Market Morsel: Are EU looking in the wrong place?

Market Morsel

There is a lot of focus on the EU as a market for Australia, at the present time, negotiations are in process for a free trade agreement. However how important is it for Australian agriculture?

I thought I would take a quick cursory look at our trade with the EU. It’s a great place for a holiday, but is it an important market for trade in agricultural produce?

Total Trade

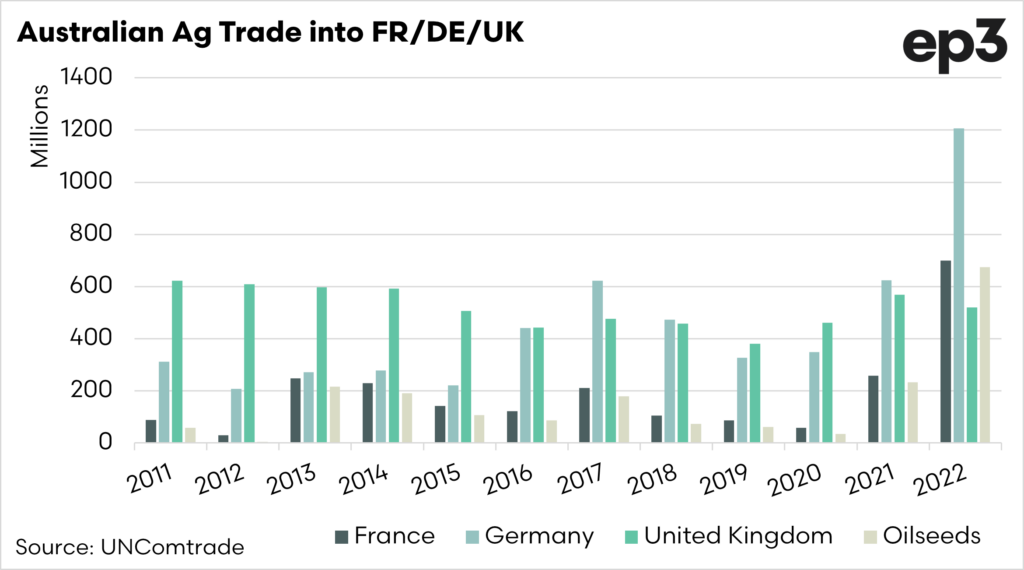

The chart below shows the total trade across a selection of agricultural* commodities since 2011. Whilst the UK is no longer in the EU bloc, I have included them for comparison.

2021 and 2022 have seen strong growth in agricultural trade into these nations. However, the majority of the increase is attributed to the value of canola headed to the EU for biodiesel production. Whilst Europe will continue to be a strong buyer of Australian canola, but external factors have contributed to our strong canola trade during this period.

- Volumes available globally were lower, with the drought in Canada and reduced availability from Ukraine.

- Australia produced two bumper crops.

- Australian canola prices were lower than the rest of the world.

- Reduced production in Europe.

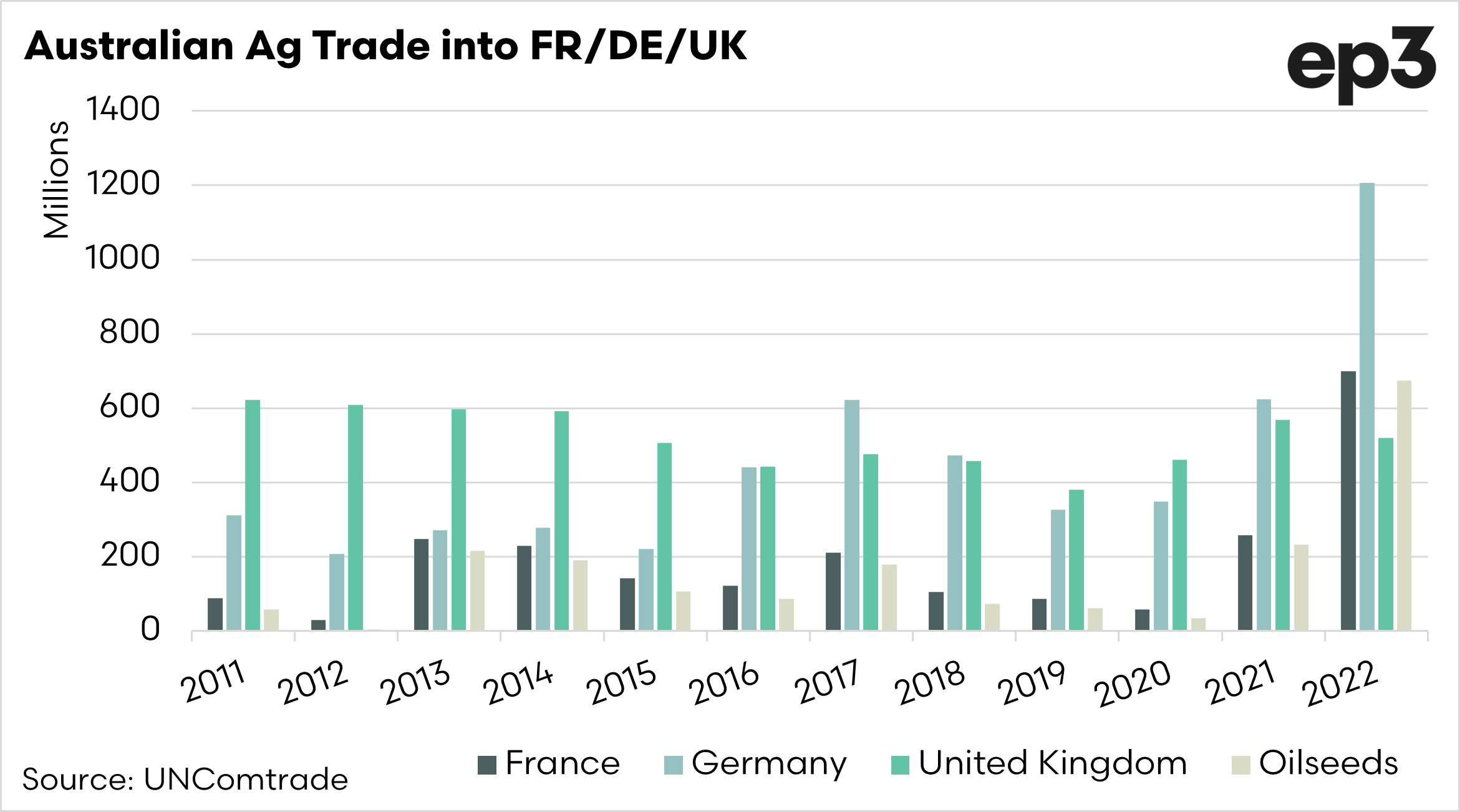

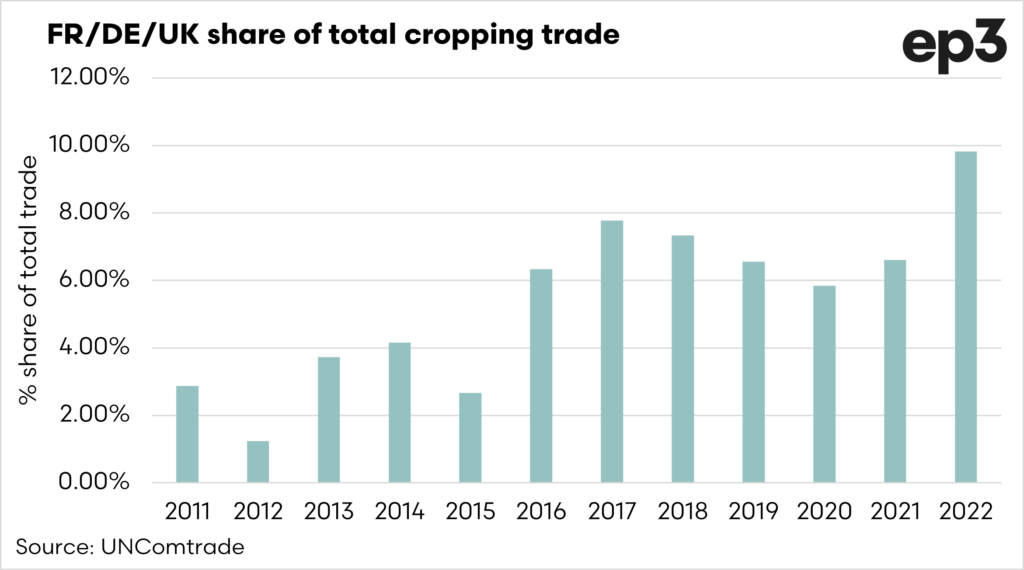

The second chart below shows these nations as a share of our overall trade in agricultural produce, on average 4%.

*Beverages, spirits and vinegar, Cereals, Cotton, Fish and crustaceans, Fruit and nuts, Meat, Oilseeds, Sugars, Vegetables, Wool

Sheepmeat

The Australian sheepmeat industry will be going through a lot of change in the coming years as the live export industry is shuttered. We will need to find new markets. Whilst nations in the middle east may switch to more boxed meat, we can see from previous experience that when our trade is closed down in live sheep, our customers purchase live sheep from other origins.

I wrote about this last June in the article ‘What do barley and live sheep have in common?‘. When the live sheep trade is closed, I imagine our existing customers will switch their flows to other origins. We will need to find new markets. Is the EU that market?

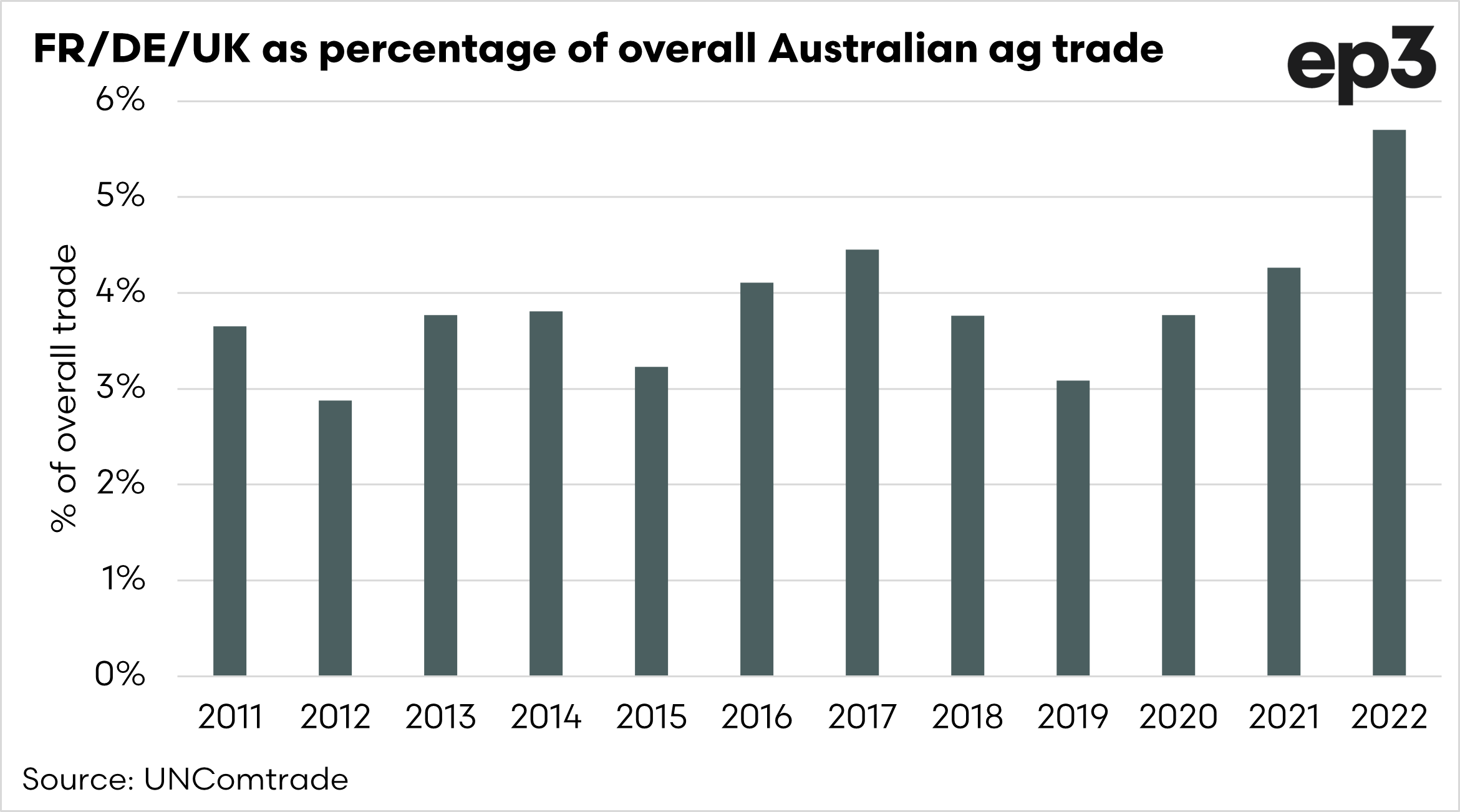

Let’s look at the details. The chart below displays the total trade of sheep (incl lamb) and goat meat into Europe from Australia as a percentage of our overall world trade.

Since 2011, on average, these three nations have contributed to a whopping 4.01% of our trade, with the majority being to Great Britain. France and Germany have each accounted for less than 0.5%.

The trade into France and Germany is barely a blip on our trade. As a nation we need to ensure that we do not change our productive farming practices in order to gain access to a European market which is meagre at best.

Grains/oilseeds

What about grains and oilseeds?

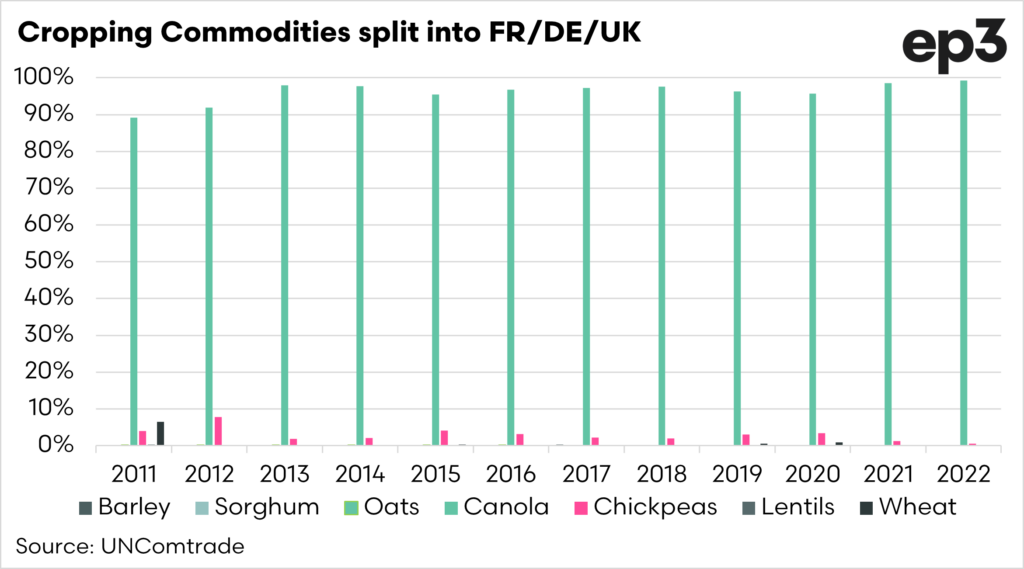

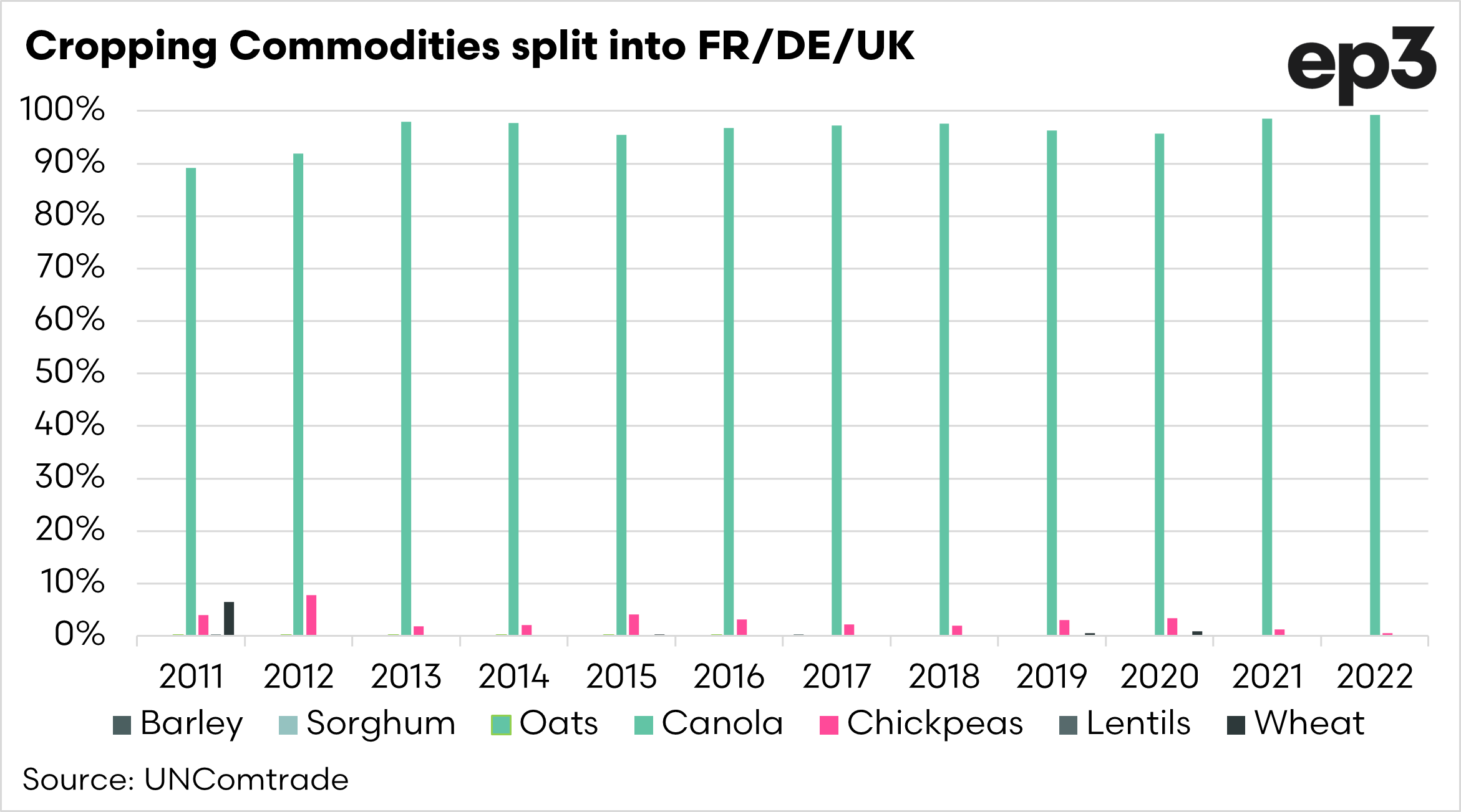

The trade of grains and oilseeds with these nations has grown in recent years. On average since 2011, it has been 5.4%, but last year hit 9.8%.

However, we shouldn’t really call it the grain trade in these countries. It is really the canola trade. The second chart shows the split of values for each commodity. Overwhelmingly the value is held in canola. On average the split of value has been 96% to canola. So when we talk about trade of grains into Europe, we are really discussing canola.

*Barley, oats, sorghum, chickpeas, lentils, wheat and canola.

Summary

We believe in free markets at EP3, and opening more doors is always good. However, there are caveats to that, especially regarding the European Union.

The European Union have policies in place and proposed to ensure that those with trade agreements follow strict controls and in some cases adhere to the same production practices as Europe.

We have to be careful that we don’t remove productive practices from our systems to chase a unicorn that might not provide all that much value.

At the moment, and well into the future, we are unlikely to produce enough food to meet all the demand in our own region.