Pay tax or interest?

Independent Contributor

The article examines the decision-making process farmers face when considering business expansion, particularly whether it is better to pay tax or take on additional debt. It is framed around the unusually strong agricultural environment in Australia and New Zealand, where beef, lamb and milk prices are all around or above ten dollars per kilogram and where farmland values, despite recent climatic challenges, remain historically strong.

This year has seen an interesting spring selling season, a lot of properties across Australia and NZ transacting or being marketed. Milk, Beef and Lamb are all knocking on or above $10/kg, very few in their wildest dreams would have picked this as what seems to be the new ‘norm’.

Australian properties after their circa 100% bounce in value 2018-22 are flat after a challenging climatic season last year. NZ land values are rising slowly due to the OIO (Overseas Investment Office) only half opening the door to foreign investment.

Combining record commodity values with post covid years of high consumer inflation, land is arguably undervalued. The pessimists will say that’s it for capital gain, the optimists will use the 20-yr average CAGR (Compound Annual Growth Rate) of 7% in their forward budgeting when analysing ROI and IRR on expansion.

Fonterra NZ has announced its Australia and Consumer business sale to Lactalis, some would say selling the family silver. However, the average dairy farmer producing 300,000 milk solids will have $600,000 tax free to spend or pay down debt, combine this with a 5% rise in their land values mean someone at 50% equity has likely risen to 60% equity.

This leads to the decision making process everyone goes through when considering expansion.

- Do I borrow back down to 40-50% equity to buy the neighbours?

- Why?….the kids don’t seem that interested….is it just more work for me?

- The pessimist says capital gain is over after paying interest we make no more….

- The optimist says if we don’t expand we will pay more tax, if we stretch ourselves to 40% equity we will pay more interest and less tax.

For me this last statement is at the heart of successful succession planning and my own biggest problem is convincing the next generation of the wonderful influence debt has in wealth creation. Looking at various expansion opportunities for my extra Fonterra money led to my brother even asking the question ‘do you really wanna stretch yourself at 54?’…..owing the bank 11 million on 20 million of assets doesn’t feel that stretched to me….why?

When looking at the 1,000 acres next door for 4k/acre my son asks the same question….he seems a bit paranoid about paying off his 80k loan on his hoof trimming trailer. Even my daughter was nervous about taking on 300k debt for her Melbourne apartment. Yep they are a bit risk averse…..and it’s the same everywhere, but the hard facts are those who can pay their interest reliably at low equity have grown their business the fastest….yes a few have fallen, but the circa 7% CAGR on farmland over 20 years speaks for itself.

A $10 million farm at even a 5% CAGR is growing in value by $500,000/year even if it just breaks even! At Australia’s last 20yr average of 9% it’s almost a million a year, worst case scenario is the CPI (Consumer Price Index), which has to be at least 2-3%, governments target 2% for a healthy economy. You can’t argue with history and as in any business your previous years actuals provide your most reliable projections.

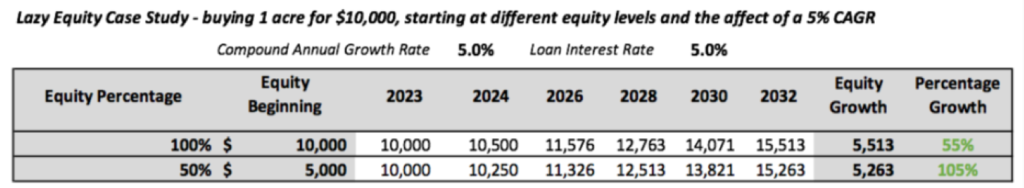

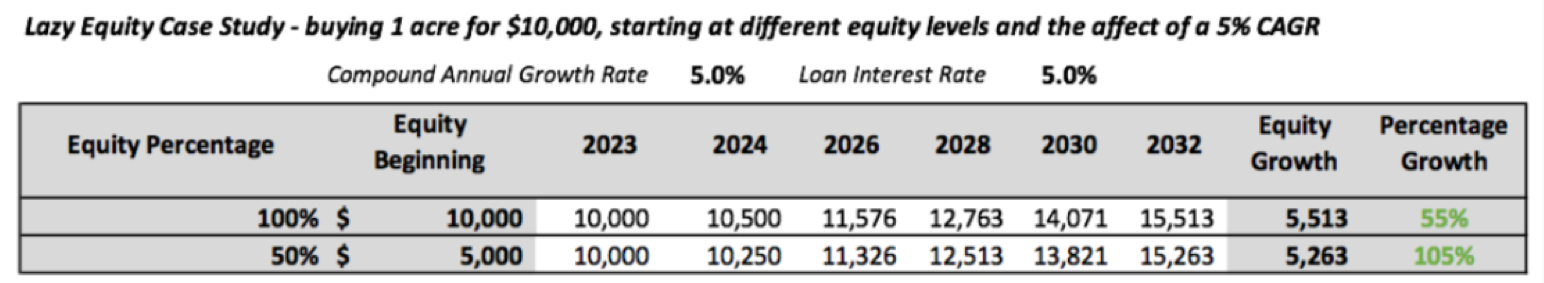

In my first article 18 months ago ‘Why I love farming’ I used the table below to explain how your equity can grow so much faster maximising borrowing or debt.

It’s like I’m talking another language though as all we see in the news is how bad debt is, from countries GDP’s to working class visa/HP debt, and even the housing crisis/price fluctuations in the cities. Stamp duty and CGT (Capital Gains Tax) are negative influences in Australia, not NZ although OIO restrictions may have a similar net effect.

If you make a profit you will likely lose 33-40% in tax, if this profit is used to pay interest (deductible expense) on new land you are creating more wealth, assuming you buy on a slowly rising market.