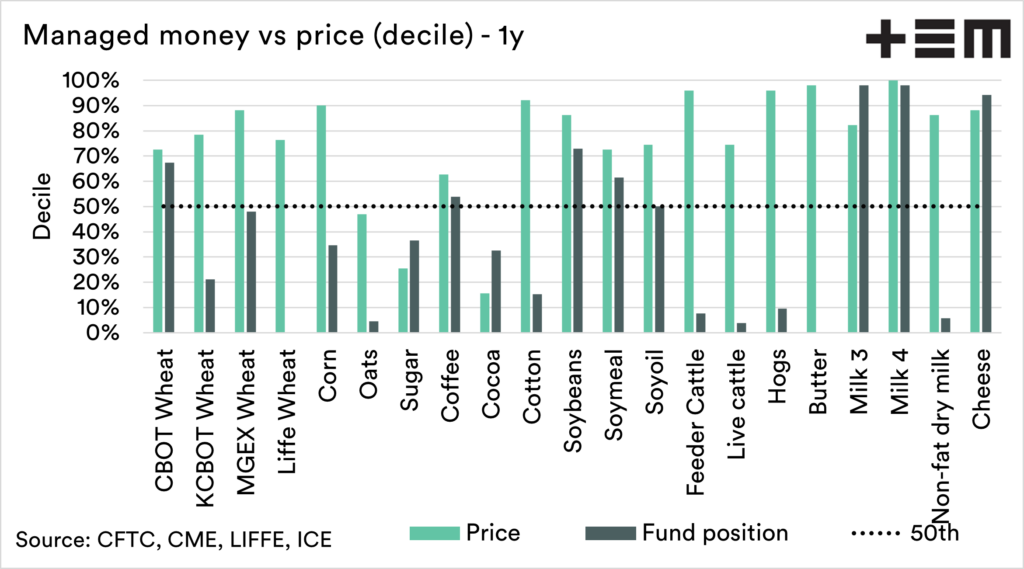

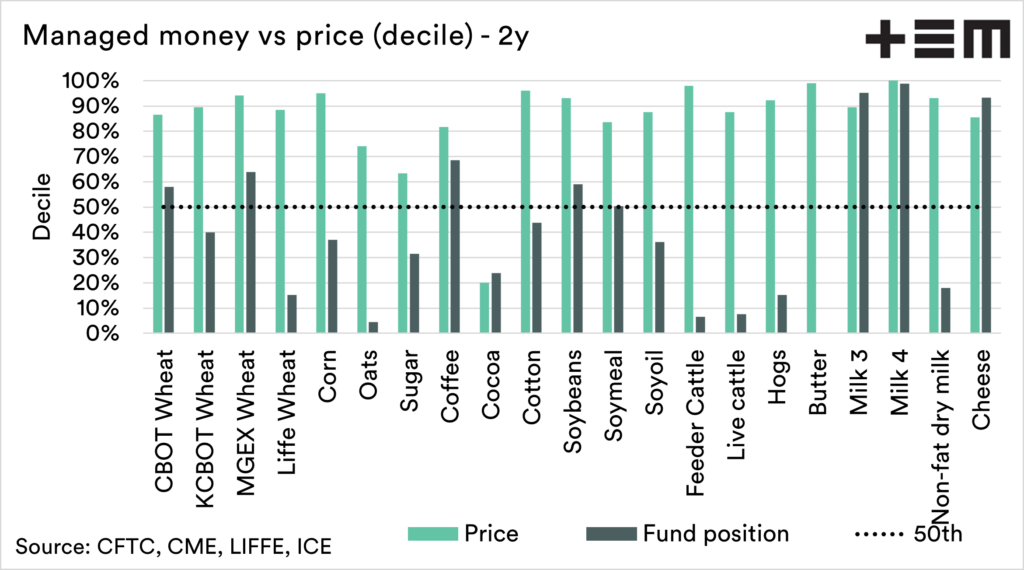

It has been some time, since I wrote about the ‘deciles of commitment’. This analysis takes a look at the deciles of pricing of a commodity vs the position of speculators.

This might sound a bit complex, but it’s not. Trust me.

Let’s start with what a decile is. A decile is a measure of the price (or other data point). If a decile is at 100% it hasn’t been higher. Conversely, it’s never been lower if it’s at 0%. So in it’s simple terms, if the price is at a high decile, it is expensive.

In this analysis, we are comparing the decile levels of the price, but also the positioning of speculators in the market (see here).

If the speculators are at a high level then they are effectively well bought, and at a low level, they have a shorter position.

What is the point of this exercise? This analysis can provide insights into the state of commodities and whether there is an opportunity.

If we look through these commodities, we can see some examples of interesting relationships.

Milk 4. This commodity is at a high price but also has a high net long position

Feeder Cattle. The feeder cattle at a high price, but the speculator position is at low levels.

Interpretation is everything, and we’ll leave that to others to make their decision. I could be viewed that milk 4 is overvalued and overbought. Feeder cattle could be overvalued and overbought.

Does that prompt speculators to pump some cash into the underbought commodities?