Rushin’ to a sanction

The Snapshot

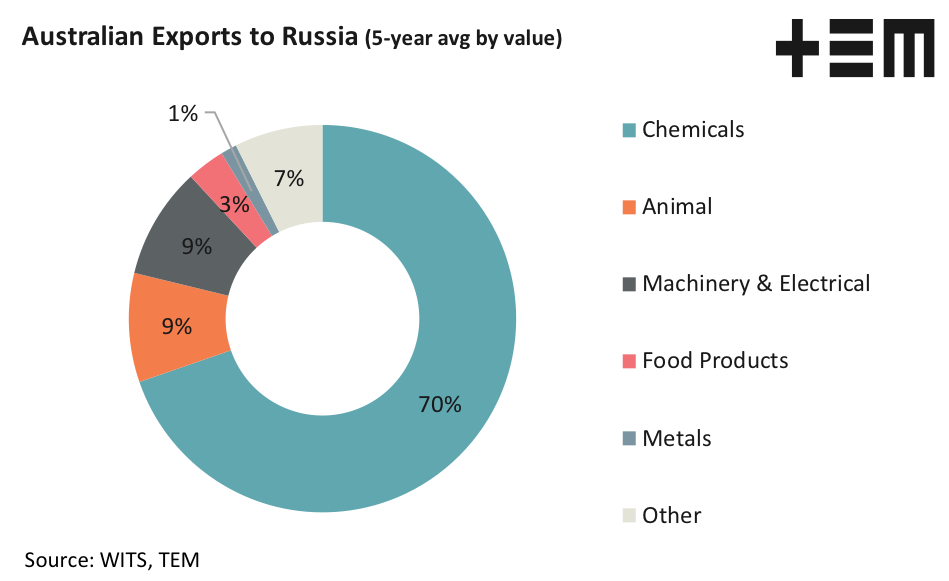

- Australian exports to Russia are largely in the chemicals sector with 70% of our export flows captured via this trade, mainly comprising of aluminium oxide.

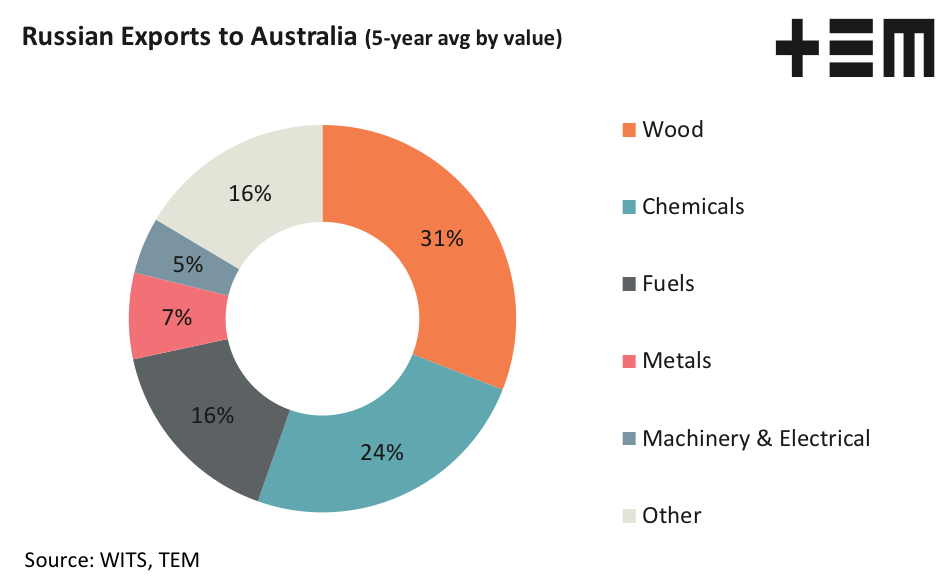

- In terms of Russian imports into Australia the trade mix is a little more balanced with wood products, chemicals (mainly fertiliser) and fuels (mainly crude petroleum) making up the top three trade sectors during most years at 31%, 24% and 16%, respectively.

- On average import flows from Russia to Australia account for about 0.1% of total imports into Australia. Meanwhile flows of all products and services out of Australia to Russia account for about 0.2% of total Australian export flows.

The Detail

As the situation deteriorates between Ukraine and Russia the prospects of prolonged trade sanctions are emerging so we thought it was an opportune time to assess the trade situation between Russia and Australia to see what sectors maybe impacted.

Australian exports to Russia are largely in the chemicals sector with 70% of our export flows captured via this trade. Drilling into the data shows that it is mainly aluminium oxide exports that make up the bulk of our chemical exports to Russia on any given year. Aluminium oxide is predominantly used in the production of aluminium.

While the export of aluminium oxide is a significant proportion of Australian trade with Russia, they aren’t our biggest trade partner for this product and are generally less than 10% of our total trade in this chemical. Around 50% of Australian aluminium oxide is exported to Asia.

The next largest trade category from Australia to Russia is animal exports at around 9% of the total export trade, which are mostly live cattle. Anyone that follows the live cattle trade will know that Indonesia, Vietnam and China dominate the trade out of Australia, most seasons Russia are about 3-4% of the Australian live cattle trade.

In terms of Russian imports into Australia the trade mix is a little more balanced with wood, chemicals and fuels the top three trade sectors during most years. Wood products from Russia mainly includes wood for construction and carpentry purposes and has averaged about a third of the total trade from Russia to Australia.

Chemicals imported into Australia from Russia mainly comprise of nitrogenous fertilisers and sulfates, with the chemical trade usually consisting of around a quarter of the total Russian imports into Australia.

The volume of fuels imported from Russia can be a bit variable year on year, averaging around 16% of the total Russian import trade. Fuel imports from Russia mainly consist of crude petroleum product.

These top three trade items from Russia are pretty crucial for many industries within Australia, so it begs the question how much does Australia rely on this source.

In terms of total carpentry wood imported into Australia the volumes coming from Russia are around 8% of the trade. South East Asia is the dominant supplier of this type of wood product to Australia, usually holding around 50% of the market share.

In recent years the market share of Russian nitrogenous fertiliser into Australia accounted for about 5% of total imports, but prior to 2017 was nearly non existent. The bulk of nitrogenous fertiliser into Australia comes from the Middle East with Saudi Arabia, Qatar, UAE and Kuwait featuring heavily. In the Asian region China, Malaysia and Indonesia are also important suppliers to Australia.

Crude petroleum imports into Australia are dominated by the South East Asian and Middle Eastern regions. On average imports of Russian crude petroleum into Australia is less than 5% of our total trade in this fuel type.

When assessing total Australian trade volumes with the entire world across all products and services Russia is a minnow. On average import flows from Russia to Australia account for about 0.1% of total imports into Australia.

In terms of Australian exports, flows of all products and services out of Australia to Russia account for about 0.2% of total Australian export flows. From this perspective, we shouldn’t be too concerned about any direct trade issues arising from a rush to sanction Russia.

It is worthwhile to note that while the Russian Australian trade flows are relatively minimal Russia is a big global player, so sanctions could still have an indirect impact on Australia in some sectors if Russian supply chain distortions from exports/import sanctions disrupt other markets and trade participants that Australia relies upon.