Nearing a full flush

Market Morsel

Spring lamb supply has begun to build as expected through November, yet the pattern across the country remains uneven and at times contradictory, producing a market where pricing outcomes are being driven as much by where the new-season lambs are appearing as by how many are flowing. The yarding index shifts from October to November provide a clear picture of where the flush has taken hold and where supply remains subdued, while changes in actual head counts help explain why the market has softened in an orderly manner rather than experiencing a sharp correction.

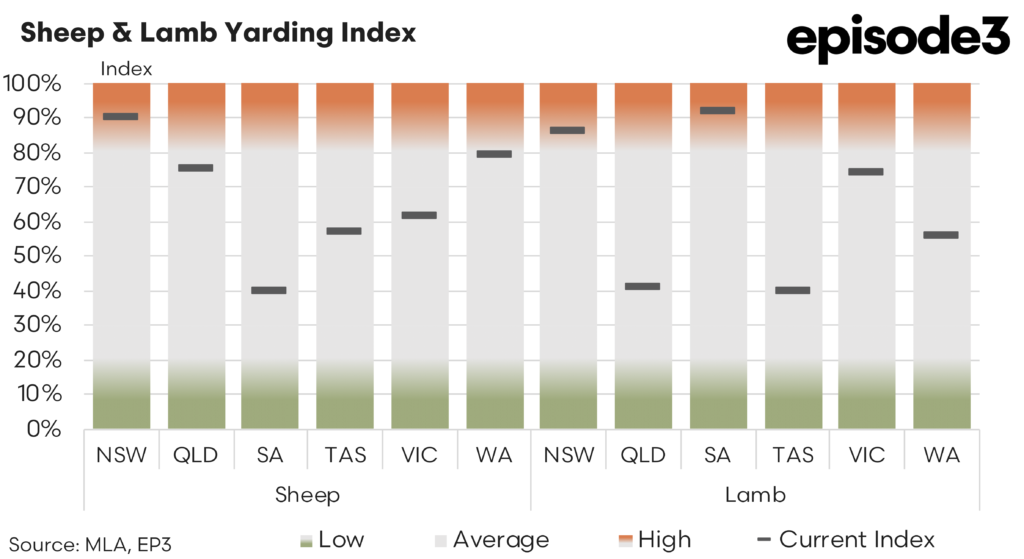

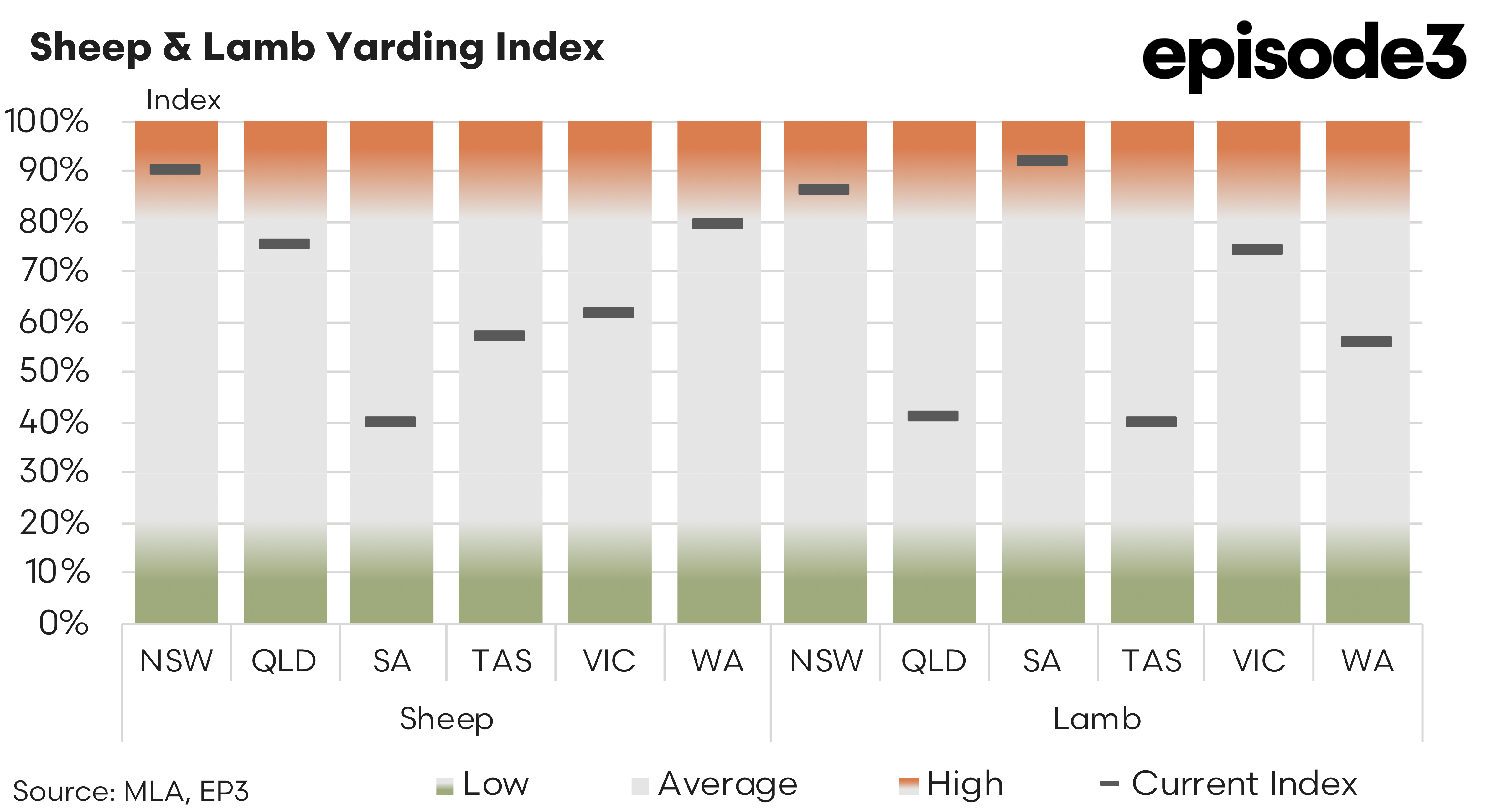

For sheep, yarding index movements were relatively modest. New South Wales lifted slightly from 89 percent to 90 percent, maintaining already strong throughput levels. Queensland rose from 65 percent to 75 percent, reflecting an easing of seasonal constraints but from a comparatively small base. Tasmania showed a more pronounced increase from 40 percent to 57 percent, while Western Australia softened marginally from 81 percent to 79 percent. Victoria slipped back from 65 percent to 61 percent and South Australia eased from 56 percent to 40 percent, indicating that the bulk of their seasonal offloading had already passed through earlier in spring. These figures demonstrate that the sheep yarding levels are not gathering meaningful momentum in the major producing states. Consequently, mutton prices have strengthened over the past week, supported by firm export demand and the absence of a significant rise in supply from the eastern states.

The lamb yarding indices, by contrast, show a more dynamic shift from October to November. New South Wales moved from 82 percent to 86 percent, a moderate lift that keeps the state at historically strong levels without adding a large new surge of supply. Queensland fell from 47 percent to 41 percent, consistent with its typical pattern where early new-season lambs dominate and supply then declines as the year progresses. Tasmania rose modestly from 30 percent to 40 percent, again from a low base. Western Australia eased from 70 percent to 56 percent, indicating a softening in seasonal momentum.

The most significant movements occurred in South Australia and Victoria. South Australia increased sharply from 63 percent to 92 percent, pushing the state firmly into full flush conditions. The scale of this movement aligns with the sharp lift in actual lamb yardings seen through November, particularly through markets in the South East and Mid-North. Victoria also recorded a strong rise from 31 percent to 74 percent, a substantial proportional increase and a meaningful shift in supply. Crucially, Victorian lamb throughput rose from around 40,000 head at the beginning of November to slightly more than 100,000 head by the end of the month. This represents a rise of 147 percent and signals that supply is building rapidly, even though the state is not yet at the usual full-flush peak of 140,000 to 150,000 head per week. Victoria is therefore in the early to middle stages of its spring run rather than at its maximum.

The combination of these index changes and the physical yarding movements provides a much clearer understanding of supply pressure in the key lamb producing states. South Australia’s lamb numbers rose by 59 percent from October to November, reflecting the rapid onset of its flush. Victoria’s very strong lift of 147 percent is now beginning to reshape national supply dynamics, while New South Wales recorded a more moderate increase of 22 percent, consistent with a state operating at high but stable seasonal levels rather than entering a new surge.

These changes explain the pattern seen in pricing over the past week and the past month. The sectors most exposed to increased flows from South Australia and Victoria have softened the most. The trade lamb indicator fell by 14c over the week and nearly 69c over the month, while the restocker lamb indicator declined by almost 8c over the month. Merino lambs weakened by more than 32c over the month.

Heavy lamb prices have also eased, falling by around 55c over the month. Heavy lamb values are still tracking above 1,080c per kilogram carcase weight, signalling that processors are continuing to compete for stock even as volumes rise. This is consistent with a market where supply is improving but where demand remains firm and broad-based.

Mutton prices present a different picture. Despite the increase in lamb supply, mutton values rose by more than 35c over the month and remain elevated relative to long-term averages. This reflects a lack of strong sheep yarding growth in major regions such as Victoria, New South Wales and South Australia. With export demand for mutton still robust, particularly from markets in Asia and the Middle East, the additional lamb throughput has not spilled over into excessive sheep turnoff and therefore has not translated into downward pressure on mutton values.

The overall relationship between supply and price through November confirms that the spring flush is underway but not yet at peak intensity across the east coast. South Australia is clearly operating at full spring capacity, Victoria is building toward its expected peak, and New South Wales remains strong but stable. As Victorian yardings continue to rise into December and possibly early January, price pressure is likely to increase further.