Bang for your buck

Independent Contributor

A common topic of discussion, this article focusses on the best value land across Australia and New Zealand. I’ve used industry data combined with numbers from my own ‘on farm’ discussions. There are many variables involved, and I use current ROI (Return on Investment) as the measure of best value.

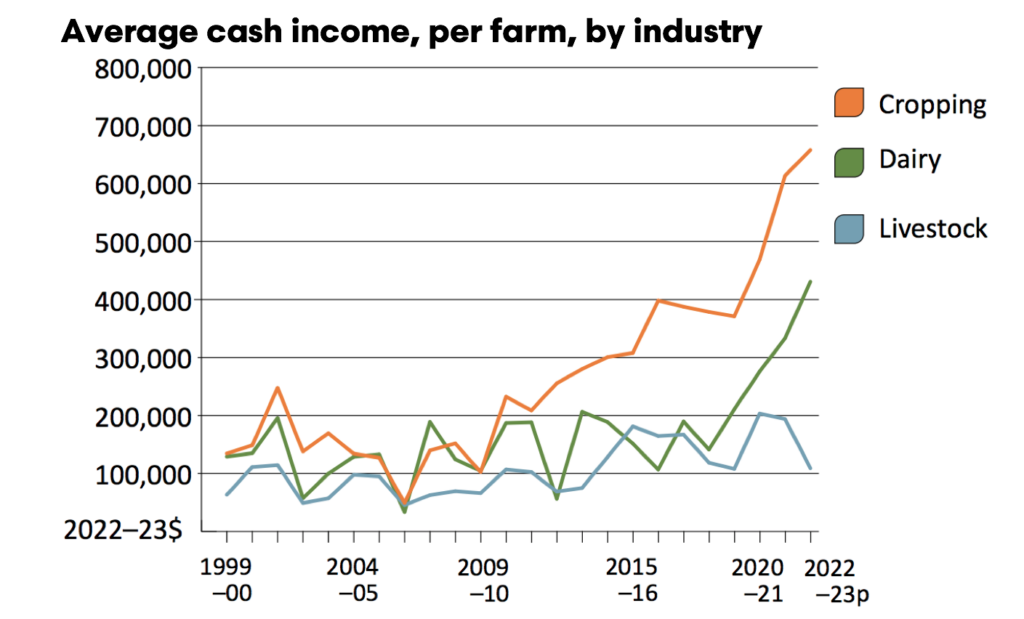

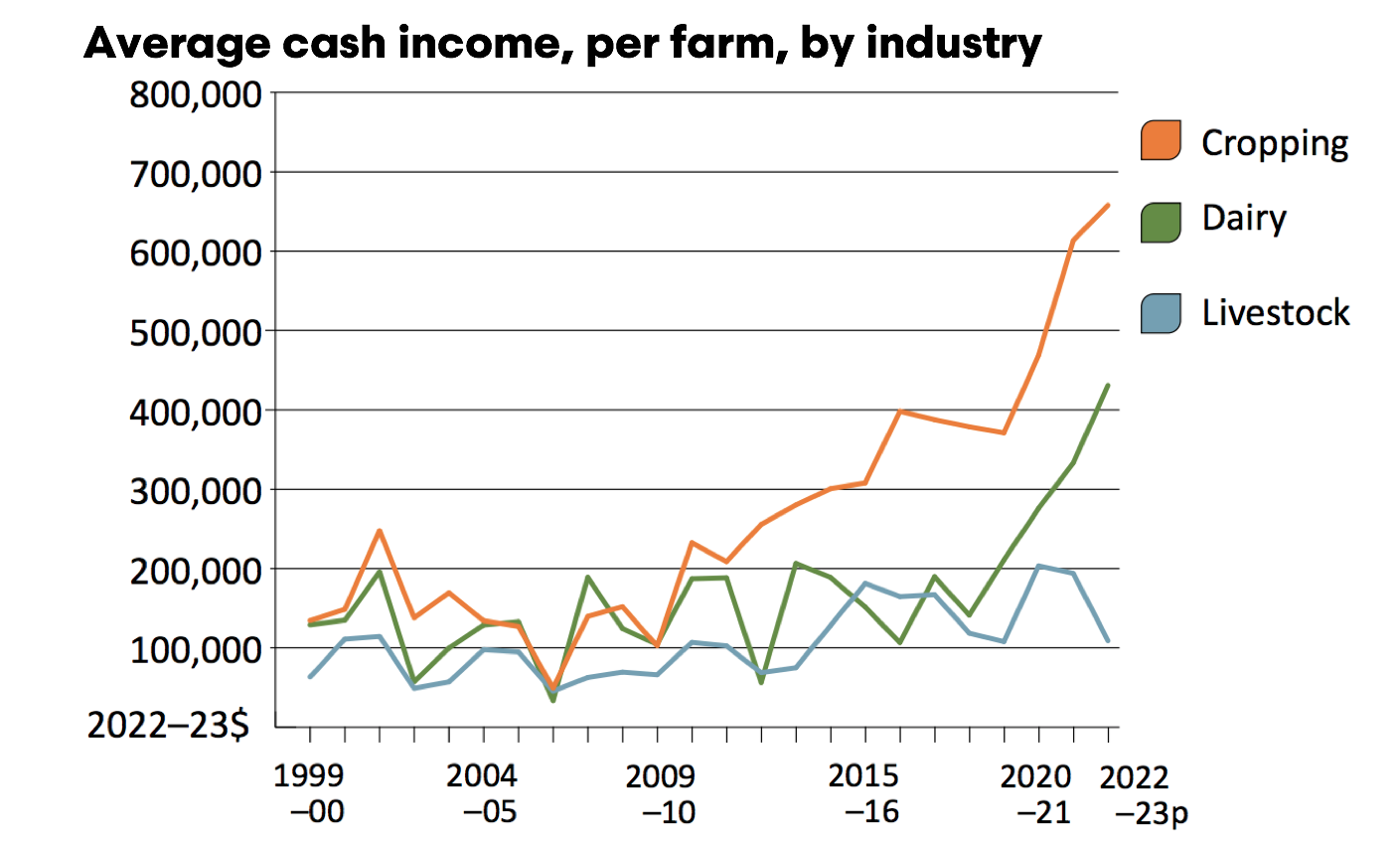

The Snapshot of Agriculture 2024 below shows the mixed cropping and dairy farmers income substantially higher than Sheep or Beef, although it is actually using 22/23 figures and all the commodities have eased from peaks.

With much of Australia’s sheep, beef and mixed cropping land values doubling since 2019, combined with inflation on inputs, their ROI’s are effectively halved. As sheep and beef are under half the cropping return, I will leave further analysis as their value potential is likely more related to improvements such as adding irrigation, system changes or capital gain. Stocking rate variables and whether you are a breeder, finisher or both, mean huge variation.

NZ sheep and beef farmers aren’t a happy bunch with new seasons lamb expected to be $7/kg (barely breakeven) through the season peak (Dec-April) and beef in the $5-6/kg range. The overseas ‘carbon cowboys’ are still paying a premium to convert to pine trees, with the associated carbon credits.

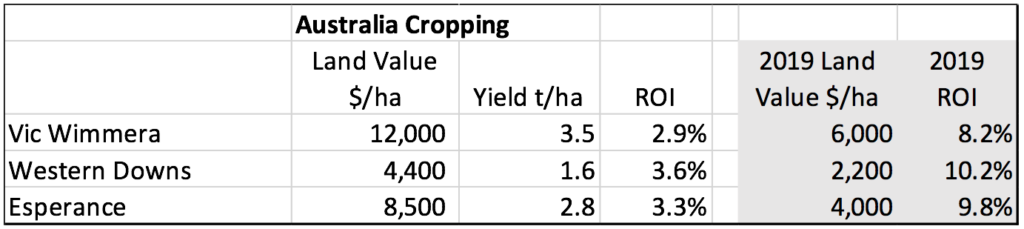

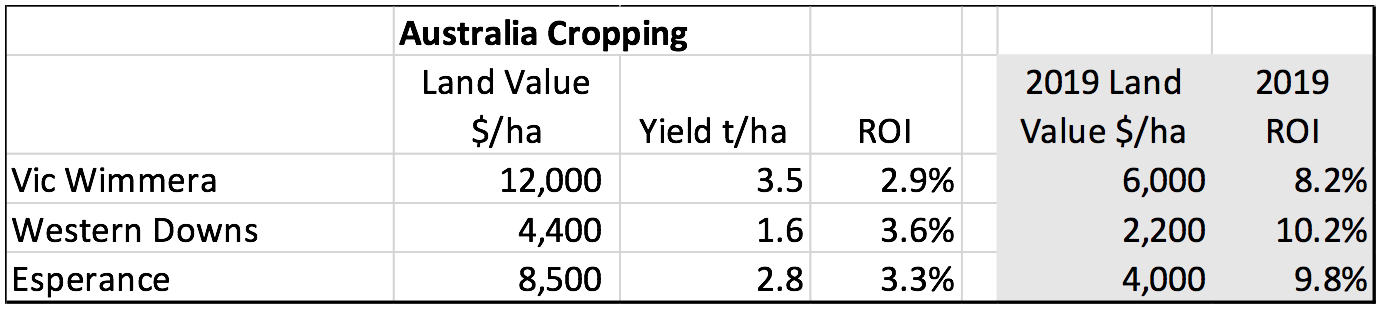

I will focus on cropping in Australia (2023/24 yields) and Dairy across both countries, it ain’t rocket science but there is enormous variation in all figures and areas, and no two seasons are the same so its more of a generalised snapshot…..

There has been some larger transactions in the cropping space with some funds cashing up, recycling cash or ending fund cycles. Irrigated cropping is seeing good demand, seen as de-risked from climatic conditions and still holding reasonable commodity pricing relative to the long term.

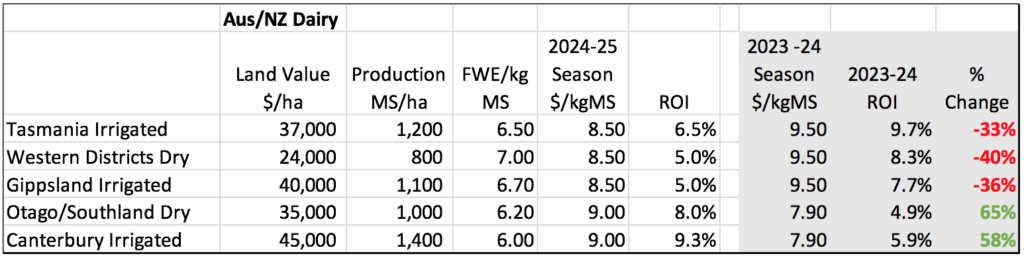

This basic table is based of recent sales and 2023-24 yields, to standardise I’ve used an average of $400/t across crop mixes and a 25% net profit margin after costs to generate the ROI on the associated value. The grey area uses 2019 values and a 35% net profit margin.

Farming is volatile and commodity prices have generally been a reflection of supply/demand since before Christ, some cropping farmers in 2021 and 22 had a circa 40% margin over costs or $160/t through good growing La Nina seasons, some easily achieving double digit ROI’s before costs caught up and rising land values diluted return.

An interesting comparison to all forms of farming is the Industrial and Commercial property sectors, I sit with these guys in our office and 5.5-6% Cap Rates is standard with triple net leases. It’s a different language, but in simple terms an example would be a Bunnings Warehouse Valued at 20mil on a 10-year rolling lease, Bunnings leases it from the owner at 5% or $1mil/year, and triple net means they pay all rates, insurance and maintenance.

I think it is something worth considering when families are succession planning and integrating off farm siblings.

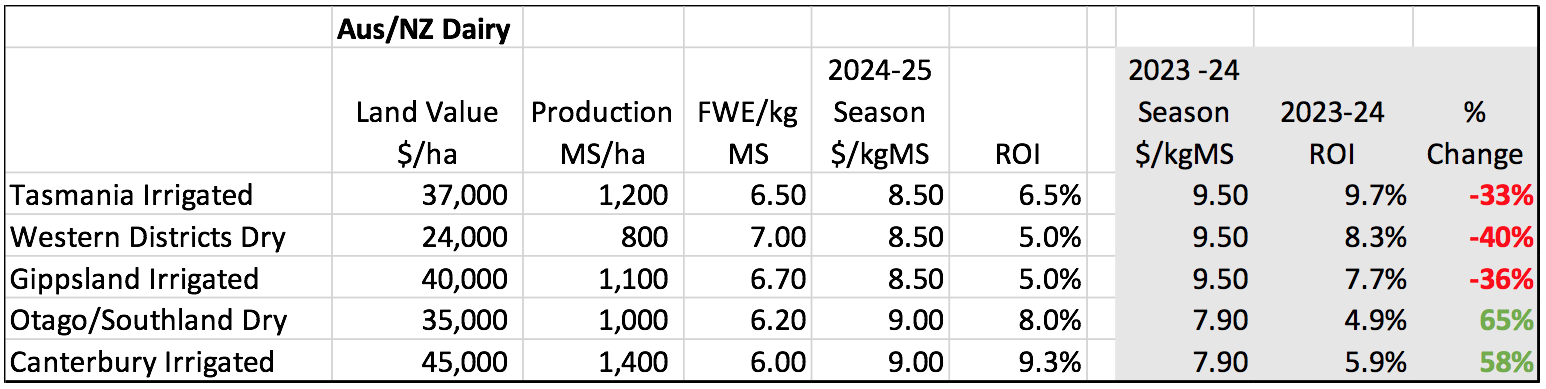

Back to real farming, albeit by a biased dairy farmer…..this table shows a ‘game of two halves’ with the volatility enough to turn you to drink, or commercial property! It’s almost the exact opposite in two seasons, I talk about other countries being corrupt but you have to question the NZ milk price being so far ahead of Australia this year after being so far behind last year…..there is an exchange rate difference here but it doesn’t affect ROI.

So, this year’s (budgeted) winner at 9.3% is Canterbury irrigated (LY 5.9%), virtually swapping with Tasmania Irrigated at 6.5% this year (LY 9.5%). This highlights the de risking of farms with low FWE related to the efficiencies of home-grown fodder, many Western Districts farmers FWE will be $8+ this season having to buy more fodder in their ‘green drought’.

Another interesting comparison, we have a conventional chicken finishing farm an hour from Melbourne for sale, key numbers

- 10% ROI consistent for last 10 years

- 200 acres/6 sheds – $11,000,000

- 1.5 million chickens/year

- Doesn’t own the chickens or supply the feed