The need for feed

The Snapshot

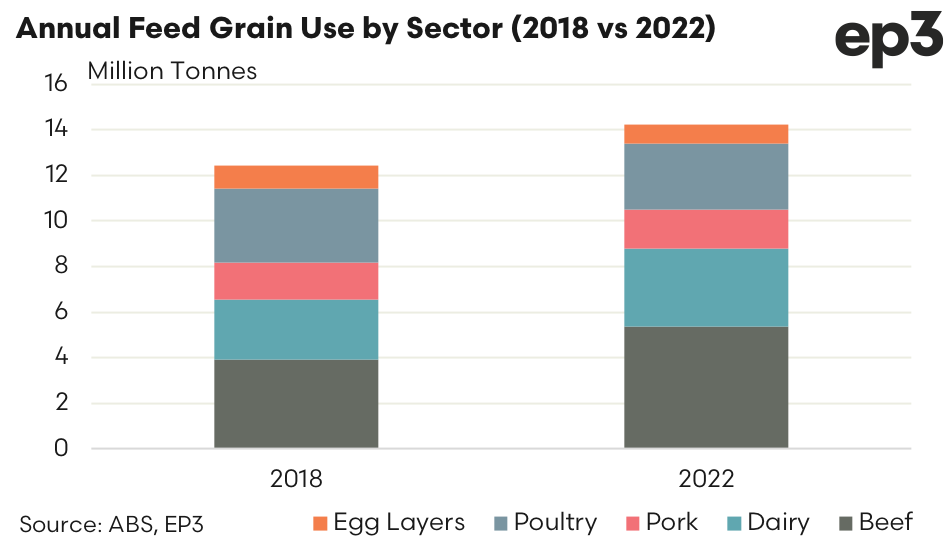

- Modelling has shown that the total domestic feed requirement has increased by around 15% from 12.4 million tonnes in 2018 to 14.2 million tonnes in 2022.

- The beef feedlot industry has seen the biggest increase in feed demand since 2018 with a 37% lift in volumes to 5.4 million tonnes in 2022.

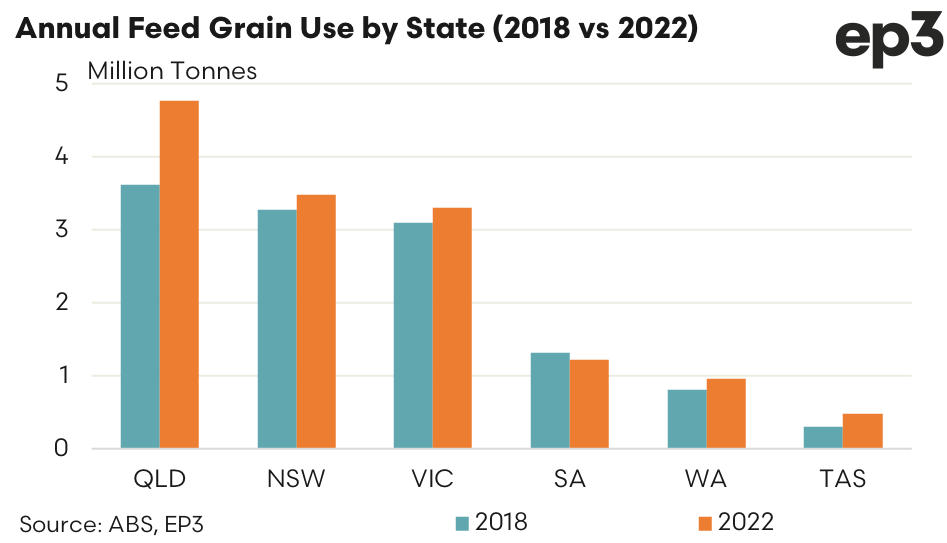

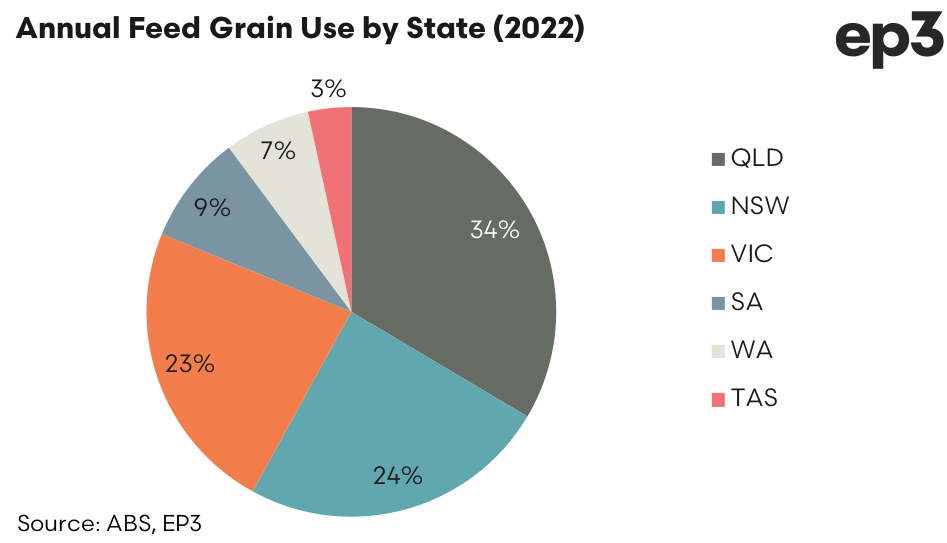

- Annual feed demand in Queensland, NSW and Victoria accounts for around 81% of total domestic feed demand requirements.

The Detail

The team at Episode 3 have been busy modelling estimated annual feed grain requirements for a selection of livestock industries within Australia, based upon livestock numbers, production levels and feed conversion ratios from the beef feedlot sector, the dairy industry, along with the pork, poultry and egg producing industries.

In 2018 it was estimated that the total feed requirement for these five industries combined was around 12.4 million tonnes. Modelling for the 2022 season has shown that the total domestic feed requirement has increased by around 15% to 14.2 million tonnes.

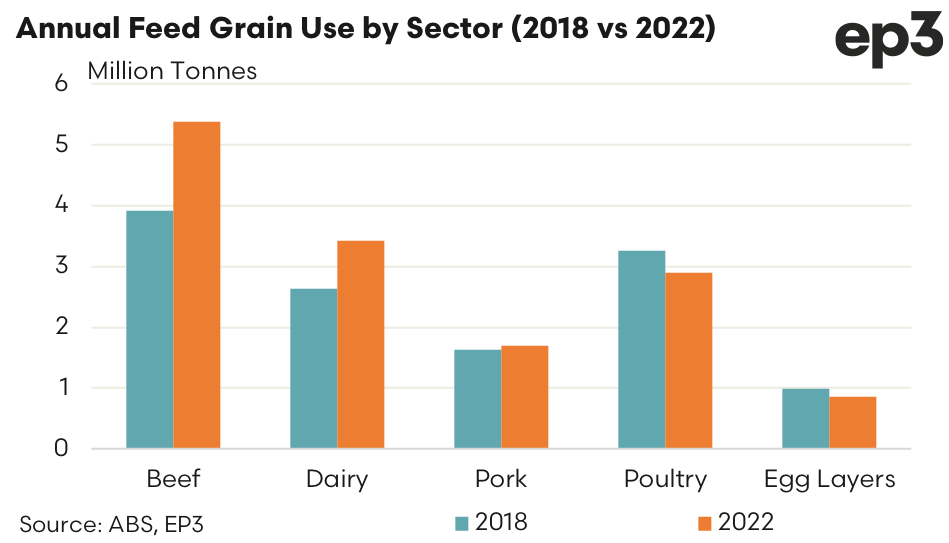

Analysis of the percentage change in feed demand across sectors shows that the beef feedlot industry has seen the biggest increase in feed demand since 2018 with a 37% lift in volumes from 3.9 million tonnes per annum to nearly 5.4 million tonnes in 2022. The national dairy sector has seen feed demand rise by around 30% from 2.6 million tonnes in 2018 to 3.4 million tones this year.

The pork industry has seen a 4% lift in feed demand since 2018 to hit nearly 1.7 million tonnes this year. Meanwhile, improved feed conversion ratios in the poultry and egg laying sector have seen feed demand soften. Estimated annual feed requirements for the poultry sector have eased 11% from 3.2 million tonnes to 2.9 million tonnes. The egg producers are estimated to require 0.86 million tonne this year, down 13% from nearly 1 million tonne in 2018.

The high concentration of beef feedlot operations in Queensland and the strong lift in beef feedlot demand for grain from 2018 to 2022 have underpinned the increase in total feed demand across all sectors with volumes increasing 32% from 3.6 million tonnes to nearly 4.8 million tonnes. At this level total feed demand in Queensland represents 34% of the national demand volumes.

Feed demand in NSW and Victoria have lifted 7% apiece over the 2018 to 2022 period. NSW feed volumes, across all sectors have increased from 3.3 million tonnes per annum to 3.5 million tonnes, which equates to 24% of the total annual national feed demand. Meanwhile, Victorian annual feed demand increased from 3.1 million tonnes in 2018 to 3.3 million tonnes in 2022, representing 23% of the total national feed demand requirements.

South Australia, was the only state to see a decline in estimated feed demand from 2018 to 2022 with volumes down by 7%. Feed requirements across all sectors in SA totals 1.2 million tonnes in 2022, which equates to 9% of the national feed demand estimates.

Western Australian annual feed demand for 2022 is anticipated to be nearly 1 million tonnes, which is 9% of the national feed demand requirement. Meanwhile, Tasmanian estimates across all sectors have lifted from 0.3 million tonnes in 2018 to nearly 0.5 million tonnes in 2022, which accounts for just 3% of the total national annual feed requirement.