Market Morsel: Show me the Australian dollars

Market Morsel

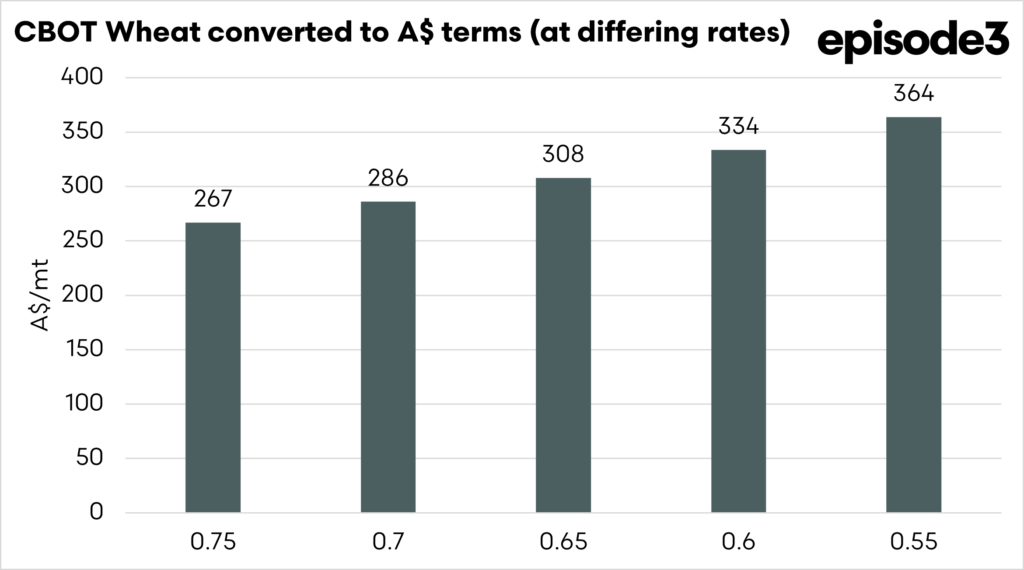

When the Australian dollar falls in value compared to the US dollar, it can be beneficial for wheat farmers in Australia. Wheat is sold globally in US dollars, so when the Australian dollar is weaker, farmers receive more Australian dollars for the same amount of wheat. For instance, if wheat sells for $300 USD per tonne, a weaker Australian dollar means farmers get more money when it is converted back to Australian dollars.

A lower Australian dollar also makes Australian wheat cheaper and more appealing to international buyers. This often increases demand, which can drive up prices for wheat in Australia. As a result, farmers can sell more wheat and receive a better price for it, improving their income.

However, farming costs can rise because many essential supplies, such as fertilisers and machinery, are imported and priced in US dollars. A weaker Australian dollar makes these items more expensive. Even so, the higher prices farmers earn for their wheat usually help offset these increased costs.

A falling Australian dollar is typically advantageous for Australian wheat farmers. It boosts their earnings from exports and helps them remain competitive in global markets, even if some of their expenses increase.

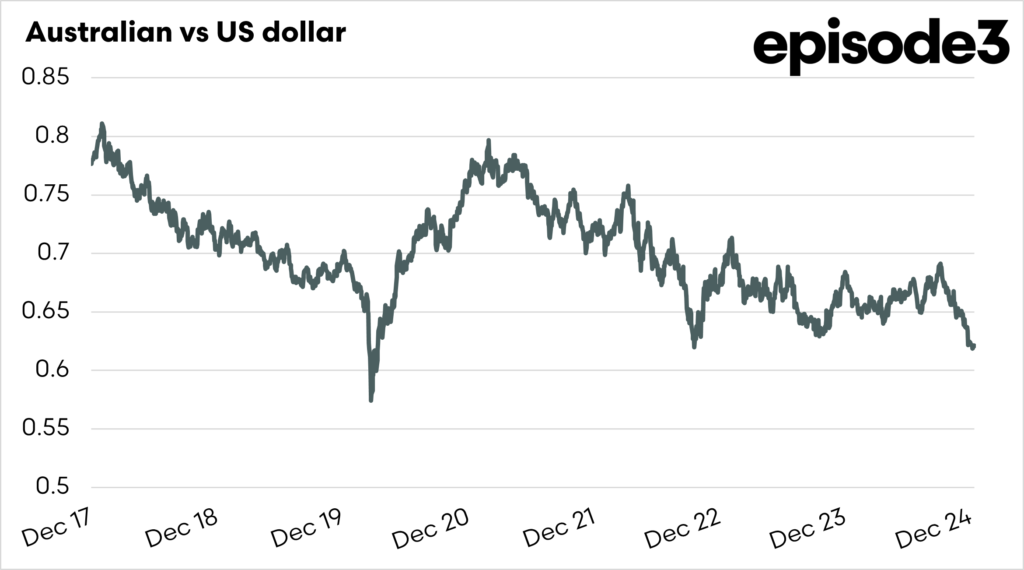

The Australian dollar is currently trading around 62c, the lowest since 2019 and 2020. This was a time when there were concerns about the US-Chinese trade tensions (we are reliant on China), then we had the impact of COVID.

The second chart below shows the current CBOT wheat value when converted into A$ terms at differing rates. This is just to highlight the impact of a change in exchange rates on the values that can potentially be passed onto farmers in Australia.