What’s at risk?

The Snapshot

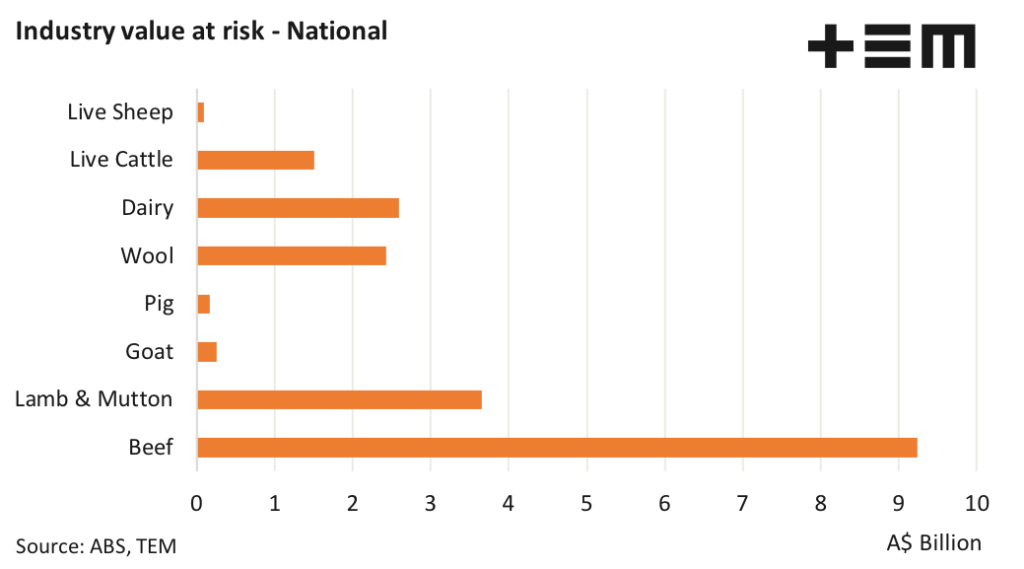

- The total national export value at risk of an FMD incursion and subsequent trade ban across all sectors reaches A$20 billion.

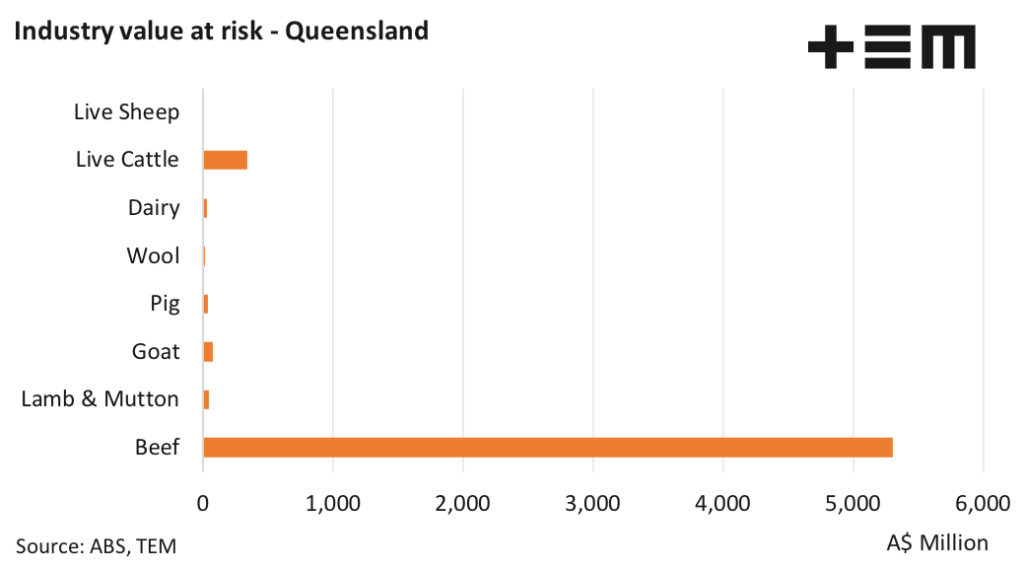

- The value of beef export sector in Queensland sits at around A$5.3 billion, meanwhile live cattle comes in at around A$343 million.

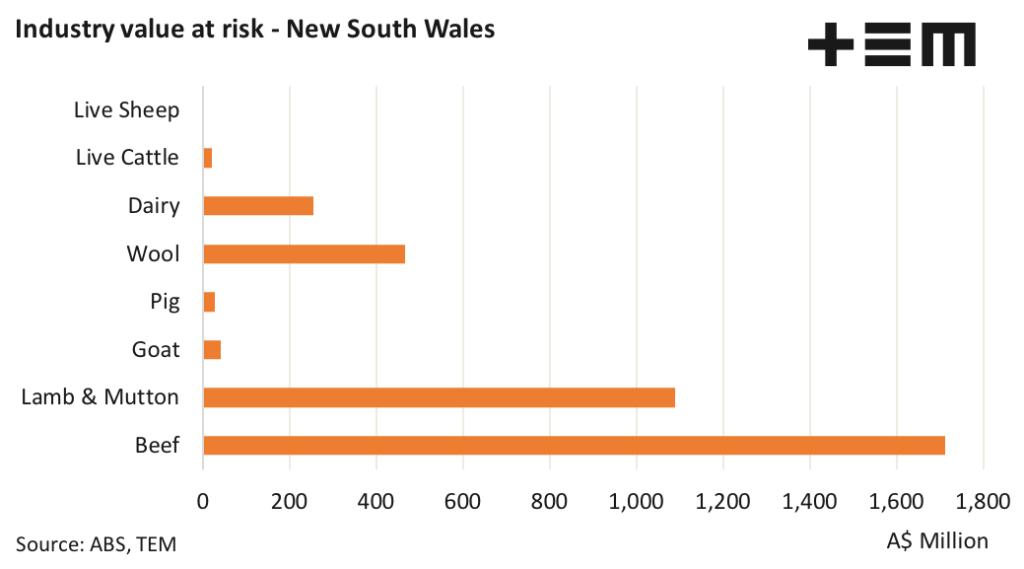

- The beef export trade in NSW is valued at A$1.7 billion and their sheep meat exports sit at nearly A$1.1 billion.

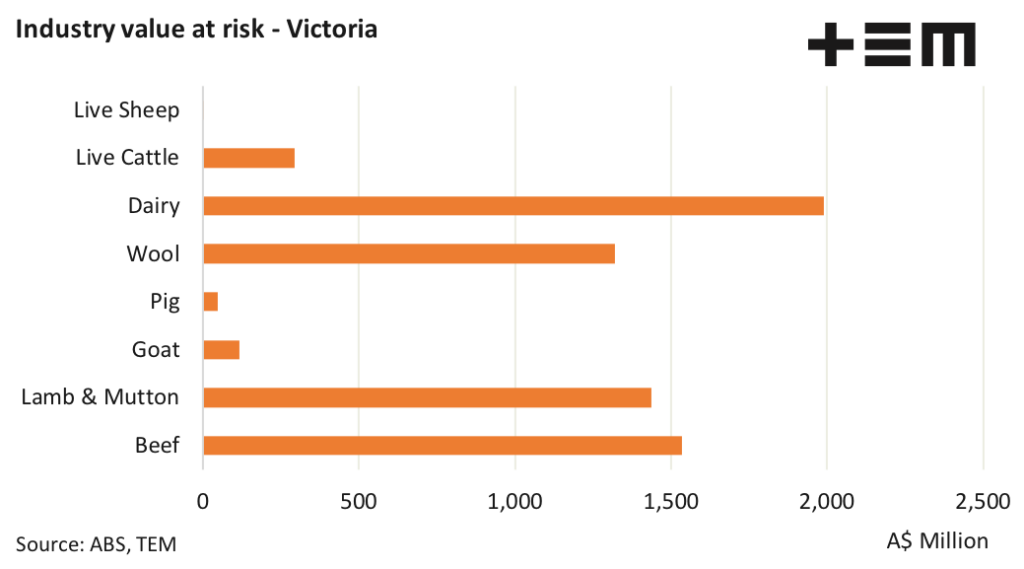

- In Victoria the dairy sector tops the risk profile at nearly A$2.0 billion of export value.

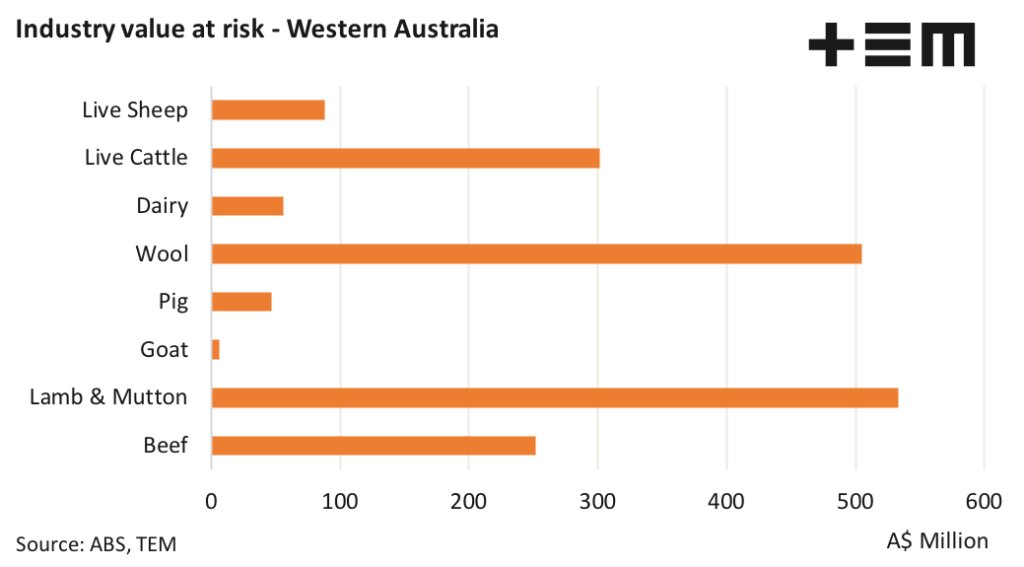

- In WA, boxed sheep meat exports and wool are neck and neck for being most at risk, sitting on A$533 million and A$505 million, respectively.

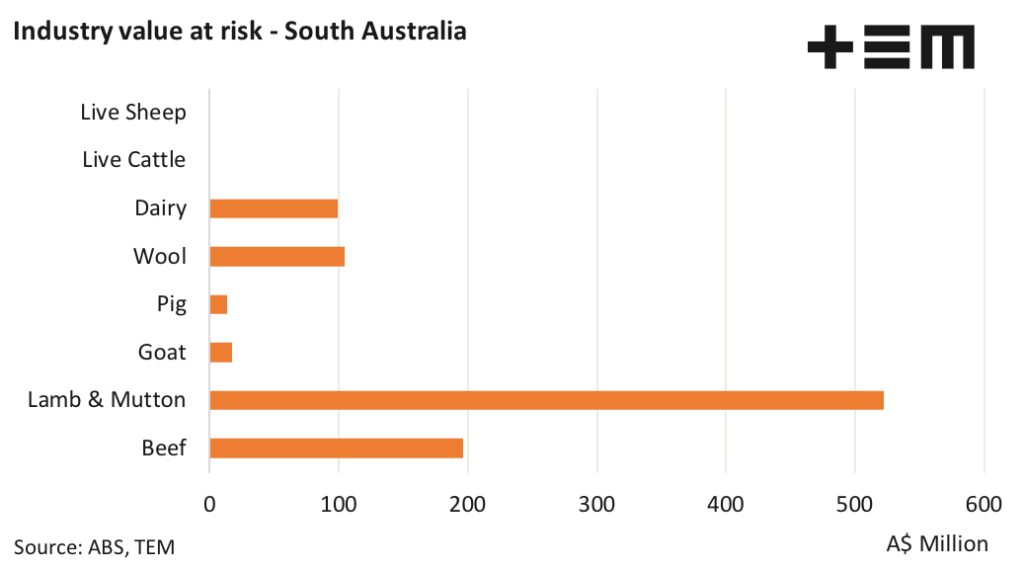

- The South Australian sheep meat export sector has the most to lose in an FMD trade ban with a value of A$522 million at risk.

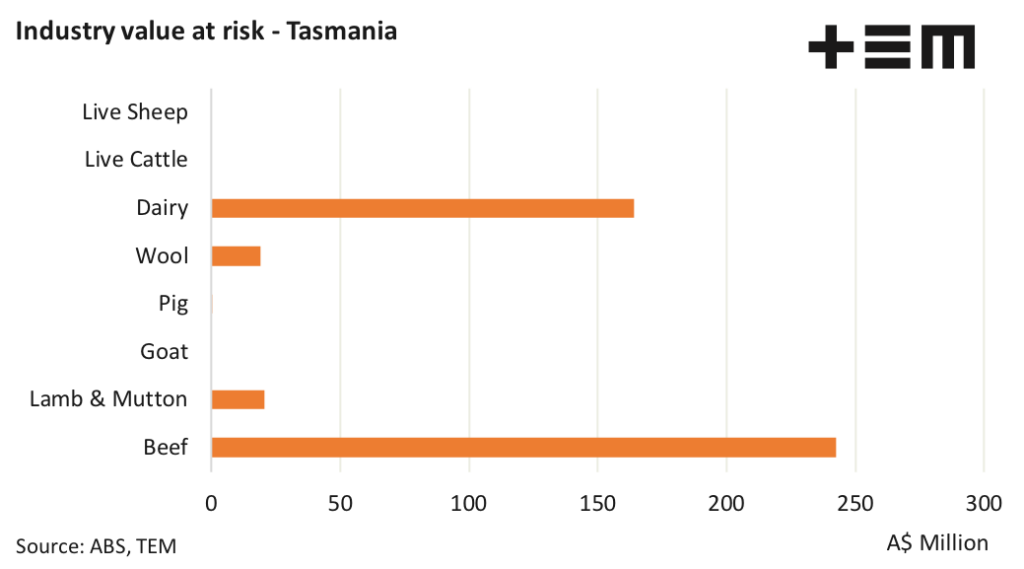

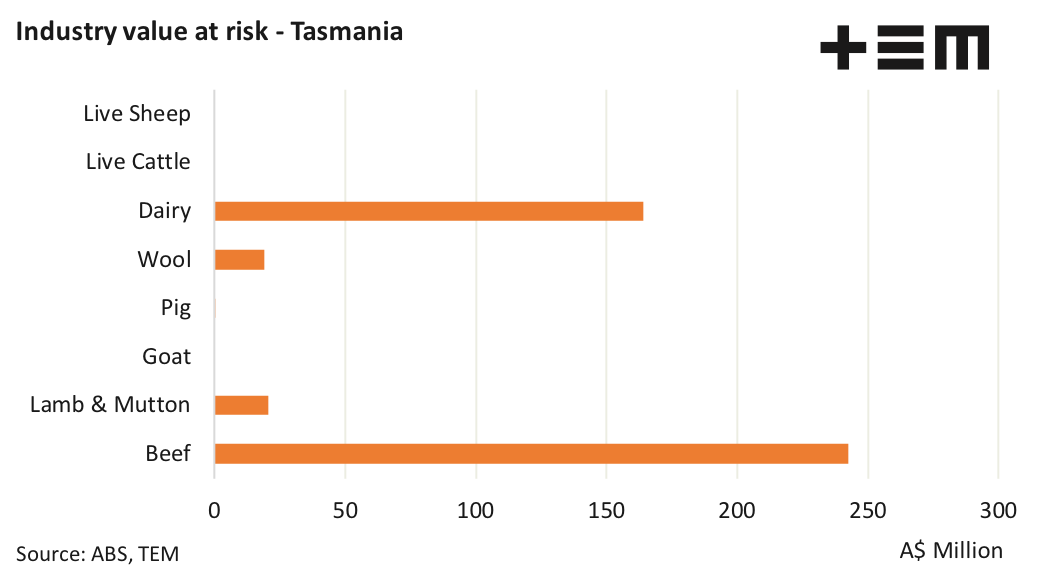

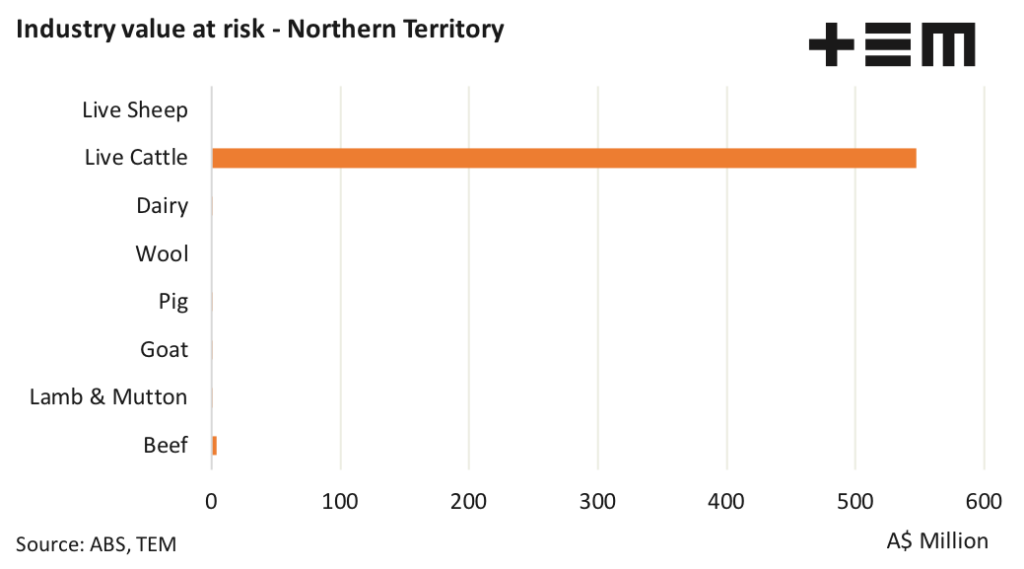

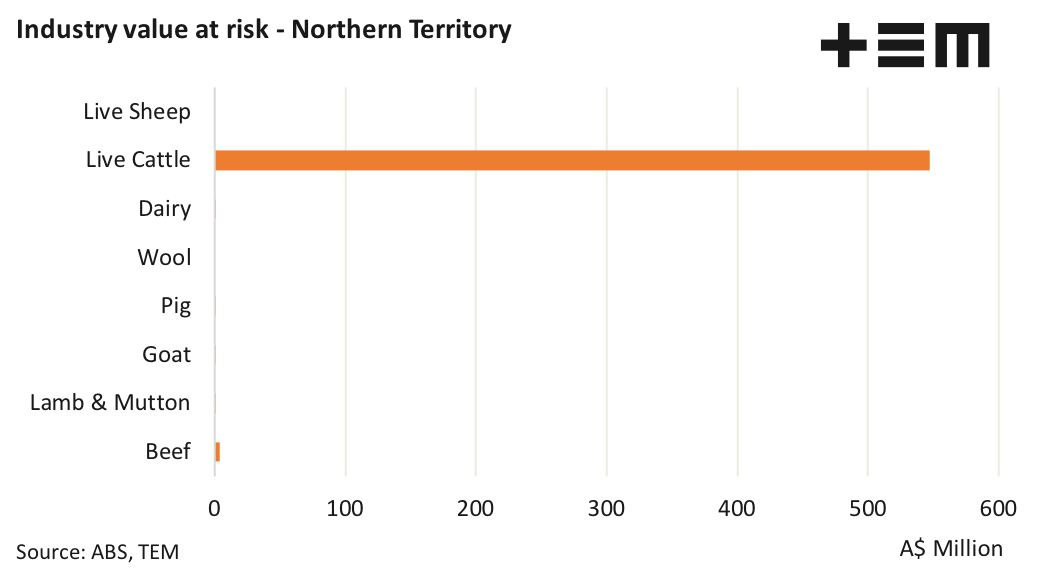

- Tasmania’s FMD risk profile is dominated by beef exports and dairy, at A$242 million and A$164 million. Meanwhile the Northern Territory is almost exclusively a live cattle export affair with A$547 million at risk.

The Detail

There has been a lot of discussion about the risk of Foot and Mouth Disease (FMD) getting into Australia. While we need to stress that the risk is relatively low, assessed recently at an 11.6% chance in the next five years, what would be at risk from an export value perspective if it got in and exports were banned?

We analyse the value of the trade data for FY2020/21 across a range of agricultural sectors that would be impacted by a trade halt, including; the live export sector, dairy, beef, sheep and goat meat, pig meat and wool exports.

Firstly on a national basis, the largest impact would be felt by the beef export sector with export values of A$9.2 billion over FY2020/21. Sheep meat exports come in next at around A$3.6 billion. Dairy, wool and live cattle exports are also impacted significantly on a national level at A$2.6 billion, A$2.4 billion and A$1.5 billion, respectively.

The total export value across all sectors nationally reaches A$20 billion.

A focus on individual state based exposure highlights that Queensland’s cattle sector, be it fresh, chilled or frozen boxed exports or live cattle, is the hardest hit. The value of beef export sector in Queensland sits at around A$5.3 billion, meanwhile live cattle comes in at around A$343 million.

New South Wales has a bit more of a diverse spread of risk, although still heavily weighted towards the boxed red meat trade. The beef export trade is valued at A$1.7 billion and sheep meat exports sit at nearly A$1.1 billion. Wool and dairy feature prominently too at A$466 million and A$254 million, respectively.

Victoria and WA are probably the two most evenly spread states when it comes to FMD risk across the agricultural sectors.

Victorian dairy tops the risk profile at nearly A$2.0 billion of export value. Victorian boxed beef and sheep meat are next in the firing line at A$1.5 billion and A$1.4 billion, respectively. The Victorian wool trade isn’t too far off the pace either at an export value of A$1.3 billion.

In WA, sheep meat exports and wool are neck and neck for being most at risk, sitting on A$533 million and A$505 million, respectively. Meanwhile, the Western Australian live cattle trade and the boxed beef export sector are in a tussle for second place (for a prize nobody wants to win) at A$302 million and A$251 million, apiece.

The South Australian sheep meat export sector has the most to lose in an FMD trade ban with a value of A$522 million at risk. Boxed beef is up there too at A$196 million, with wool and dairy straddling either side of the A$100 million mark.

Tasmania’s FMD risk profile is dominated by beef exports and dairy, at A$242 million and A$164 million. Meanwhile the Northern Territory is almost exclusively a live cattle export affair with A$547 million at risk.