New Trump shipping rule could help Aussie grain

The Snapshot

- The US trade representative is looking to introduce significant fines on Chinese vessels.

- Vessels visiting the US with Chinese owners would get significant fines.

- Vessels visiting the US with non-Chinese owners but Chinese built vessels would be fined, based on the composition of their fleet.

- Fines are significant.

- It could cost an extra A$26.50 per tonne for a panamax of wheat, but could cost more.

- It could cost an extra A$1590 per container.

- It would be beneficial for grains as it would make US grain less competitive.

- On meat it would make our exports to the US more expensive, but also their exports.

The Detail

It seems like we are talking about Trump a lot at the moment, but that is because he is making so many changes to the shape of trade around the world through his policies. The tariffs have been big-picture ones, but another one that will have a large impact is his actions against shipping companies.

Trump is trying to protect American interests, and that is all very good, but we do live in a global economy. So, what is he doing in shipping?

Most of the world’s vessels are built in China, which has increased its global share significantly in the past twenty years. Ship building in the US, and the west in general has declined massively.

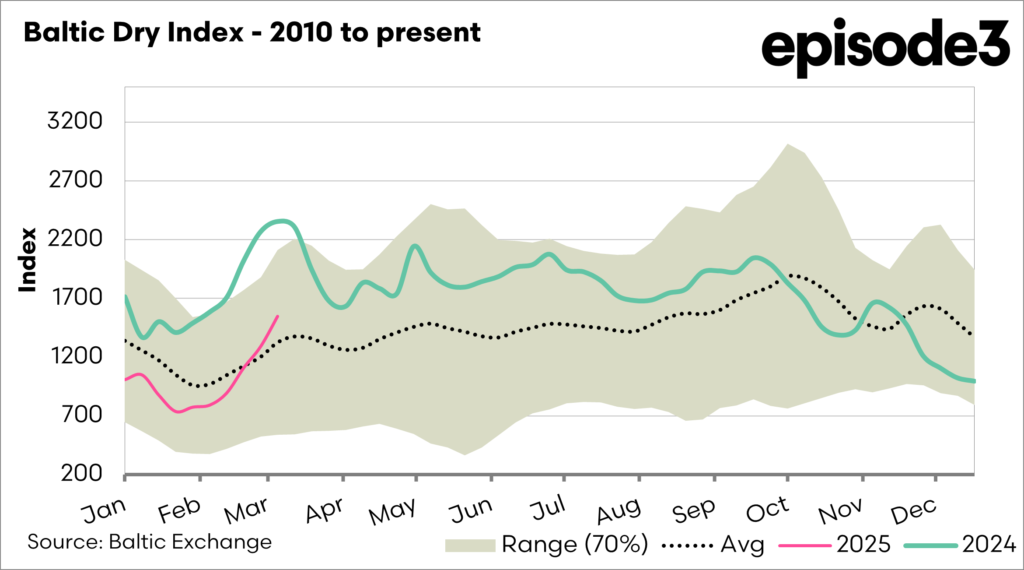

In a dataset which I pulled of vessel production orders for bulkers in recent years, which has 4708 bulk vessels. Construction orders for 3022 are in China, with 3 in the USA. This can be seen in the first chart below.

Trump wants to encourage importers and exporters to use US vessels and to start applying port fines to Chinese vessels. The fines are significant and will apply to vessels built in China, and also operaters with fleets comprised of Chinese vessels.

· Fee on Chinese Maritime Operators

- Up to US$1M per vessel entry to a US port or US$1,000 per net ton of capacity.

- Fee on Fleets with Chinese-Built Vessels

- 50%+ Chinese-built: Up to US$1.5M per operator or US$1M per vessel.

- 25–50% Chinese-built: Up to US$750K per vessel.

- Up to 25% Chinese-built: Up to US$500K per vessel.

- Fee on Future Orders from Chinese Shipyards

- 50%+ of orders: Up to US$1M per vessel entry.

- 25–50% of orders: Up to US$750K.

- Up to 25% of orders: Up to US$500K.

It is expected that these fines will be stackable and could lead to significant fines. Fellow analysts that we have spoken to who focus on freight markets have told us that fines could reach US3.5M in some cases.

The world shipping council estimate that these proposals could impact 98% of all ships that go to the US.

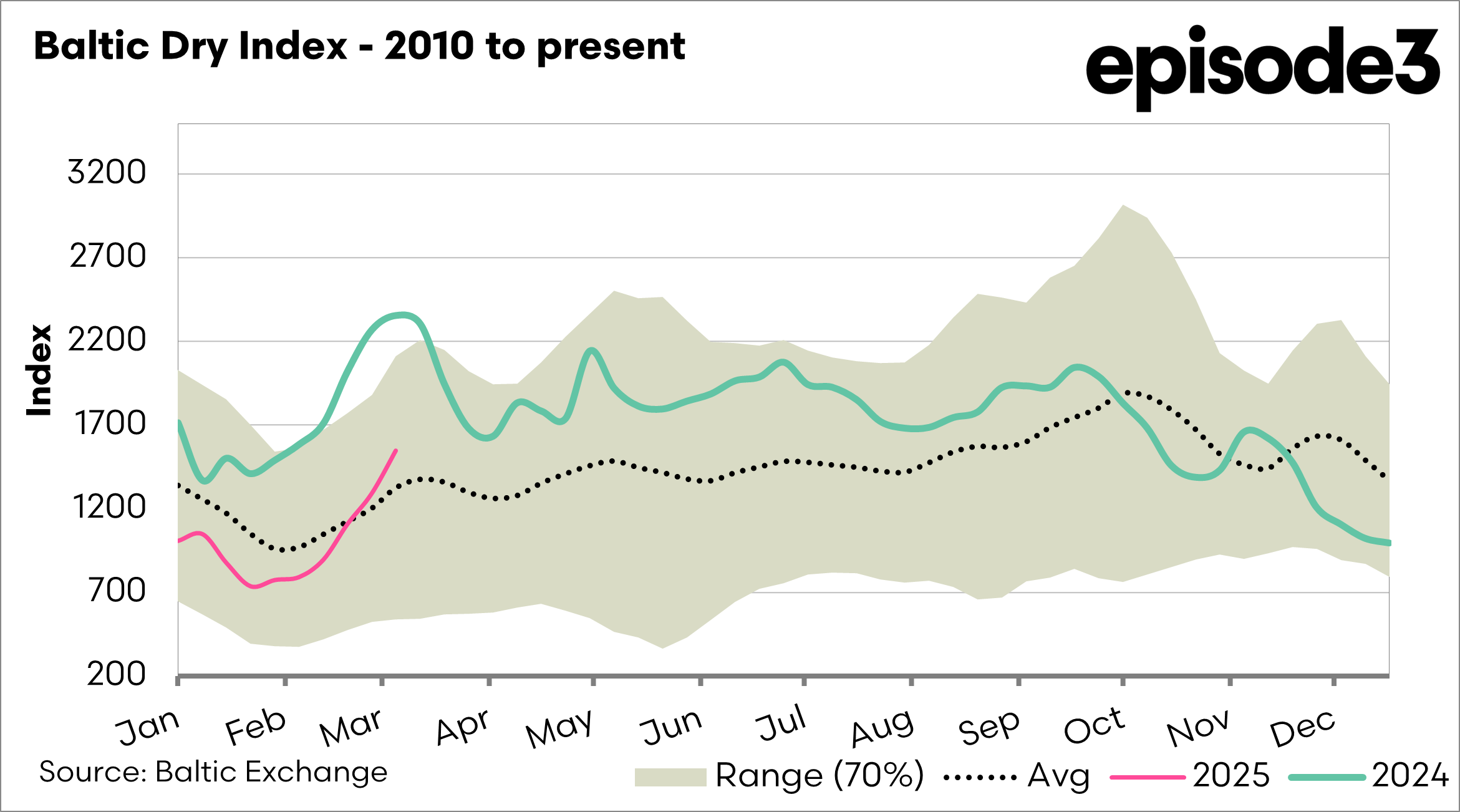

If we base a low-level fee of US$1M on a Panamax of wheat with 60,000mt, this equates to A$26/mt higher costs for exporting from the United States.

This will make Australia (and other origins) far more attractive to export from, as our cost and freight rate will be more attractive. US grain will have to be discounted to make up for the extra freight rates.

The idea of fining Chinese vessels to encourage the use of US-built vessels is not really going to work. The US imports and exports a huge volume of goods, and the reality is that China is a significant fleet owner. As the first chart shows, Chinese-built vessels make up a huge majority of those on the seven seas.

On a side note, I have focused on grains, as I am a grains analyst. The reality is that container ships will also be heavily impacted by this, as many of the fleets, including majors like Maersk, have large numbers of Chinese vessels in their fleets. This could lead to the potential of a US$1000 increase in the cost per container, and we export a huge volume of meat to the US in containers. Conversely it would make US meat more unattractive.

Will this go ahead? We don’t know, but it will harm the US consumer if it does. Imagine the worst-case scenario of extra freight costs on meat going into the USA and the potential discussed ag imports tariff.