Market Morsel: Wood is in-tree-guing.

Market Morsel

Lots of assets are going crazy at the moment. One of them is an important one and is technically an agricultural product – wood. I thought it was important to branch out to cover this, as the wood market has logged some major gains in recent times.

As someone hailing from both a building and a forestry family, the importance of lumber is not lost on me.

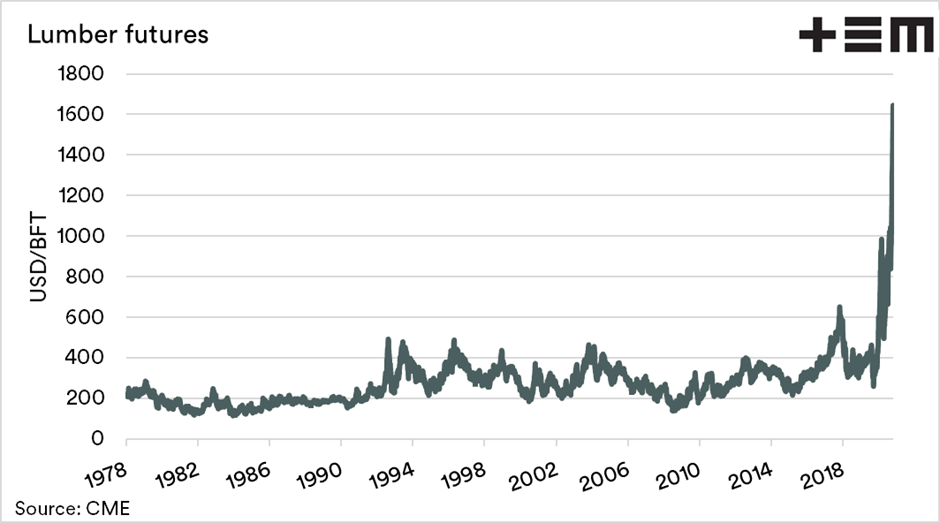

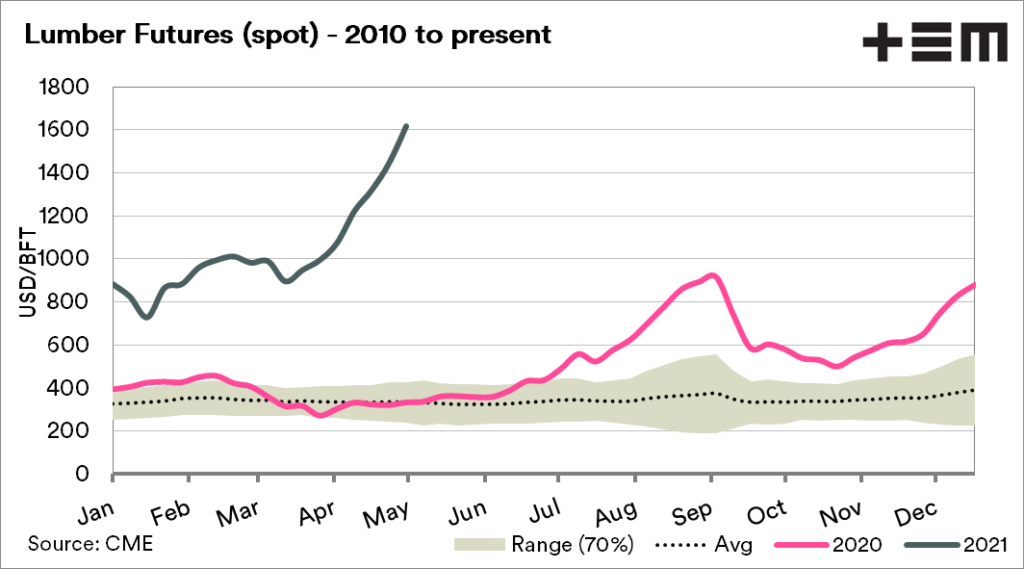

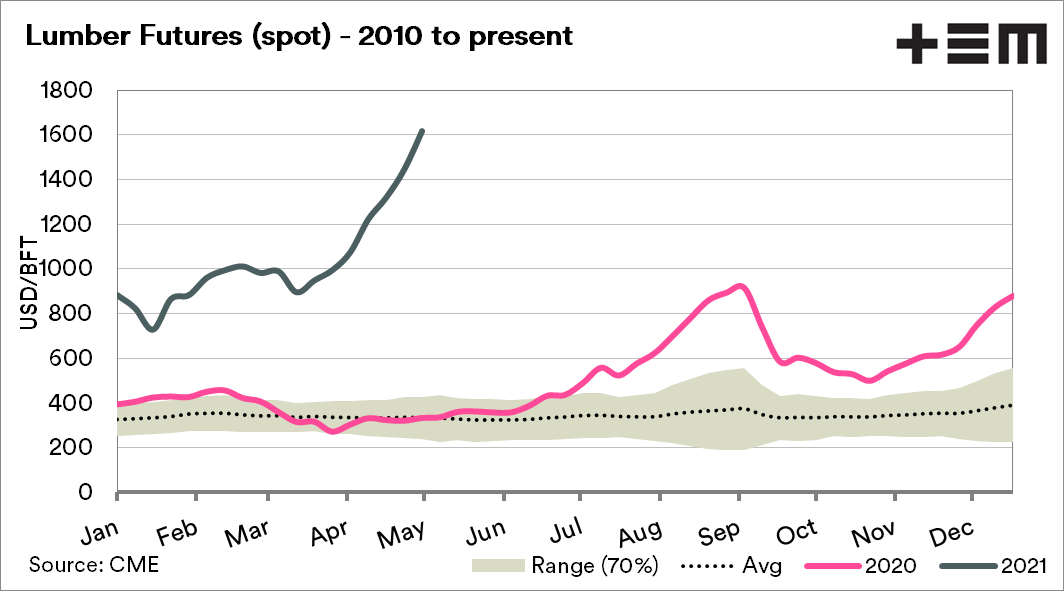

The market for lumber has gone barking mad. The first chart shows the price for lumber futures from 1978 to the present. The lumber price has gone through the roof to generational records.

The root cause has been covid (yet again), resulting in strong demand for DIY projects and new build houses. The result is that the cost of housing is increasing, potentially pricing some buyers out of the market.

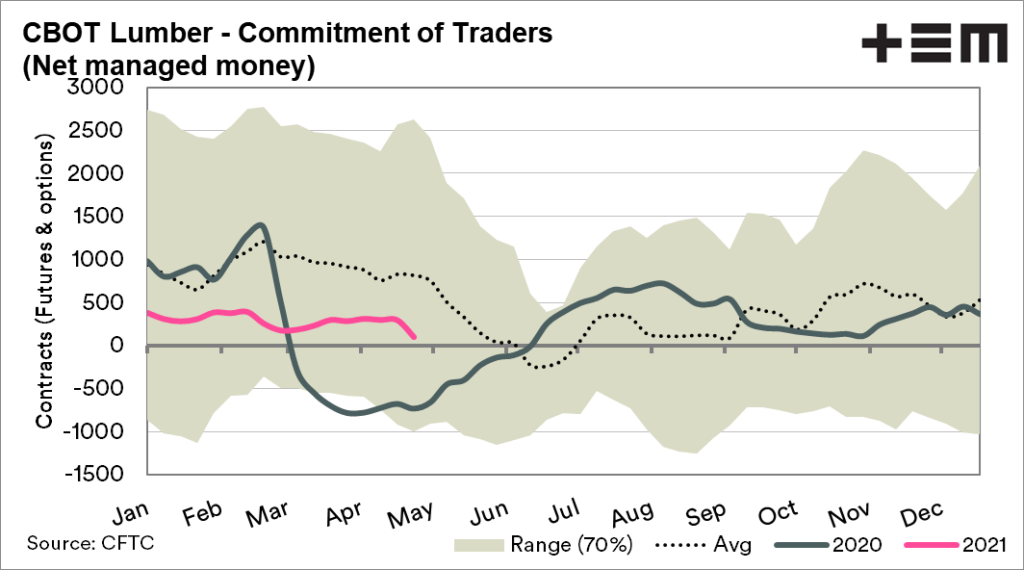

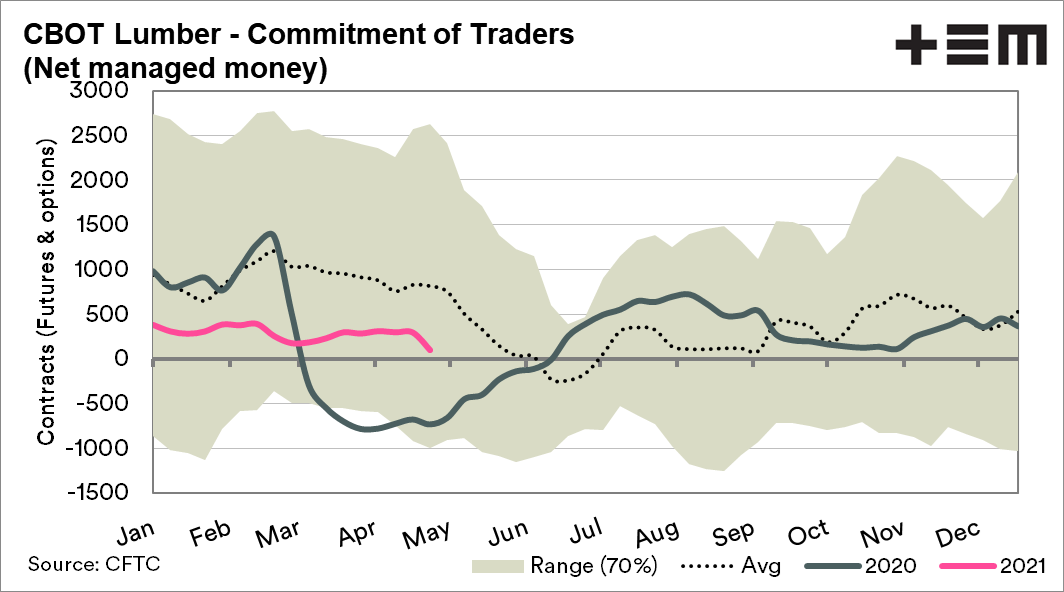

Speculators: The speculators in the market have not significantly impacted the market and are only narrowly long.

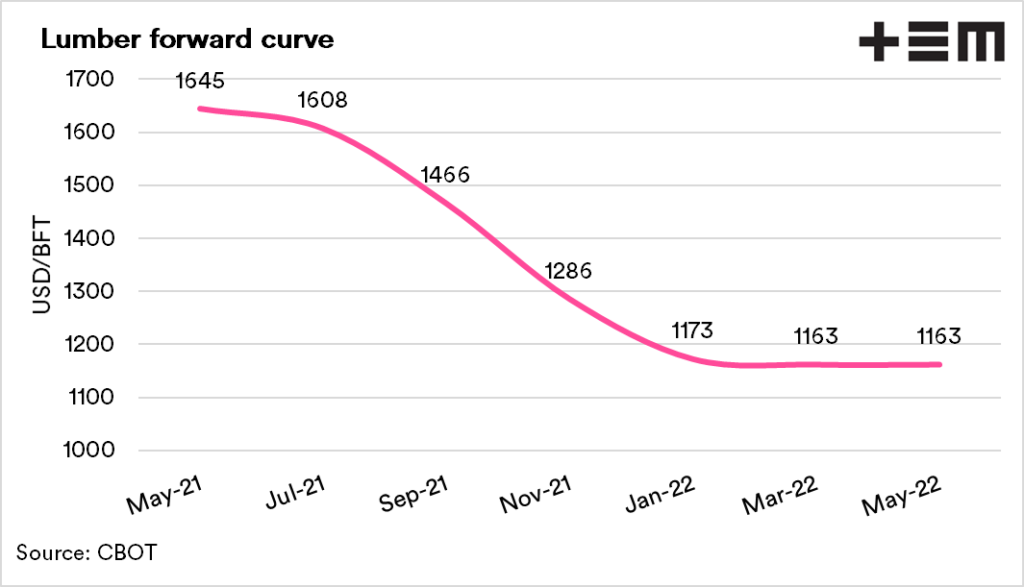

Forward curve: The market is heavily in backwardation (or inverse) where the market offers a hefty premium to forward contract periods.

The market is heavily inflated. Any wood purchases for fencing or that new shearing shed are likely to be substantially higher than previous levels. It might be worthwhile waiting for corrections before outlaying for unnecessary works.